The remaining revenue soon after deducting income from Ethereum network costs registers a big adverse amount. This displays that even the primary ecosystem is nevertheless “suffering” due to the present gloomy market place time period.

Cryptocurrency winter is difficult, even the Ethereum network “does business” at a reduction!

Cryptocurrency winter is difficult, even the Ethereum network “does business” at a reduction!

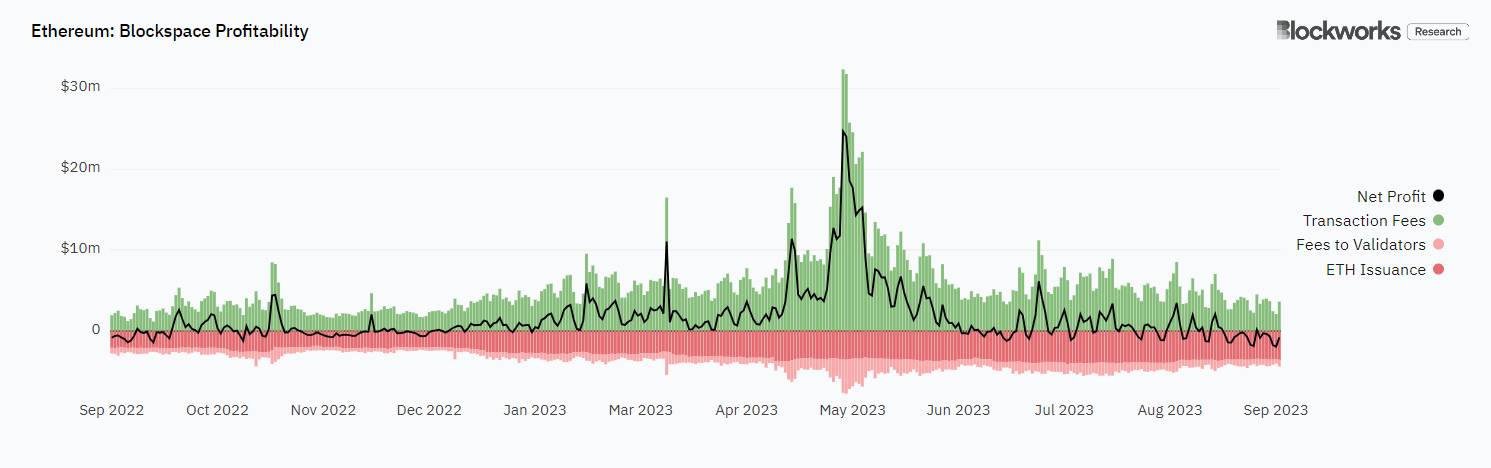

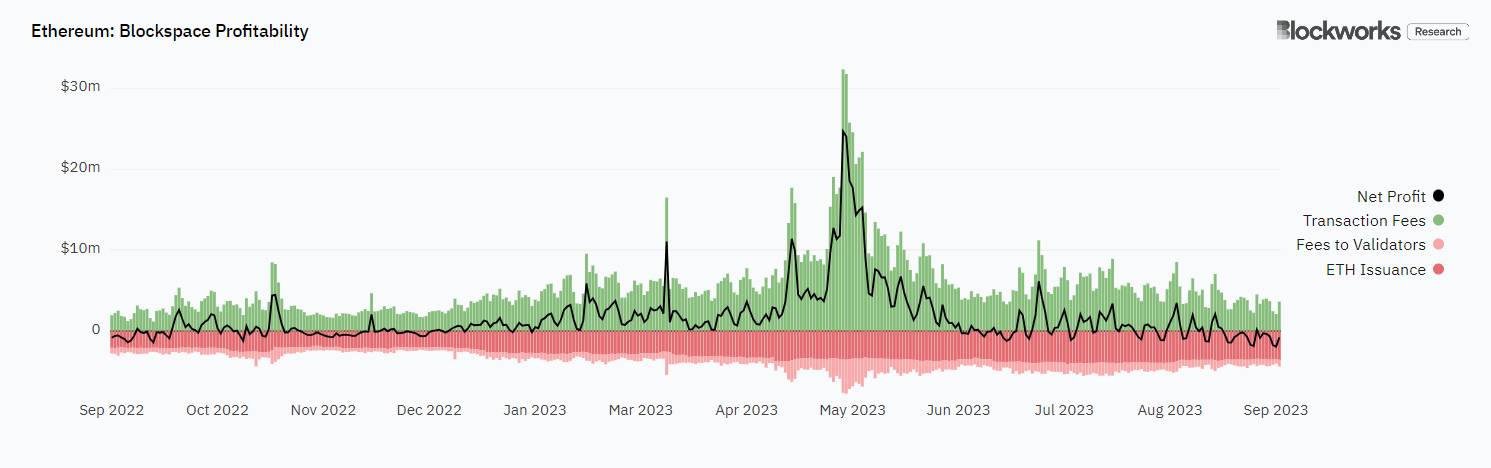

According to information from Block investigation, the Ethereum blockspace has constantly viewed revenue considering the fact that The Merge. But with this September the revenue of the ETH “business” endure hefty losses!

Blockchain revenue refers to the working revenue of the Ethereum network, i.e. the sum remaining soon after subtracting costs from income. With Ethereum, earnings are the complete transaction costs. Meanwhile, the network should refund the validator and the newly issued ETH.

From that:

Blockspace Profit = Total Transaction Fees – (Fees paid to validators + worth of newly issued ETH)

As Coinlive explained in The Merge anniversary submit one particular 12 months later on, the Ethereum network is far more productive, deflationary, and consumes a lot much less vitality than when it applied Proof of Work. However, due to harsh market place problems and a prolonged winter that has decreased on-chain action, Ethereum is reporting adverse blockchain revenue for the 1st time in quite a few months.

Ethereum blockchain revenue. Source: Blockworks investigation

Ethereum blockchain revenue. Source: Blockworks investigation

Second ultrasound.revenue, eight,900 new ETH had been issued this month, mixed with a decline in on-chain action, resulting in transaction costs collected by the network to plummet. This prospects to a adverse revenue of $15.9 million in September 2023.

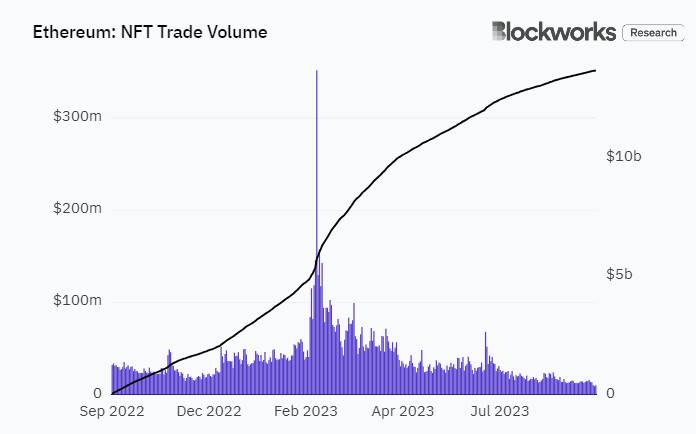

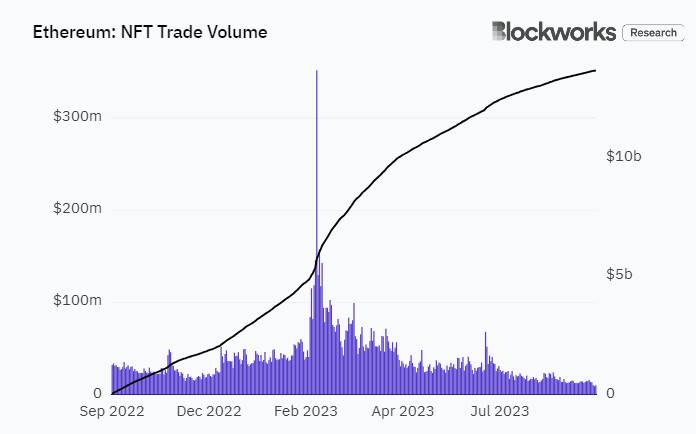

The clearest proof is that swap and trading action for stablecoins like USDT and USDC have declined by as a lot as 90% considering the fact that peaking in March 2023. Next came the decline of NFTs as a series of blue-chip NFT collections fell 83% from the optimum price tag, forcing quite a few traders to minimize their losses and no longer have any “interest” in the area.

NFT trading volume on the Ethereum network. Source: Blockworks investigation

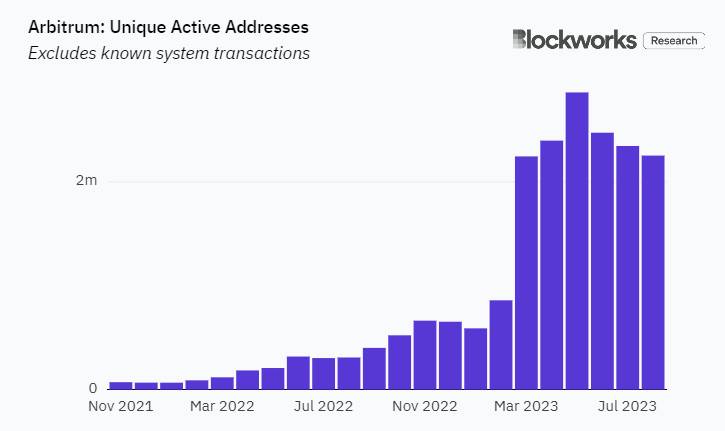

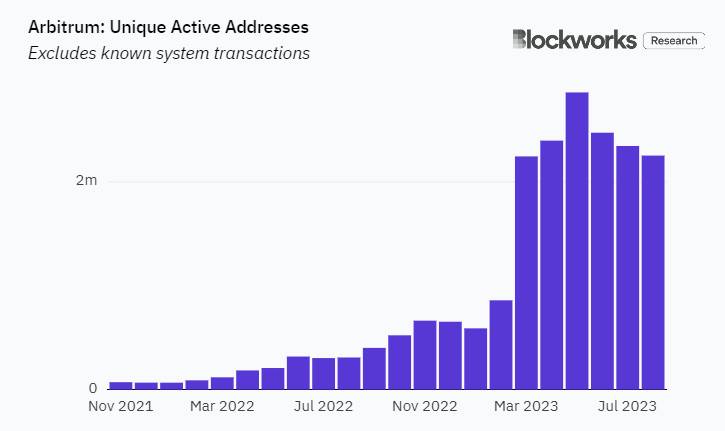

However, the great information is that some critical Layer-2s this kind of as Arbitrum and Optimism nevertheless preserve sustainable functionality regardless of the downward trend.

Number of lively Arbitrum wallet addresses. Source: Blockworks investigation

According to a valuation examine based mostly on the amount of network end users, the price tag of ETH is undervalued by 27% in contrast to its actual worth.

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!

The remaining revenue soon after deducting income from Ethereum network costs registers a big adverse amount. This displays that even the primary ecosystem is nevertheless “suffering” due to the present gloomy market place time period.

Cryptocurrency winter is difficult, even the Ethereum network “does business” at a reduction!

Cryptocurrency winter is difficult, even the Ethereum network “does business” at a reduction!

According to information from Block investigation, the Ethereum blockspace has constantly viewed revenue considering the fact that The Merge. But with this September the revenue of the ETH “business” endure hefty losses!

Blockchain revenue refers to the working revenue of the Ethereum network, i.e. the sum remaining soon after subtracting costs from income. With Ethereum, earnings are the complete transaction costs. Meanwhile, the network should refund the validator and the newly issued ETH.

From that:

Blockspace Profit = Total Transaction Fees – (Fees paid to validators + worth of newly issued ETH)

As Coinlive explained in The Merge anniversary submit one particular 12 months later on, the Ethereum network is far more productive, deflationary, and consumes a lot much less vitality than when it applied Proof of Work. However, due to harsh market place problems and a prolonged winter that has decreased on-chain action, Ethereum is reporting adverse blockchain revenue for the 1st time in quite a few months.

Ethereum blockchain revenue. Source: Blockworks investigation

Ethereum blockchain revenue. Source: Blockworks investigation

Second ultrasound.revenue, eight,900 new ETH had been issued this month, mixed with a decline in on-chain action, resulting in transaction costs collected by the network to plummet. This prospects to a adverse revenue of $15.9 million in September 2023.

The clearest proof is that swap and trading action for stablecoins like USDT and USDC have declined by as a lot as 90% considering the fact that peaking in March 2023. Next came the decline of NFTs as a series of blue-chip NFT collections fell 83% from the optimum price tag, forcing quite a few traders to minimize their losses and no longer have any “interest” in the area.

NFT trading volume on the Ethereum network. Source: Blockworks investigation

However, the great information is that some critical Layer-2s this kind of as Arbitrum and Optimism nevertheless preserve sustainable functionality regardless of the downward trend.

Number of lively Arbitrum wallet addresses. Source: Blockworks investigation

According to a valuation examine based mostly on the amount of network end users, the price tag of ETH is undervalued by 27% in contrast to its actual worth.

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!