[ad_1]

Institutional publicity to cryptocurrencies through derivatives continued to develop within the second quarter, as CME Group’s just lately launched Bitcoin (BTC) microcontract acquired a big enhance through the first two months of trading.

Since its launch on May 3, CME Bitcoin micro futures have exceeded 1 million traded contracts. CME CEO Tim McCourt mentioned the brand new product has been common with establishments and day merchants as it’s an effective way to attempt to hedge Bitcoin’s spot value.

See extra: CME Group formally launches Micro-Bitcoin, the subsequent blow to the cryptocurrency market

This micro-contract is one-tenth the scale of Bitcoin, the worth is 0.1 BTC. For comparability, the principle unit of CME’s Bitcoin futures contract is 5 BTC. Brooks Dudley, international head of cryptocurrencies at ED&F Man Capital Markets, mentioned that now seeing a higher-than-expected quantity of institutional funding coming into the market suggests the timing is correct for a smaller Bitcoin contract.

More exercise within the derivatives market reveals that merchants are hedging their positions. While derivatives trading has elevated institutional publicity to Bitcoin, it has additionally grow to be an intense battle for these trading within the spot market.

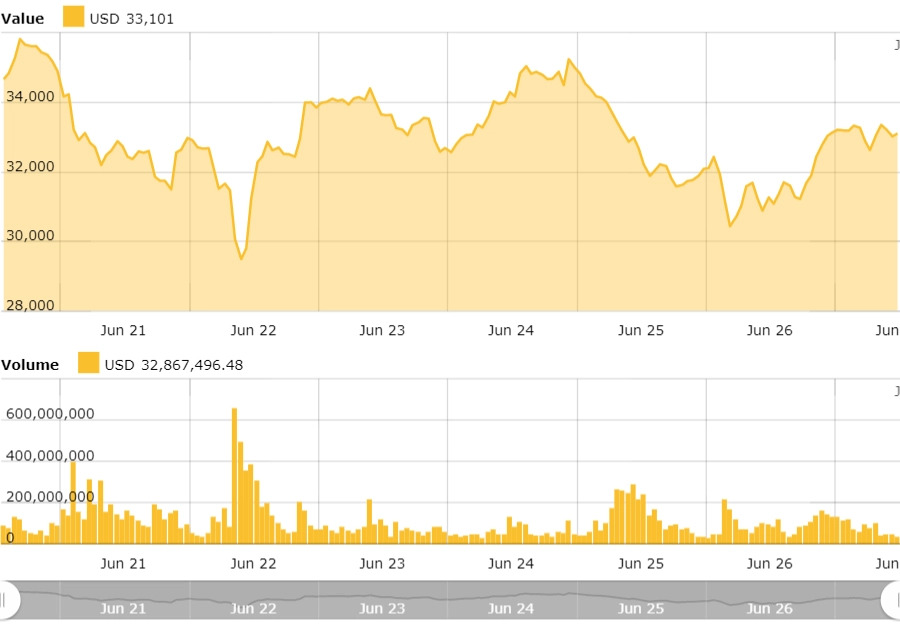

Typically, the $ 6 billion expiration of Bitcoin (BTC) and Ethereum (ETH) on May 25 has created vital battle out there, with some merchants anticipating excessive volatility. With the value of BTC down 13.6% from peak to low between June twenty fourth and twenty sixth.

Synthetic foreign money 68

Maybe you have an interest:

.

[ad_2]