Certainly the DeFi marketplace participants had to wait a extended time to acquire details about the Arbitrum (ARB) airdrop and token. So now, now that we have plainly recognized tokenomics and Arbitrum implementation, let us do a small comparison with the competition’s optimism (OP) to see these two amounts two. What’s the distinction!

Note: The write-up beneath is not meant to recommend a valuation for ARB tokens prior to listing. All written content beneath is for informational functions only and is my personalized viewpoint and is NOT meant as investment assistance.

Tokennomics overview

First, you can read through the particulars about how optimism implements tokenomics in the following write-up.

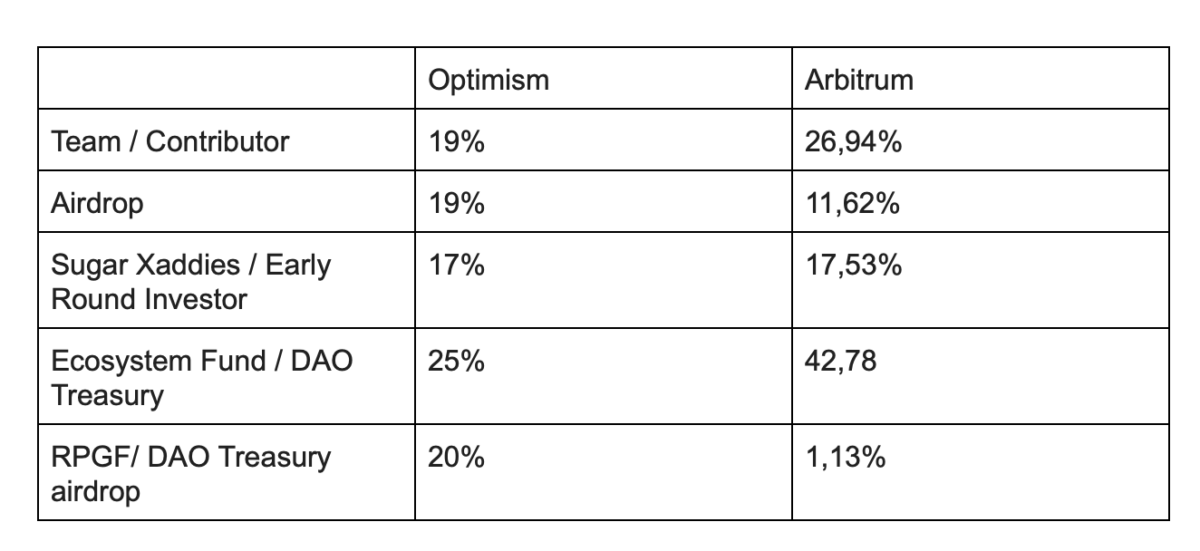

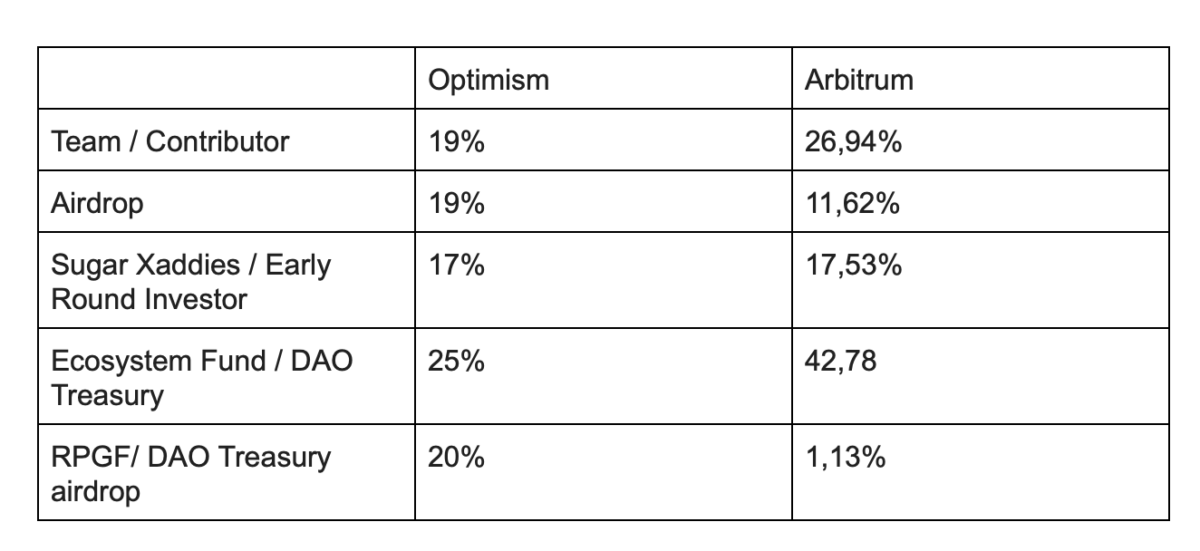

I’ll rapidly move on to evaluating the token allocation of the two tasks in the table beneath:

Of program, assembling some factors involving the two tasks for comparison is a bit tedious. For illustration, the item “Fund for the ecosystem” AND “Darling DAO”since the Arbitrum documentation has not yet detailed the purpose of “DAO honey“. However, with the other goods, we can relatively review, for the reason that the use objective is rather comparable.

Overall, the Arbitrum distribution will Not biased in direction of the consumer neighborhood and the venture builder object like optimism. This is proven in the allocation for Airdrops, Teams, Early Investors, and the largest distinction is almost certainly the aspect of the help fund that is redistributed to the venture (Grant).

Many of you are also wanting to know why the Arbitrum percentage is type of weird. The motive is for the reason that Unlimited provide of Arbitrum and will carry on to flourish above time (with a dedication of no additional than two% per annum).

Both Tier 2s will use ETH as a payment unit and their native token will be made use of for governance and neighborhood help grant.

Operational standing

Thus, the two working with ETH to shell out fuel tariffs and expenditures linked to information logging and Layer-one interaction will call for the two Arbitrum and Optimism to retain the identical model 🙁Revenue from transaction costs/operations on degree two) – (Data price for tier one) = Great dealearnings remaining to the Foundation.

In this aspect, from my personalized level of see, Arbitrum has been rather “filtered” in deciding upon the following token option, whilst retaining the historical past of the airdrop, making determination for consumers to constantly transact on the .net network, consequently attracting a big volume of cash flow No want to overspend in the type of issued tokens and grant to the ecosystem.

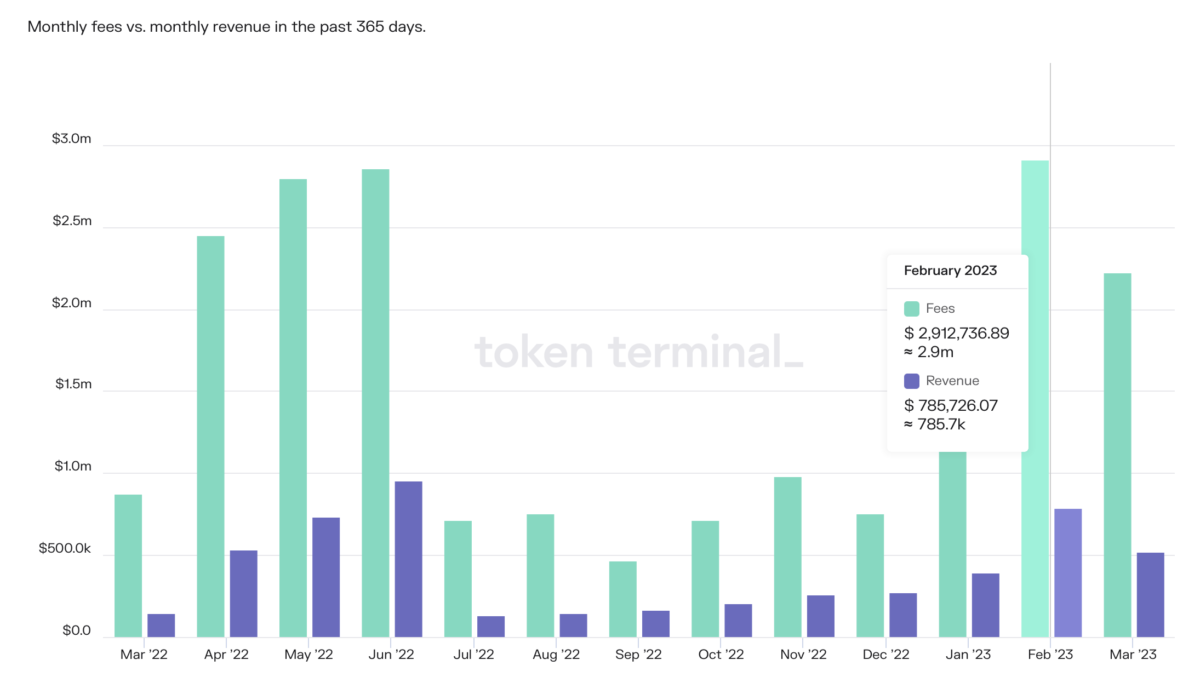

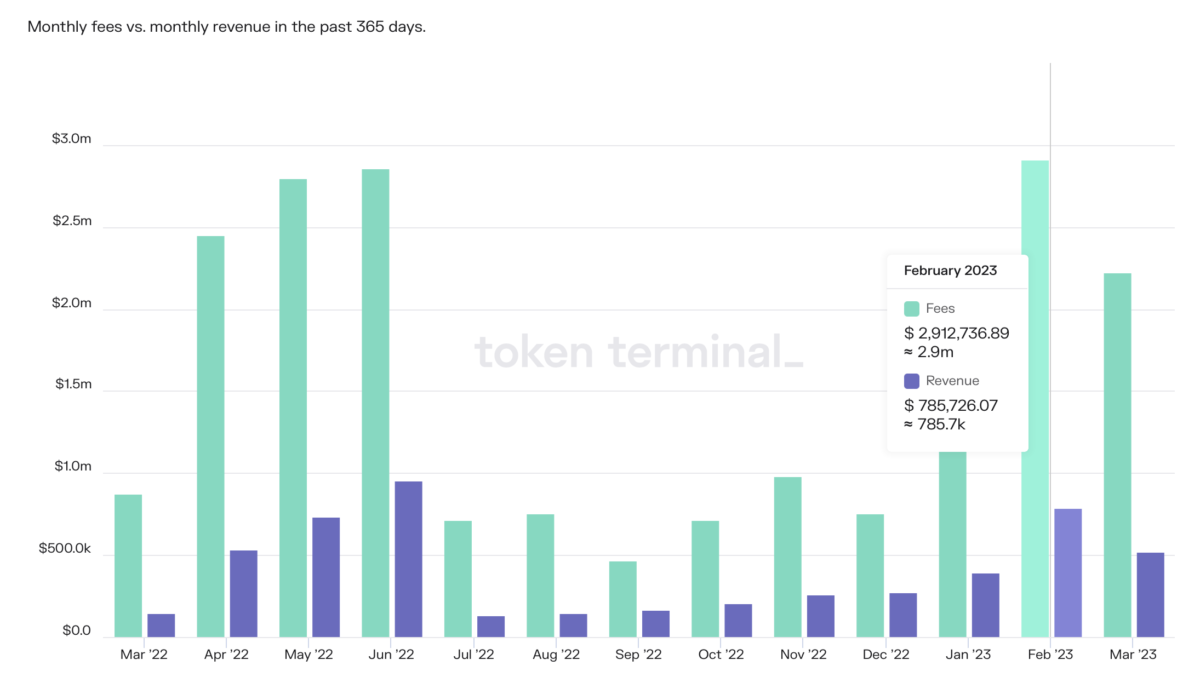

The most outstanding second for Arbitrum’s operation occurred in July 2022 and February 2023. In the earlier two timeframes, the complete charge assortment is about $two.9 million and the income / cash flow (in this situation, the aspect that Arbitrum earns immediately after deducting degree one information expenditures) is 785 ~ 900 thousand USD.

Conversely, with Optimism, a big volume of tokens allotted to the Grant array will be a price burden if the venture does not have a voting approach, as effectively as a acceptable alternative, in buy to lessen the strain of token income and expenditures as an difficulty.

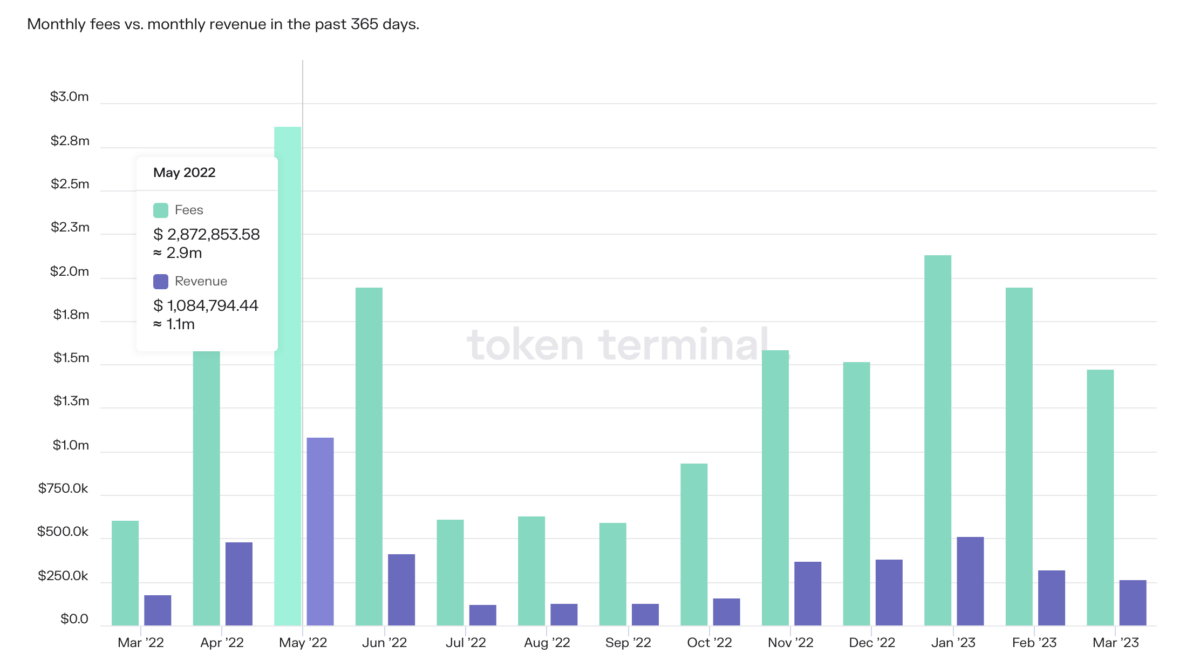

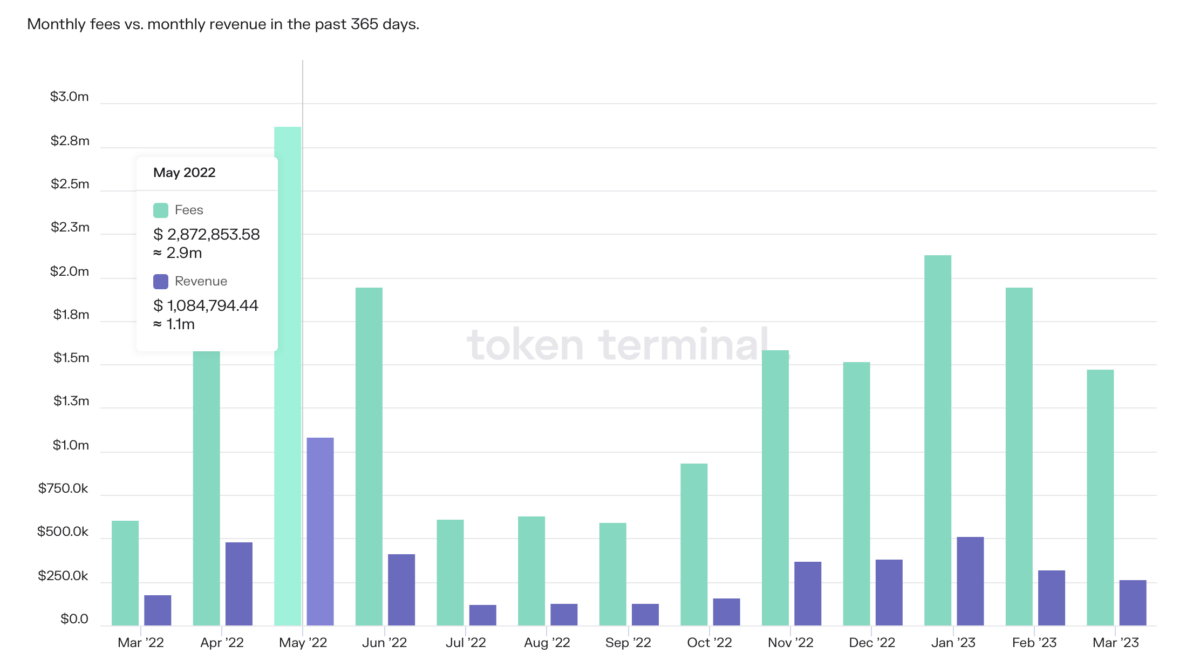

The peak of optimism pleasure occurred once more in May 2022, even immediately after the announcement of the airdrop information. This move can be explained by the truth that optimism divides the airdrop into quite a few elements. By late 2022, early 2023, exercise on this layer-two has started off to bustle once more to put together for the 2nd airdrop, this is also when the OP value sets a new ATH .

Looking at the assortment considering the fact that the starting of 2023, Arbitrum is somewhat greater in terms of income, but as talked about over, it will be essential if the venture can entice funds movement to keep immediately after the airdrop announcement. Meanwhile, optimism nonetheless has a single additional “card up its sleeve” which is the following round of toss.

Future technical developments

EIP-4844

In the two graphs in the earlier part, if you review the Transaction Fees collected from consumers (the blue aspect) and the Revenue returned to the venture (the purple aspect), you will see a rather big distinction. This comes from the expenditures of interacting with layer one, obtaining and aggregating information. The bottleneck in the enterprise model can be explained to come up from yet another bottleneck of a technical nature. This is when Layer-two is inherently dependent on Layer-one Ethereum to assure decentralization and safety. However, in the close to potential, this difficulty ought to be dealt with by EIP-4844.

In a information evaluation by the writer “dcrapis” pertaining to the following transaction charge construction EIP-4844comparisons involving Arbitrum and Optimism have also been talked about.

With a time frame of the initially two months of 2023, when the Layer-two marketplace was the most energetic, the information parameters that the aforementioned Rollups sent to Layer-one have been not also various all through the day. In unique:

- Referee: medium sending 100MB of information per day on the ETH mainnet.

- Optimism: medium sending 93MB of information per day on the ETH mainnet.

That explained, even immediately after EIP-4844 is implemented, the distinction in get in touch with information expenditures (that is, recording and evaluating transaction information to Layer one) of the two tasks will not be also terrific.

However, relative to themselves, the two Optimism and Arbitrum will be in a position to lower a big volume of calldata overhead. Current estimates are about 10x, and some projections recommend that the price of Layer-two information per transaction Batch will be nearly…free. If you are interested in updating EIP-4844, you can discover the particulars in the write-up beneath.

> See also: What is EIP-4844? How will Layer-two remedies advantage?

Expanded construction

Notably, Arbitrum will also distribute the Orbit products branch and get started speaking about the notion Layer-three. Meanwhile, Optimism introduces the OP Stack mechanism and the Superchain model.

Basically, Optimism and Arbitrum will carry on to be a platform on which to create other tasks in the type of App-chains. However, Arbitrum degree three will favor the layering mechanism (i.e. degree three builds on the degree of degree two). Meanwhile, OP Stack’s Superchain will favor a core network model, and surrounding chains will advantage from the toolkit produced by Optimism to distribute the products.

