The accumulated pools from agriculture are by now acquainted to numerous DeFi gamers, nonetheless, the reality that numerous of these pools are saturated and curiosity charges are falling is a single of the motives this marketplace section is falling. To entice much more capital to the marketplace, tasks want intriguing and progressive products strategies and produce larger curiosity charges. Today let us study by way of a new resolution, Options Covered Call, to see if this model has something specific!

The latest problem of the Performance Aggregators

First, I’ll summarize how functionality aggregators perform. These products pools:

- Get assets from consumers, so go farm in these liquidity pool of numerous AMMs.

- Bonus sale by now bred preserve going back to the pool to carry on cultivating.

As this kind of, this products style and design produces a compound curiosity result, as farm rewards are accumulated back into the resource pool. However, the weakness of this model is the reliance on curiosity charges in AMM pools.

In the previous, curiosity charges in AMM pools generally fluctuated all-around a hundred%, stablecoin pools have been typically thirty-forty%. However, the model is now saturated, leading to curiosity charges to drop by just about much more than half in the pools and, at the exact same time, the accumulation of Yield Aggregator solutions also decreases.

Covered Call Vault Options – Solution Worth the Wait?

First, I’ll describe how selections contracts perform.

How alternative contracts perform

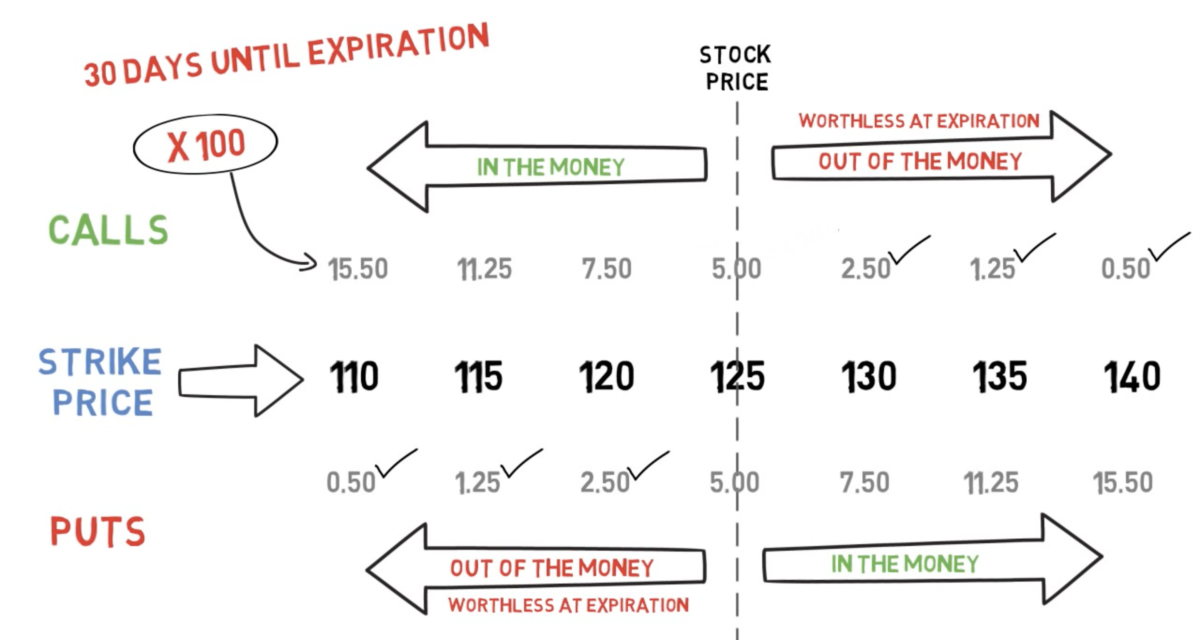

There are the following standard ideas that we want to have an understanding of:

- Strike Price: This is the pricing milestone that determines whether or not a contract is executed or not. Buyers can opt for from many beginning strike charges.

- Call alternative: contact alternative.

- Put Option: A place alternative.

- Expiry date: the time the Options contract expires.

If on the expiration date, if the asset selling price is beneath the Strike Price, the caller will not have the suitable to execute the contract.

Conversely, if the Strike Price is reduced than the asset selling price on the maturity date, the particular person who sets the Put Options will not be entitled to training the contract.

These illustrative selling price ranges are marked “Out of The Money” in the picture beneath.

How do Covered Call Vault solutions perform?

In this instance, I will opt for ETH and the undertaking will be Ribbon Finance. When a consumer enters ETH into the deposit, The finance of the tape will do it Set up a contact selections contract, with a sample strike selling price of $ 25,000 and a one week expiration. There will be two circumstances when the contract expires (in this situation, right after one week):

- The selling price of the ETH does not exceed $ 25,000: this time purchaser in the contact selections contract it will be “Out of the Money” e they do not have the suitable to get back the quantity of ETH that Ribbon provides as collateral. In the meantime, the purchaser even now has to pay out the alternative premium for the undertaking. The commission earned from this alternative will be accumulated by Ribbon Finance and returned to the Vault.

- The selling price of the ETH exceeds $ 25,000: At this time, the residence mortgaged by Ribbon Finance will have to be transferred to the purchaser of the Call Options. And this signifies that the user’s ETH in the preceding repository is also misplaced.

The strengths of this new model

First, why selections is a yr round marketplace and the demand is usually there. Therefore, the chance for the undertaking to produce higher and steady income for consumers will be improved than the previous Yield Farm model (which depends on the curiosity of the AMM pools).

Second, compound curiosity will accumulate in the pool once again, assisting depositors establish up assets at a more quickly fee.

Risks of this model

Self the undertaking chooses an inappropriate system, that is, opt for The strike selling price is not optimum, The quantity of products utilised to obtain the contract will disappear. In this regard, it is important to examine the Vauts creation system of the undertaking, thoroughly check out the parameters and even report the information that the undertaking has matched to its system.

Furthermore, Options are a difficult products and handful of consumers have an understanding of how to operate and how to perform properly. Special, Covered Call is the suitable system these days paragraph marketplace very low volatility. Any drastic fluctuations can bring about quick depletion of assets in the vault.

Several tasks are establishing this resolution

This resolution was initially popularized when Finance tape announced the airdrop to its consumers early on. Currently, Ribbon Finance is also steadily establishing many chains, producing it less difficult for consumers to entry undertaking strategies.

Furthermore, with EVM chains, ThetaNuts it is also a amazing resolution. This undertaking also isn’t going to have a token, so you can contemplate placing some assets in the Vault for testing, producing it less difficult to see how the products will work and, much more importantly, have the means to obtain Retroactive.

Solana’s tasks that are driving improvement in this course also are Clutch And Katana. You can also check and check solutions on the two mainnet and Devnet to improve your odds of winning Retroactive!

finish

So, we looked at some standard attributes, advantages, and hazards of the Covered Call Options products model. Hope the over short article offers you a whole lot of worth.

Note, the over content material is for informational functions only and must not be deemed investment information!

Synthetic Currency 68

Maybe you are interested: