Chainlink (LINK) price recently hit a three-year high, showing a staggering 87% increase over the past 30 days. However, LINK has dropped nearly 5% in the past 24 hours, signaling the possibility of short-term weakness.

Whale activity has also decreased, with the number of large investors gradually decreasing since late October, suggesting a degree of caution or profit-taking by mainstream investors.

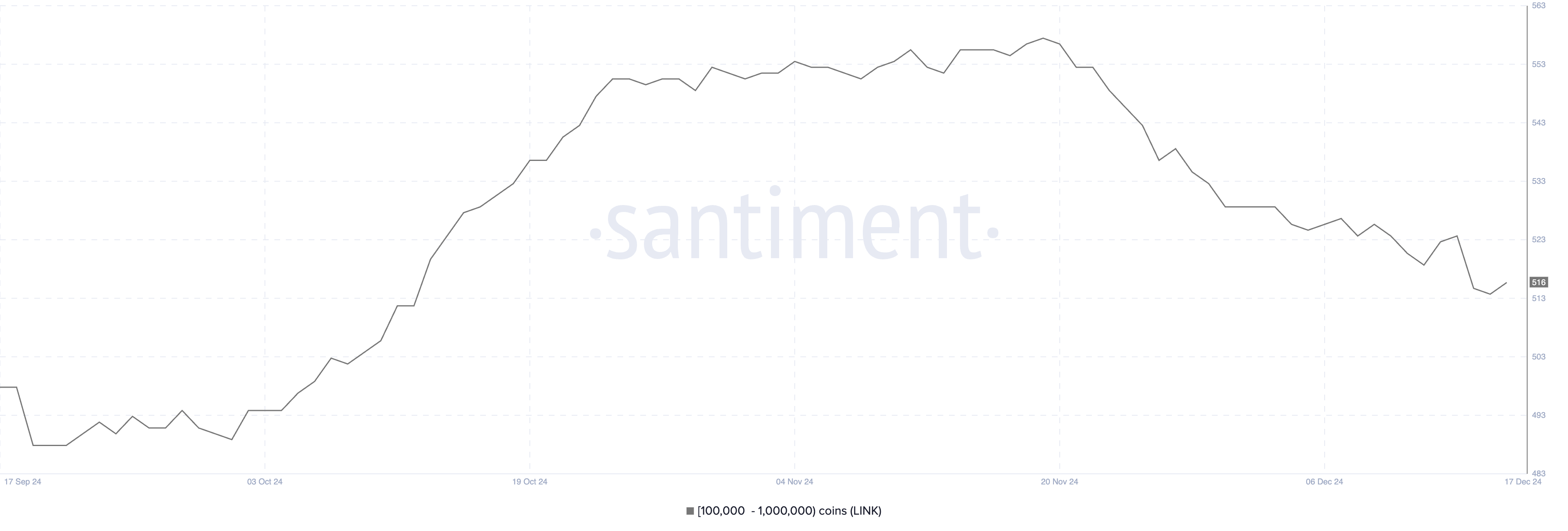

LINK “whales” have not accumulated since late October 1

The number of wallets holding between 100K and 1 million LINK has dropped to 516, down from a three-month high of 558 recorded on October 19. More recently, the number decreased from 524 on October 14 to 515 on February 15, indicating a significant decline in the number of large investors in the short term.

This drop could suggest that some whales are reducing their positions, potentially reflecting caution or profit-taking in current market conditions.

Tracking whale activity is important, as large investors often have a significant influence on price movements. A decline in the number of whales could signal a loss of confidence or a change in sentiment among mainstream investors, which could create short-term selling pressure for LINK.

However, if this decline stabilizes or reverses, it could indicate renewed accumulation, potentially supporting a price recovery in the near future.

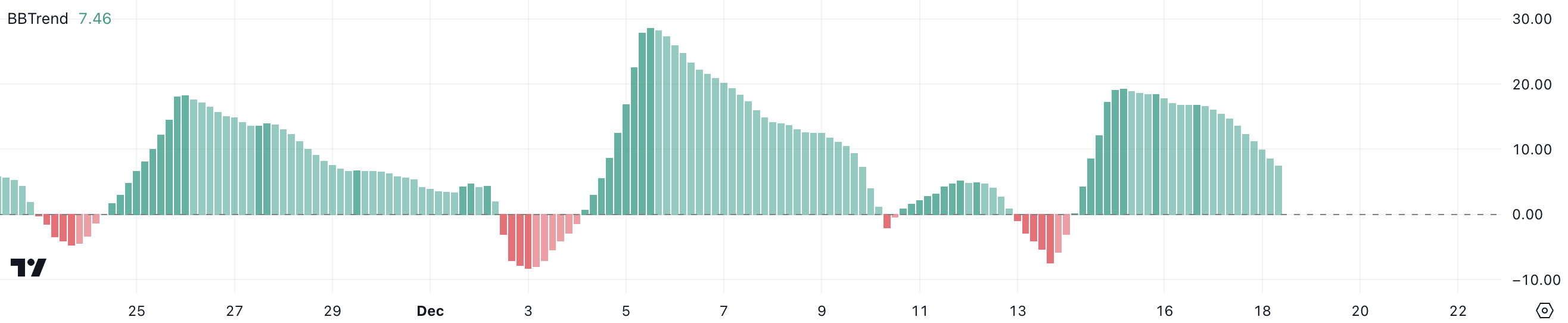

Chainlink’s BBTrend is decreasing

Chainlink’s BBTrend is currently at 7.46, reflecting a positive trend since Oct. 14 but showing signs of weakness after peaking at 19.31 on Feb. 15.

This decline shows that while Chainlink price remains in an uptrend, momentum has slowed in recent days, pointing to the possibility of a short-term correction or decline.

BBTrend is a momentum indicator derived from Bollinger Bands. It measures the strength and direction of the price trend. A positive BBTrend typically signals bullish price momentum, while a falling value indicates waning strength.

With LINK’s BBTrend falling to 7.46, it could indicate that the current uptrend is losing momentum. This could lead to a period of sideways or bearish moves in the short term unless buying power reappears.

LINK Price Prediction: Could LINK drop below $20 soon?

LINK’s short-term EMAs are currently above the long-term ones, maintaining a bullish structure for now. However, the short-term EMAs are trending down, and if they cross below the long-term EMAs, it could signal a bearish change.

If the support at $26.89 fails to hold, LINK price could face further decline, potentially falling to $22.41 or even $19.56.

Conversely, if the uptrend regains momentum, LINK price could recover and test the resistance at $30.94. This level will be an important target for buyers to assert control and maintain a stronger growth trajectory.