This technical detail will open a new alter in tokenomics and enterprise facets, when the native tokens of the two tasks can be made use of to capture a big volume of worth from the tasks created about their public domain equipment. Typically, Coinbase’s Base has announced that it will deduct aspect of its transaction costs to return it to the Optimism Treasury.

Potential rivals

Any enterprise model will want a aggressive edge. And it seems to be like the two optimistic rollups in this write-up will encounter some issues in the potential when zkEVMs are implemented.

>> See additional: DeFi Discussion ep.fifty five: Scaling Wars Talk – Who advantages?

However, with two updates Bottom rock Together nitroit is simple to see that the two optimism and arbitrum are open to likelihood switch to the zk-rollups mechanism if required. This can be noticed as a protective layer of safety, assisting these two names safe initially-mover benefit, entice a big volume of funds movement and tasks up front, whilst nonetheless making certain the potential to move flexibly. connected.

The last

From my personalized level of see, Arbitrum and Optimism have quite a few similarities from model implementation, technical settings and neither side has an mind-boggling aggressive benefit. There is only a single detail in the layout of tokenomics, I consider optimism is additional neighborhood oriented, whilst Arbitrum chooses an method that desires to assure additional management to simply coordinate routines in the.net neighborhood.

Hope the over write-up will carry you worth and intriguing standpoint. We hope the over details assists you make the proper investment choices for by yourself. For now, bye and see you quickly in a new publish.

Synthetic currency68

Maybe you are interested:

Certainly the DeFi marketplace participants had to wait a extended time to acquire details about the Arbitrum (ARB) airdrop and token. So now, now that we have plainly recognized tokenomics and Arbitrum implementation, let us do a small comparison with the competition’s optimism (OP) to see these two amounts two. What’s the distinction!

Note: The write-up beneath is not meant to recommend a valuation for ARB tokens prior to listing. All written content beneath is for informational functions only and is my personalized viewpoint and is NOT meant as investment assistance.

Tokennomics overview

First, you can read through the particulars about how optimism implements tokenomics in the following write-up.

I’ll rapidly move on to evaluating the token allocation of the two tasks in the table beneath:

Of program, assembling some factors involving the two tasks for comparison is a bit tedious. For illustration, the item “Fund for the ecosystem” AND “Darling DAO”since the Arbitrum documentation has not yet detailed the purpose of “DAO honey“. However, with the other goods, we can relatively review, for the reason that the use objective is rather comparable.

Overall, the Arbitrum distribution will Not biased in direction of the consumer neighborhood and the venture builder object like optimism. This is proven in the allocation for Airdrops, Teams, Early Investors, and the largest distinction is almost certainly the aspect of the help fund that is redistributed to the venture (Grant).

Many of you are also wanting to know why the Arbitrum percentage is type of weird. The motive is for the reason that Unlimited provide of Arbitrum and will carry on to flourish above time (with a dedication of no additional than two% per annum).

Both Tier 2s will use ETH as a payment unit and their native token will be made use of for governance and neighborhood help grant.

Operational standing

Thus, the two working with ETH to shell out fuel tariffs and expenditures linked to information logging and Layer-one interaction will call for the two Arbitrum and Optimism to retain the identical model 🙁Revenue from transaction costs/operations on degree two) – (Data price for tier one) = Great dealearnings remaining to the Foundation.

In this aspect, from my personalized level of see, Arbitrum has been rather “filtered” in deciding upon the following token option, whilst retaining the historical past of the airdrop, making determination for consumers to constantly transact on the .net network, consequently attracting a big volume of cash flow No want to overspend in the type of issued tokens and grant to the ecosystem.

The most outstanding second for Arbitrum’s operation occurred in July 2022 and February 2023. In the earlier two timeframes, the complete charge assortment is about $two.9 million and the income / cash flow (in this situation, the aspect that Arbitrum earns immediately after deducting degree one information expenditures) is 785 ~ 900 thousand USD.

Conversely, with Optimism, a big volume of tokens allotted to the Grant array will be a price burden if the venture does not have a voting approach, as effectively as a acceptable alternative, in buy to lessen the strain of token income and expenditures as an difficulty.

The peak of optimism pleasure occurred once more in May 2022, even immediately after the announcement of the airdrop information. This move can be explained by the truth that optimism divides the airdrop into quite a few elements. By late 2022, early 2023, exercise on this layer-two has started off to bustle once more to put together for the 2nd airdrop, this is also when the OP value sets a new ATH .

Looking at the assortment considering the fact that the starting of 2023, Arbitrum is somewhat greater in terms of income, but as talked about over, it will be essential if the venture can entice funds movement to keep immediately after the airdrop announcement. Meanwhile, optimism nonetheless has a single additional “card up its sleeve” which is the following round of toss.

Future technical developments

EIP-4844

In the two graphs in the earlier part, if you review the Transaction Fees collected from consumers (the blue aspect) and the Revenue returned to the venture (the purple aspect), you will see a rather big distinction. This comes from the expenditures of interacting with layer one, obtaining and aggregating information. The bottleneck in the enterprise model can be explained to come up from yet another bottleneck of a technical nature. This is when Layer-two is inherently dependent on Layer-one Ethereum to assure decentralization and safety. However, in the close to potential, this difficulty ought to be dealt with by EIP-4844.

In a information evaluation by the writer “dcrapis” pertaining to the following transaction charge construction EIP-4844comparisons involving Arbitrum and Optimism have also been talked about.

With a time frame of the initially two months of 2023, when the Layer-two marketplace was the most energetic, the information parameters that the aforementioned Rollups sent to Layer-one have been not also various all through the day. In unique:

- Referee: medium sending 100MB of information per day on the ETH mainnet.

- Optimism: medium sending 93MB of information per day on the ETH mainnet.

That explained, even immediately after EIP-4844 is implemented, the distinction in get in touch with information expenditures (that is, recording and evaluating transaction information to Layer one) of the two tasks will not be also terrific.

However, relative to themselves, the two Optimism and Arbitrum will be in a position to lower a big volume of calldata overhead. Current estimates are about 10x, and some projections recommend that the price of Layer-two information per transaction Batch will be nearly…free. If you are interested in updating EIP-4844, you can discover the particulars in the write-up beneath.

> See also: What is EIP-4844? How will Layer-two remedies advantage?

Expanded construction

Notably, Arbitrum will also distribute the Orbit products branch and get started speaking about the notion Layer-three. Meanwhile, Optimism introduces the OP Stack mechanism and the Superchain model.

Basically, Optimism and Arbitrum will carry on to be a platform on which to create other tasks in the type of App-chains. However, Arbitrum degree three will favor the layering mechanism (i.e. degree three builds on the degree of degree two). Meanwhile, OP Stack’s Superchain will favor a core network model, and surrounding chains will advantage from the toolkit produced by Optimism to distribute the products.

This technical detail will open a new alter in tokenomics and enterprise facets, when the native tokens of the two tasks can be made use of to capture a big volume of worth from the tasks created about their public domain equipment. Typically, Coinbase’s Base has announced that it will deduct aspect of its transaction costs to return it to the Optimism Treasury.

Potential rivals

Any enterprise model will want a aggressive edge. And it seems to be like the two optimistic rollups in this write-up will encounter some issues in the potential when zkEVMs are implemented.

>> See additional: DeFi Discussion ep.fifty five: Scaling Wars Talk – Who advantages?

However, with two updates Bottom rock Together nitroit is simple to see that the two optimism and arbitrum are open to likelihood switch to the zk-rollups mechanism if required. This can be noticed as a protective layer of safety, assisting these two names safe initially-mover benefit, entice a big volume of funds movement and tasks up front, whilst nonetheless making certain the potential to move flexibly. connected.

The last

From my personalized level of see, Arbitrum and Optimism have quite a few similarities from model implementation, technical settings and neither side has an mind-boggling aggressive benefit. There is only a single detail in the layout of tokenomics, I consider optimism is additional neighborhood oriented, whilst Arbitrum chooses an method that desires to assure additional management to simply coordinate routines in the.net neighborhood.

Hope the over write-up will carry you worth and intriguing standpoint. We hope the over details assists you make the proper investment choices for by yourself. For now, bye and see you quickly in a new publish.

Synthetic currency68

Maybe you are interested: