Recently, on the social twitter, a statistical post was launched on the truth that Anchor Protocol does not decentralize information on rates and favors the liquidators of the workforce that performs the liquidation of assets.

Anchoring protocol at a glance

Anchor Protocol is the synthetix-stablecoin protocol on the Terra platform. Users will mortgage loan their assets, from which UST stablecoins will be minted. To make it simple to consider, Anchor is equivalent to MakerDAO and the UST coin plays the exact same function as DAI.

Anchor Protocol total manage above the LUNA rate index?

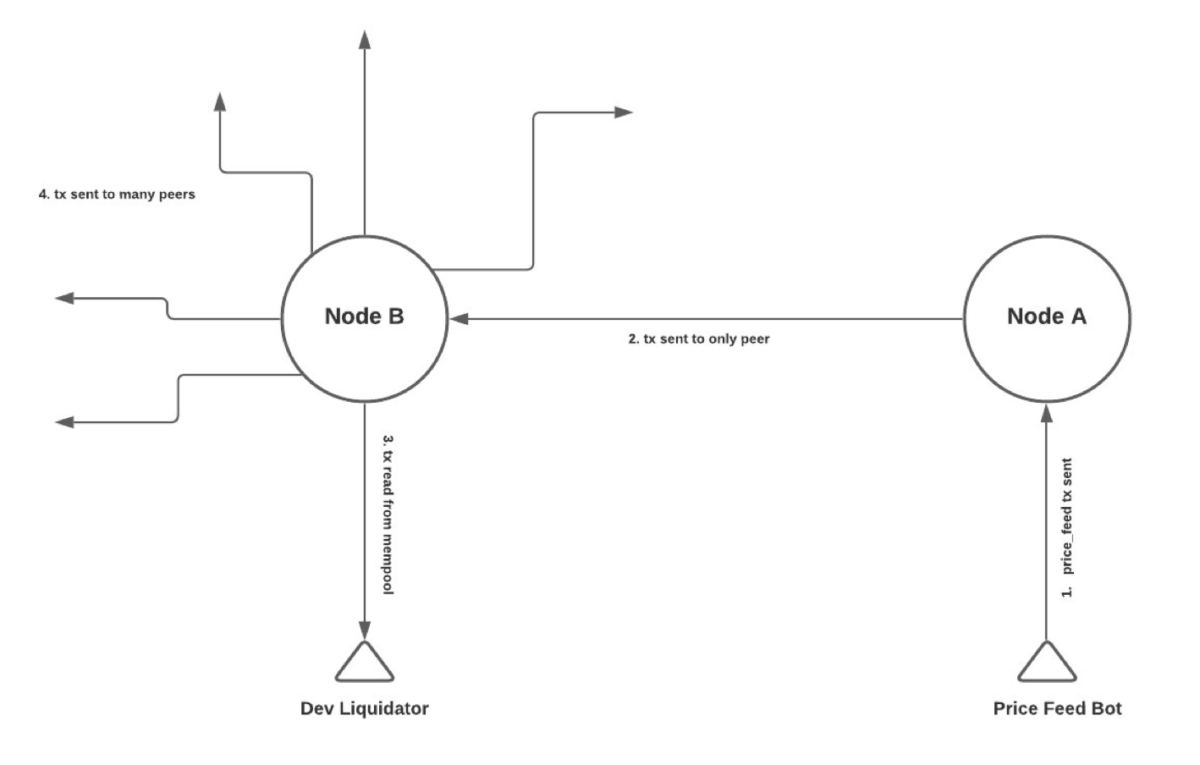

The @ _0xfr account medium channel publish stated that the Dev Liquidator workforce had been the to start with to acquire signals from Luna’s Price Feed indicator. This, if accurate, would be unfair for the improvement workforce to completely advantage from the asset liquidation approach.

Twitter account Larry0x mentioned:

“The Band Protocol network is up and running, but there is still no fully decentralized way to get data from the Band Chain to the Earth network.”

two / a) is the situation for the reason that there is now no really decentralized oracle on Earth

there is @BandProtocol, even so, there is now no way to transmit information from the band chain to the Earth chain in a decentralized way

– THE_LARRY (@ larry0x) August 16, 2021

However, Larry also mentioned, with the implementation of col-five, the approach of transferring information from Band to Earth can be via Cosmos IBC. In addition, the improvement of the cross-chain port wormhole, Oracle information can be transferred from other chains this kind of as Ethereum, Solana to Terra.

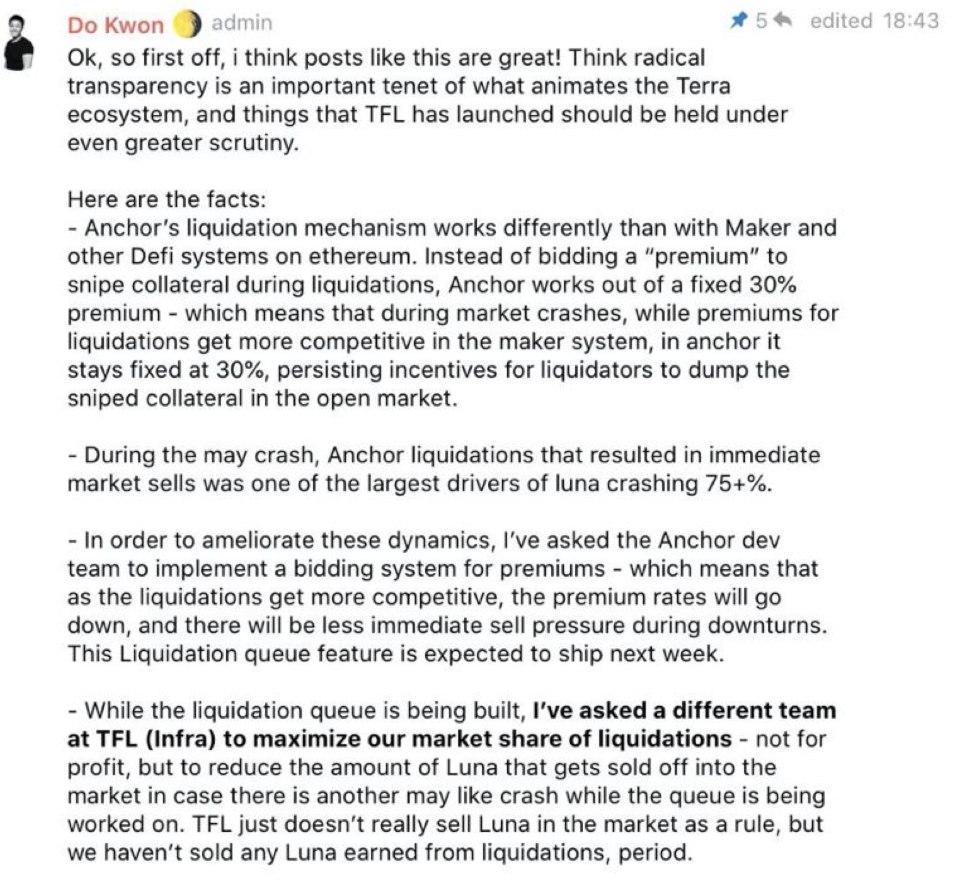

Regarding this challenge, Do Kwon, co-founder, Terra mentioned that following the occasion in which Luna collapsed by additional than 75% in May, the workforce made a decision to employ a settlement transaction auction procedure, in buy to to improve the dependability of the transaction. and lessen the occurrence of this kind of violent incidents.

However, the auction procedure on it must be launched up coming week, and now have 1 workforce control the liquidation of assets to reduce Luna from staying oversold. Do Kwon also extra that Luna’s liquidated sum has not nonetheless been offered by the workforce.

Regarding the alleged management of the trade and the advantage of the Oracle of Anchor, Do Kwon explained that this is due to the truth that Oracle Terraform Labs (TFL) Team determine when to send the settlement transaction. Since Oracle sources are equivalent and tricky to recognize, it seems the workforce rewards from prior information of the rate index.

Transparency in the liquidation of assets

Earlier, MakerDAO was also criticized for its transparency in liquidating assets, but the Maker workforce speedily corrected this incident. Related particulars, interested folks can read through in the publish beneath in the local community Coinlive Chats Please!!!

Synthetic Currency 68

Maybe you are interested: