one. What is the platypus?

Platypus is a single-side AMM protocol that supports stablecoin trading on Avalanche. Platypus makes it possible for you to present single token liquidity (with a single token, alternatively of a pair of tokens like other AMMs), consequently minimizing the Impermanent Loss (IL) for LPs (Liquidity Providers) and slippage for consumers.

Basically, we can see Platypus as a new curve on Avalanche, which is an AMM exchange that supports stablecoin trading. In addition, Platypus also focuses on enhancing capital efficiency and minimizing IL for consumers.

two. Tokenomic PTP

PTP is the native token of Platypus. PTP can be applied for staking and to get vePTP in return. vePTP will have two significant functions:

- Right vote: vePTP offers its owners the proper to participate in governance, to vote on significant selections in the protocol.

- Boostrap April: If you participate in the provision of liquidity on Platypus, owning vePTP makes it possible for you to get additional APR.

Similar to Curve’s veCRV, the longer it will take a sibling to commit to blocking the PTP, the additional beneficial the vePTP will be in the vote and also in the APR boostrap.

This prospects to the creation of PTP wars. I will clarify in additional detail beneath.

three. PTP Wars

As I stated, the additional vePTPs you have in your hands => the additional manage you have in excess of the protocol, particularly for distributing LP rewards to the preferred pool => appeal to additional participants present liquidity => maximize transactions, maximize commissions.

Therefore, protocols want to very own as a lot of PTPs or vePTPs as feasible to distribute reward rewards to their money pool => make revenue.

There are two methods these third-celebration protocols can consider in excess of additional of vePTP:

- Buy PTP immediately on the marketplace and then block it.

- Find a way to enable retail consumers to entrust vePTP to their protocol, then use and reward retail consumers.

In which, the 2nd way is the primary element that produces PTP wars. Currently, there are three protocols participating in the PTP wars like: Yield Yak, Vector Finance and Echidna Finance. In the subsequent area, we will find out these 3 protocols collectively.

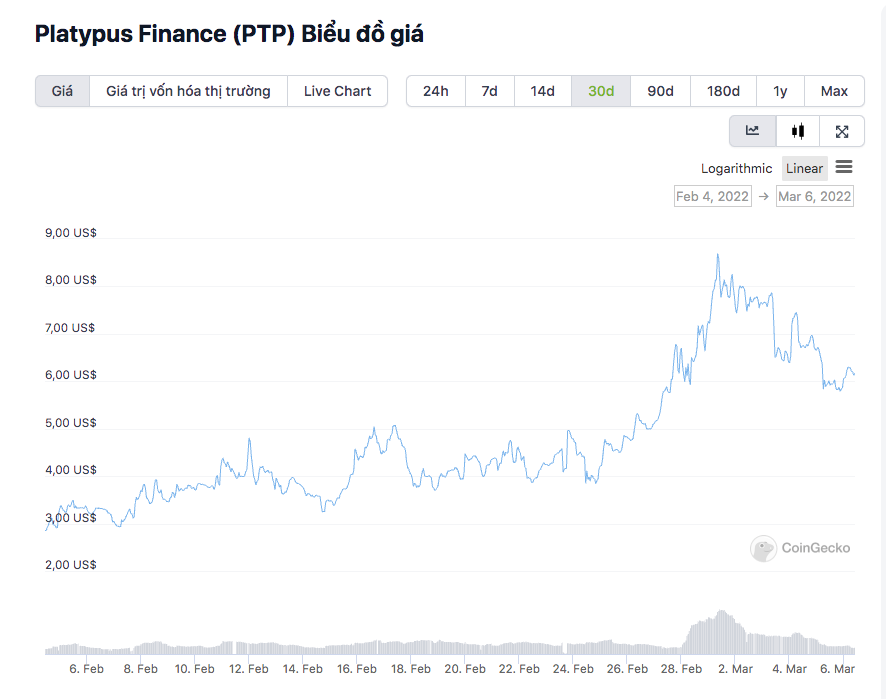

Immediately immediately after the announcement of the PTP wars, the value of the PTP professional speedy development:

four. Find out the events in the PTP wars

four.one. Make by yourself Yak

Yield Yak is the quantity one agricultural manufacturing platform on Avalanche. Almost all tasks launched on Avalanche have Yield Yak pool farming to generate liquidity and incentivize consumers. It can be stated that Yield Yak on Avalanche has a totally equivalent position to Yearn Finance on Ethereum.

While participating in the PTP Wars, Yield Yak leveraged its agricultural manufacturing platform by pledging to supply consumers a greater APR. To do this, Yield Yak gives a method:

- PTP “Diamond handing” as a result of the Treasury

- Part of the PTP obtained (reward) will be in staking permanently.

- Launched yyPTP – tokenized by vePTP. This usually means you can send vePTP to Yield Yak and get a yyPTP representative.

- Automatically include rewards to your stake to make additional earnings.

four.two. Echidona Finance

Echidna is a protocol made for Platypus, with the aim of developing additional revenue and worth for PTP holders and the PTP local community.

Echidona Finance’s method:

- Community PTP will be completely wagered to accumulate vePTP.

- It makes it possible for events that present liquidity to Platypus to get supplemental rewards without having holding vePTPs.

- The prizes for PTP contributors will be distributed by way of the project’s token, ECD.

There are two methods to join the PTP wars by way of Echidna.

If you are a liquidity supplier on Platypus:

- Deposit money immediately into Platypus or by way of Echidna, get LP Token.

- Deposit that LP token in the pool on Echidna.

- Your earnings will be optimized thanks to the vePTP Treasury on Echidna.

- Claim the revenue (anytime is fine).

If you are a PTP proprietor:

- Convert vePTP => ecdPTP by way of Echidna.

- Staking ecdPTP in the protocol for revenue (paid by way of ECD).

- Continue to block ECD in the protocol to share Echidona’s earnings + voting rights.

four.three. Vector finance

Vector Finance is a Platypus-primarily based revenue optimization instrument for ve-tokens.

Similar to the protocols over, Vector Finance also aims to optimize consumer earnings and accumulate additional vePTPs for the protocol. Vector Finance also has two mechanisms for two objects to maximize earnings equivalent to Echidna Finance.

four.four Preliminary evaluation

After observing, I truly feel that Vector Finance and Echidna Finance each have the probable to develop into the “Convex” edition for Platypus. Both protocols have been launched and have attracted a excellent deal of PTP help.

Echidna obtained one.four million PTP in staking, though this quantity on Vector Finance is one.three million PTP. Each protocol represents just about ten% of the PTPs circulating on the marketplace. This is a genuinely spectacular quantity.

Compare APR stablecoins on two protocols

Currently, just about April on Echidona is additional eye-catching than Vector Finance.

April comparison concerning xPTP and ecdPTP

With a fairly substantial April, I assume the value of VTX (Carrier Token) and ECD (Echidna Token) will decline for a though until finally emissions stabilize. In purchase for VTX, ECD to have the possibility to maximize in value => the quantity of tokens blocked to get commissions from the protocol need to be higher than the quantity of inflation tokens offered. This also usually means that the two protocols need to have an ample method to “hold” and demonstrate consumers the rewards of blocking tokens.

five. End

The PTP wars are a smaller sized scale war than the Curve wars, but for that matter, they are much less eye-catching. Choosing the proper winner can carry you excellent revenue probable in this battle.

Please depart your views and remarks on the PTP Wars.

Poseidon

Maybe you are interested: