Not all bear markets are designed equal, and the exact same can be mentioned when evaluating the 2018 crypto bear industry and the present 2022 bear industry.

Exchange BTC stability 2018-2019

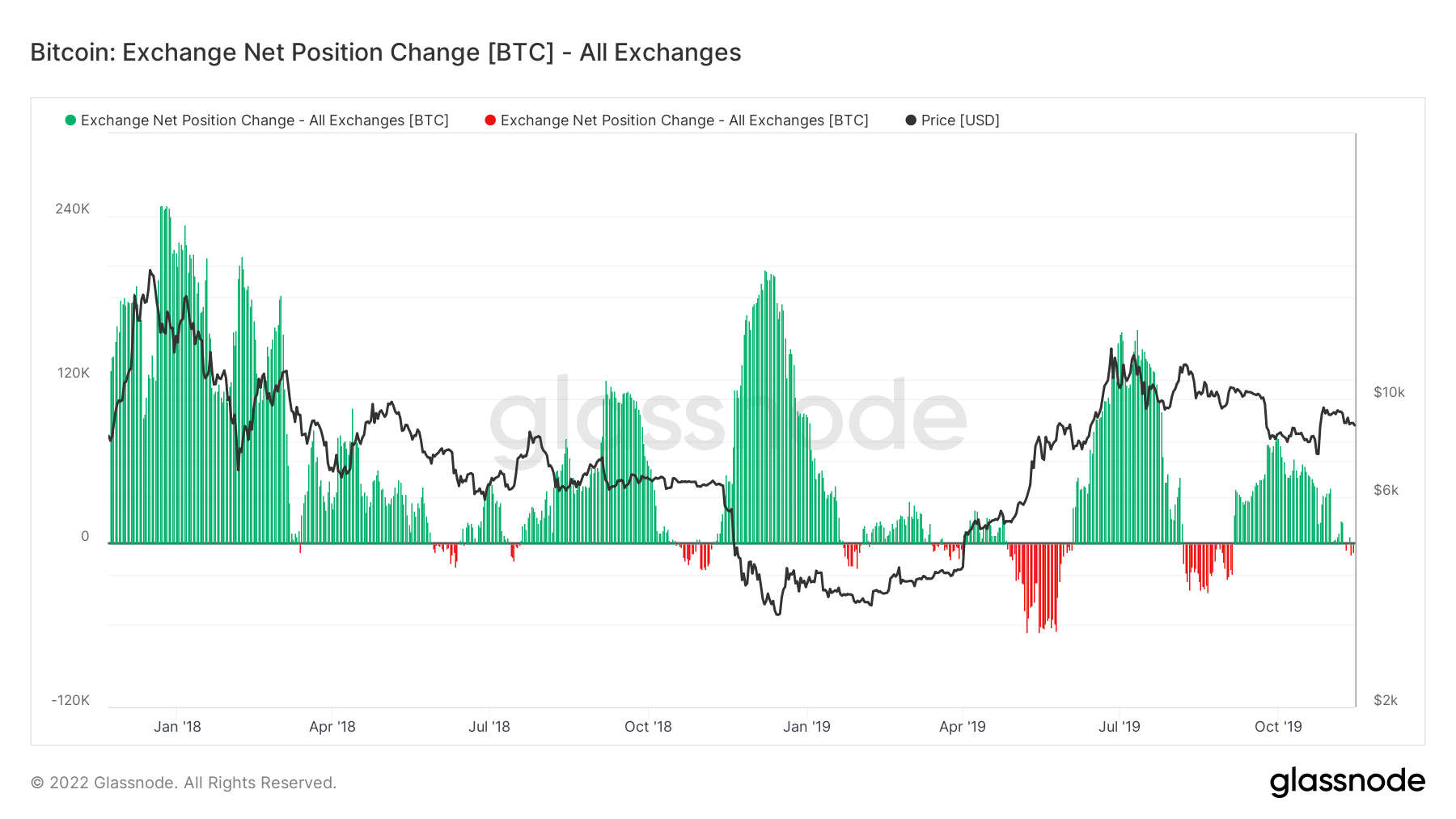

After the peak of the bull run in December 2017, the Bitcoin (BTC) selling price fell under $ten,000 and what followed from January 2018 to Q4 2019 was a large influx of BTC into exchanges. Translate.

Starting with about one.seven million BTC on exchanges in January 2018, by the finish of 2019, exchanges held an estimated three million BTC.

BTC 2022 stability exchange

Unlike its 2018 predecessor, the 2022 bear industry has presented itself as a fully distinct animal. By 2022, an unprecedented volume of BTC has driven exchanges into the hundreds of 1000’s at a time.

In the aftermath of the FTX crash, a complete of close to 300,000 BTC started off leaving exchanges starting up in early June 2022. After the crash, the upward trend in BTC withdrawals from these exchanges only elevated pace when the spell ‘not your keys, not your coins’ has been held.

The peak of the 2018 bear industry lasted for about 136 days and noticed the selling price of BTC drop extra than 80% from its all-time large (ATH). When in contrast to the present BTC selling price – down about 76% from its all-time large (ATH) in excess of the previous handful of days – chart patterns recommend that the top rated of the 2022 bear industry could be right here.

Introduction to Derivatives

One stark distinction in between the bear industry of 2018 and 2022 is the introduction of derivatives into the crypto industry.

With the advent of futures and alternatives in 2021, derivatives have considering that turn out to be a basic factor of the crypto industry – generating up a massive chunk of the crypto ecosystem. Built on $two.five trillion in derivatives, the international banking technique proves that derivatives are of absolute relevance in the crypto ecosystem — and the influence they can and will have.

In analyzing preceding bear markets, Cryptoslate found that a bottom had formed when quick marketing grew to become so solid that the BTC selling price would not fall any even more. This has been witnessed in preceding bear industry bottoms, the outbreak of the Covid-19 pandemic, China’s crypto ban in summer season 2021, with the fall of Luna and now is the demise of FTX.