What is Composable Finance (LAYR)?

Composable Finance is a platform created to carry cross-chain and cross-layer interoperability to DeFi tasks. Composable will fix the difficulty of liquidity fragmentation across distinctive blockchains.

Composable not long ago won Polkadot’s eighth parachain place, with in excess of $ 150 million raised from in excess of six million DOT grants from backers.

Features of Composable Finance

Composable has a modular engineering stack consisting of layers and chain guards that operate with each other to make improvements to the efficiency of the platform. Here are some vital functions:

- Composable Multi-Chain Virtual Machine (Composable XCVM)

Composable XCVM is an uncomplicated-to-use interface built to interact and create wise contract functions across a quantity of offered L1 and L2 blockchain networks.

The undertaking is generating a set of impressive resources for XCVM that permit developers to seamlessly coordinate interactions with distinctive blockchains when making certain large uptime and transaction scalability.

Mosaic is a layer capable of doing cross-chain and cross-layer interactions across various blockchains. This is built to guarantee a seamless transfer of details and liquidity, on each L1 and L2.

Thanks to Mosaic, consumers can freely move their digital assets and do not encounter the lack of liquidity maximization frequent to other protocols. It guarantees that liquidity is transferred to the demanded regions.

Composable Finance also constructed Mural, a cross-chain NFT bridge. Mural leverages a Mosaic chain and tier linking answer to generate a potential for NFT that exists past a single chain, the place consumers can freely mint, invest in and lease NFTs from any marketplace or marketplace, unlocking their genuine probable .

Composable Finance is rolling out parachain on each Polkadot and Kusama networks, to make improvements to network safety and reduce censorship. Picasso is an L1 blockchain constructed on Kusama, this Parachain will serve as a cross-chain hub for DeFi tasks. Picasso Parachain provides better interoperability, personalization and safety past common blockchain structures.

Meanwhile, Composable Parachain will perform the exact same roles as Picasso Parachain in Polkadot.

Basic details about the LAYR token

- Token identify: Modular Finance

- Ticker: LAYR

- Blockchain: Updating

- Token typical: Updating

- To contract: Updating

- Token kind: Utility, Governance

- Total provide: one hundred,000,000 LAYR

- Circulating provide: Updating

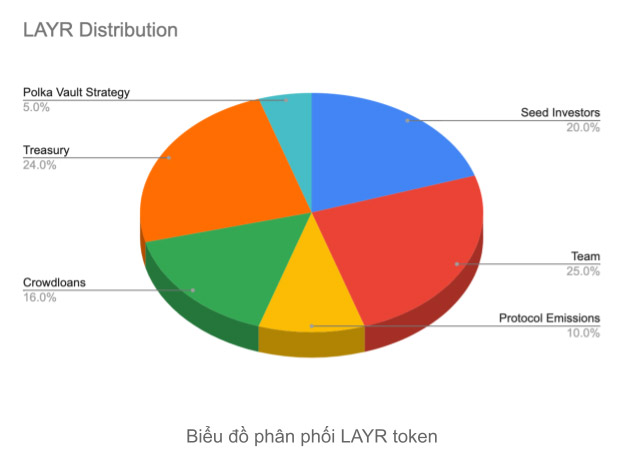

Token allocation

t

- Seed: twenty%

- Squad: 25%

- Protocol Incentive Award: 10%

- Mass loans: sixteen%

- treasure: 24%

- Volta a Polka Strategy: five%

Token release system

| Dress calendar | |

| Seed | twenty% will be launched at the TGE, the rest will accrue in two many years |

| Squad | Freeze for six months, tokens will be acquired in two.five many years |

| Protocol Incentive Award | |

| Mass loans | 25% is unlocked at the time of the TGE, the rest will be accrued in two many years |

| treasure | |

| Polka dot vault Strategy | 50% will be launched at the TGE, the rest will be accrued inside of six months |

What is the LAYR token for?

- Gas charge payment

- Vote for undertaking governance selections

- Collator Staking: Staking to get rewards from transaction charges

- Oracle Staking: Staking to give a cost feed for the undertaking to get rewards

- Provide liquidity on PabloDEX for rewards

LAYR Token Storage Wallet

Updating…

How to earn and personal LAYR tokens

Updating…

Where to invest in and promote LAYR tokens?

Updating…

Investors and partners

Composable Finance partners and traders have some major names in the degree two discipline like: Polygon, zkSync, Arbitrum.

summary

Composable Finance is a substrate-primarily based blockchain created to carry cross-chain interoperability to DeFi tasks.

Through this report, you should have by some means grasped the standard details about the undertaking to make your investment selections. Coinlive is not accountable for any of your investment selections. I want you accomplishment and earn a great deal from this probable marketplace.