Buyers of stablecoins do not assume earnings, so this is not an investment contract, a representative of the USDC issuer mentioned.

Citing the SEC-Binance lawsuit, stablecoin issuer Circle and investment fund Paradigm have just expressed their opinions in their hottest filing.

Circle: Stablecoin trading does not constitute an investment contract

Expressing his viewpoint on the litigation scandal amongst the US Securities Commission (SEC) and the Binance exchange, Circle argued that economic transaction laws really should not be utilized to stablecoins, due to the fact they area worth on other assets. .

In early June 2023, the SEC accused Binance of facilitating disguised securities trading. Some coins are listed as securities by the company this kind of as SOL (Solana), ADA (Cardano) and stablecoin BUSD (Binance BUSD)…

Until now, the SEC has often made use of the over cause to target the cryptocurrency sector. At the very same time, Coinbase obtained very similar accusations to Binance. But all the platforms pressured by the SEC have experimented with to argue that cryptocurrencies do not fall underneath present US economic laws.

According to Circle in its hottest statement, BUSD and USDC can’t be classified as securities, as customers do not assume any revenue from their obtain. The representative of the Club stated:

“Settlement stablecoins themselves do not have the basic functions of investment contracts, which means they are outside the jurisdiction of the SEC. Decades of case law have proven this.”

The SEC alleges that BUSD was offered as an investment contract, as Binance promised earnings to shoppers in the kind of a rewards plan. Last week, Binance, Binance.US and CEO Changpeng Zhao filed a movement to dismiss the lawsuit, accusing the commission of working out electrical power above digital assets with no congressional authorization.

Heath Tarbert, Circle’s chief legal officer and former CFTC chairman, submitted the query as amicus curiae. Under US law, an amicus curiae is an personal or experienced organization that assists the court by delivering legal facts or suggestions.

Paradigm: The SEC is attempting to “break” the law with a lawsuit towards Binance

According to Paradigm, gold, silver and artwork can be rewarding, but marketing them is not the very same as trading stocks.

In file amicus curiae 29 September Venture capital fund Paradigm accuses the U.S. Securities and Exchange Commission of upending public perceptions of securities laws by ongoing lawsuits. The unique Paradigm text reads as follows:

“In this case, the SEC is simply exploiting the allegations it has made to change the law and circumvent the regulatory process. It is clear that the commission is exceeding the scope of its authority, and we oppose this.”

The SEC accused Binance of violating securities laws, which include failing to register as an exchange, broker-dealer, or clearing home. However, this is just a single of lots of cryptocurrency tasks that the SEC has just lately targeted.

Additionally, Paradigm highlighted worries with regards to the SEC’s application of the Howey check. The company usually relies on the Howey Test, a set of criteria originating from a 1946 lawsuit, to identify qualifications. Consequently, an asset is deemed a safety when it meets the following three criteria:

-

It is an investment in dollars or relevant assets

-

The dollars is invested in a joint venture

-

Investors assume earnings from the investment and the organization opens the sale or presents the investment.

“There are a number of assets that are promoted and traded for their profit potential, but they are often not stocks,” Paradigm mentioned, citing gold, silver and fine artwork as proof.

In common, in accordance to Paradigm, the growth of crypto laws by the SEC ought to be officially authorized by the US Congress. Meanwhile, the present SEC relies largely on the Howey Test and the Securities Act to physical exercise its electrical power. Furthermore, these two requirements are very outdated, so they are unlikely to be powerful in the cryptocurrency sector.

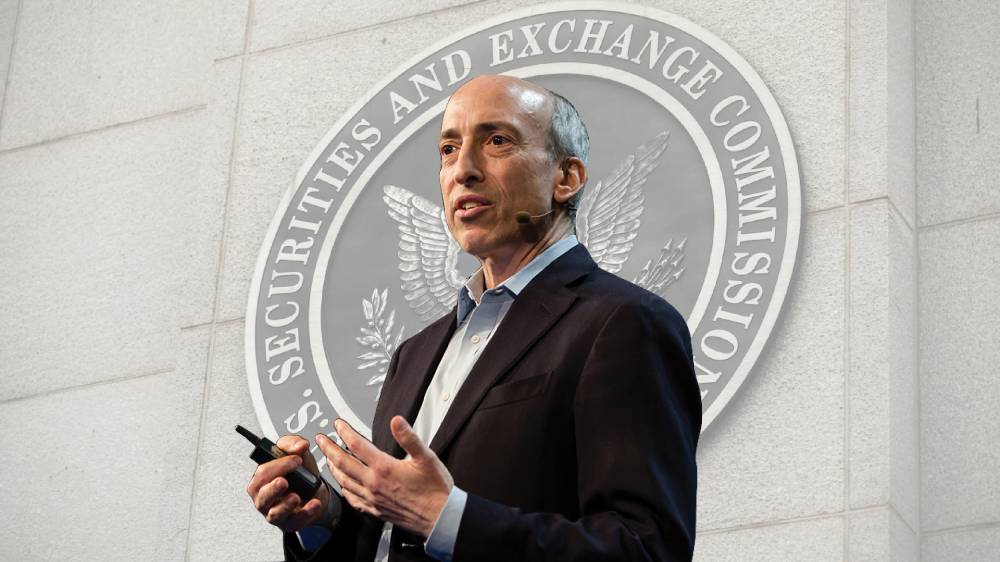

During a White House hearing on September 27, SEC Chairman Gary Gensler continued to get criticism above his agency’s cryptocurrency regulatory stance. A member of Congress accused the SEC of not staying an impartial company and of regulating by harassing the digital assets sector.

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!