To assess the prospective of a cryptographic undertaking or a lot more exclusively a DeFi protocol, there are usually a lot of diverse approaches. Including the examination of the working designs, the examination of the help teams, the technical examination, … However, in this report, Coinlive will deliver you with a strategy to assess a undertaking with the Total Value Locked and Revenue metrics by means of the Token Terminal instrument. Look meticulously!

Token Terminal instrument overview

What is the coin-operated terminal?

Token Terminal is a enterprise that gives and aggregates the money information of the primary blockchains and Dapps for end users. The centralized instrument extracts raw information and transforms it into standardized metrics to help end users with options this kind of as:

- Help end users locate out which blockchains and prospective Dapps are undervalued.

- It delivers end users a a lot more intuitive see of previous movements thanks to different money indicators.

- Help end users evaluate and assess the effectiveness of the undertaking they are interested in with rivals to make superior investment selections.

Additionally, Token Terminal also focuses on the income index produced by just about every blockchain and Dapp, creating pricing a lot easier for end users.

Acquiring information and facts about the income and exercise of a blockchain or Dapp will assist traders have information to assess the effectiveness and worth of that blockchain or Dapp.

Partner of the coin-operated terminal platform

The partners of the instrument are well-known investment money in the cryptocurrency industry this kind of as Dragonfly Capital, Polychain Capital

Total blocked worth and revenues

With Token Terminal instrument, end users can quickly track two distinctive indicators, TVL – Total Value Locked (Total Value Locked) and income indicators of that Blockchain or Dapp. So what is TVL and Revenue?

Real locked worth (TVL) is the complete quantity of sources locked in a DeFi clever contract. It represents the quantity of assets at the moment held in a specific protocol.

=> Find out a lot more about TVL right here: What is TVL? Learn the notion of Total Value Locked (TVL) in DeFi (coin68.com)

Enter – Enter is the complete cash flow produced by the technologies and utility produced by the blockchain.

Therefore, we can consider of TVL as representing the user’s dollars when positioned in a Dapp or blockchain (this is rather related to the user’s dollars deposited in a financial institution). The income will be the revenue that the Dapp or blockchain relies on the dollars deposited by the consumer to produce income (related to the financial institution employing the financial savings to produce revenue). In summary, the partnership amongst TVL and Revenue is related in nature to the dimension-effectiveness partnership.

- The partnership amongst scale and effectiveness is usually the situation with Blockchain economies – effectiveness varies with scale. This usually means that when inputs this kind of as capital (TVL) are higher-development, the development price of output (income) is very likely.

Note: When the TVL of a Blockchain and Dapp increases and the income things do not expand, it is incredibly very likely that it is a undertaking with robust development prospective in the close to potential and vice versa when if the TVL decreases and splits with income fluctuations. , you require to contemplate and contemplate your investment selection. Although TVL’s monitoring of volatility is only goal, mainly because the rate of a project’s token is also impacted by other things.

Therefore, when we test the undertaking on Token Terminal, we can test the income of Blockchain and TVL to make a judgment on the effectiveness of that blockchain or Dapp.

How to test undertaking income on Token Terminal

With the Token Terminal instrument, end users can test the TVL information and facts of a certain Blockchain or Dapp as follows:

Step one: Go to the official homepage at: Coin operated terminal | Fundamentals of cryptocurrency

Step two: Go to the View dashboard.

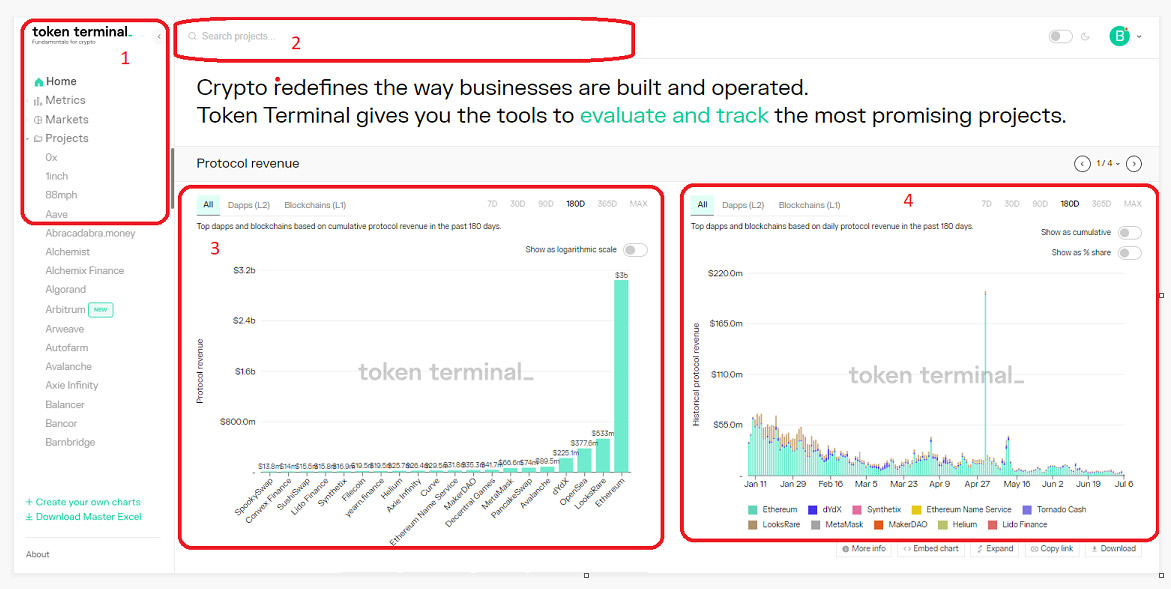

You will see Token Terminal primary interface as follows:

In this interface, there are three primary components that end users can interact with quickly:

Part (one): This is the component that end users primarily based on criteria decide on the Tag in accordance to their wants. This part involves four primary tags:

- Home: The primary interface of Token Terminal. Provide end users with an overview of the income of most tasks

- Metrics: Provide end users with the parameters of blockchain revenues primarily based on just about every criterion this kind of as: Total revenues, Revenues of just about every Protocol, P / S (Price to Sale) index of the undertaking, P / E (Price to Earning) index of the undertaking …

- Markets: Provides indexes on Exchange, loan, blockchain, DeFi.

- Projects: Provides a certain index of a undertaking.

Part (two): This is the spot to promptly search for tasks.

Section (three), (four): Specific metrics are displayed right here.

So let us consider a certain instance to superior clarify the use of Token Terminal. We will use Aave as a concrete instance.

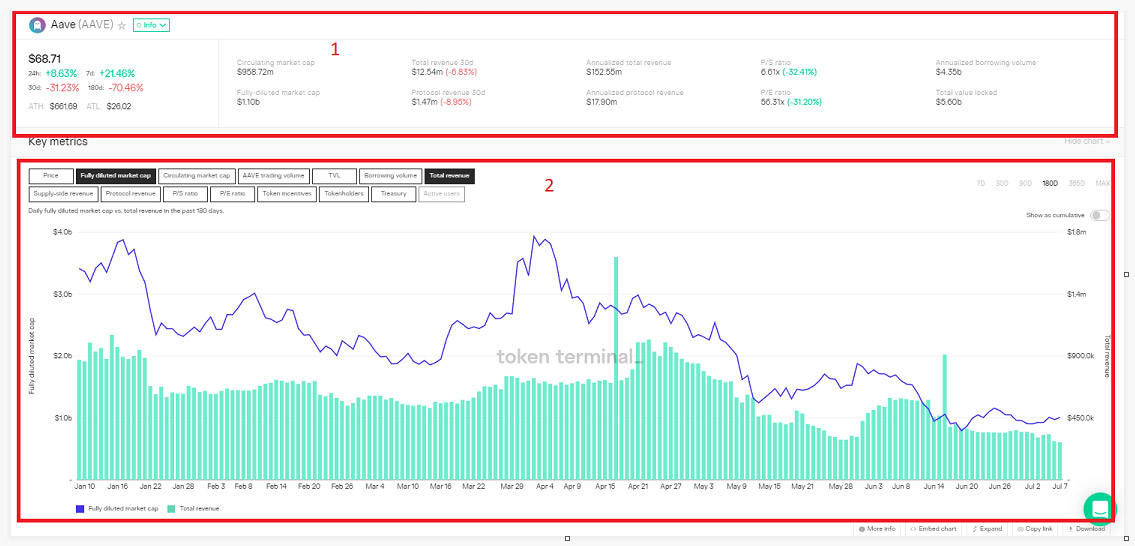

For the simple information sheet

In the index frame (one): The information display vital indicators this kind of as:

- Total undertaking provide: $ one billion

- Increase or lower in complete undertaking income in thirty days: six.83% lower

- Total income in a single 12 months of the undertaking: $ 152 million

- Price / product sales ratio (P / S)

- Unlike the regular money side (the regular wants three primary things), for Dapps and Blockchain, this index is calculated on the basis of the complete provide or complete circulating provide divided equally by the complete income.

- Hence, the enhance in P / S product sales will lower, if the product sales lower P / S will enhance. So the reduced the P / S, the superior.

Through this graph, we see that the AAVE undertaking income decreases later on and the P / S tends to enhance, so it is not proper to invest in AAVE tokens at this time.

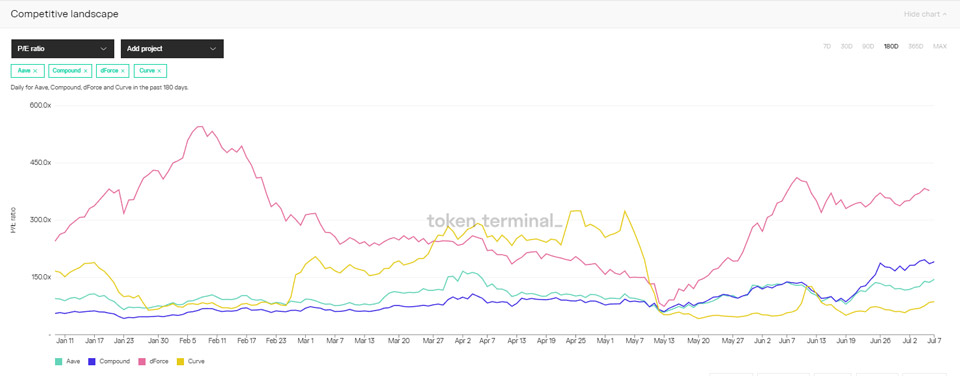

- Earnings Price Ratio (P / E)

- This is an indicator of how a lot traders are inclined to obtain in purchase to obtain one AAVE, figuring out no matter if AAVE’s worth is a lot more pricey than anticipated and its worth.

- With AAVE’s P / E = 56.31x, it usually means that end users will shell out 56.31 instances a lot more than the revenue produced by AAVE.

The two ratios P / S and P / E are also a single of the crucial indicators when creating investment selections of blockchain tasks or decentralized applications.

For the P / E index of tasks in the identical array, it truly is not that greater P / E usually means the token rate is pricey, reduced P / E usually means the token rate is very low. This can also be an indicator of investors’ potential expectations. The anticipated worth of the token to expand into depends on the potential revenue the blockchain brings.

Projects with a higher P / E ratio are usually a precious undertaking that is anticipated to expand strongly in the potential. But the downside is that there is higher volatility and it is usually a risky investment.

Low P / E tasks relative to the investment segment’s regular P / E ratio are usually deemed worth investments, and these tasks usually have a tendency to have prospective for potential development in the encounter of industry volatility.

Compared to other Dapps, Aave has a under regular P / E ratio and is somewhat safe and sound to be deemed a prospective undertaking in the potential.

In the chassis quantity (two): are optional tags for the indicators in the chart under. Only two markers can be picked at the identical time. In which five crucial indicators when employing Token Terminal are:

-

- Offer – secondary cash flow: the revenues of the Dapp or blockchain are divided amid individuals who deliver liquidity to the undertaking.

- For blockchain, this charge is split amongst Stakers or Validators.

- For DEX, it corresponds to the Liquidity Provider premium.

- Revenue of the protocol: residual income in the protocol or blockchain and immediately generates worth for the token holders of that undertaking.

- The remaining income movement will movement into that project’s vault or treasury

- Total income: the complete income that blockchain or Dapp brings to each end users and

- Offer – secondary cash flow: the revenues of the Dapp or blockchain are divided amid individuals who deliver liquidity to the undertaking.

- P / E ratio: displays the cash flow prospective of a undertaking

- P / S Index: It displays the rate / product sales ratio. It demonstrates how a lot we have to commit to obtain back a dollar of that project’s income.

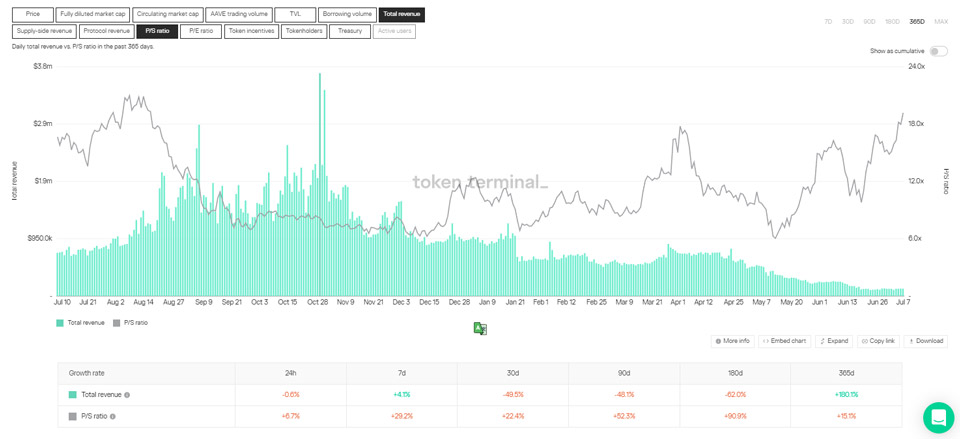

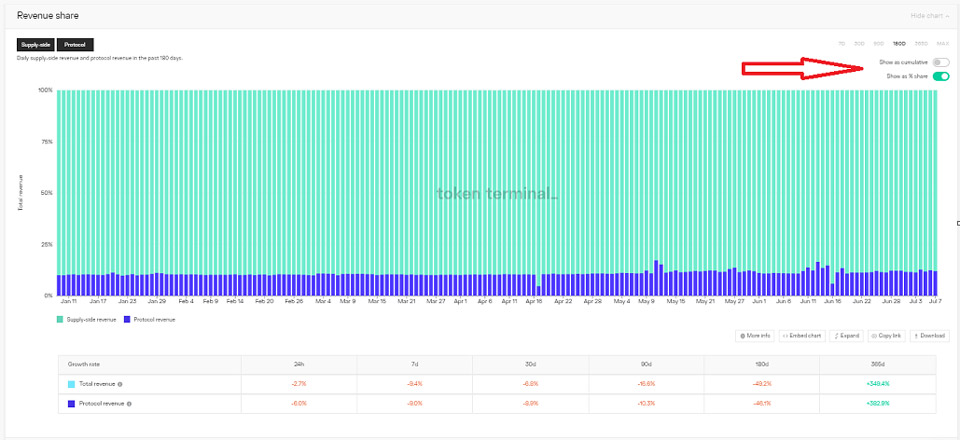

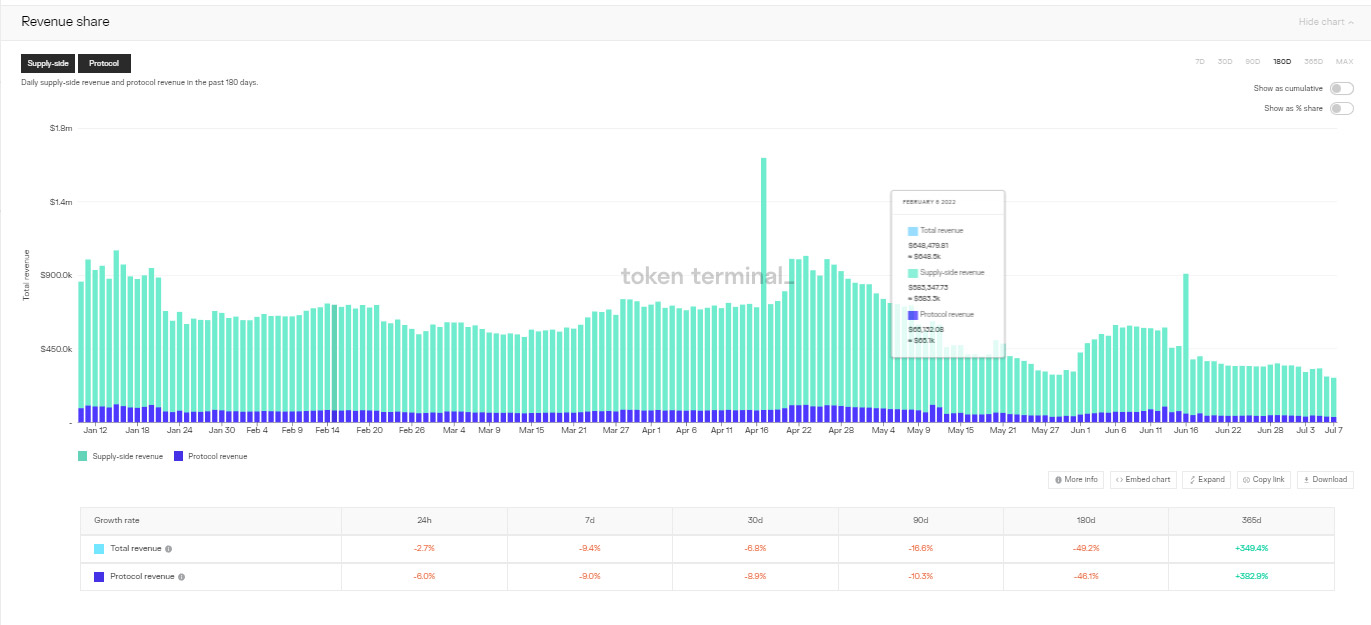

For the income share chart

This chart has four formats to permit end users to have a a lot more intuitive see:

- Default: Displayed as a stacked column chart, exhibiting a day’s complete income for and for the protocol and consumer income as a percentage in that column.

- Show as Circulation – Displayed as a provide curve, exhibiting the cumulative income degree of the complete undertaking in excess of time

- Show as% Share: Shows all income for folks and Dapp income as an spot chart for

- Both apply concurrently

In my viewpoint, employing the very first three formats will be a lot easier and a lot more intuitive for end users in terms of income and income distribution ratio.

Based on this graph, end users can predict potential prospective income primarily based on previous information.

For instance, for Aave’s income share chart we can see the following:

Aave’s complete income has been reducing constantly in excess of the previous 180 days, but there are some days with robust fluctuations like April 17th and June 16th, so what took place in these two days? You can adhere to him on Coinlive. So, along with fluctuations in income and information acquired, you can also make proper judgments in the potential. You can inquire your self the following queries to get a a lot more goal see this kind of as:

- How is the industry?

- Is this information undesirable or fantastic? Is it definitely especially eye-catching to end users?

- What did the sudden upheaval of the undertaking reflect at that time?

- How will this information and facts have an effect on the undertaking and undertaking revenues in the potential?

- What do you require to do to put together in advance if the undertaking is like?

Therefore, you will have an goal see of the prospective of that undertaking in …