Transactions of up to billions of bucks linked to the Binance exchange portfolio produced the neighborhood worry the explanation for this occasion.

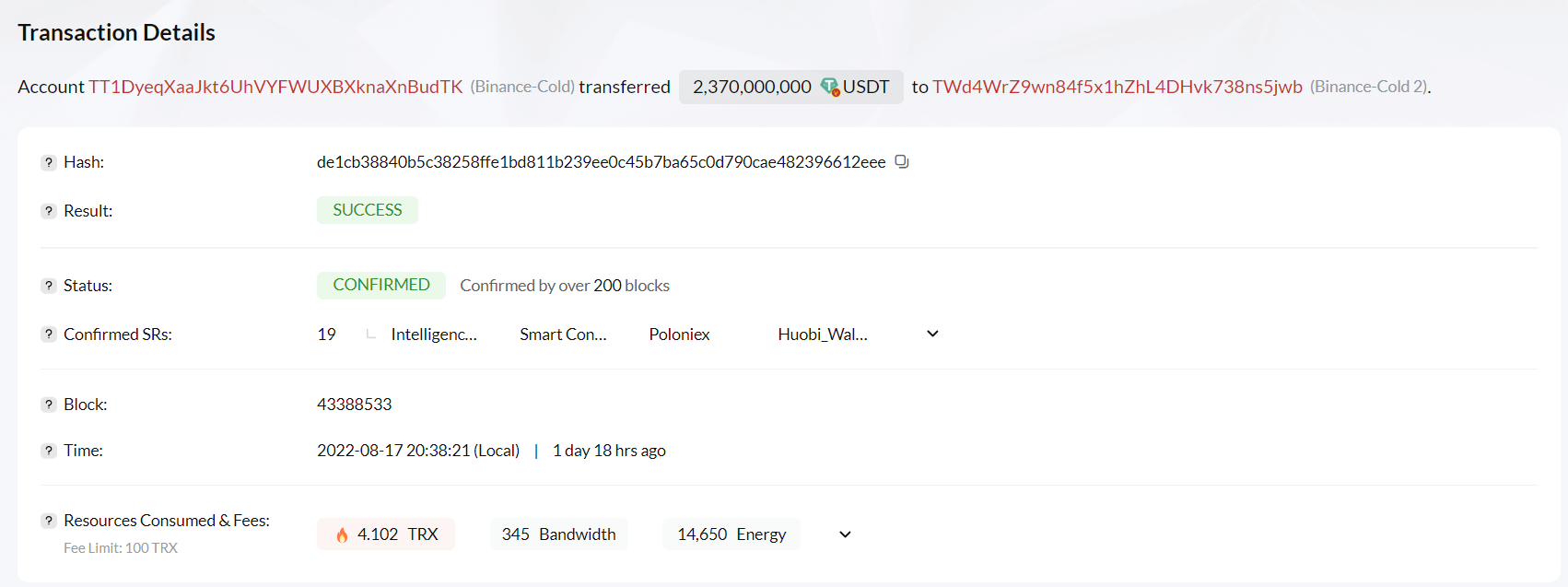

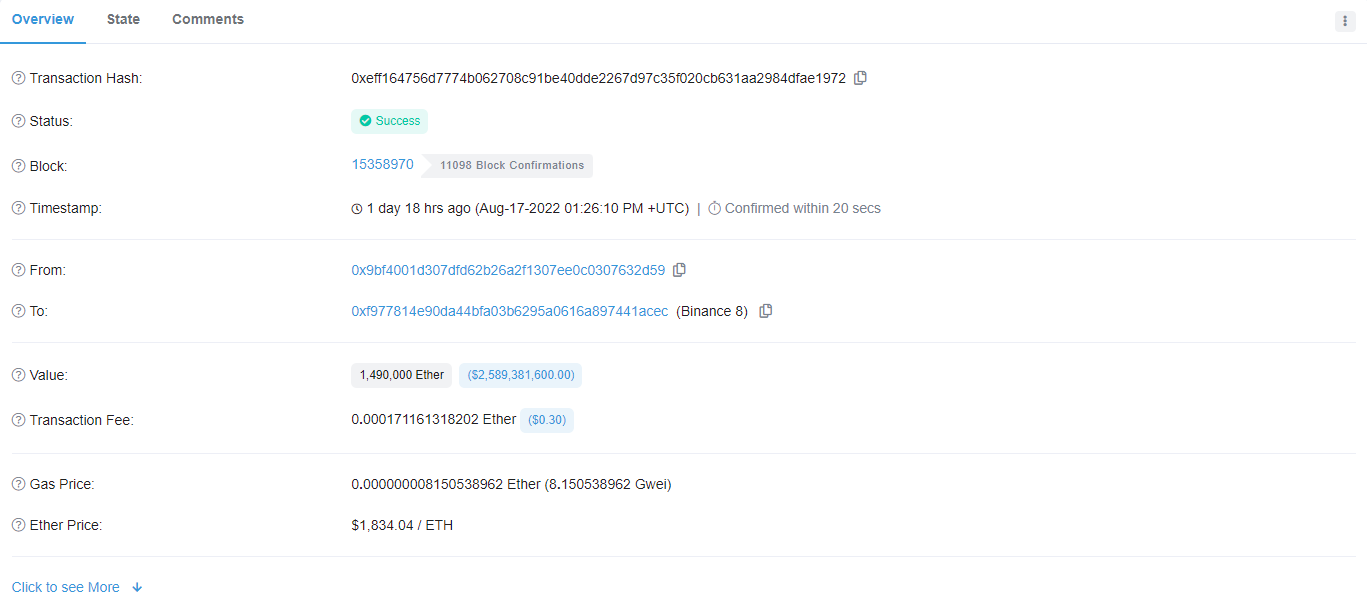

Two cryptocurrency transfers of “huge” volume have been found involving the wallet of the Binance exchange. A transfer of two.37 billion USDT concerning two Binance cold wallets and an additional up to one.49 million ETH destined for the Binance eight wallet.

Binance organized wallets that concerned enormous fund transfers, transferring USDT two.37 billion concerning two TRON cold wallets and transferring one.49 million ETH to the Binance eight wallet.

trc20-USDT: https://t.co/KnJr6FAXPv

ETH: https://t.co/wC2EfjnnLa– Wu Blockchain (@WuBlockchain) August 18, 2022

Both transactions are recorded on the network-unique blockchain search engine TRON (TronScan) and Ethereum (Etherscan) respectively.

It is nonetheless unclear what the explanation and motive behind these two transactions is. The standout element, having said that, was the transfer time, which occurred following Binance resolved the withdrawal hold at 15:twenty (UTC) on August 17th. Binance stated that due to a technical challenge with the services supplier, withdrawals have been stopped.

Earlier right now, all over 07:00 UTC, #Binance withdrawals temporarily closed for several networks due to an problem with a third get together technical supplier.

Our group responded immediately, resolving the problem inside of one hour.

The money are SAFU. Thanks for your persistence and comprehending.

– Binance (@binance) August 17, 2022

For the remaining ETH transaction, it can be applied for the approaching Ethereum Merge occasion in September 2022. Analysts at Genesis, 1 of the major cryptocurrency lenders in the industry, say they have viewed consensus on a unique technique the place traders would retain spots, they would hedge ETH in futures contracts and borrow Ether in the course of consolidation.

Therefore, as the exchange delivers this kind of items to traders, they ought to also very own a significant volume of ETH for this function. This argument tends to make sense provided the present institutional action on ETH. It would seem most assume ETH’s rate will be really optimistic when The Merge requires location.

Additionally, Coinbase has supported ETH staking for US customers as nicely as the world’s greatest derivatives exchange, CME, which strategies to launch an ETH futures choices item on September twelve.

However, in any situation, it is undeniable that this kind of a significant income transfer operation that occurred abruptly produced the neighborhood come to feel rather concerned, particularly in the context the place the industry has not entirely recovered, recovered following so numerous crises from the starting. as of 2022. as a outcome, in the afternoon of August 19, BTC flash dropped to $ 21,500, ETH almost hit $ one,700, the industry was bleeding.

Synthetic currency 68

Maybe you are interested: