The rally in CRV, the native coin of stablecoin-centered decentralized exchange platform Curve Finance, is overcoming August weakness and reached a new substantial on September 22 as of this creating . Indicators demonstrate that CRV is up 22% above the previous two weeks, expanding yet another ten% in the previous week alone.

Incidentally, there has been improved exercise of a wealthy person moving CRV from Binance, the world’s greatest cryptocurrency exchange by quantity of prospects.

A whale transferred CRV from Binance to Curve Finance

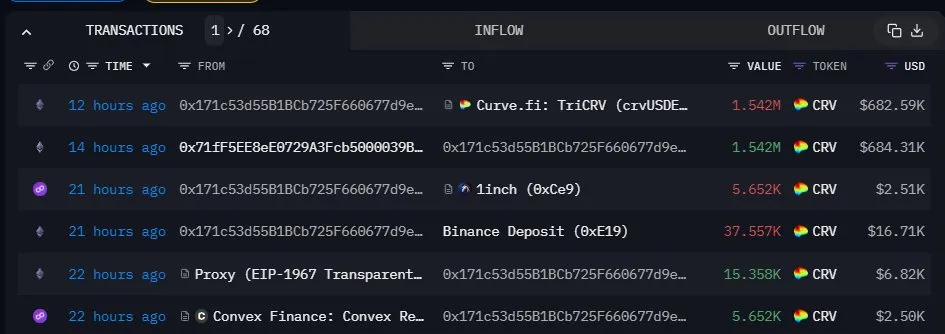

The Data Nerd, an account tracker, announced that a whale investor transferred one.542 million CRV, well worth around $684,000, from Binance. This whale, recognized only as “0x171,” then supplied liquidity to Curve Finance.

Over the previous week, whalers have continued to aggressively deliver liquidity to Curve Finance, supplying five.36 million CRV well worth $two.27 million.

CRV is the governance token in CurveDAO, the decentralized autonomous organization (DAO) behind Curve Finance. Since the exchange is decentralized, CRV holders have voting rights. Furthermore, they can also acquire rewards for supplying liquidity to any pool in Curve Finance.

Curve Finance utilizes an automated exchange model (AMM) to reliably exchange stablecoins, which includes DAI, USDT, USDC, and other tokens like ETH and wBTC. However, to operate at its ideal, Curve Finance should depend on liquidity pools wherever end users can deliver liquidity and acquire a charge share in CRV.

Withdrawing money from Binance to a non-custodial wallet exhibits believe in in CRV. The token has been on a slide in the third quarter of 2023. To illustrate, CRV dropped 32% in August alone.

The decline continues as the cryptocurrency industry suffers from the failure to approve complicated versions of futures contracts for Bitcoin and Ethereum. At the identical time, regulatory measures, specially from the Securities and Exchange Commission (SEC), substantially have an effect on the sentiment and worth of tokens.

CRV offered out right after hack

CRV’s selling price plunge could be right attributed to a Curve Finance liquidity pools vulnerability at the finish of July 2023. In a re-entrancy assault, a hacker exploited a vulnerability in an previous edition of Vyper compiler, stole above $61 million well worth of tokens from Curve Finance pools.

Through the re-entrancy assault, hackers can withdraw limitless money from Curve Finance’s pools, major to substantial losses.

Curve Finance patched the hole later on, but CRV rates have however to recover in spite of a latest selling price boost. Additionally, Curve Finance CEO and co-founder Michael Egorov had to liquidate a huge portion of the CRV he employed to safe loans on several platforms, which includes Aave.

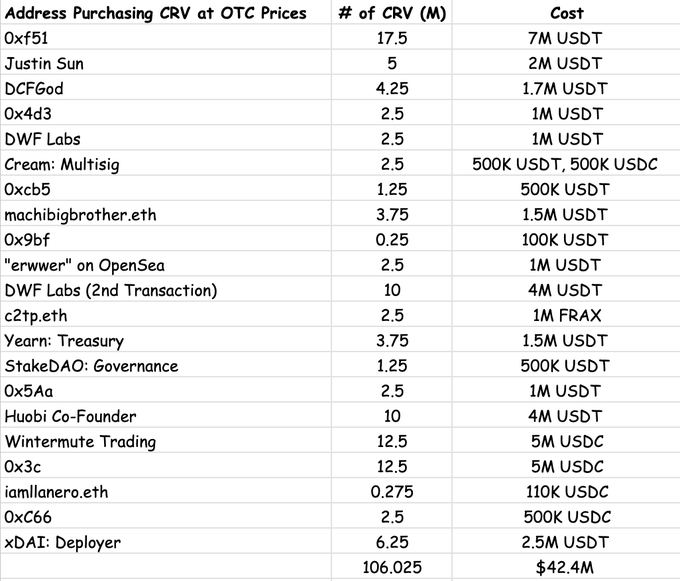

By early August, Egorov was sell 106 million CRV through off-the-shelf (OTC) transactions at lowered rates for several partners. Top purchasers incorporated Justin Sun, co-founder of Tron, who purchased two million CRV, and Jeffrey Huang, who purchased three.75 million CRV.

General Bitcoin News