Cryptocurrency investment capital flows are turning good yet again, moving in sync with Bitcoin’s spectacular recovery momentum in October.

Cryptocurrency investment capital flows are returning strongly

Cryptocurrency investment capital flows are returning strongly

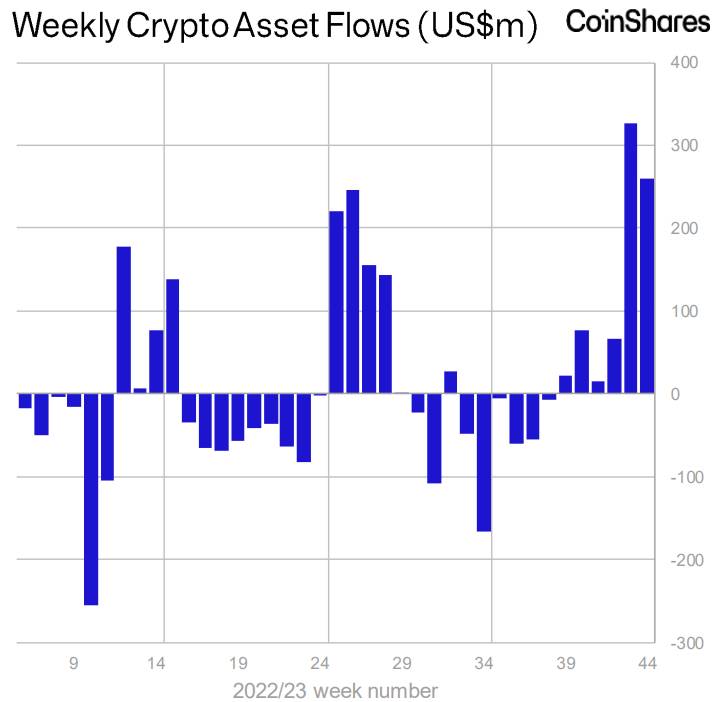

According to CoinShares statistics, the inflow of cryptocurrency investment items in the final six weeks has reached $767 million. This is a variety that has not been viewed considering that the finish of 2021, time period Bitcoin sets a new substantial at USD 69,000.

🟢 Positive exercise continues with the sixth week of sentiment inflows totaling $261 million.

– #Bitcoin –

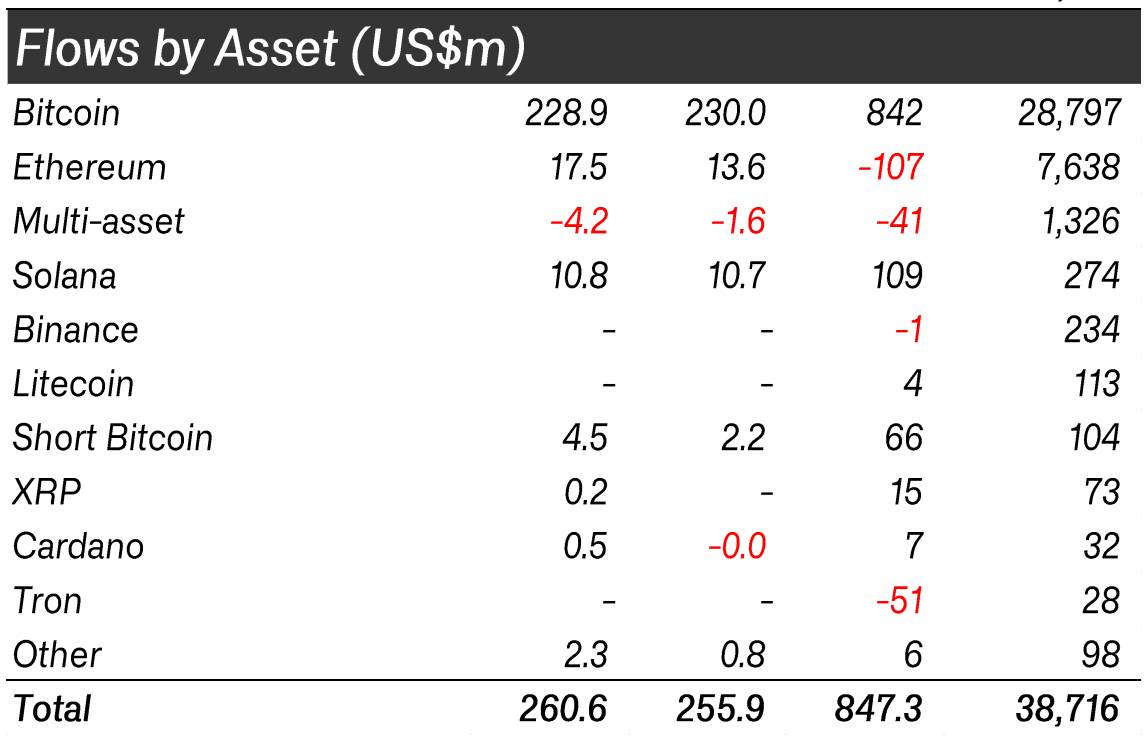

🟢 $BTC: Inflows of $229 million (YTD inflows: $842 million)

🟢 Short Bitcoin: inflows of $four.five million🔎 The increasing probability of a US spot ETF and weaker-than-anticipated macro data… pic.twitter.com/Frkq4egEqT

— CoinShares (@CoinSharesCo) November 6, 2023

Last week alone, capital inflows recorded $261 million, following the preceding five consecutive weeks of good net inflows.

Net inflows invested in cryptocurrency items by week. Source: CoinShares

Capital flows have been principally targeted on Bitcoin (BTC), with complete investment capital reaching $229 million final week and $842 million this 12 months. James Butterfill, head of analysis at CoinShares, explains that the explanation for this is the “fever” surrounding Bitcoin ETFs in the US and some weaker macroeconomic information.

Ethereum (ETH) items created funds movement of $17.five million, the highest considering that August 2022, soon after a extended time period of investor disinvestment.

Capital flows into person cryptocurrency items. Source: CoinShares

Notably, Solana (SOL) investment money reached the highest degree in 14 months, with a recorded inflow of $eleven million, followed by Chainlink (Website link) which attracted $two million.

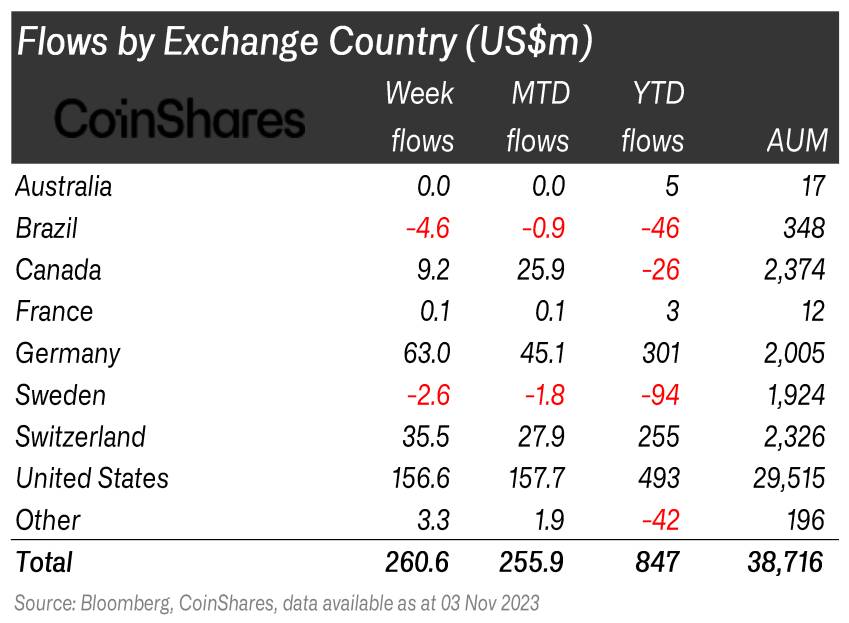

Regionally, the United States and Germany are the two major nations in capital inflows with $156.six million and $63 million, respectively.

Cryptocurrency investment capital flows of some nations about the globe. Source: CoinShares

Cryptocurrency investment capital flows of some nations about the globe. Source: CoinShares

Cash inflow and outflow is thought of an indicator that displays the investment requirements of massive organizations. The current influx of capital into the cryptocurrency sector exhibits that the cryptocurrency field is steadily recovering soon after a series of scandals and collapses of giants this kind of as FTX, Terra…

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!