The world’s primary derivatives exchange CME has “considered” giving futures contracts for two new altcoins, marking a historic turning stage for the exchange. So which encounter will be named?

Payal Shah, Head of Equity and Crypto Products at CME, informed CryptoCompare’s Digital Asset Summit in London that Solana (SOL) and Cardano (ADA) may well be arriving quickly.Distribute futures contracts on exchanges. The solution came as quickly as she was asked if CME was contemplating giving futures and other derivatives for altcoins.

“The CME is wanting into the matter. We have obtained a number of consumer inquiries for a selection of distinctive altcoins. Among these, Solana and Cardano dominate the bulk “.

While the curiosity is unquestionably large, Shah explained the CME will encounter two big issues prior to giving futures contracts for SOL or ADA. First, on-exchange futures contracts have to have to be index-aligned since they are primarily based on 5 distinctive exchanges for value. If one thing goes incorrect, they nevertheless have a definite value and can settle their futures contract. The remaining concern is regulation.

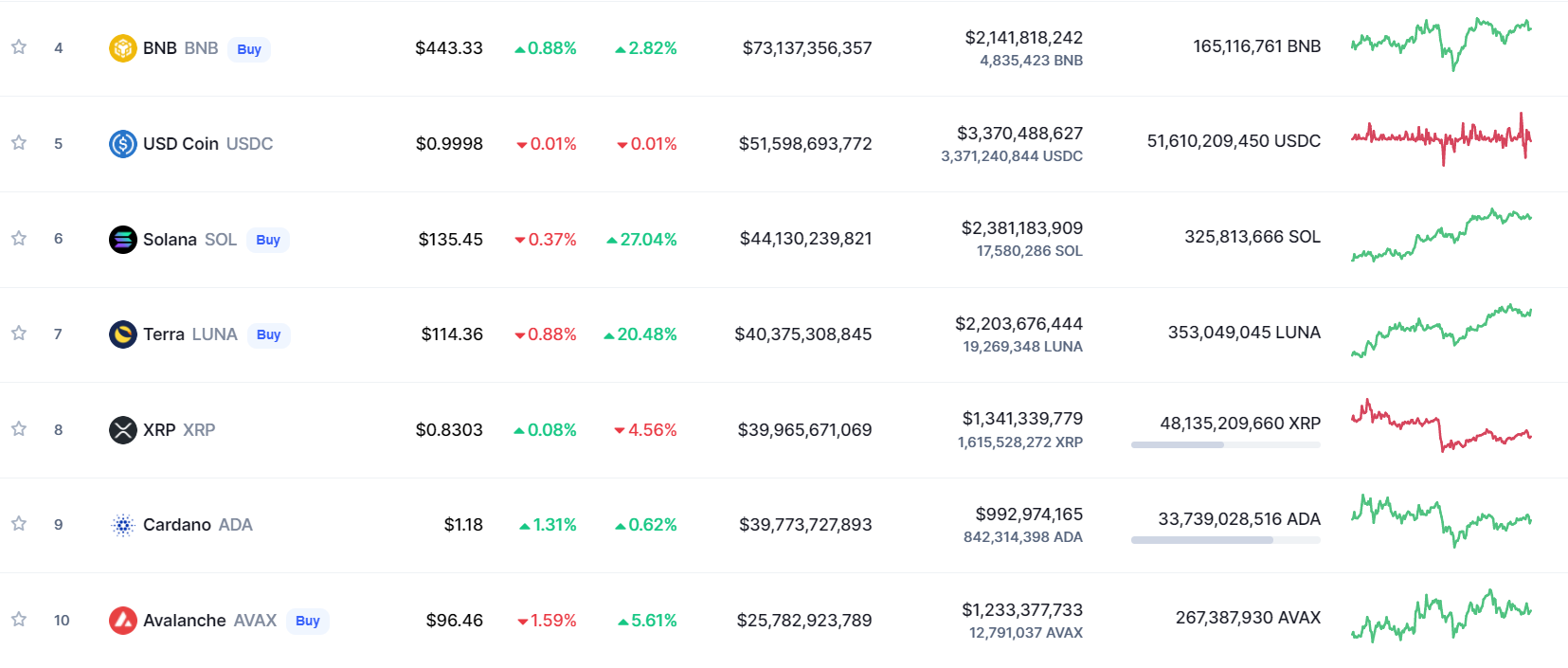

The truth that SOL and ADA have consolidated their positions in the major ten by industry capitalization has been reliable so far. SOL is the sixth greatest coin with a industry capitalization of $ 44.three billion though ADA is in eighth location with a complete capitalization of $ 39.seven billion.

Of program, the CME ought to have its causes for producing this daring consideration. The initially is Solana. Not only going through fast development and reaching the major of the initially coins in 2021, SOL is also steadily turning out to be a priority location in the eyes of institutional traders.

The evidence is that right after becoming additional to Bloomberg’s information solution suite right after Bitcoin and Ethereum, SOL has constantly supported 21Shares AG’s ETP solution on the Swiss exchange 6, mixed ETP with CoinShares and FTX trading as properly as ETF Solana. in Germany by VanEck. Not only that, getting into the time period the place it obtained a sudden robust return in institutional funds movement final week, SOL was unexpectedly the 2nd greatest undertaking to entice capital, right after Bitcoin.

As for Cardano, even however ADA is still to be as outstanding as SOL in all respects, the organization’s latest reception of the undertaking is a critical component of shock, as no one particular would have imagined. ADA can be so trusted by the organization with several “dramas” that they have clung to the platform more than time.

At the finish of March, Grayscale announced the creation of an investment fund for blockchain tasks to exchange Ethereum. In which, ADA is the undertaking Grayscale trusts the most with an investment bodyweight of up to 24.six%. Not stopping there, just a week later on, there had been indicators of organizations commencing to “run” at ADA on on-chain indices, assisting TVL and the total Cardano ecosystem to rise by much more than 50%. Interestingly, in accordance to a poll carried out by Ethereum founder Vitalik Buterin in mid-January, the neighborhood nevertheless confidently voted ADA as the most elite representative who can exchange ETH.

At the time of creating, CME has only launched two futures contracts for Bitcoin and Ethereum with accompanying Micro solutions to raise diversity for traders.

The explanation why the exchange is particularly mindful in listing is since the CME is normally noticed as the principal “gateway” for massive US-primarily based institutional traders to start off getting into the industry and attain industry publicity. At the similar time, 3 historic Bitcoin futures ETFs in the United States, together with ProShares Bitcoin Strategy ETF (BITO), The Valkyrie Bitcoin Strategy ETF (BTF), and VanEck’s Bitcoin Strategy ETF (XBTF), had been accredited by the SEC in October. value contracts.

However, if CME decides to comprehend its ambitions for SOL and ADA futures, it will possible build a robust impetus to support the two of these coins break as a result of much more in the potential. In the previous, the story has been proven that CME has “charmed” Bitcoin and Ethereum. In December 2017 CME officially launched the world’s initially Bitcoin futures contract, BTC straight away hit $ twenty,000 ATH, marking a “successful” 12 months. Next up is ETH, the solution launched in February 2021, and ETH also set an ATH in May at $ four,a hundred.

Summary of Coinlive

Maybe you are interested: