The cryptocurrency business ended the third quarter of 2022 with lots of surprises. Let’s get a seem at the essential occasions that have taken area in excess of the previous 3 months.

This is a summary of the third quarter 2022 cryptocurrency industry report performed by CoinMarketCap in partnership with industry study organization TokenInsight. Interested readers can see the total report HERE.

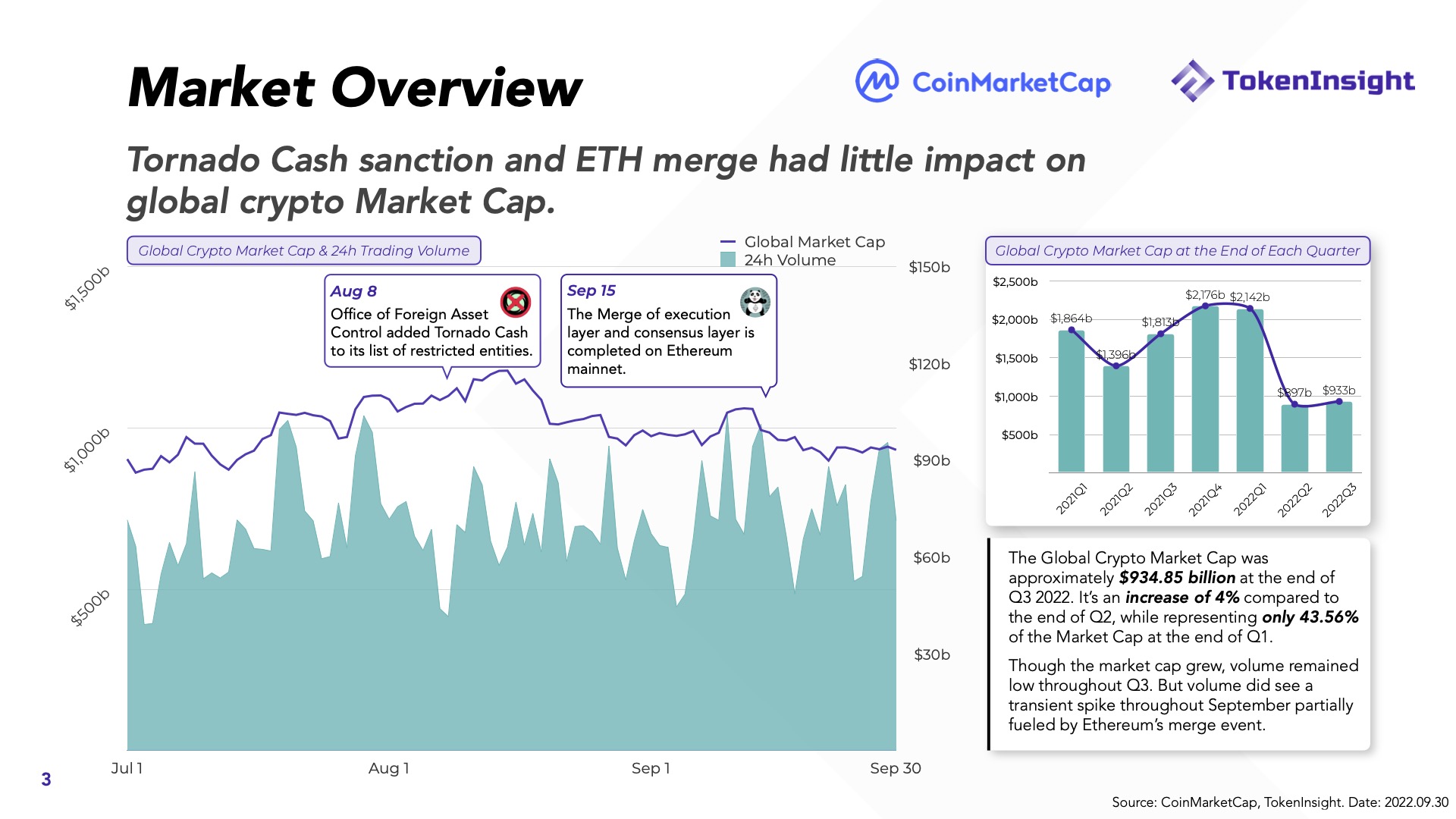

one. Low volatility of the international cryptocurrency industry capitalization

The international industry capitalization of cryptocurrencies is approx 934.85 billion bucks at the finish of the third quarter 2022. The industry capitalization has Increase of four%. in contrast to the finish of the 2nd quarter, but nevertheless they signify only 43.56% of the capital industry at the finish of the initially quarter.

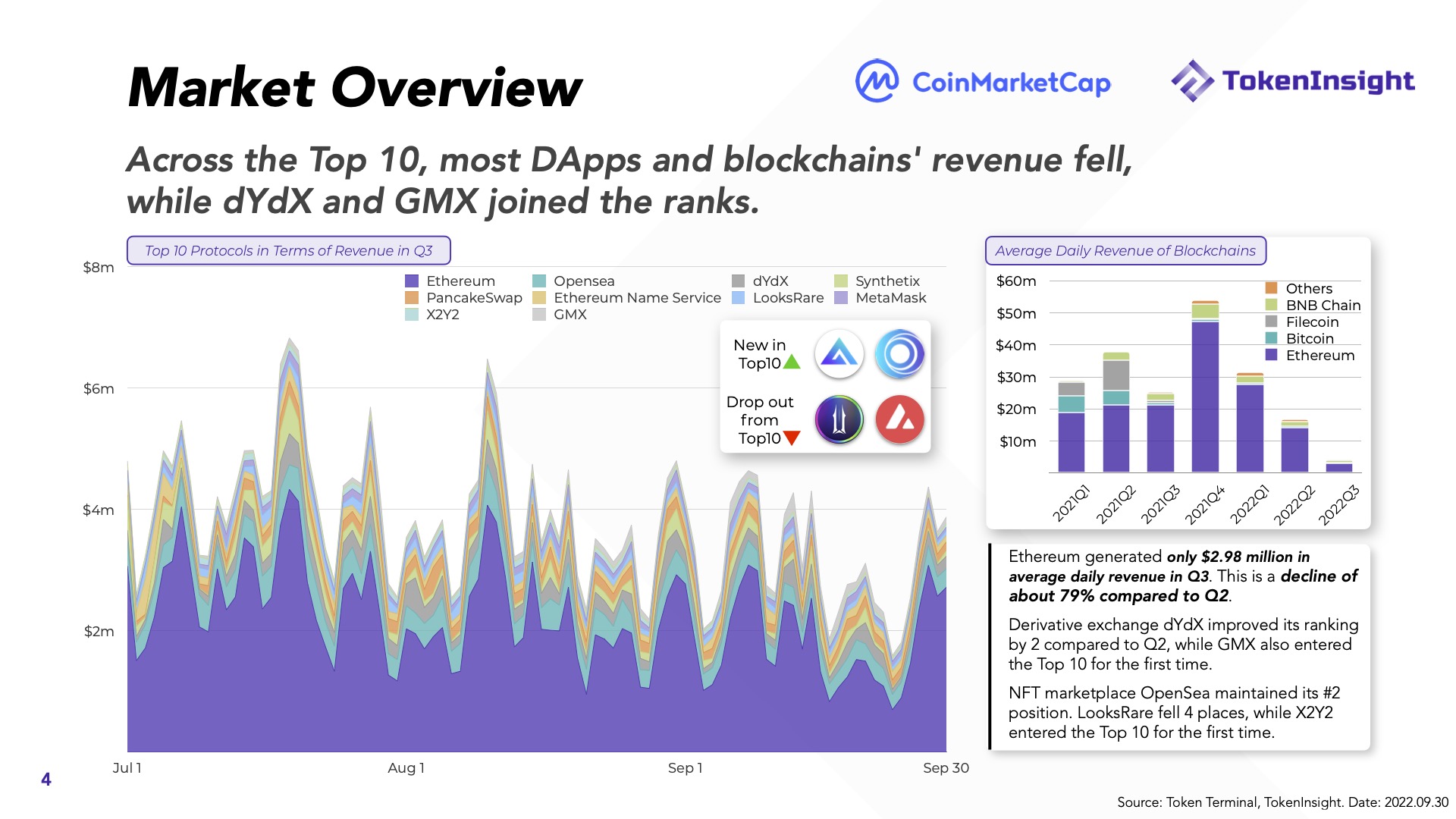

two. The income of most of the top rated ten DApps and blockchains is down

Ethereum raked in $ two.98 million in regular every day income in the third quarter, down 79% from the 2nd quarter.

The derivatives exchanges dYdX and GMX recorded an maximize in revenues this quarter. NFT exchange OpenSea maintained its # two spot. LookRare dropped 4 destinations, when X2Y2 entered the Top ten for the initially time.

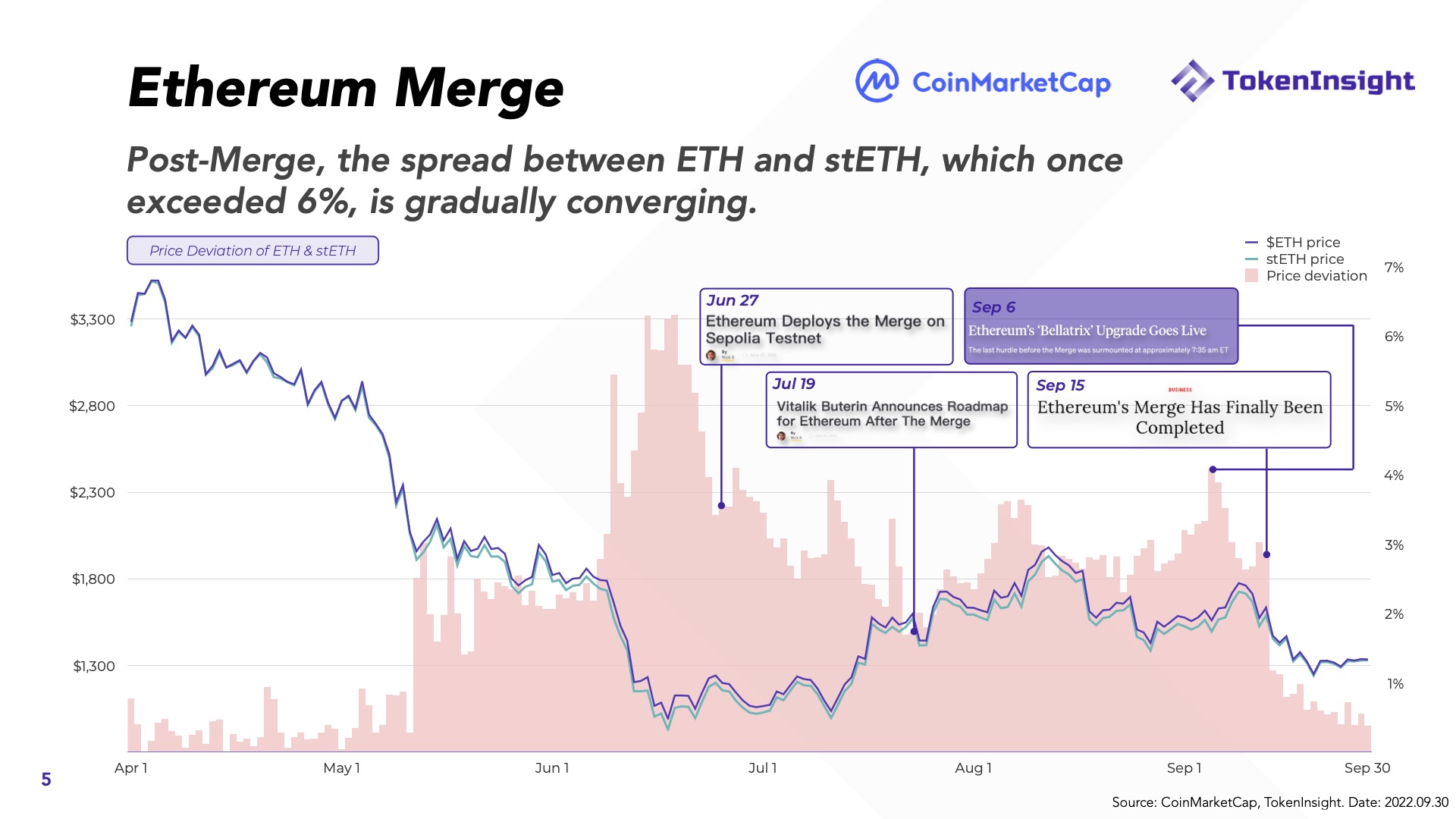

three. The merger of Ethereum

After The Merge, the distinction in between ETH and stETH is slowly reducing, whilst from time to time the distinction is up to six%.

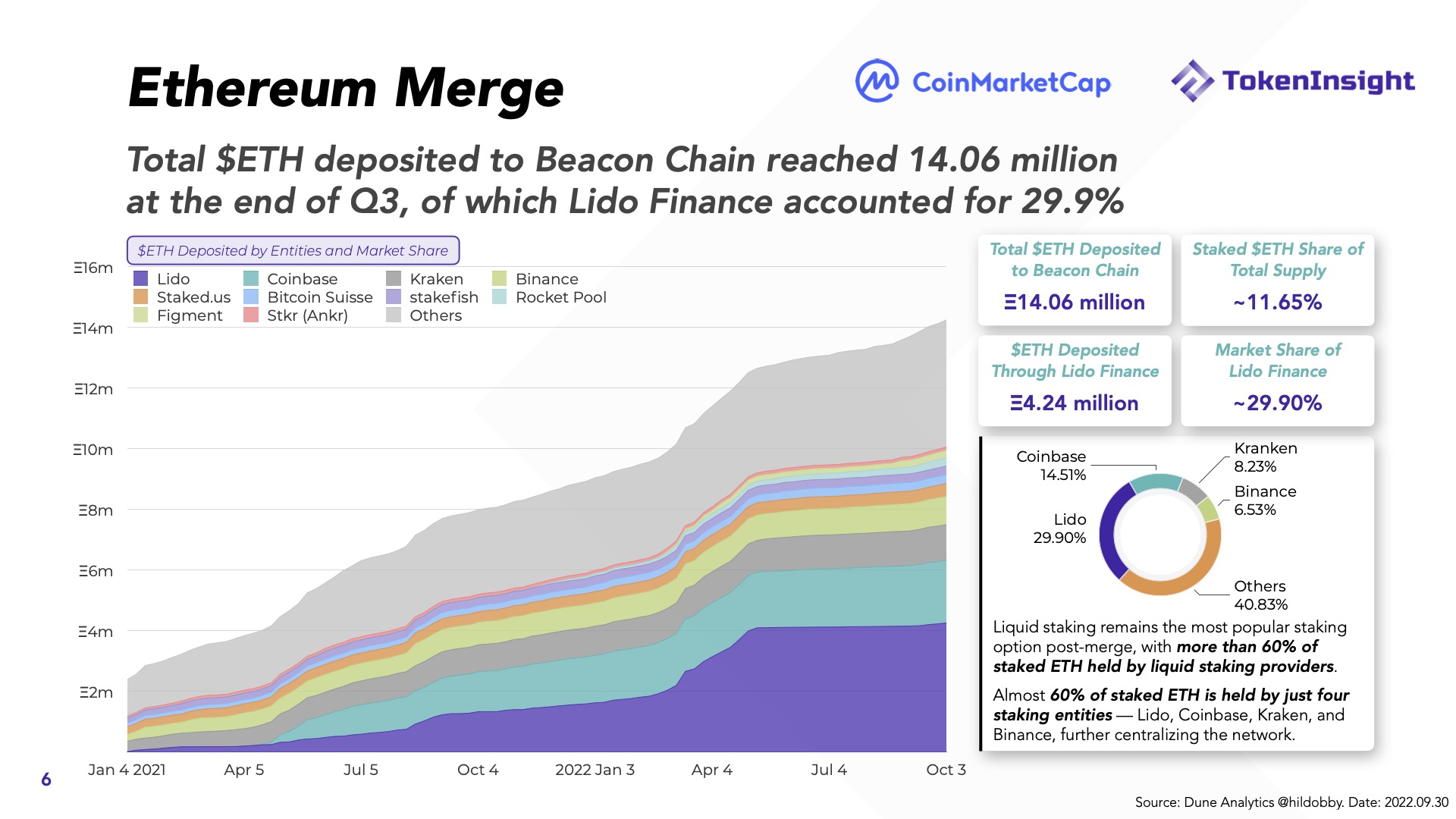

Close to 60% of ETH staking is held by just 4 institutions – Lido, Coinbase, Kraken and Binance, additional centralizing the network.

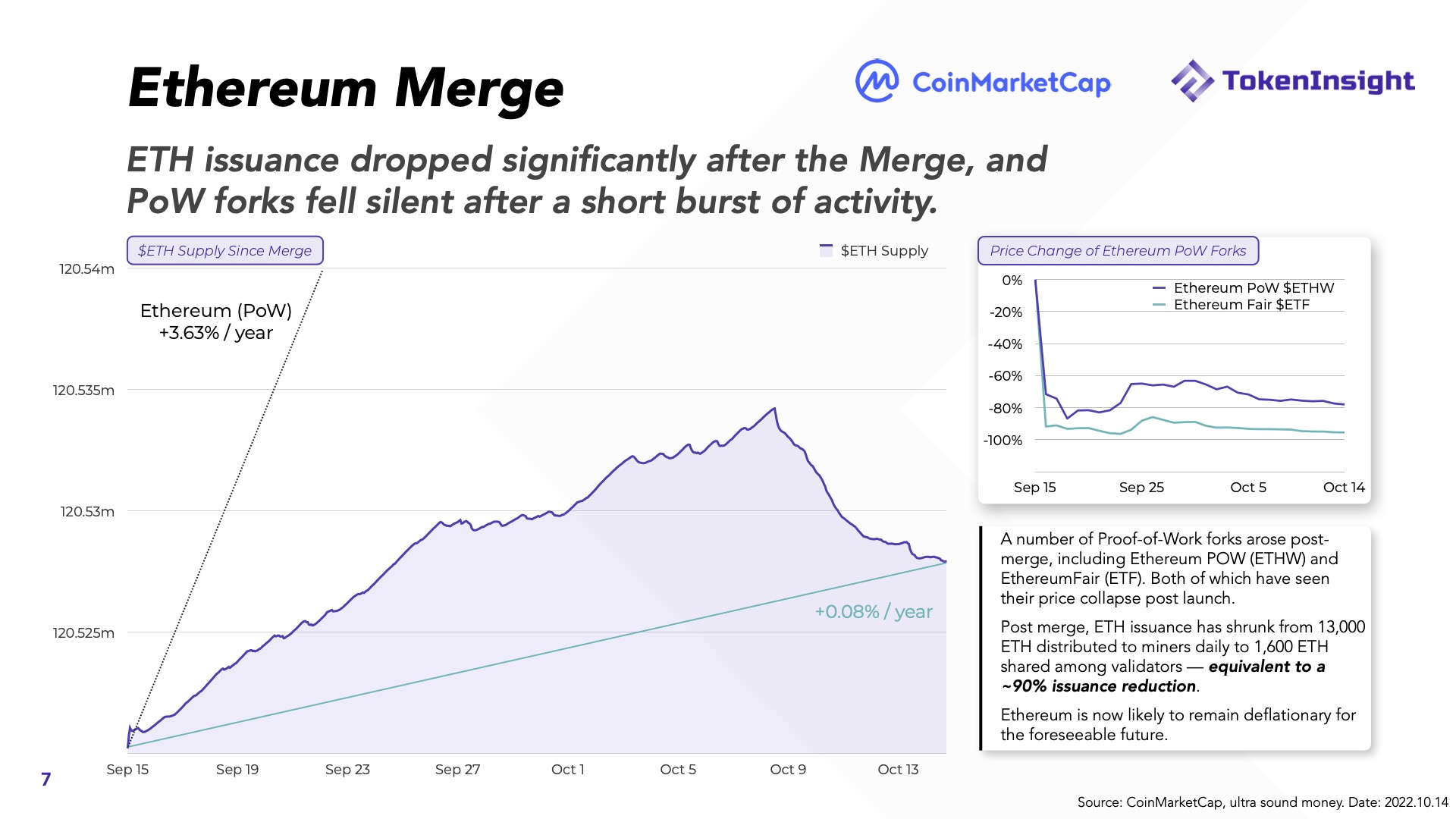

The provide of newly launched ETH dropped considerably soon after The Merge and PoW forks have been immediately “silenced” soon after a short time period of explosive action.

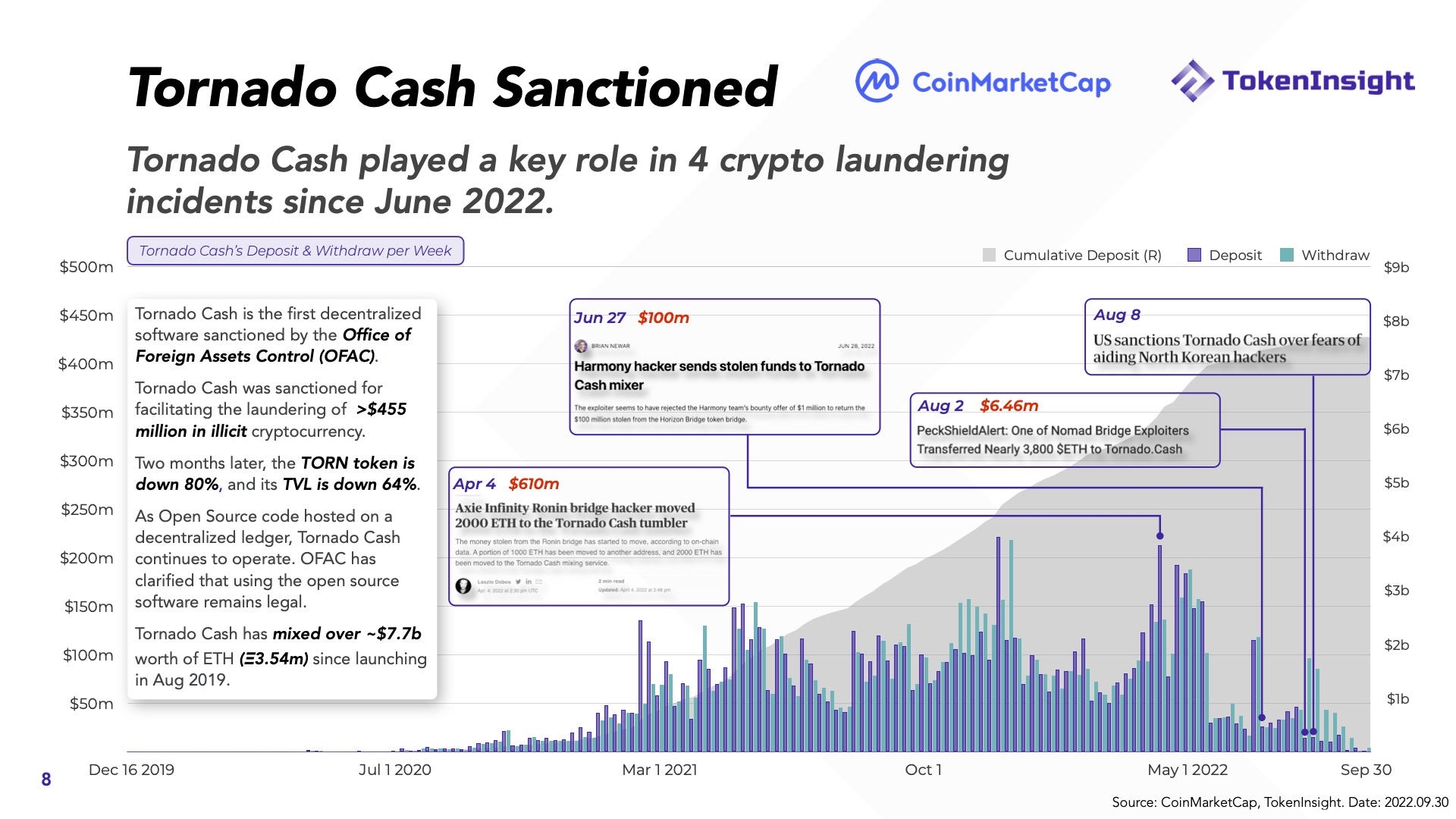

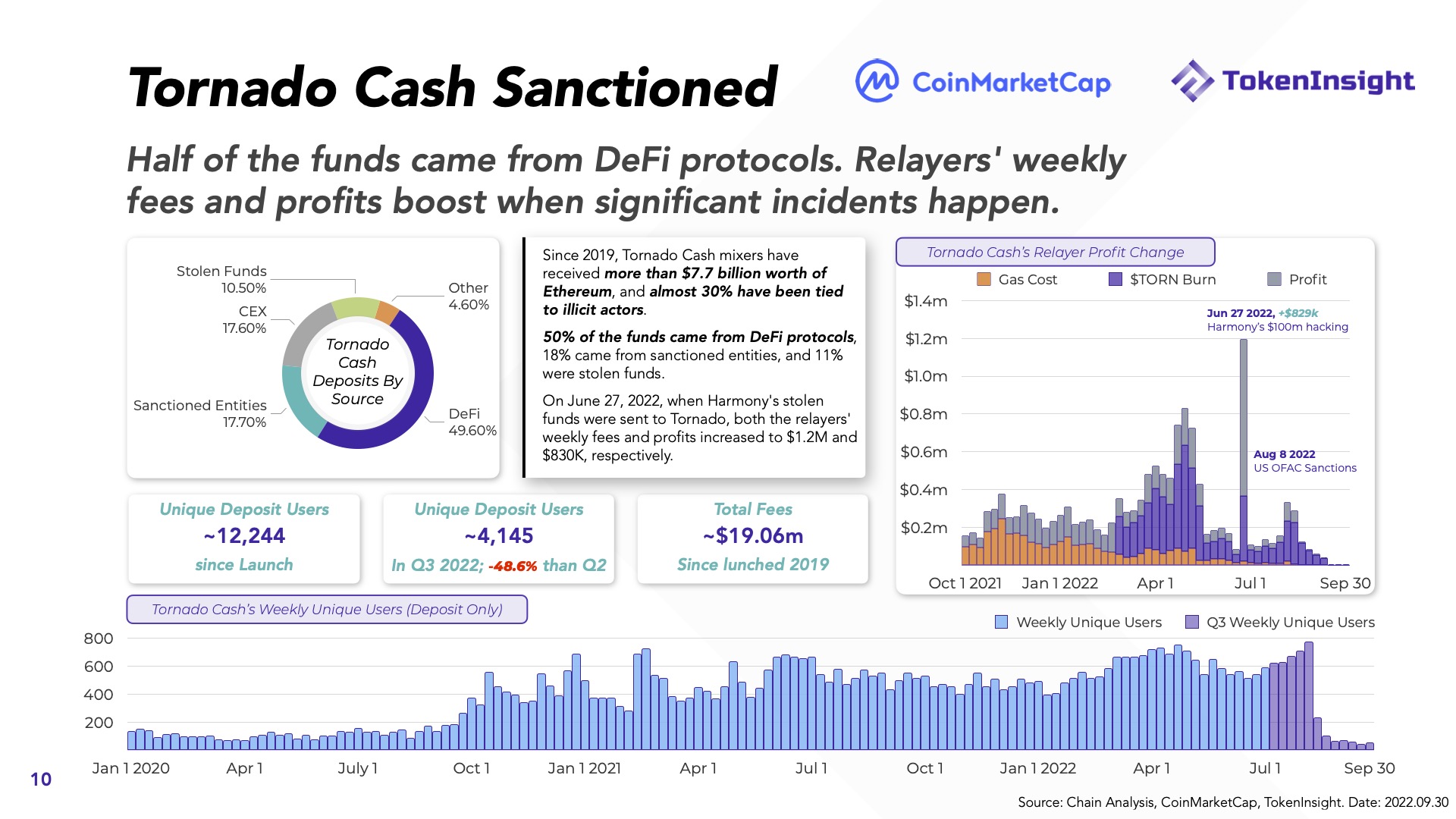

four. Tornado Cash is “sealed”

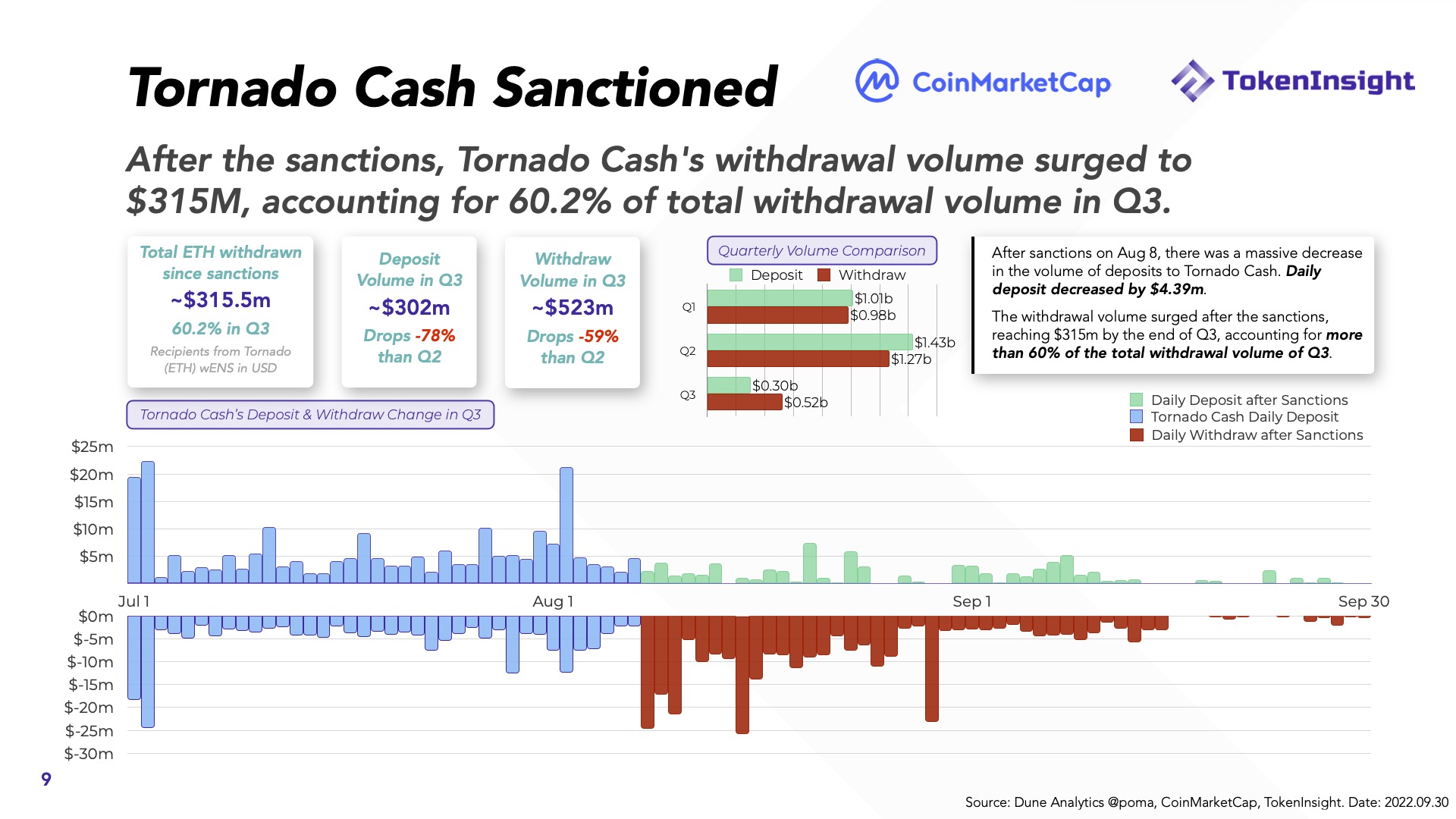

After the United States issued a “sanctions” selection on August eight, there was a sizeable drop in the volume of Tornado Cash deposits. The every day deposit dropped to $ four.39 million.

The withdrawal volume has skyrocketed soon after the sanctions, it reached $ 315 million at the finish of the third quarter.

Half of the volume they come from protocols DeFi. Transfer costs and weekly revenue maximize when some thing major takes place.

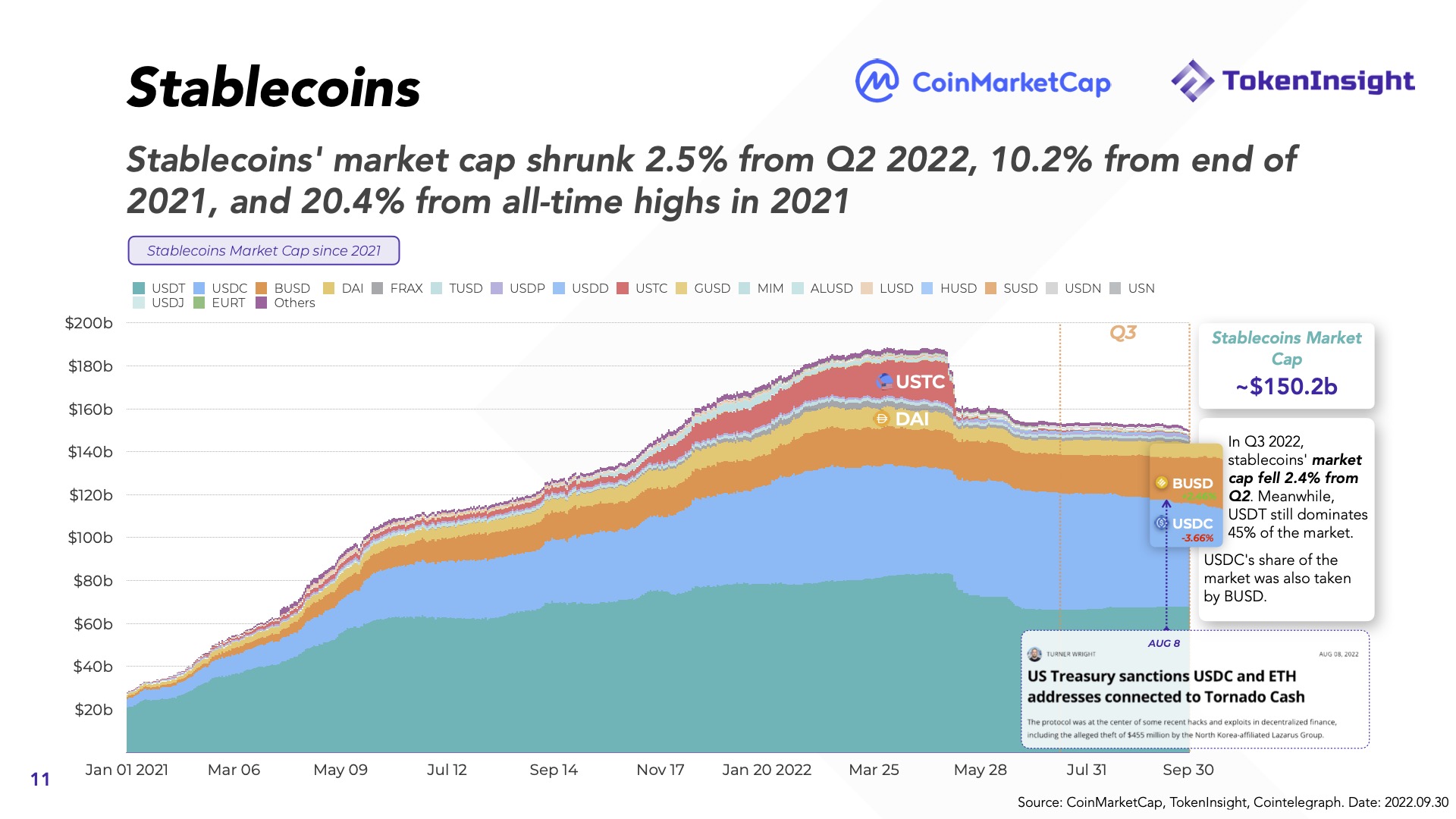

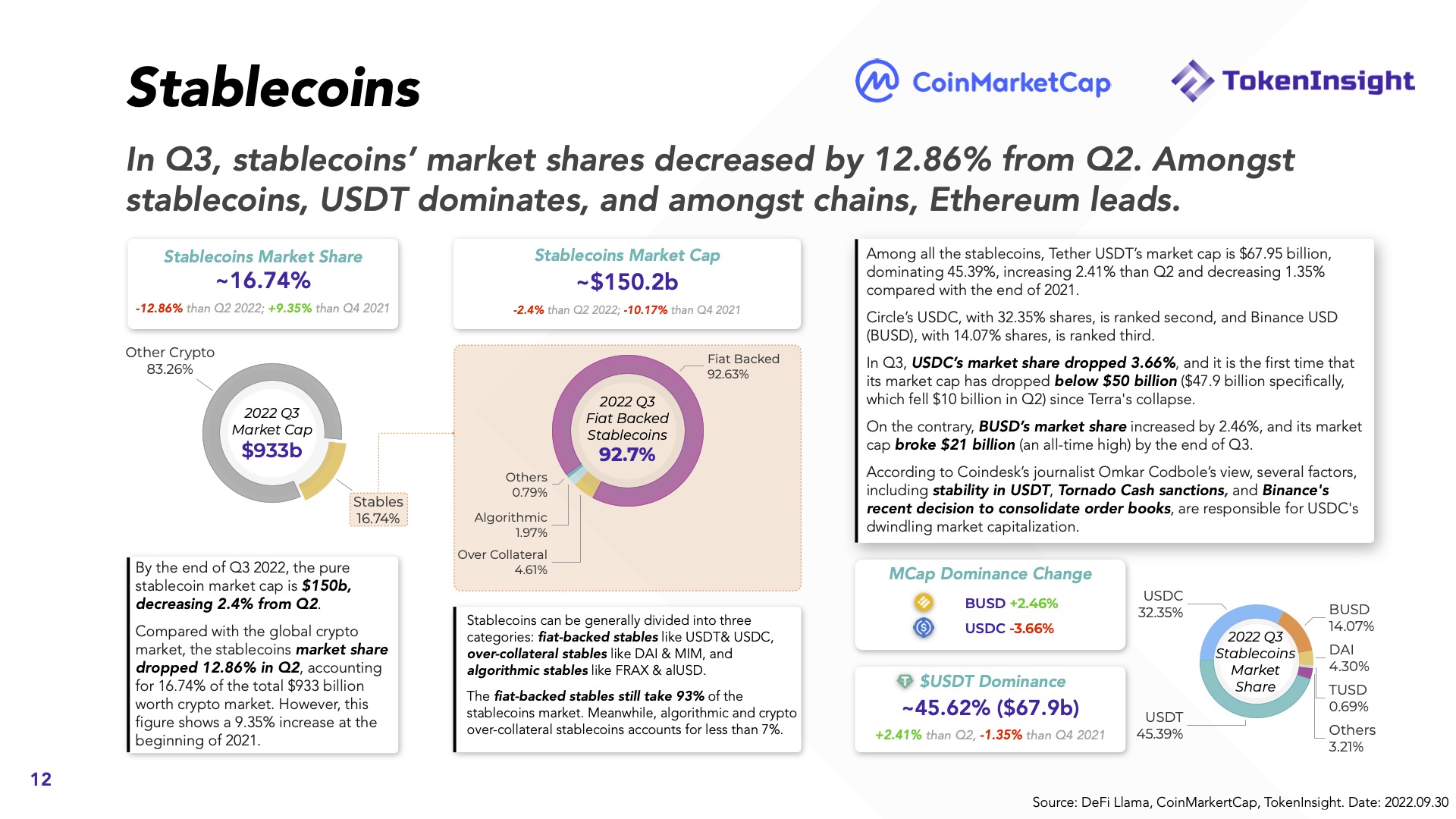

five. Situation of stablecoin

During the third quarter of 2022, the industry capitalization of stablecoins decreased by two.four%. USDT nevertheless dominates 45% of the industry, when BUSD is slowly gaining industry share from USDC.

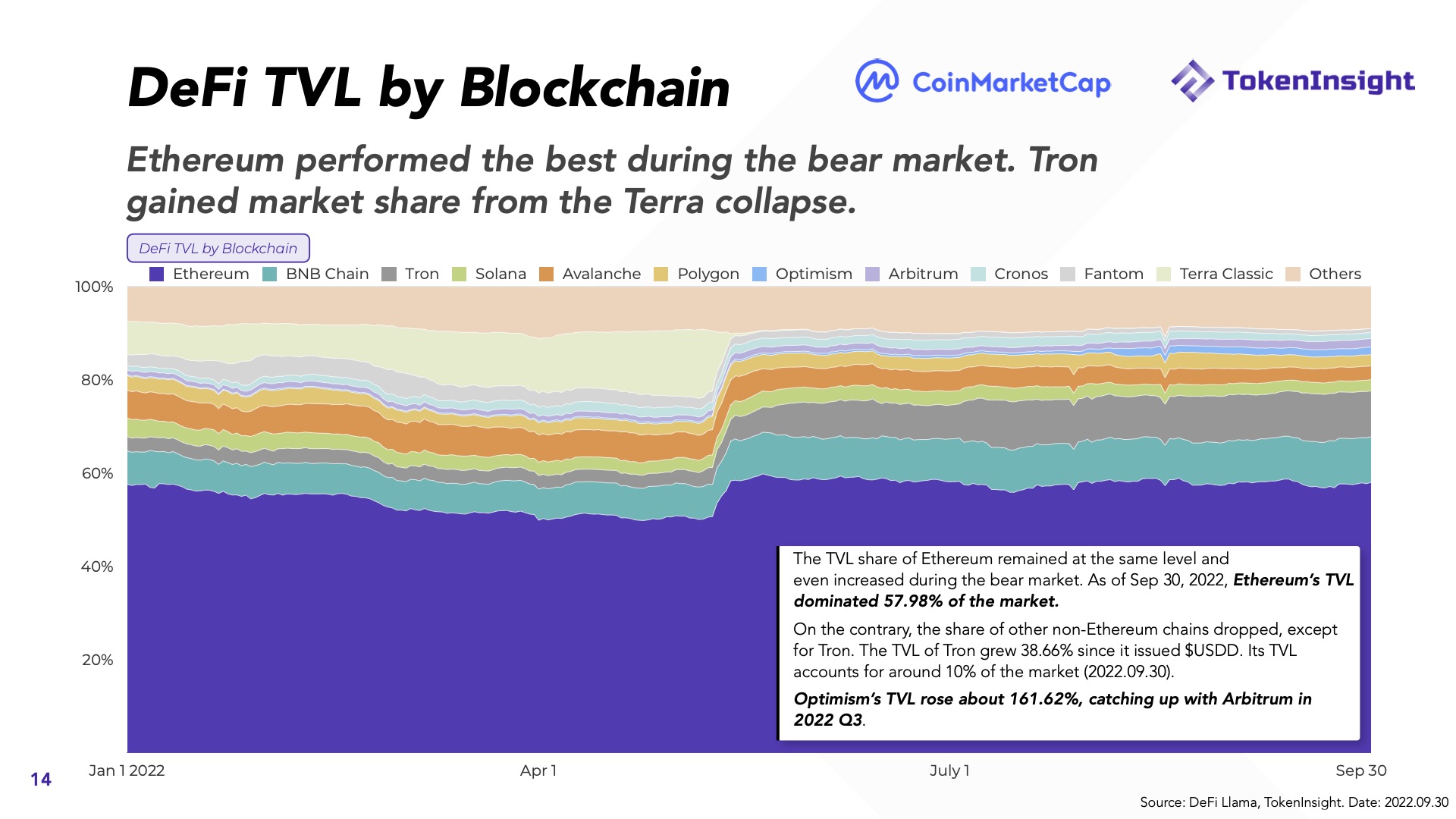

six. Overview of the DeFi industry

TVL of the very best chains down 67.76%but general on-chain transactions stay the exact same.

Ethereum is the very best bearer in this bear industry. Tron has acquired industry share considering that Terra’s disappearance.

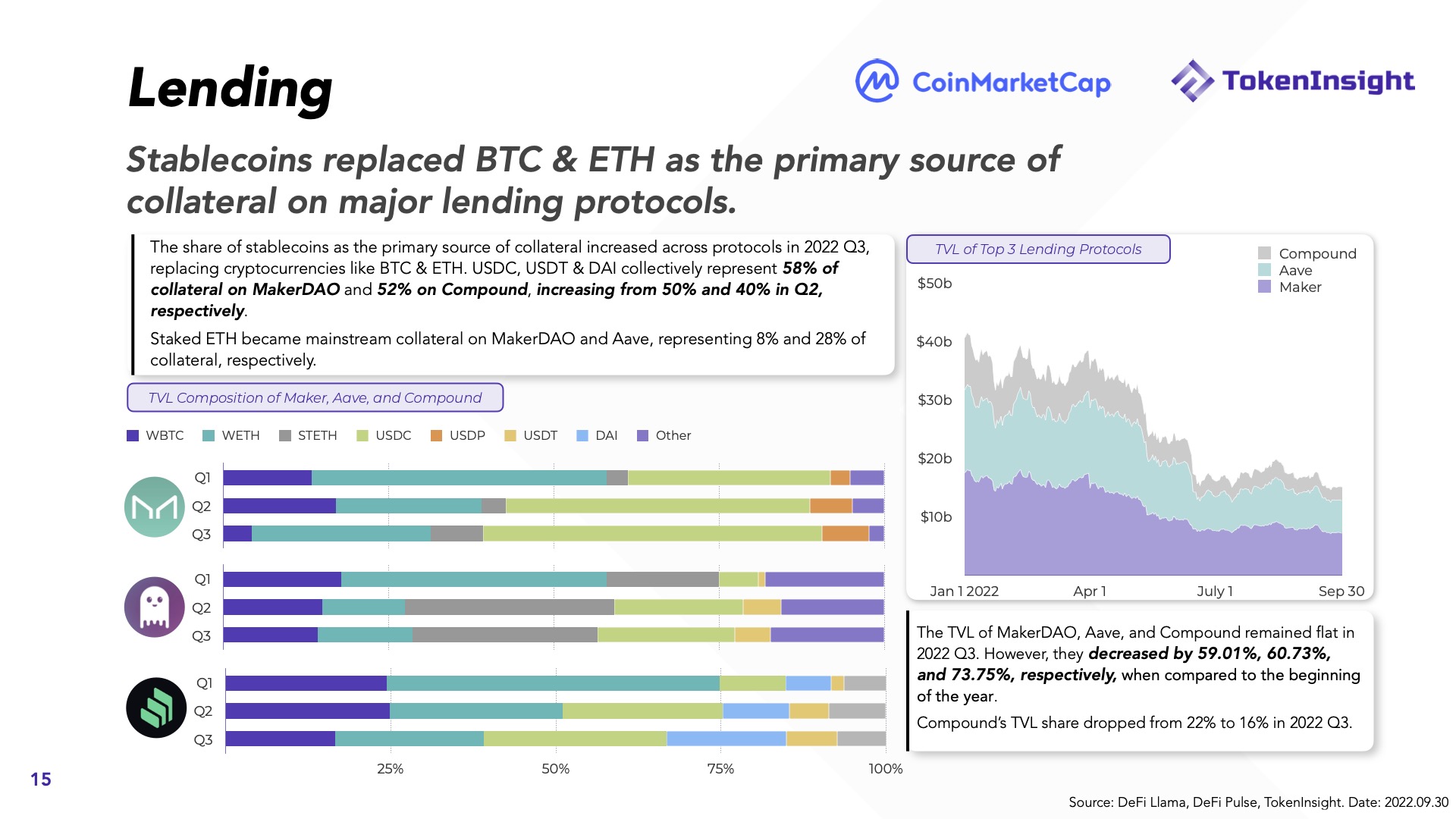

seven. Lending and borrowing actions

Stablecoins have replaced BTC and ETH as supply of ensure principal on the principal loan protocols.

The industry share of stablecoins as a principal supply of collateral greater in between protocols in the third quarter of 2022, changing cryptocurrencies this kind of as BTC and ETH. Meanwhile, USDC, USDT and DAI account for 58% of the collateral on MakerDAO and 52% on Compound, up from 50% and forty% respectively in contrast to the 2nd quarter.

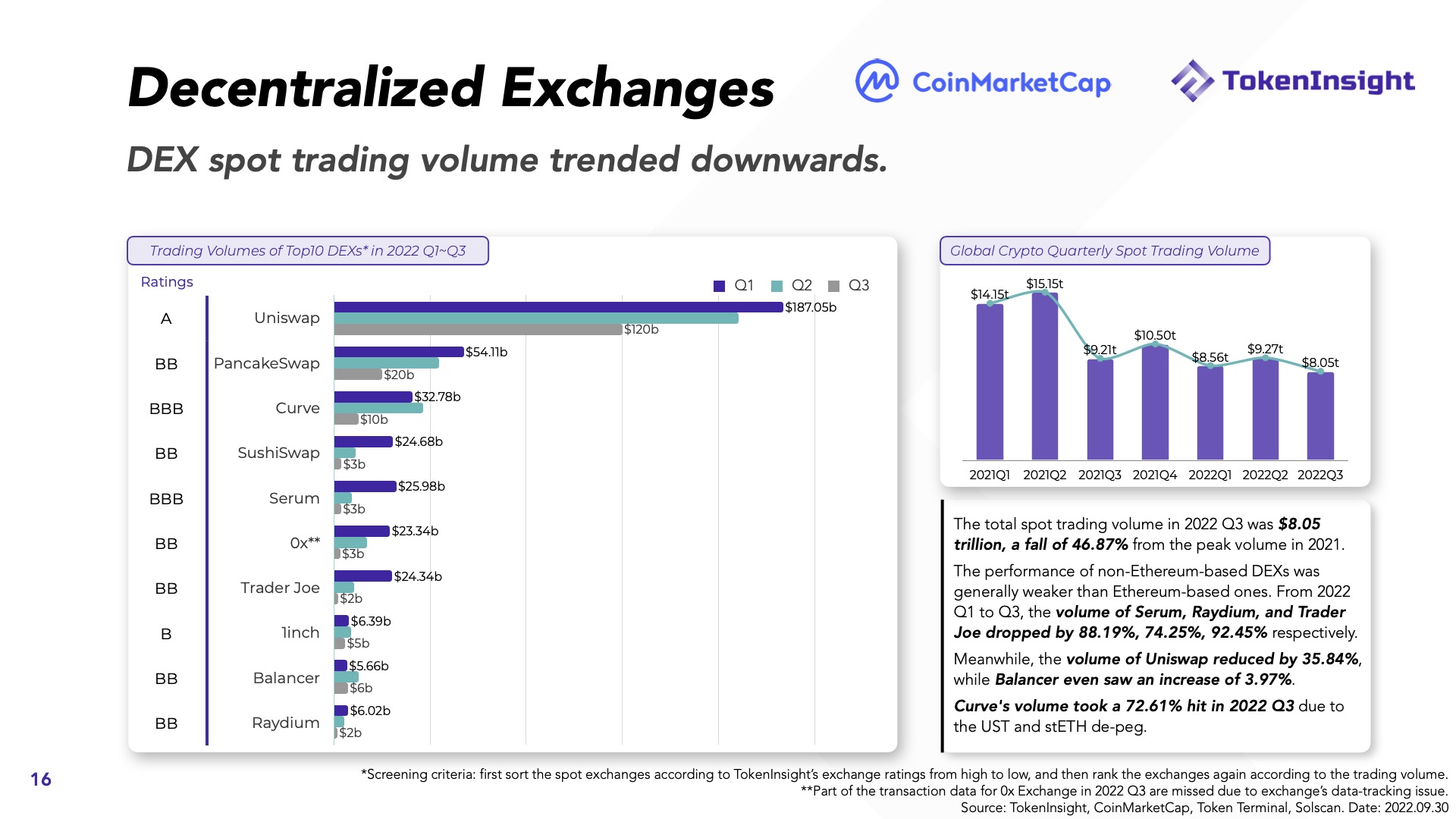

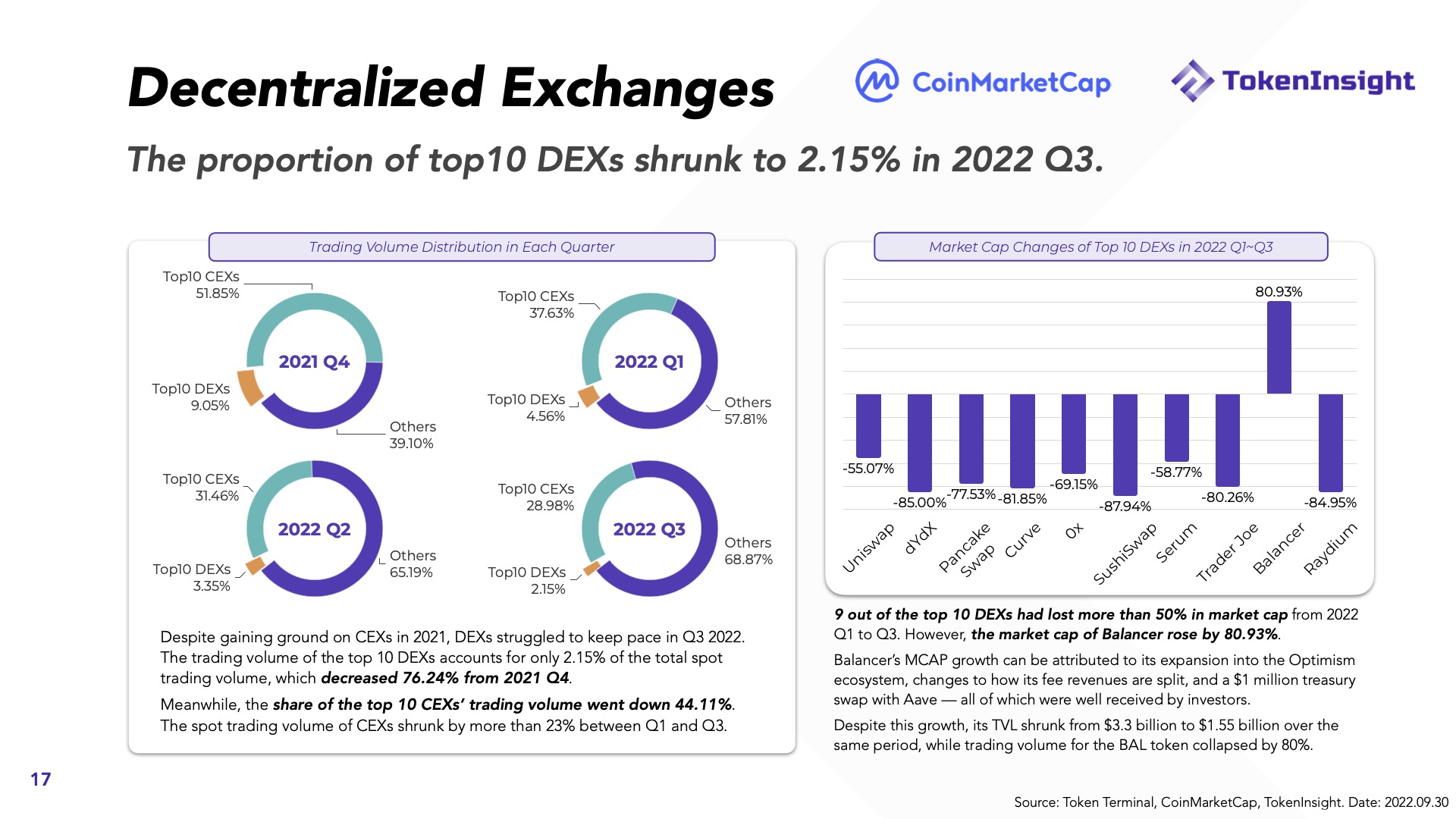

eight. Decentralized Exchange (DEX)

The volume of spot trading on DEX tends to lessen.

Total spot trading volume fell 46.87% from the peak in Q2 2021. Despite the rise in the CEX in 2021, DEX struggled to retain up in the third quarter of 2022. Trading volume of The top rated ten DEXs signify only two.15% of the complete spot trading volume. Additionally, 9 of the top rated ten DEXs misplaced much more than 50% of their industry capitalization in between the initially and third quarters of 2022, with Balancer remaining the only exception.

The functionality of DEXs devoid of an Ethereum platform is usually weaker than that of DEXs with an Ethereum platform.

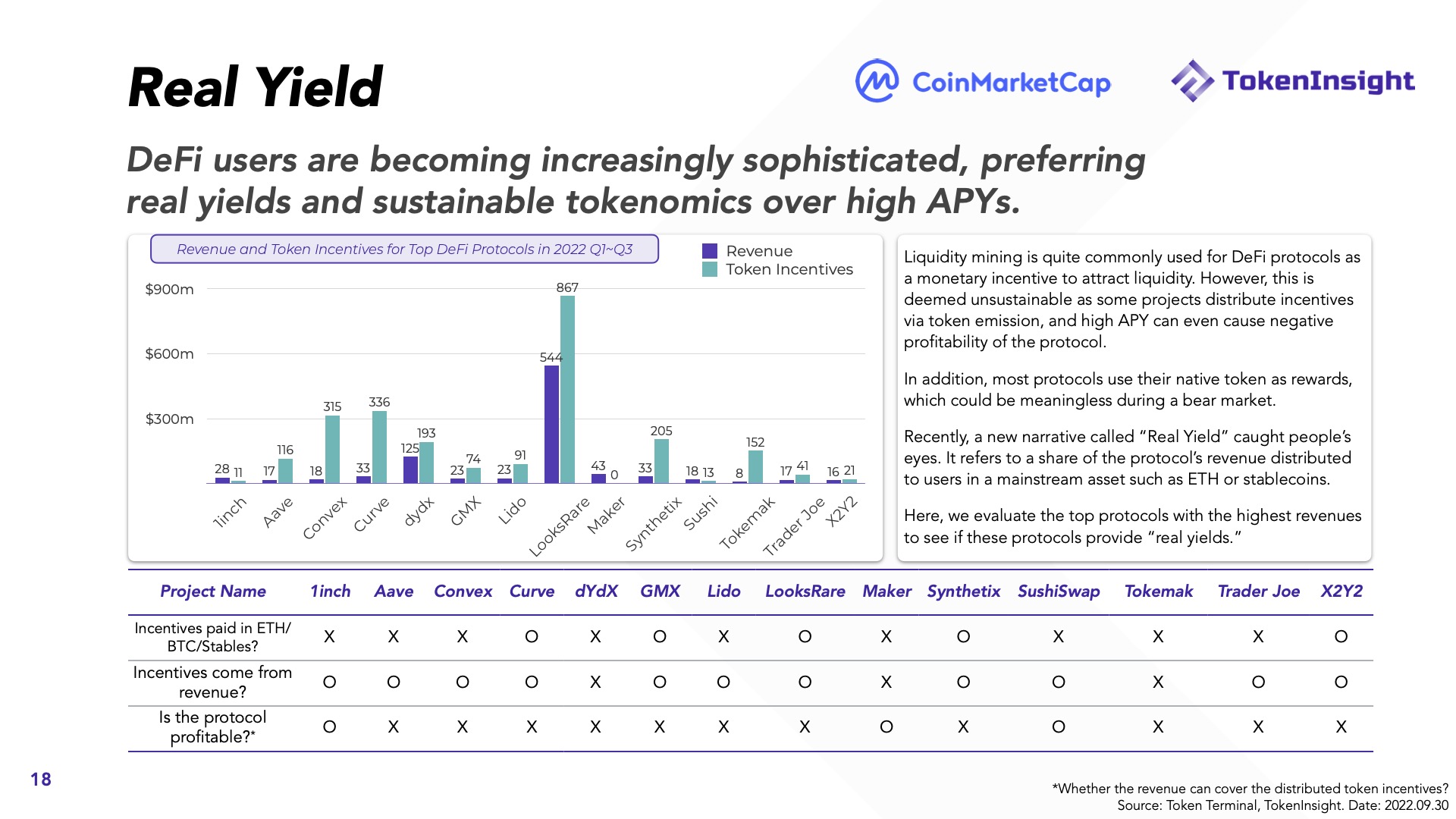

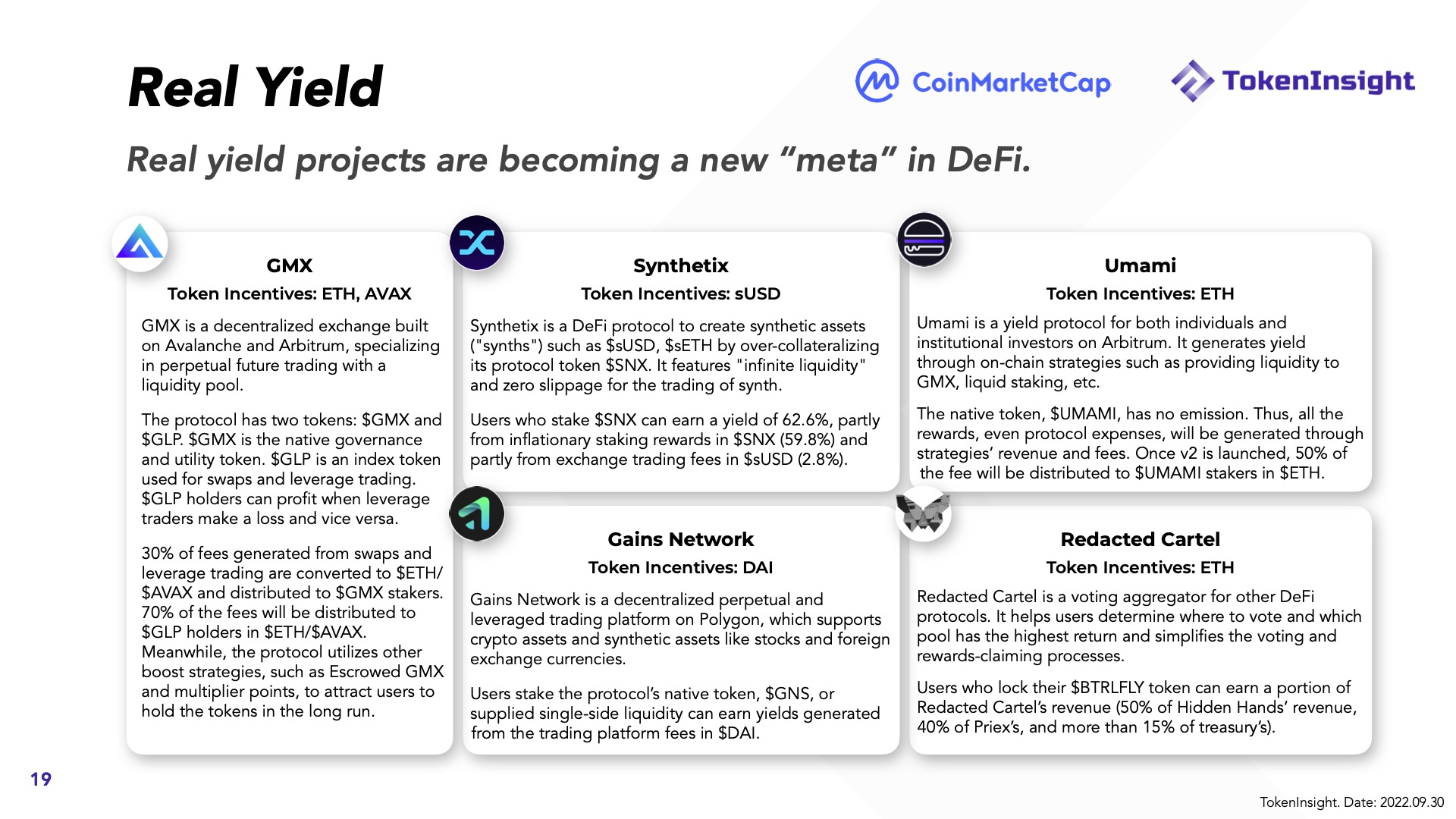

9. Search Trends for Real Return

DeFi consumers are turning into much more sophisticated, preferring successful investment options and owning sustainable APY, aka the Real Yield motion.

ten. NFT industry

The volume of NFT trading fell by 66.five% in the final quarter, when the variety of traders fell by thirty.four%. The NFT industry has now returned to pre-July 2021 amounts and is possible to decline additional.

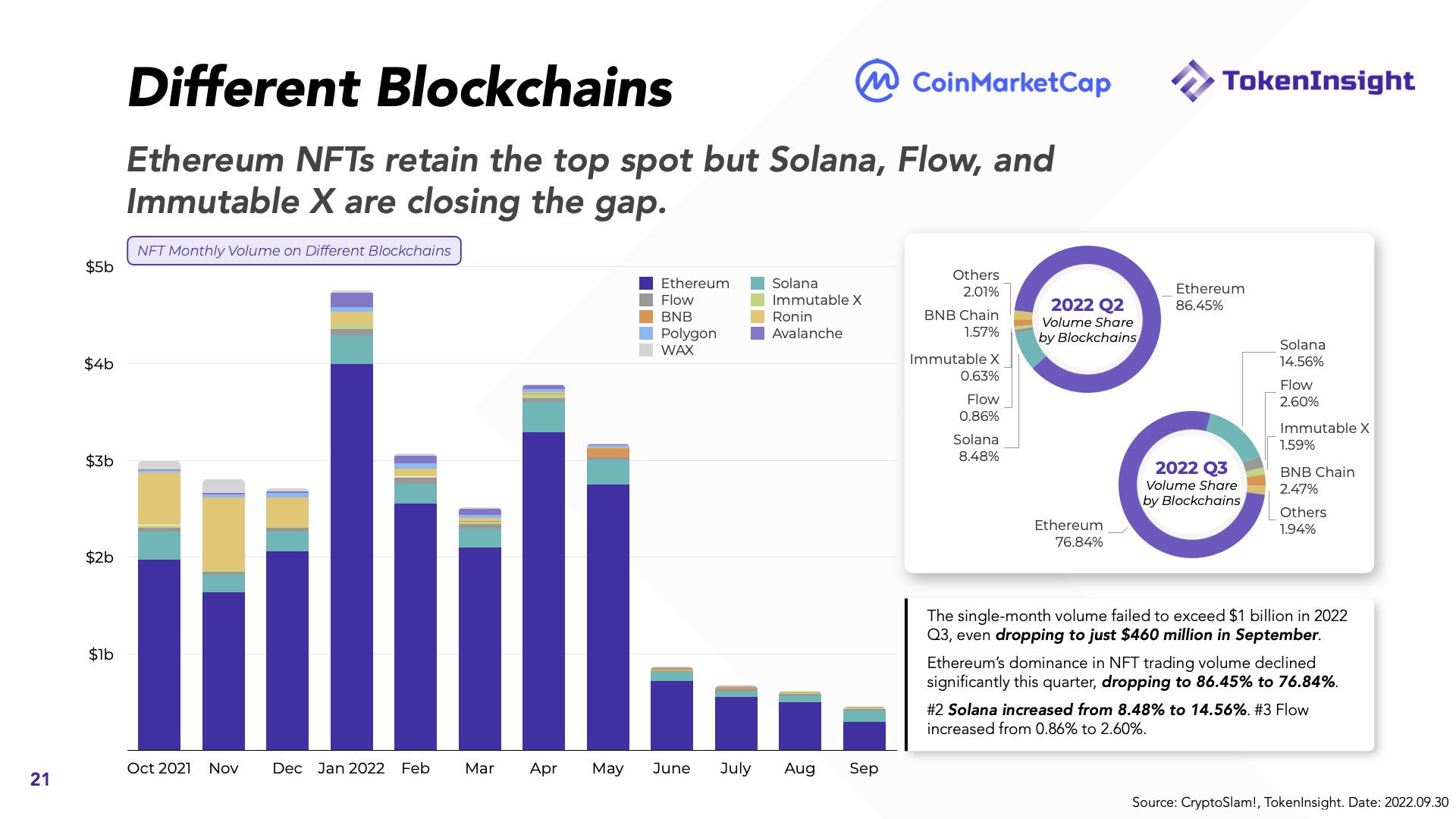

Ethereum NFT they nevertheless hold the top rated spot but Solana, Flow and Immutable X are closing the gap.

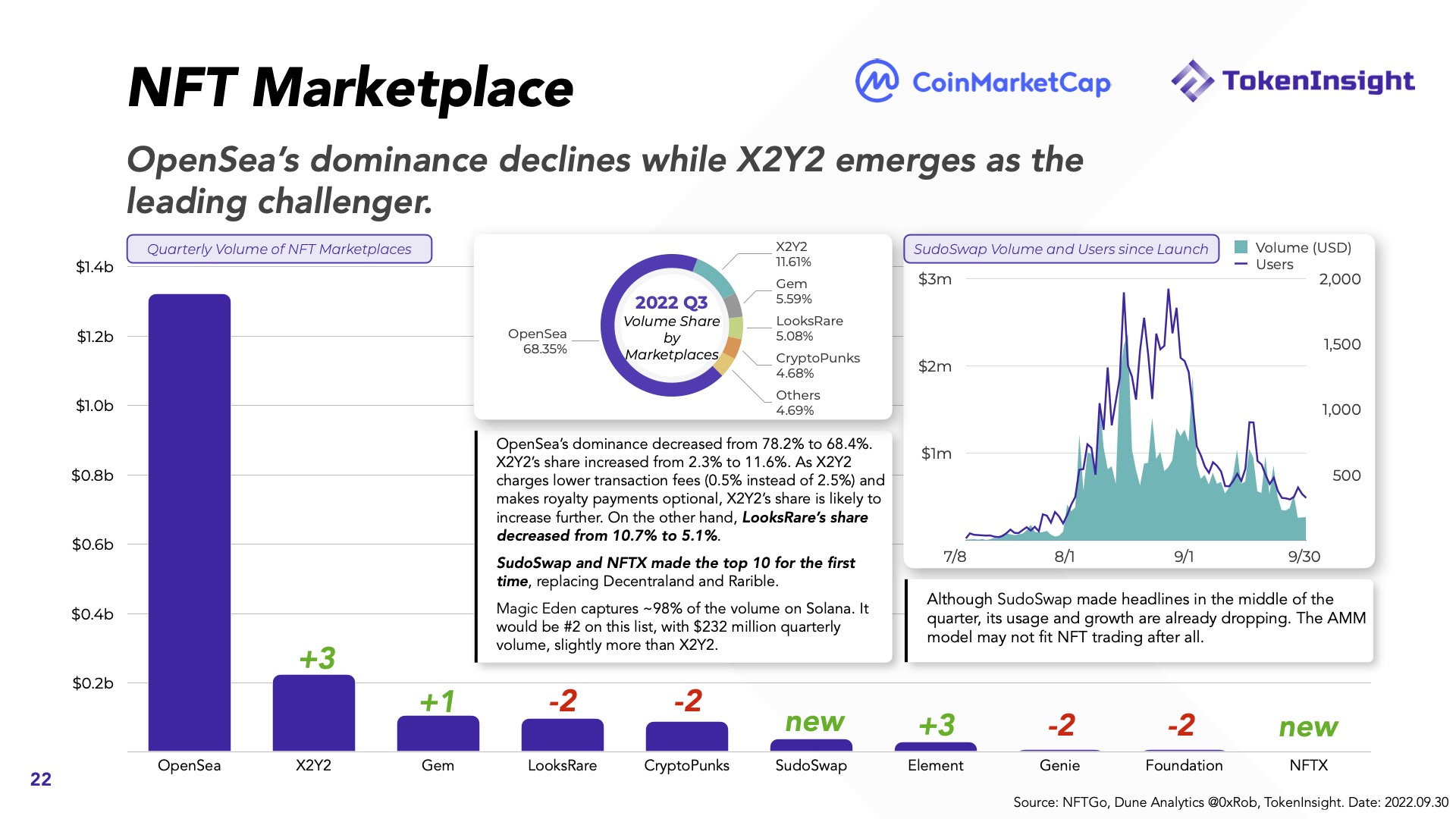

OpenSea’s domain decreases as X2Y2 emerges as the principal challenger.

Sudoswap and NFTX entered the top rated ten for the initially time, changing Decentraland and Rarible.

Magic Eden accounts for somewhere around 98% of the trading volume on Solana.

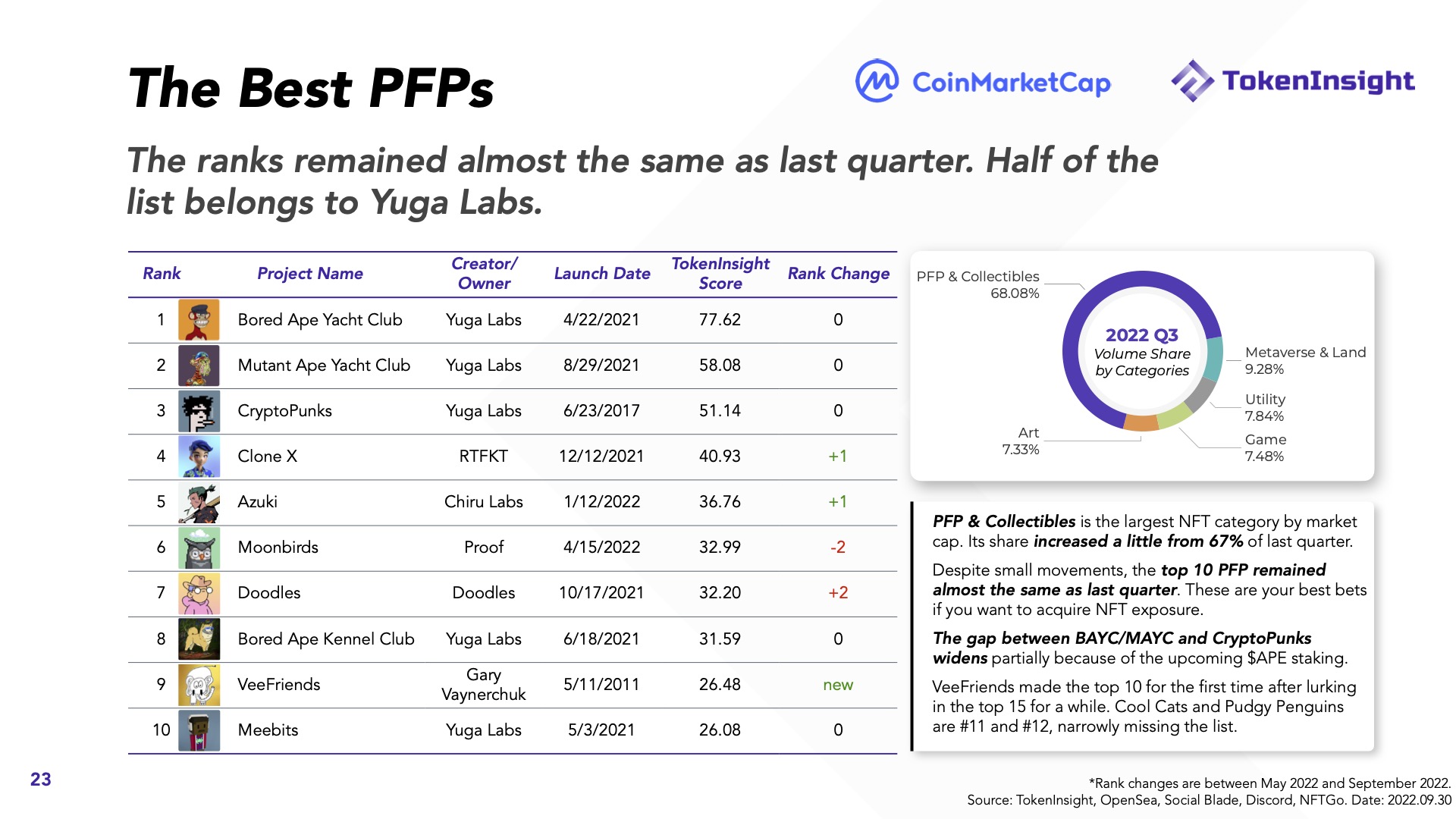

PFP (representative photograph) e Collectible goods (collectibles) are the greatest NFTs by industry capitalization. Its industry share greater somewhat from 67% in the former quarter.

Although there are modest variations, The ten very best PFPs remained pretty much unchanged from the former quarter, with the new addition of VeeFriends .

- New NFT tasks are born

We have some new styles that have risen in value lately, whilst the general industry is nevertheless a bear industry.

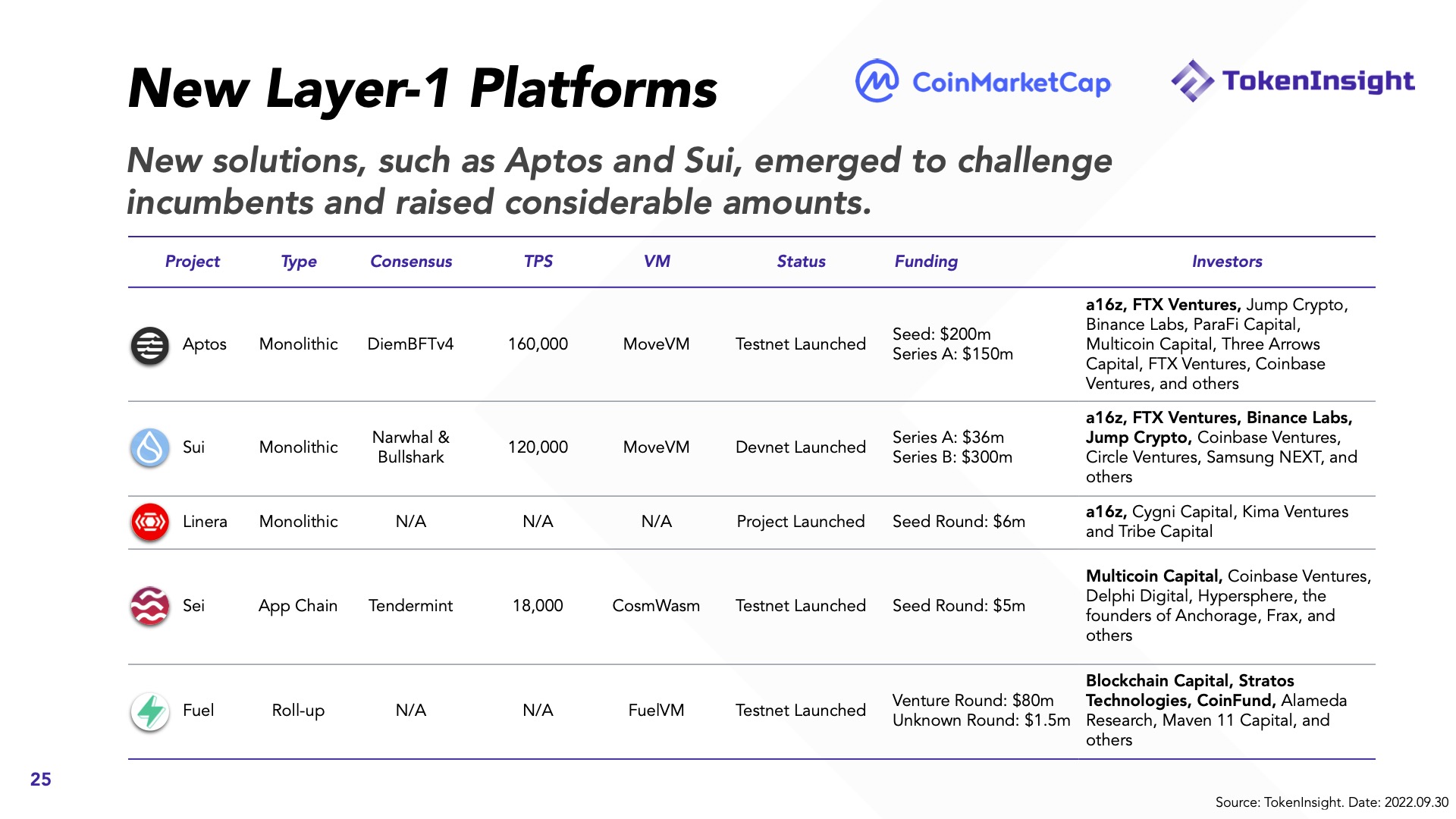

eleven. Emerging degree one basis

New tasks, this kind of as Aptos and Sui, have emerged to challenge current tasks and increase large capital.