Green fills the stock and cryptocurrency markets in spite of the Fed acquiring just raised curiosity charges for the fourth consecutive time in 2022.

The Fed raises curiosity charges for the fourth time in 2022

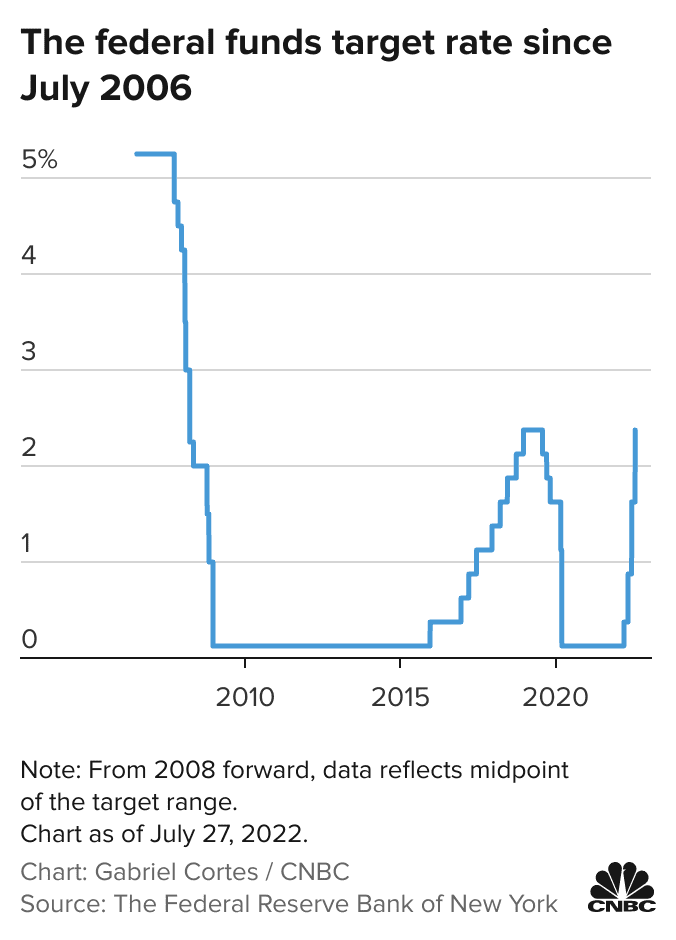

As reported by Coinliveat dawn on July 28, the US Federal Reserve (Fed) announced that it would increase curiosity charges to a new degree of two.five%, up .75% from the June adjustment, bringing them back to the degree of 2018, the time period just before curiosity charges had been pushed back to close to zero to spur investment for the duration of the COVID-19 pandemic.

Since the starting of 2022, the Fed has raised curiosity charges four occasions in a row in March, May, June and July, with changes of .25%, .five% and .75% and .75% respectively . The Fed’s intention will be to deliver curiosity charges into the three% -three.five% array by the finish of this 12 months by way of the remaining changes in September, November and December.

This is a move by the Fed to regulate the industry in the context in which the company given that the COVID-19 outbreak in mid-2020 in the United States has constantly pumped funds into the industry to subsidize persons and firms. the inflationary predicament showed indications of out of management.

US inflation, reflected in the customer value index (CPI), reached 9.one% in June, the highest degree in four decades and surpassed all experts’ forecasts. However, the present predicament is not just the end result of the Fed, but a mixture of several other macro elements this kind of as the vitality crisis and worldwide provide chain disruptions resulting from the conflict amongst Russia and Ukraine and the COVID predicament in China.

At the similar dawn press conference this morning, Fed Chairman Jerome Powell presented some much more insight into the US central bank’s feedback, which includes:

– Inflation is at this time also substantial, the Fed will carry on to modify the funds provide to cope.

The June inflation report showed worse than anticipated success.

– The up coming curiosity price hike in September is very likely to see an unusually substantial adjustment.

– The Fed’s target curiosity price at the finish of this 12 months will be amongst three and three.five%.

– The Fed expects indications of a slowdown in the US economic climate, but does not imagine a economic downturn has started out.

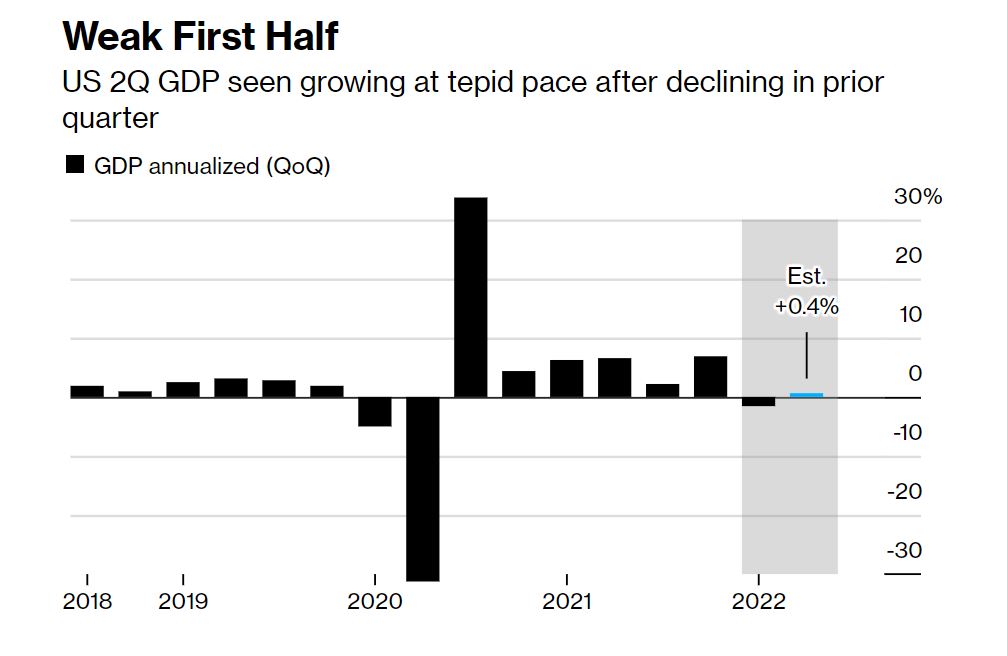

Another macro piece of facts the industry will will need to view in the up coming number of hrs is that the US will release its GDP report on the evening of July 28, an indicator that demonstrates no matter if the world’s biggest economic climate is getting into economic downturn or not when GDP of the initially quarter fell one.six%. To stick to Bloombergobservers assume US GDP in the 2nd quarter to raise somewhat by .four%.

Strong recovery of the cryptocurrency industry

Although the information that the Fed has raised curiosity charges is typically noticed as a unfavorable signal, it is feasible that by getting ready in advance for the situation of a .75% hike, the two the US stock industry and the cryptocurrency industry are the two good rather than unfavorable. obtain the over facts in a good way.

As quickly as information of a .75% rise was confirmed by the Fed, Bitcoin (BTC) even regained its momentum from the $ 21,900 area and even climbed to $ 23,one hundred. Subsequently, the biggest cryptocurrency in the planet is stabilizing all around the $ 22,700-23,000 zone. Previously, due to fears that the Fed may be aggressive, BTC at one particular stage dropped to twenty,706 on July 26.

Similarly, the 2nd Ethereum (ETH) coin has created a robust comeback with a achieve of more than twelve% in the previous 24 hrs at $ one,644. ETH is nearing its July peak at $ one,664, acquired from bullish momentum led by information of The Merge coming in September.

Another title that also benefited from The Merge is Ethereum Classic (And so forth), which is up much more than thirty% to $ 33.77. The cause is mainly because several persons are hoping that just after Ethereum switches to Proof-of-Stake, ETH miners will switch to Ethereum Classic mainly because this network is the closest copy of Ethereum but nonetheless utilizes Proof-of-Work. .

The strongest raise in the industry in the previous twelve hrs was Lido (LDO) with a surge of just about 45% thanks to the information that the undertaking management crew had up to date the proposal to promote one% of the complete provide of LDO. to the Dragonfly Capital investment fund at a industry value of amongst $ one.45 and $ two.45, as nicely as imposing a one-12 months token blocking necessity, which is why the outdated proposition failed. Therefore, several persons are pushing the LDO value up to make Dragonfly invest much more funds.

Other important cryptocurrencies in the best twenty are also building gains of six-twenty% ideal now. Market capitalization is stabilizing at all around $ one.045 billion.

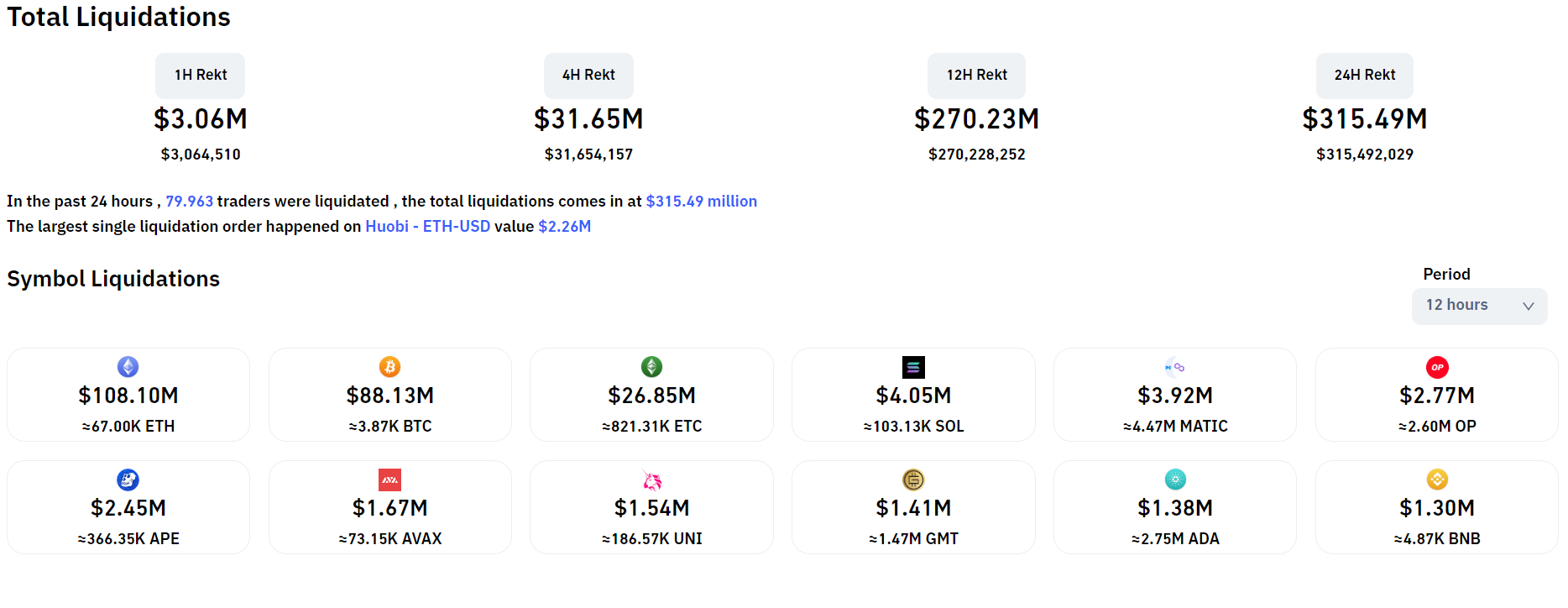

Over the previous twelve hrs, much more than $ 270 million well worth of derivative orders on the industry have been cleared, led by three ETH, BTC and And so forth. The percentage of brief orders burned represented 78.seven%.

Synthetic currency 68

Maybe you are interested: