Cryptocurrency exchange Crypto.com continues to be exposed to suspicious exercise, plainly possessing a shut partnership with FTX.

After FTX, the cryptocurrency trading platform went bankrupt just five days soon after it was identified for possessing liquidity troubles, the awareness of the crypto local community turned to a further platform, Crypto.com.

As reported by Coinlive, on the morning of November 13, a lot of crypto end users spread on Twitter that Crypto.com had sent up to 400 million USD in ETH to Gate.io’s account at the finish of October, just prior to Gate.io. launched evidence of ownership of customers’ assets, fueling rumors that these exchanges had been conspiring with every other to make false claims.

Crypto.com CEO confirmed that the over transaction was “accidentally transferred by mistake”, but this is a tough explanation to verify, even irresponsibly, provided not only the nature and dimension of the transaction, but also the place of Crypto. com and Gate.io. The two exchanges subsequently launched official announcements stating that there was no shady partnership behind it, and the second Gate.io captured the stability was prior to Crypto.com mistakenly transferred the revenue.

On the morning of November 14, it was identified that Crypto.com had manufactured a series of transactions to transfer USDC stablecoins to FTX in 2022, well worth extra than USD one billion, along with a lot of CRO tokens issued by the exchange. onion.

two /

The Etherscan tackle in the screenshot over is: 0xadd6d754b48a7eb4b4a71651722666093f7bc5d9

URLs: https://t.co/XTS8RvyC6f

Go uncover on your own and, if you are a consumer, withdraw prior to withdrawals are disabled. Please, spread the word as quickly as probable!

— WIZΞ (@TraderWize) November 13, 2022

Responding to the most current allegation, CEO Kris Marszalek mentioned:

To simplify for men and women who never recognize how hedging will work in this situation: We deposit USDC, use it to purchase other coins on the exchange, and withdraw to our wallets.

– Cri | Crypto.com (@kris) November 13, 2022

“The over facts is not genuine. We never preserve a whole lot of revenue on FTX (beneath $ ten million) and only use it as a hedge for our clientele. We by no means use consumer money for revenue on FTX or any other third get together.

To simplify this hedging method: We deposit USDC, use it to purchase coins on FTX and withdraw to our wallet. “

Mr. Marszalek’s response was really surprising simply because not only did the CEO admit to the aforementioned shady trading exercise, but he also claimed that the exchange had “hedged” users’ assets by converting USDC into other cryptocurrencies: capital is not a secure way to hedge assets when moving from a reasonably steady coin to very volatile cryptocurrencies.

Almost as if to “fire”, the CEO of Crypto.com also accused the biggest US exchange, Coinbase, of acting like him.

It is also most likely well worth including that Coinbase has $ 15 million caught on FTX for precisely the exact same purpose. Some of the tokens associated to FTX (SRM, RAY or as Crypto Twitter referred to as them Sam’s coins) only had good liquidity in the buy guide on FTX.

— Chris | Crypto.com (@kris) November 13, 2022

“I would also like to even more disclose that Coinbase is caught at $ 15 million on FTX for the exact same purpose. Some of the coins tied to FTX (SRM, RAY or the so-referred to as Sam coin), only have massive liquidity on FTX.

The CEO did not present even more facts on irrespective of whether or not the USDC would be withdrawn.

Coinbase CEO Brian Armstrong on November 9th denied being involved with FTX or the Alameda Research Foundation.

Meanwhile, a lot of cryptocurrency end users carry on to “tease” Crypto.com when they publish facts that one particular of the exchange’s wallets has stopped supporting withdrawals simply because there is not ample ETH left to shell out gasoline taxes.

Hey @cryptocom possibly you ought to try out to stay away from any withdrawal claims through the FTX crash by possessing ample ETH to shell out withdrawals? pic.twitter.com/eINl9hMtTL

– Steven (@Dogetoshi) November 14, 2022

Binance CEO Changpeng Zhao, who a short while ago announced that he no longer has any tricks about “problem” crypto corporations in the business, is continuously posting cryptic Twitter posts about rivals.

If an exchange requires to move massive quantities of cryptocurrencies prior to or soon after proving their wallet addresses, which is a clear signal of problems. Stay away. To stay #SAFU.

—CZ Binance (@cz_binance) November 13, 2022

“If a cryptocurrency exchange moves massive quantities of money correct prior to or soon after offering evidence of wallet addresses, which is a clear signal that there is a issue. Stay away from them.

On November 13, the value of DeFi wallet applications tokens greater considerably as traders had been concerned that the association from FTX could spread to other CEX exchanges, leading to a lot of men and women to rush to withdraw revenue and get closer to extra answers. decentralized.

Difficulties surround Crypto.com

Like FTX, Crypto.com is an up-and-coming trading platform in 2019-2022, possessing resonated with hundreds of hundreds of thousands of bucks in endorsement bargains like investing $700 million to purchase back the naming rights to a city of Los Angeles (USA), devote a whole lot of revenue to make a worldwide promotion campaign with the talent of Matt Damon or devote $ 215 million to purchase other cryptocurrency corporations. The exchange also a short while ago announced that it will create a new headquarters in France with an investment of $145 million, regardless of possessing to lower 260 staff members in the middle of the yr.

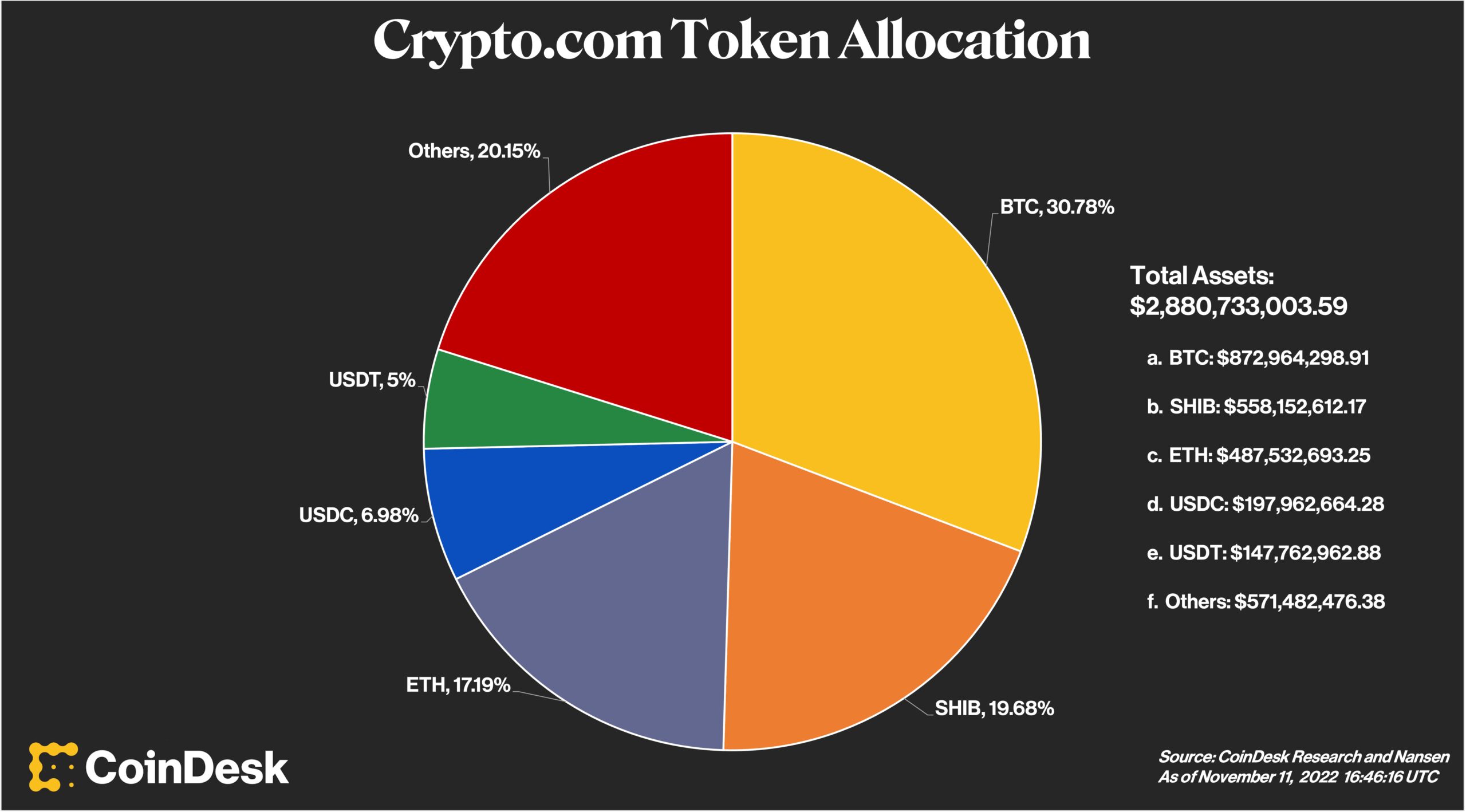

Additionally, of the $two.eight billion in consumer reserves announced by Crypto.com, 19.68% of which are Shiba Inu (SHIB) tokens. The worth of SHIB held by the exchange is even larger than ETH.

In response to the over difficulty, CEO Kris Marszalek wrote:

These are client deposits @NeerajKA – we securely retail outlet one: one every thing our end users purchase and hold on the platform.

And certainly, end users purchased a whole lot of Shiba & Doge in 2021. You can inform by seeking at their worldwide industry rankings (Doge #9, Shiba #14).

– Kris | Crypto.com (@kris) November 11, 2022

“They are customer deposits, we keep everything that users buy and sell on the platform. Many people bought Doge and Shiba in 2021, which is reflected in their market capitalization right now: Doge is 9th, Shiba is 14th ”.

The Crypto.com CRO coin value has dropped extra than 60% in the previous seven days due to continued negative information, as very well as the cryptocurrency industry crash due to the FTX crash.

Synthetic currency 68

Maybe you are interested: