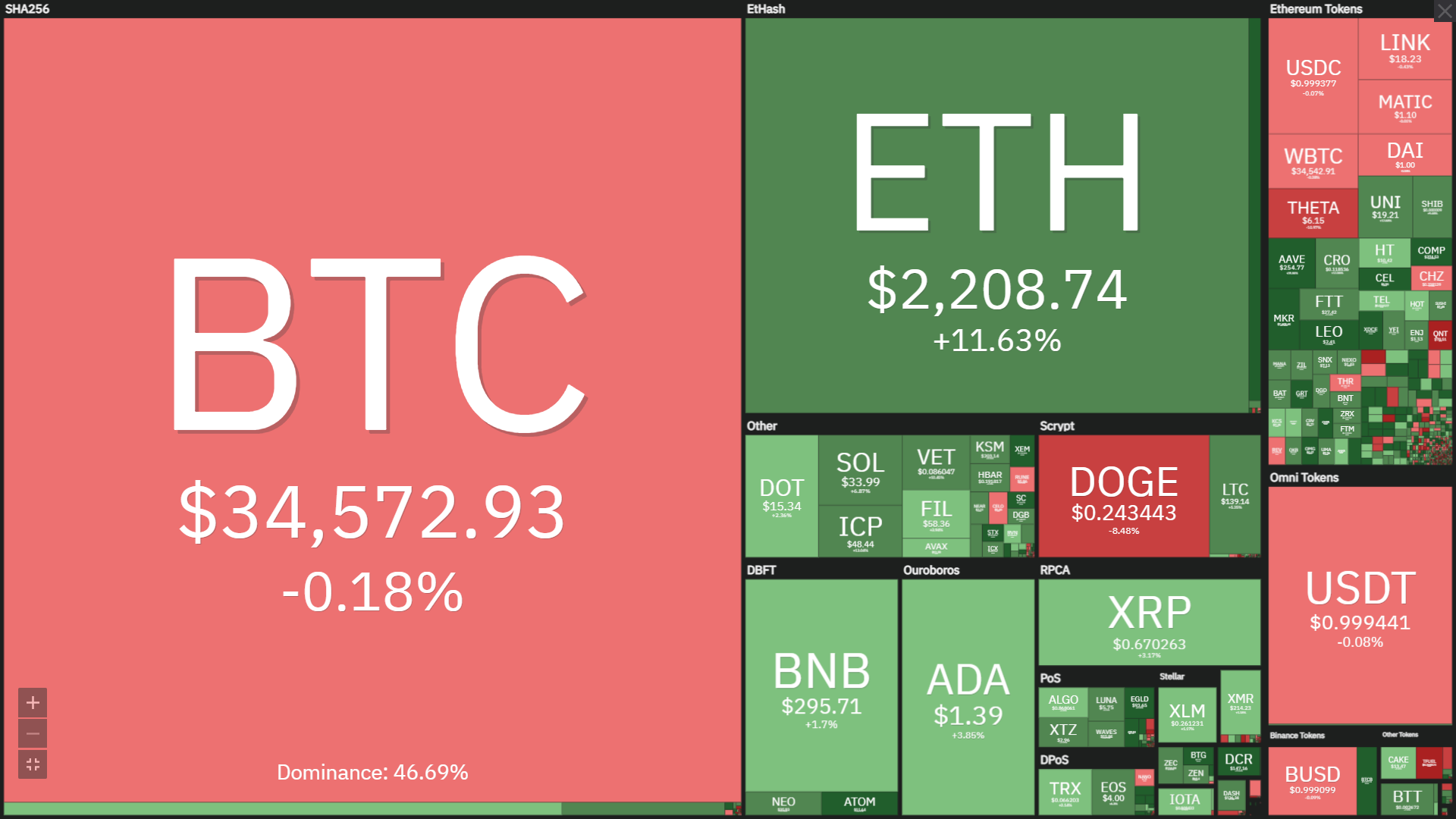

Bitcoin within the final week of June, early July prolonged a sequence of gloomy days the place there was no clear signal of restoration. The essential trigger continues to be the results of the crackdown on BTC mining in China, which plunged the hashrate, forcing the Bitcoin network to have the largest adjustment problem in historical past. In addition, the truth that Bitcoin simply recorded a 40.37% decline within the second quarter of 2021, the most important decline ever within the second quarter, reinforces the notion that the brand new bear market on this planet.

Meanwhile, the story is totally totally different with altcoins. The inexperienced shade is again in most altcoins higher than 7 days in the past. The cause is that in contrast to pure BTC which relies upon solely on information, altcoin tasks nonetheless have their very own energy, which is the event progress of the mission itself. This is much more evident when the Bitcoin Dominance Index fell from 47% earlier within the week to 45% on the time of writing.

Let’s overview every part with Coinlive to ensure you do not miss any vital information! 😉

📌 Coinlive Originals – Articles to learn

– Crypto Lighthouse # 5 Livestream: “Game of Thrones” between ecosystems

– Coinlive Blog: Tips for Saving Gas Tax on Ethereum – Did You Know?

– Coinlive TV: Ref Finance Experience – Near Ecosystem Warrior Potential

– Analysis: GBTC unlocked: the crypto market’s “boggart” in July?

1 / The focus 🔥

– Internet pc protocol (ICP) – “The trick of the century”?

– “The person who claims to be Satoshi Nakamoto” Craig Wright Bitcoin whitepaper copyright lawsuit wins, BSV’s worth “builds columns”

– FUD from China: Oldest Cryptocurrency Exchange Stops Bitcoin Trading, Huobi cease trading in derivatives

– Binance in authorized bother all around the world: from the United Kingdom, Japan, Cayman to Thailand

– Binance P2P Starting to cost customers, Vietnam is “preferred”

2 / Uppercase

– Bitcoin mining algorithm problem recorded the most important decline in historical past

– Bitcoin has entered a bear market But when will all this finish?

– Bitcoin billionaire Mircea Popescu is believed to have drowned

– Greyscale “down money” so as to add a big quantity Cardano (ADA) within the pockets

– Bitcoin Cash ABC change identify to “Electronic cash”, the BCHA token converts to XEC

– Elon Musk continually posting tweets that “blow up prices” DOGE – But it appears to have “run out”

– Classic Ethereum Big exhausting fork announcement in July, ETC worth doubled in only one week

– USDC might quickly broaden operations throughout 10 totally different blockchains with another “surprising” statistics on this rising stablecoin.

3 / DeFi 🦄

– Oracle Series # 1: Oracle overview

– CoinMarketCap shake fingers with Uniswap to launch the token trade operate

– finance cream Integrated Layer 2 answer of Polygon

– 1 inch companion with ICHI to launch the one1INCH ONLY stablecoin

– The first assault on the polygon: Safe Dollar (SDO) was “mined” USD 248,000, the token worth dropped to 0

4 / NFT

– Twitter challenge 140 NFTs on the Rarible platform.

– NFT the supply code of the Internet Sold for $ 5.4 million

– Katy Perry will launch the NFT assortment on the finish of 2021

5 / Investments from giant organizations

– Billionaire’s funding fund George Soros it’s stated to trade Bitcoin

– DelicateBank make investments 200 million {dollars} in Mercado Bitcoin trade in Brazil

– NYDIG present options Bitcoin for 650 banks within the USA

– The Mexican billionaire plans his financial institution accepts Bitcoin

– “Power Couple” Tom Brady and Gisele Bündchen turn out to be a shareholder of FTX

6 / Legal and Hospitality ⚖️

– The Bank of Vietnam began researching and piloting the “virtual currency”

– Mexico cryptocurrencies declared banned from the monetary system

– Ukraine put CBDC on par with money within the new funds legislation

– America suggestion El Salvador It ought to make it possible for Bitcoin is “well managed”

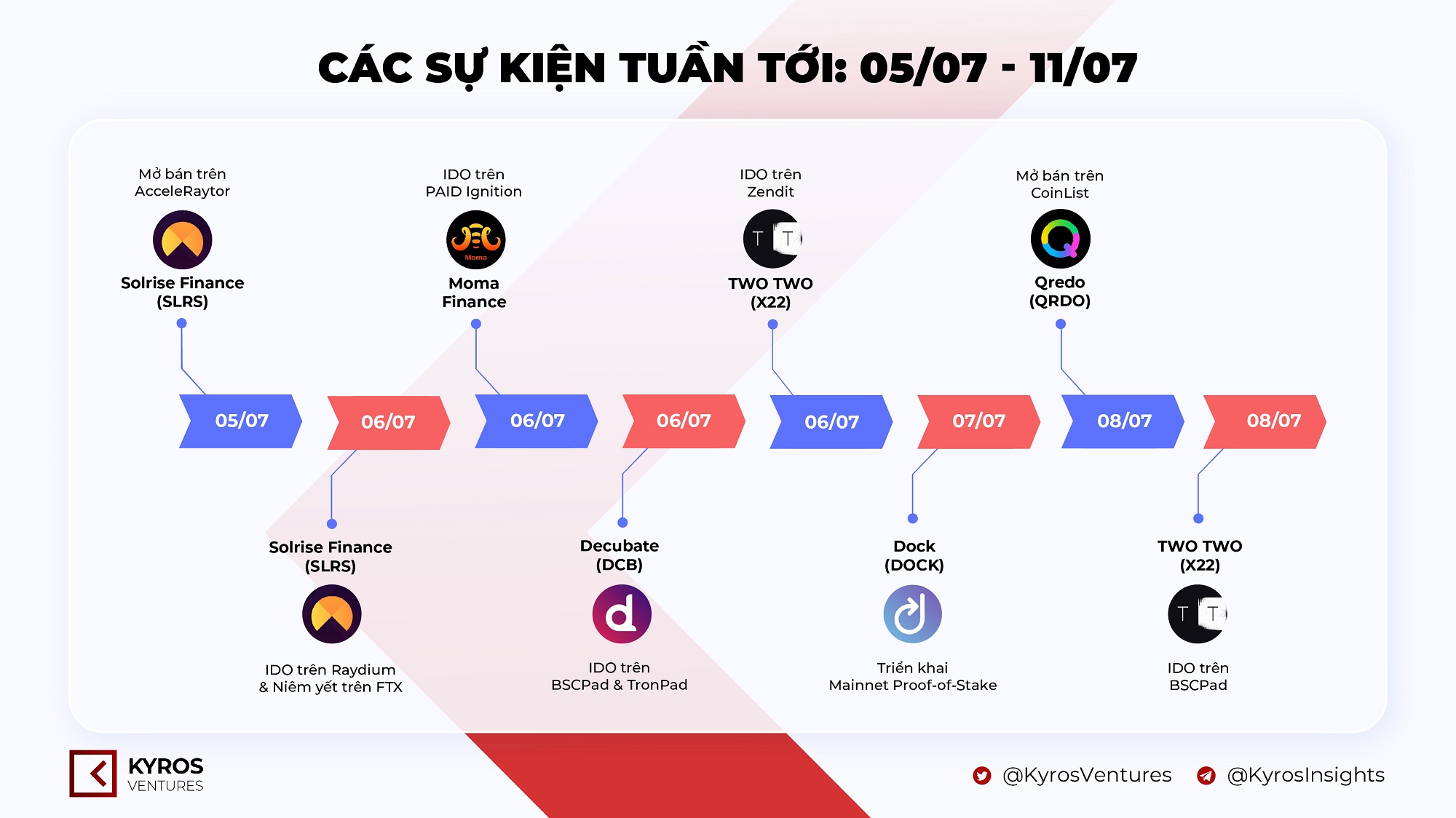

7 / Notable occasions subsequent week (July 5 – July 11) 📆

Synthetic Currency 68

.