Equity and cryptocurrency markets are each correcting themselves just after the Fed announced its most current price hike in response to US inflation.

As of the dawn of May six, Bitcoin’s rate continued to promote down to $ 35,571. Therefore, in contrast to 24 hrs in the past, the greatest cryptocurrency in the globe has misplaced a lot more than USD four,500 in worth, equivalent to an eleven% lower.

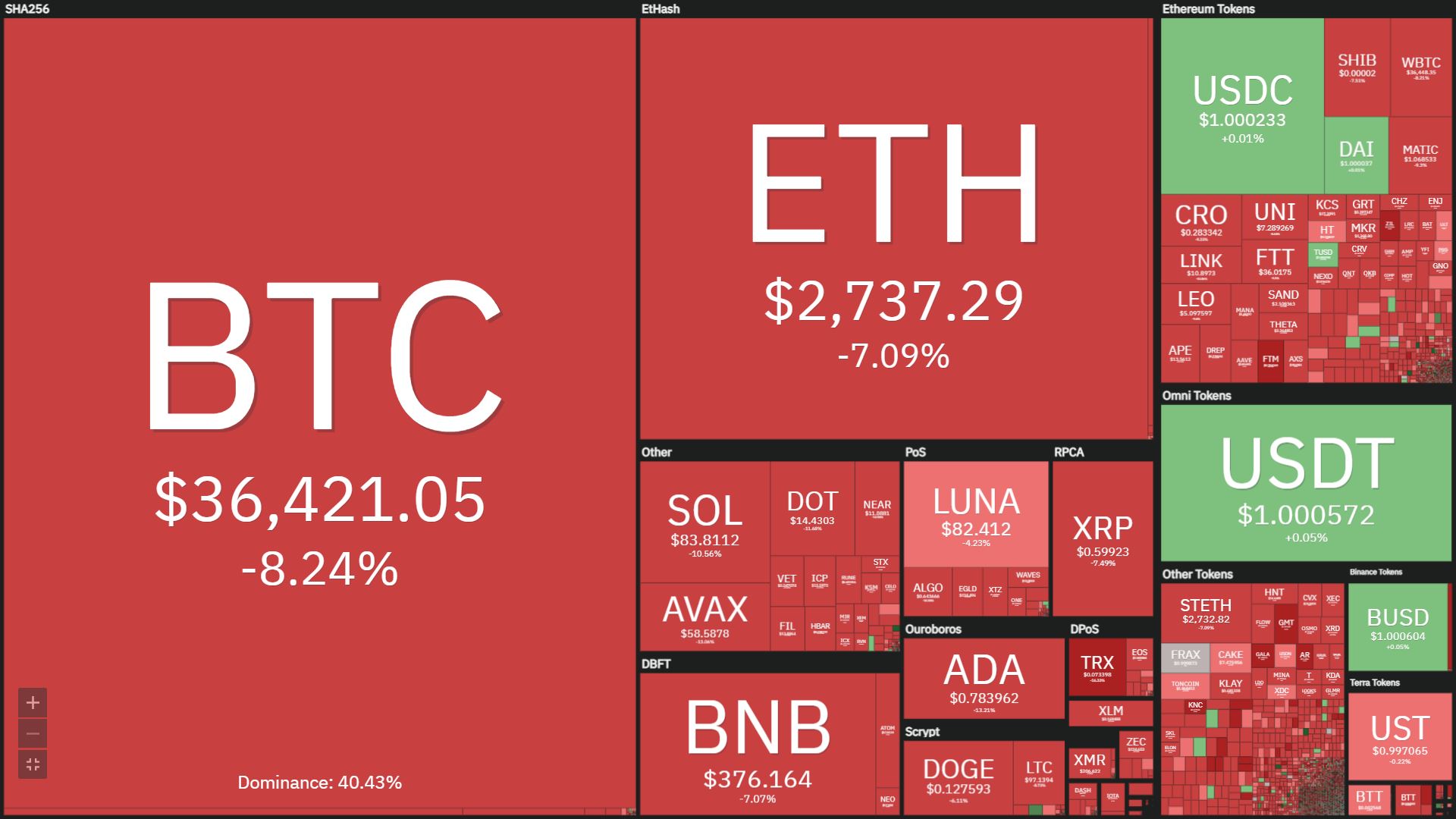

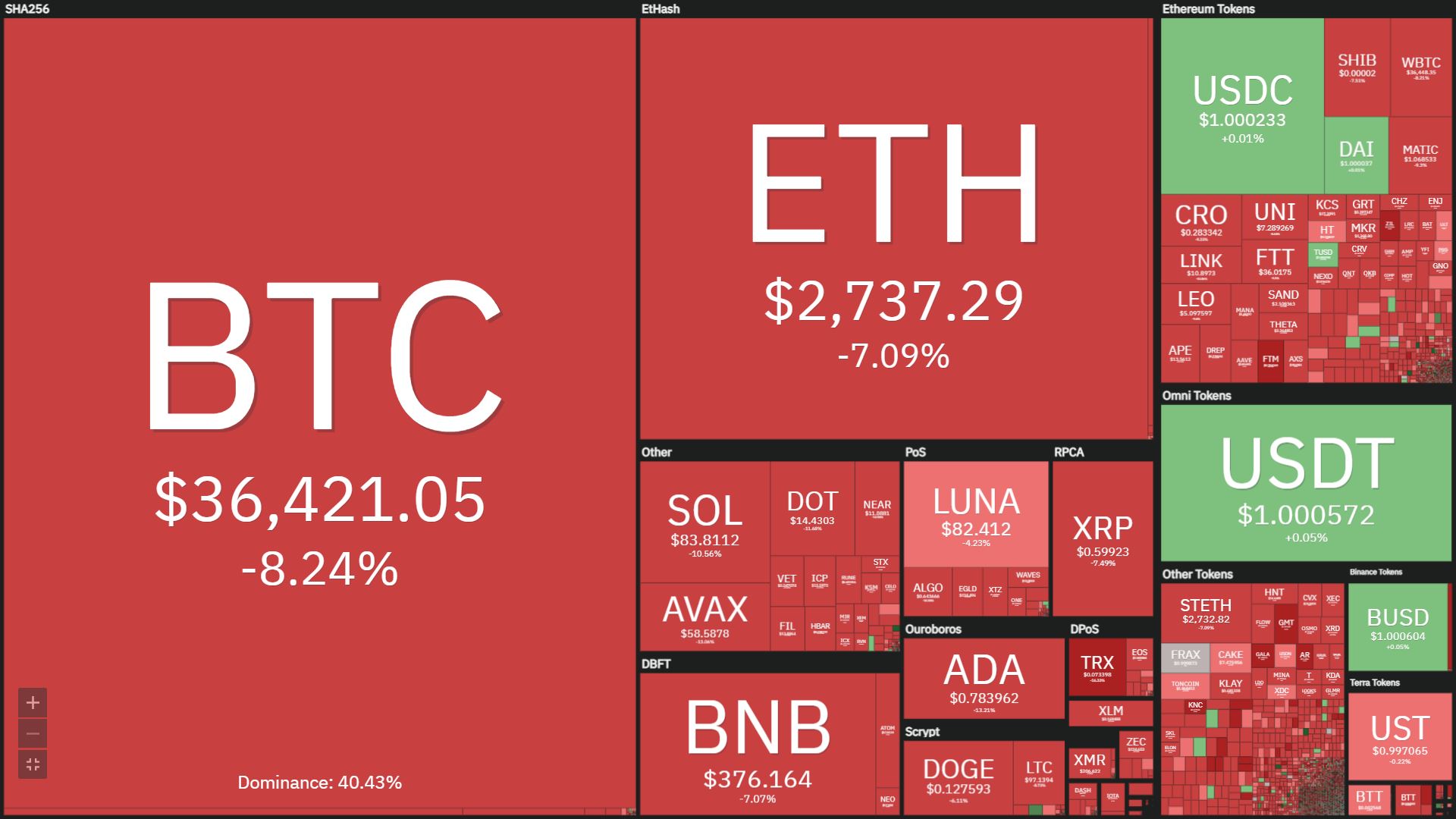

Many other significant altcoins have also observed drops of seven% -twelve%, although the complete industry cap of cryptocurrencies at the time of the update was $ one.six trillion.

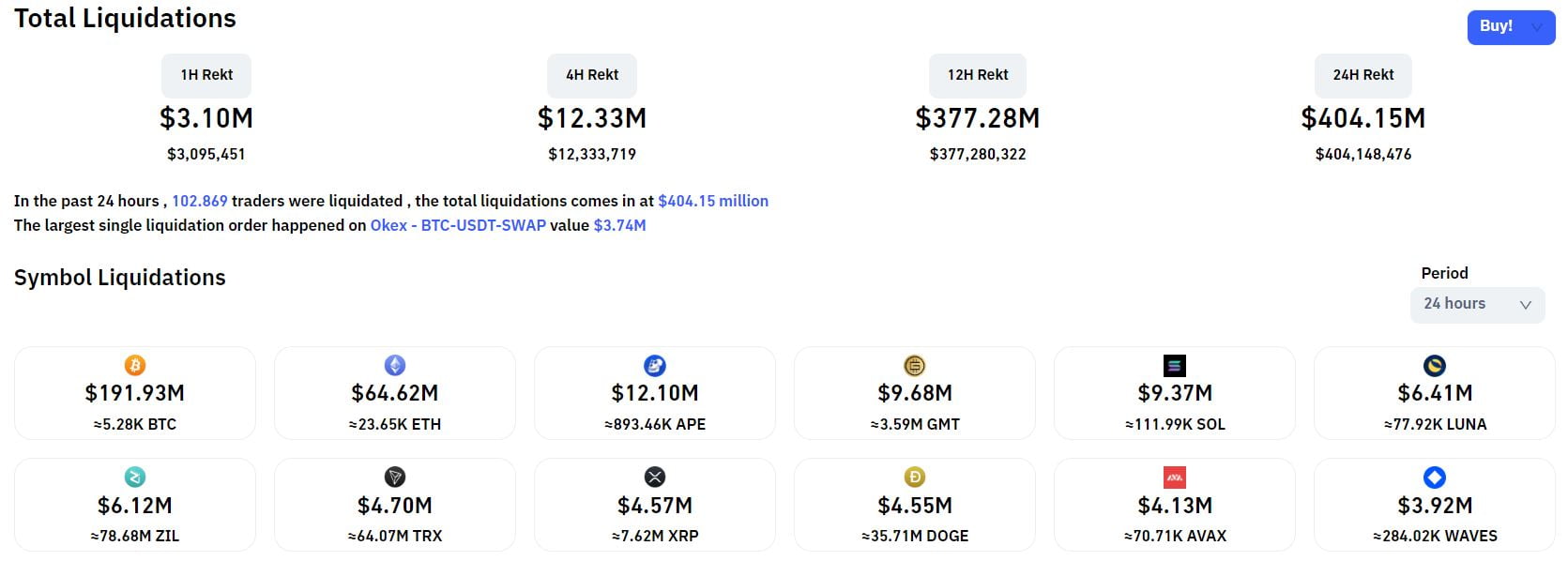

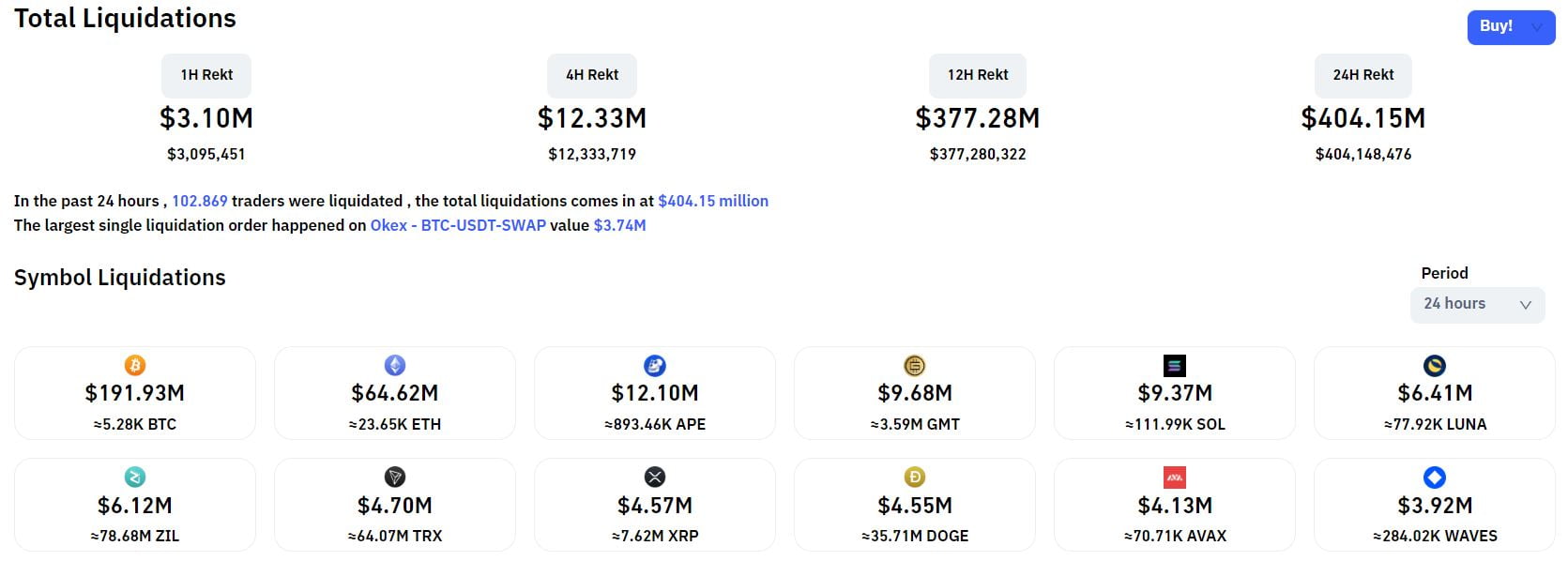

The liquidation worth in the derivatives industry in the previous 24 hrs reached $ 605 million, dominated by Bitcoin. The price of orders burned is 84% long – sixteen% brief.

Meanwhile, the US stock industry also closed the May five session in a state of “red fire” as significant equity indices this kind of as the Dow Jones, NASDAQ and S&P 500 all dropped three.twelve% to four.99%. .

As reported by Coinlive, the motive for the new adjustment of the US money sector stems from the enhance in curiosity prices by the US Federal Reserve (Fed) to curb inflation in the US. has risen to a maximum of 4 decades in March 2022.

In unique, at dawn on May five, Fed Chairman Jerome Powell announced raise interest rates by 0.5% to a base level of 1%and also uncovered that the US central financial institution is thinking of a equivalent .five% enhance in approaching curiosity price changes in June and July.

Stocks and cryptocurrencies at first obtained this information fairly properly when they did not knowledge also a lot volatility in the May four trading session, with Bitcoin has even returned to $ 40,000generating lots of traders truly feel that the industry has presently adjusted.

The most current fluctuations also verify past predictions from former BitMEX exchange CEO Arthur Hayes, who stated the world’s greatest cryptocurrency is remarkably correlated with the NASDAQ index and will be topic to even further corrections just before hitting bottom in the 2nd. quarter of 2022.

Synthetic currency 68

Maybe you are interested:

Equity and cryptocurrency markets are each correcting themselves just after the Fed announced its most current price hike in response to US inflation.

As of the dawn of May six, Bitcoin’s rate continued to promote down to $ 35,571. Therefore, in contrast to 24 hrs in the past, the greatest cryptocurrency in the globe has misplaced a lot more than USD four,500 in worth, equivalent to an eleven% lower.

Many other significant altcoins have also observed drops of seven% -twelve%, although the complete industry cap of cryptocurrencies at the time of the update was $ one.six trillion.

The liquidation worth in the derivatives industry in the previous 24 hrs reached $ 605 million, dominated by Bitcoin. The price of orders burned is 84% long – sixteen% brief.

Meanwhile, the US stock industry also closed the May five session in a state of “red fire” as significant equity indices this kind of as the Dow Jones, NASDAQ and S&P 500 all dropped three.twelve% to four.99%. .

As reported by Coinlive, the motive for the new adjustment of the US money sector stems from the enhance in curiosity prices by the US Federal Reserve (Fed) to curb inflation in the US. has risen to a maximum of 4 decades in March 2022.

In unique, at dawn on May five, Fed Chairman Jerome Powell announced raise interest rates by 0.5% to a base level of 1%and also uncovered that the US central financial institution is thinking of a equivalent .five% enhance in approaching curiosity price changes in June and July.

Stocks and cryptocurrencies at first obtained this information fairly properly when they did not knowledge also a lot volatility in the May four trading session, with Bitcoin has even returned to $ 40,000generating lots of traders truly feel that the industry has presently adjusted.

The most current fluctuations also verify past predictions from former BitMEX exchange CEO Arthur Hayes, who stated the world’s greatest cryptocurrency is remarkably correlated with the NASDAQ index and will be topic to even further corrections just before hitting bottom in the 2nd. quarter of 2022.

Synthetic currency 68

Maybe you are interested: