Coinbase reported a reduction of $ one.one billion, but CEO Brian Armstrong stated final quarter the business was not targeted on building a revenue, but on advertising staking.

Business condition “red alert”

Coinbase posted a net reduction of $ one.one billion for the 2nd quarter, double the anticipated reduction of $ 546 million. This is the 2nd consecutive quarter of losses and the biggest quarterly net reduction for the cryptocurrency company because its listing on the Nasdaq stock exchange in July 2021.

Financial success also fell brief of analysts’ expectations. Letter to the shareholders from Coinbase on August 9, stating that the 2nd quarter was a hard time for the institute.

The exchange announced income of $ 802.six million, down by 45.one% on a quarterly basis and by 153.one% on an yearly basis. In Knet reduction of $ one.one billion, non-financial costs of $ 446 million due to the collapse in cryptocurrency costs.

Trading volume and income also plummeted, dropping by thirty% and 35% respectively. The “cold” of the cryptocurrency winter has manufactured retail and institutional traders “cold” with digital asset trading. Trading volume on Coinbase has dropped much more than 50% above the similar time period final yr, from $ 462 billion to just $ 217 billion.

Coinbase did not flinch

Despite the red alert, the business stays optimistic that it will consider benefit of the cryptocurrency winter to increase organization. Coinbase CEO Brian Armstrong stated:

“Any quarter can make a profit or a loss. It is important to distinguish between what is under our control and what is beyond our control ”.

CEO Emilie Choi expressed:

“This is typically the ideal time to be greedy when other individuals are afraid. We will carry on to advertise probable merger and acquisition agreements. As for investments, we frequently choose to invest early stage revenue for the duration of this time period simply because this is the ideal time to create, a great deal of innovation will occur at the grassroots degree. “

Coinbase CFO Alesia Haas admits that in the encounter of ups and downs, traders have a tendency to shift from trading to holding. However, she stated the amount of month-to-month trading consumers improved by 200,000 in the quarter.

In ancient letter D.he, Coinbase stressed that it is holding back consumers by means of staking, one particular of the exchange’s priority solutions, and considers this an “early win” for the business. Letter wrote:

“Due to fewer transactions from big retail consumers, mixed MTU [monthly transacting user – người dùng giao dịch hàng tháng] it is oriented in the direction of non-investment pursuits, in individual staking. In the 2nd quarter, 67% or six million MPUs participated in the trading of non-investment solutions, primarily staking. “

The business continues to target on staking as portion of its organization model ahead of The Merge, bringing the world’s 2nd biggest blockchain to a Proof-of-Stake mechanism.

“In early August, we started offering Ethereum staking to institutional clients. We will continue to add more client staking resources in the future.”

In truth, the main cryptocurrency exchange in the US is possessing a really hard time due to the basic bleak condition sweeping the industry. Since the monetary report for the to start with quarter of 2022 with a 53% drop in net revenues, the COIN share cost has persistently hit a reduced in April. Also to lower prices and strengthen revenue overall performance, Coinbase has determined to make a determination: ideas to lay off one,one hundred staff and discontinue the Coinbase Pro platform by the finish of 2022.

“Overall, it will consider some time to notice the complete monetary affect of its actions. However, we have decreased the variety of prices for the complete yr for technologies and improvement, as properly as for basic and administration. “

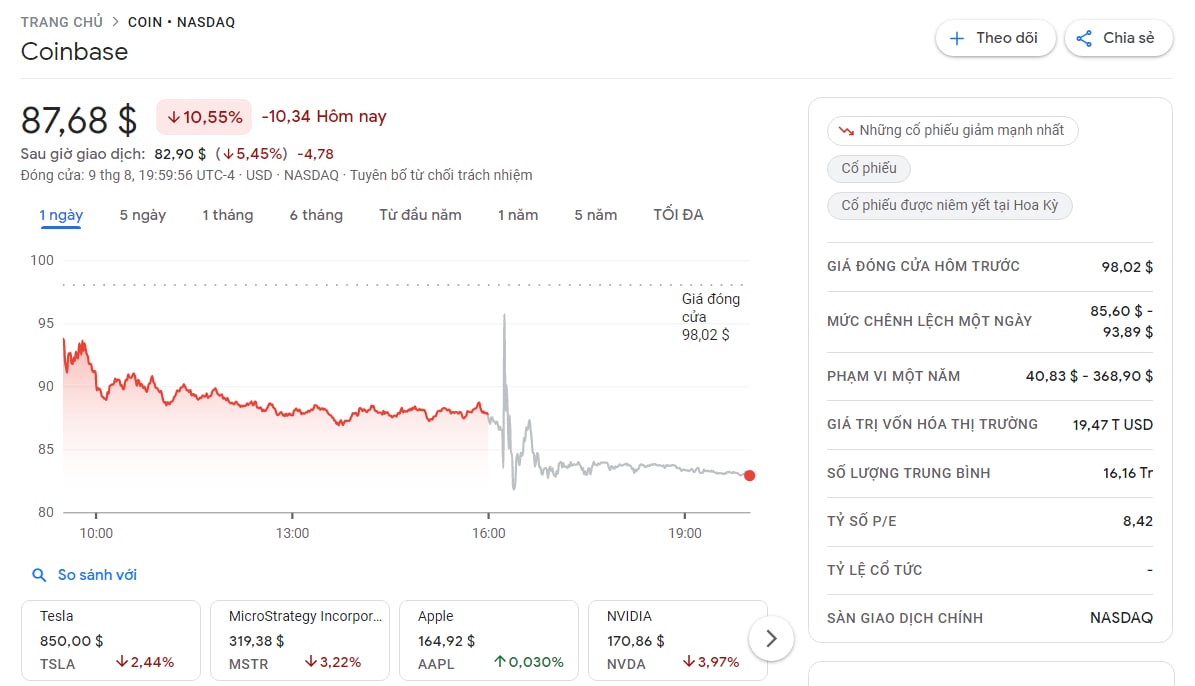

Coins share cost by Coinbase It fell ten.fifty five% following the organization launched its 2nd quarter monetary statements and as of press time it is trading all over the $ 87.68 mark.

Synthetic currency 68

Maybe you are interested: