Coinbase has challenged the SEC’s current ruling that staking is a disguised safety.

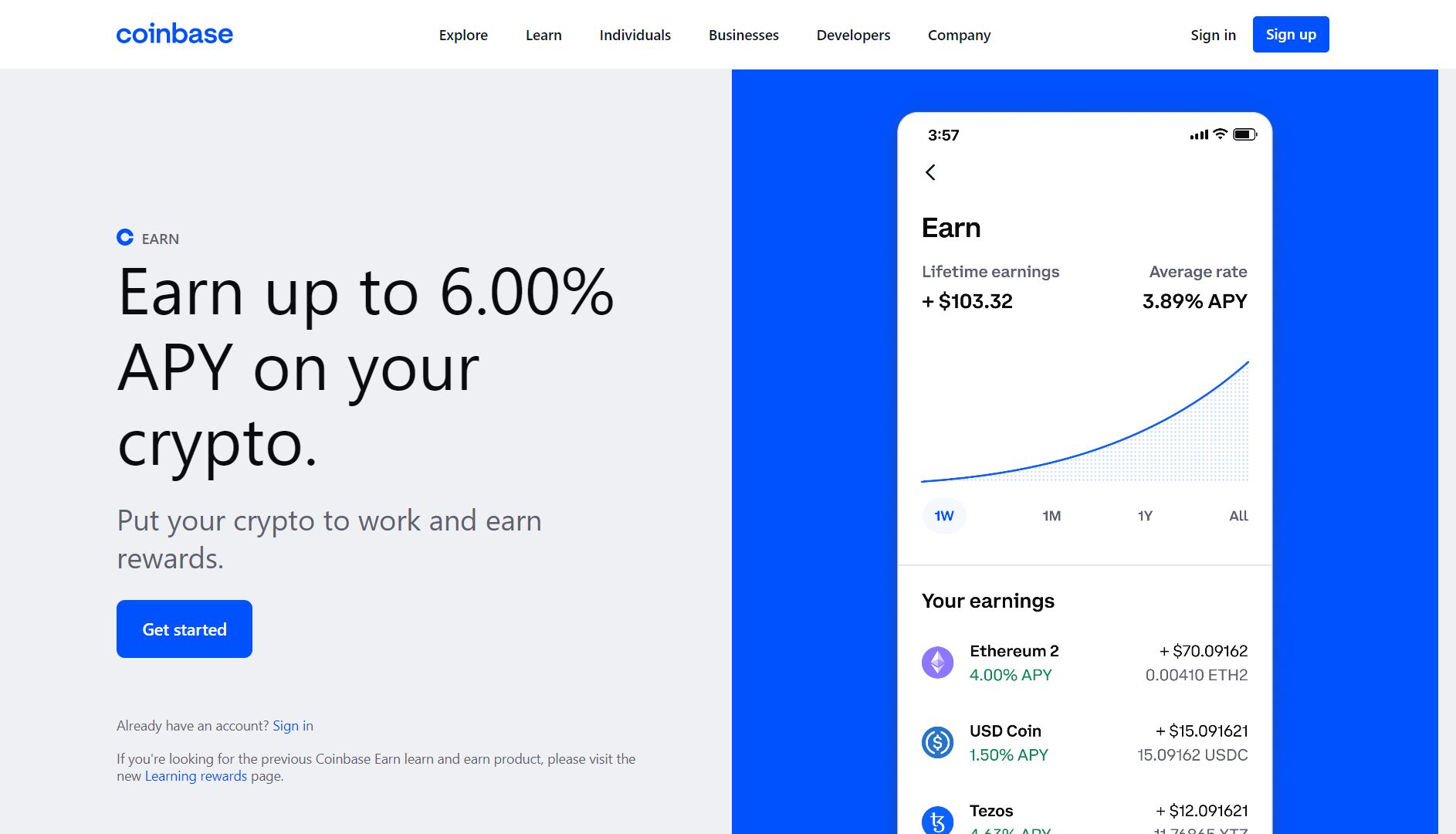

Chief Legal Officer Paul Grewal of Coinbase, the biggest US cryptocurrency exchange, stressed that its staking solution, identified as Coinbase Earn, is not a safety, in response to the new ruling right here by the Securities and Exchange Commission (SEC). American. .

The over comment was posted by Mr. Grewal in an post towards the SEC soon after he fined Kraken Exchange $thirty million for supplying a cryptocurrency staking solution, claiming it was a disguised safety. SEC Chairman Gary Gensler later on mentioned the Kraken situation should really be viewed as a “head-on” to US crypto companies giving comparable items, which includes Coinbase.

At the starting of the post, Mr. Paul Grewal mentioned that Coinbase’s staking support is not a safety.

“Staking is not a security under the United States Securities Act, nor is the Howey Test, the methods used by the SEC to assess whether an investment contract is a security.”

@secgov has produced a variety of incorrect claims about staking in excess of the previous couple of days and has asked a variety of misleading inquiries. Let’s get this straight level-by-level: There’s a whole lot of FUD to cover. https://t.co/2CBT8mdKke

— paulgrewal.eth (@iampaulgrewal) February 10, 2023

The Howey check is a effectively-identified safety rating system usually applied by the SEC, whereby an asset is regarded a safety if it is:

- An investment in income

- The investment of dollars in a joint venture

- There is an expectation of return on investment

- This revenue comes from the exercise of the organization marketing the investment or a third celebration.

Consequently, because staking customers “always retain full ownership of the assets, as well as the right to withdraw funds”, the relevant providers are unable to be regarded a financial investment.

Furthermore, staking customers do not invest in “a common asset” mainly because the assets are contributed to a decentralized network, interconnected through the blockchain network. Staking rewards are also established by the blockchain, rather than Coinbase.

In terms of return on investment, Coinbase believes that staking participants only use their personal money to make sure the safety and working of the blockchain network, in exchange for getting staking rewards in the kind of “fees” for supplying providers . Users can also bet without the need of going as a result of Coinbase, but will incur further gear prices and dangers of technical complexity.

Finally, staking generates rewards from “one side’s efforts”. A staking supplier like Coinbase are unable to make your mind up the reward that the protocol pays for staking. Coinbase is just an IT support supplier, not an investment support.

Mr Grewal concluded:

“Stakeout is not a safety. Imposing securities laws on staking does not enable traders, but as an alternative produces further barriers to reduce US traders from accessing standard cryptographic providers and drives customers away to foreign, beneath-regulated platforms.

Earlier in the week, Coinbase CEO Brian Armstrong exposed that there are rumors that the SEC is getting ready to ban cryptocurrency staking. This comment comes just one particular day in advance of the SEC’s choice to penalize Kraken.

Coinbase COIN stock cost is down virtually twenty% this week due to SEC ruling concerning staking as securities in disguise.

Synthetic currency68

Maybe you are interested: