According to a report by blockchain analytics company Elliptic, unregistered securities offerings represent over half of crypto fines issued by US regulators.

In Elliptic’s June 21 Sanctions Compliance report, the provider’s co-founder and Chief Scientist Dr. Tom Robinson writes that US authorities have given $2.5 billion fines for crypto-related offenses since 2014.

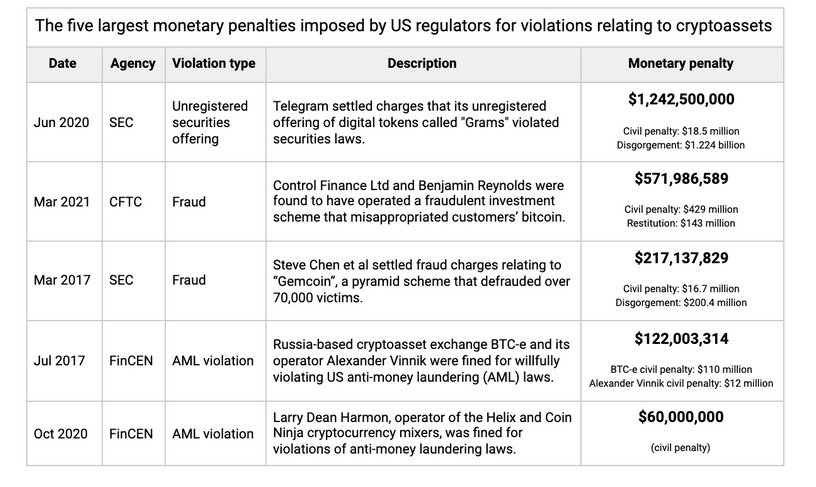

Of the total $2.5 billion, unregistered securities offerings accounted for $1.38 billion in fines, or 55.19% of the total fines issued. Fraud was the next biggest cryptocurrency violation found in the report, accounting for 37.12percent or $928 of penalties.

The largest crypto breach on record was that the SEC’s 2020 judgment on Telegram’s ICO offering, together with the crypto messaging program being accused of violating securities laws through an unregistered ICO in 2018, increased $1.7 billion in 2018. Telegram has been ordered to pay $1.2 billion and $18.5 million in civil penalties.

The biggest fraud penalized by the CFTC was Control Finance Ltd. ‘s Ponzi scheme, with its owner, Benjamin Reynolds, using AWOL last year before being discovered and billed in March 2021. The fraud led to a $429 million civil penalty, along with $143 million in damages.

With many successful enforcement actions taken through time, Dr. Robinson asserts that the cryptocurrency industry isn’t the “wild west” of fund it’s often described as from the mainstream circles. :

“Our analysis of crypto-asset-related enforcement actions in the United States demonstrates that crypto is far from being the ‘wild west’ of finance. Regulators have successfully used existing laws to prevent and punish illegal activity that has been mining cryptocurrencies.”

Elliptic’s investigation of US regulatory enforcement activities since the arrival of Bitcoin in 2009 reveals that $2.5 billion in penalties have been levied against companies and individuals dealing in crypto ➡️ https://t.co/i3hoWhrcLI

— elliptic (@elliptic) June 21, 2021

The U.S. Securities Exchange Commission (SEC) issued the most financial penalties for crypto offenses, accounting for $1.69 billion or 67 percent of the total fines.

Following that the SEC is the Commodity Futures Trading Commission (CFTC), which has decreased its penalties worth $624 million by 25 percent, the Financial Crimes Enforcement Network (FinCEN) with 7 percent or $183 million, and the Office Foreign Assets Control (OFAC) in 2.4percent or $606,000.

The report also notes that the growing creative tactics employed by sanctioned organizations to bypass cryptocurrency access and limitations.

Elliptic states that sanctioned parties are using “private coins, mixers and private wallets to avoid detection” along with decentralized exchange (DEX) programs that enable users to trade without needing to offer information regarding your client (KYC).

Synthetic

Maybe you’re interested:

.