DeFi is an very aggressive race track among platforms for the reason that of the consistently shifting nature to adapt and the speedy elimination of the marketplace. Prominent in latest instances is Curve (CRV). The relentless advancement has assisted CRV develop into the emphasis of the uncompromising battle among two electrical DeFi tasks for two distinct eras, Yearn Finance and Convex Finance.

Event overview

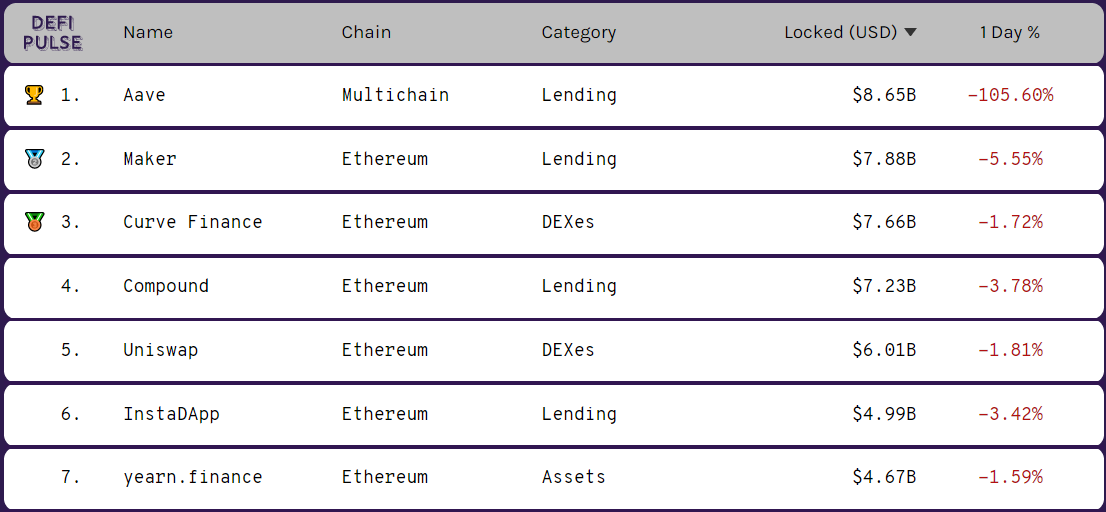

The revenue battle is at this time going on among Yearn and Convex. Both protocols are competing for as lots of CRV keys and numbers as achievable. With additional than 15% of the worth locked in DeFi becoming in these three protocols. And substantially of that relies on Curve earnings as a basis.

Prior to Convex, Yearn had no serious competitors with any protocol in staking veCRV. Both Yearn and Convex are creating Curve Finance’s CRV an significant element of their platforms’ income-making designs. This led to the “CRV War” breaking out and building substantial area for CRV to develop into one particular of the most significant assets in DeFi.

Come on let us Coinlive Discover what is actually going on within this war!

Note: This ought to only be viewed as details, not investment information.

Main character Curve

Curve Finance (CRV) is one particular of DeFi’s biggest decentralized exchanges, with in excess of $seven billion in complete locked worth (TVL) and facilitating hundreds of hundreds of thousands of everyday trading volumes.

Curve is an interesting capital-raising venture for the reason that of the great returns that the platform delivers. In addition to getting .02% per trade, along with some pools accumulating lending curiosity from markets like Compound and Aave, Liquidity Providers can earn rewards from yield farming. Recently, Curve launched Curve V2 to compete straight with Uniswap V3, the subsequent massive launch pad that plainly demonstrates the platform’s ambitions.

Between the possibility of reduction and the successful APY in extra of forty%, primarily based on present rates among liquidity and volume, Curve has develop into a sizzling spot for liquidity by delivering significant returns to its customers in a way decrease possibility in contrast to other options in DeFi.

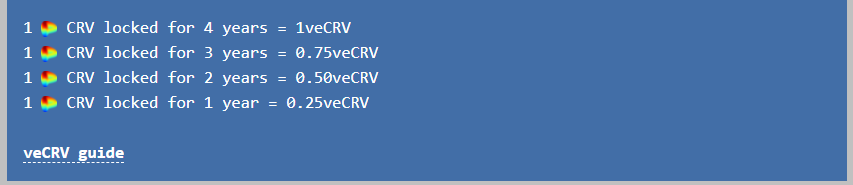

The motive why the yield on Curve is so higher is due to the specificity of the CRV token. Users can lock their CRV to accessibility the total added benefits of that asset. Locking is the procedure of putting a CRV in the Curve for a time period of time, from one particular week to 4 many years, to get a Vote Margin CRV (veCRV). To improved comprehend the complicated framework of Curve, please study the write-up under.

It ought to be mentioned that this procedure can not be reversed, that means that when converting CRV to veCRV, we will not have accessibility to our underlying tokens right up until the lockup time period ends. In addition, veCRV is non-transferable. To motivate a longer lock time, the variety of veCRVs we get will be proportional to the time it requires to make your mind up to lock the CRV.

We will get one veCRV for each and every CRV that decides to lock for 4 many years, .50 veCRV for just about every CRV locked for two many years, .25 veCRV for each and every CRV for one particular yr, and .02 veCRV for each and every CRV that is locked lock for a month.

It is for the reason that this higher variety gets to be the crux of the “conflict” among Yearn and Convex. Both protocols check out to use as substantially CRV as achievable to lock down veCRV. Thus they can earn the most significant achieve achievable and deliver the most revenue, for their customers.

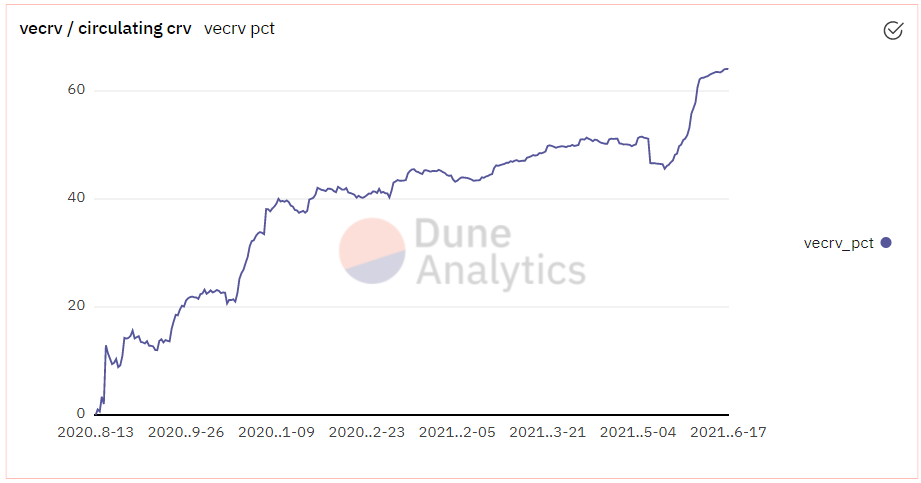

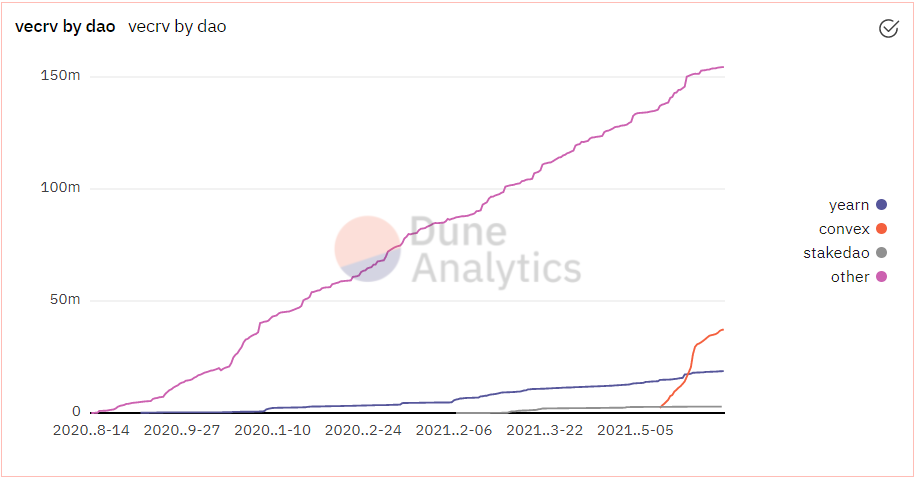

This is the driving aspect for the sudden improve in the volume of locked CRV. The ratio of CRV staking getting veCRV, in contrast to CRV in circulation, peaked at 63%, a clear indicator of the developing demand for rewards that come from locking up CRV.

“DeFi Empire” Yearn Finance

Yearn Finance is one particular of DeFi’s earliest and biggest revenue-making DeFi protocols with in excess of $five billion in TVL. One of Yearn’s principal sources of revenue comes from Curve, as 41 of Yearn’s 46 V2 vaults utilize some type of system that will involve earning CRV by enhanced rewards.

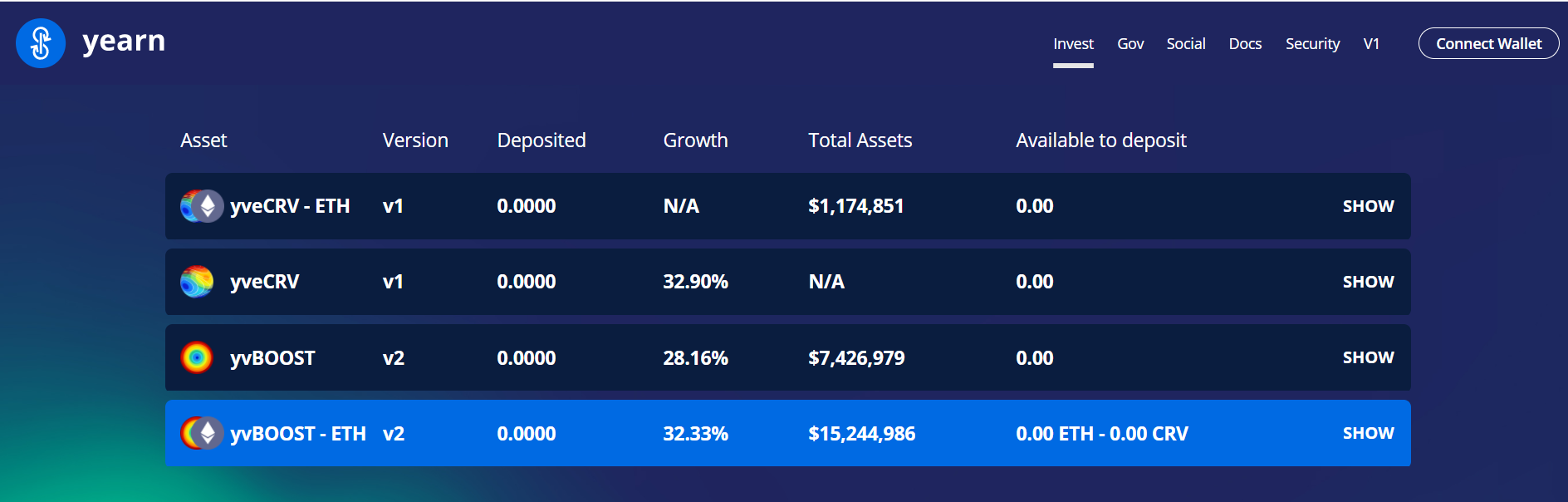

Remember, strengthening the CRV essential necessity implies that Yearn has to have some way of obtaining the CRV within the protocol. This is in which Yearn’s yvBoost platform comes into perform.

With the reverse filter, the consumer can submit a CRV to convert to yveCRV, which represents the encrypted edition of veCRV. Both tokens function the very same, yveCRV holders will nevertheless earn 50% of Curve transaction costs.

However, yveCRV also will allow holders to reap the added benefits of CRV locking with out dropping accessibility to its liquidity, as it can be traded on SushiSwap. The platform also immediately combines earnings by reinvesting transaction costs earned from Curve back into the vault by mining or paying for additional yveCRV.

Yearn reserves CRV by deposits to the yvBoost pedestal, which is then utilised to improve CRV rewards for other Yearn vaults, ten% of CRV rewards from all vaults deposited back into the pedestal.

Yearn’s purpose is extremely clear in accumulating as lots of CRVs as achievable to attain the highest achievable achieve for all vaults. Yearn will most likely be exclusive in the game of accumulating CRV, right up until the look of Convex Finance.

Young “Dark Horse” Convex

In essence, Convex is a protocol made to aid Curve liquidity suppliers and CRV holders maximize their earnings. Although it was launched much less than a month in the past, the venture has develop into well known, attracting additional than three.four billion USD of TVL.

Over $3B in @CurveFinance LP deposits obtaining that $CRV $veCRV increase! pic.twitter.com/uvcTRGkAtK

— Convex Finance (@ConvexFinance) June 5, 2021

Like Yearn, Convex supplies the skill for CRV holders to convert their holdings into a cryptographic edition of veCRV, cvxCRV. Users can stake cvxCRV to earn Curve trading costs, improve CRV rewards, shell out with efficiency charge revenue of LP vaults (ten% of complete CRV earned), plus CVX rewards. CVX can also be staked on the platform, assisting customers earn additional cvxCRV.

As with Yearn, the CRV locked from the cvxCRV vault is utilised to improve the vault’s reward for Curve LPs. In it, customers can stake their tokens to earn transaction costs, along with enhanced CVX and CRV rewards. This increases capital efficiency and maximizes returns for LPs so they can earn rewards with out holding and locking up CRVs.

On Convex, customers will have to manually reinvest their rewards back into distinct vaults to mix rather of becoming accomplished immediately on Yearn. Convex has a reduce charge framework, as it keeps sixteen% of earnings as a efficiency charge, even though Yearn fees a two% management charge along with twenty% of earnings. On Convex, customers can farm CVX or can also be reinvested back into distinct vaults.

So we have a improved knowing of how each Yearn and Convex operate by the rewarding “pie” of CRV. What will the end result be?

Winner portrait

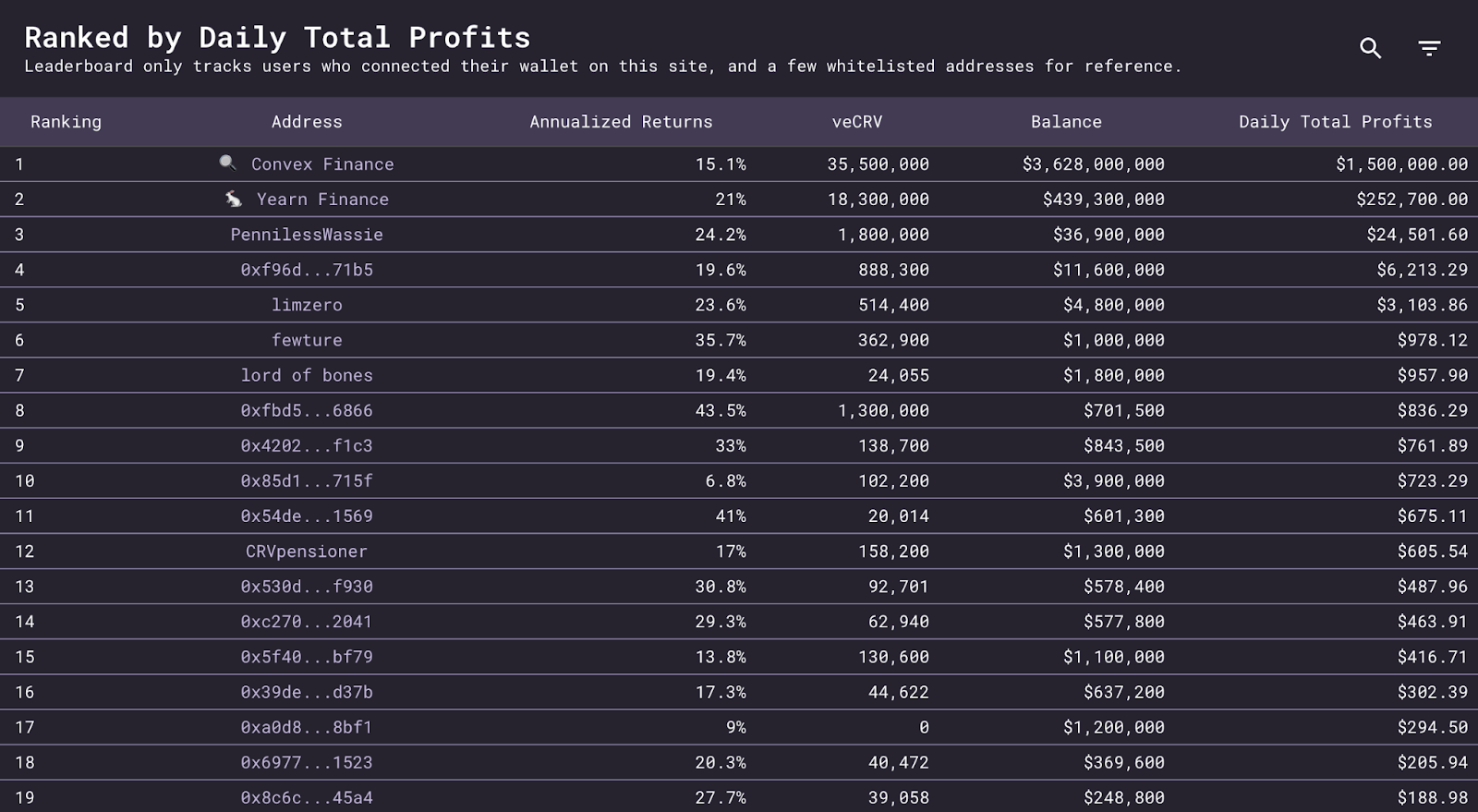

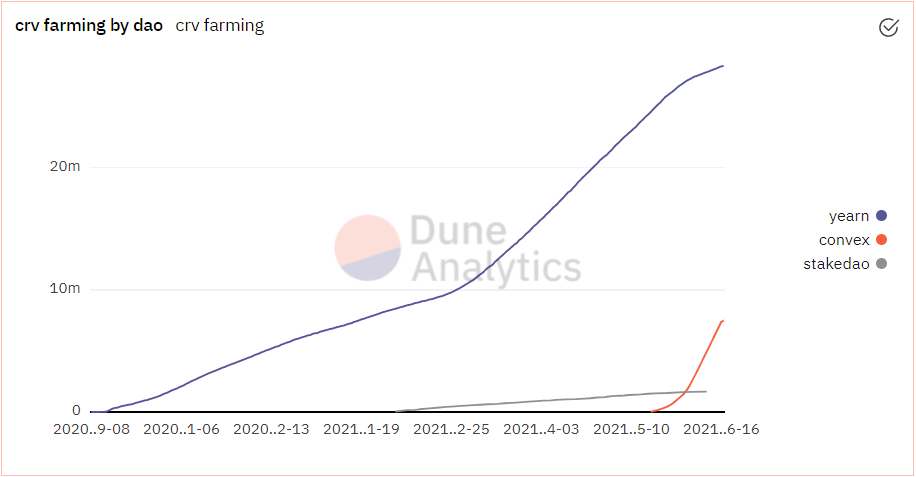

As pointed out earlier, the ratio of CRV staking getting veCRV, in contrast to the circulating provide of CRV, peaked at 63%. Out of the 212 million veCRV, the two most significant holders are Convex with 35.five million, or 17.one% of the provide, and Yearn with 18.three million, about eight.seven% of the provide.

At 1st glance, it can be noticed that the benefit is additional in favor of Convex. Since the platform delivers comparable increases in capital efficiency, returns, and liquidity to LP and CRV holders, with the additional advantage of CVX rewards, Yearn does not. However, a closer appear exhibits that this kind of conclusions ought to not be rushed.

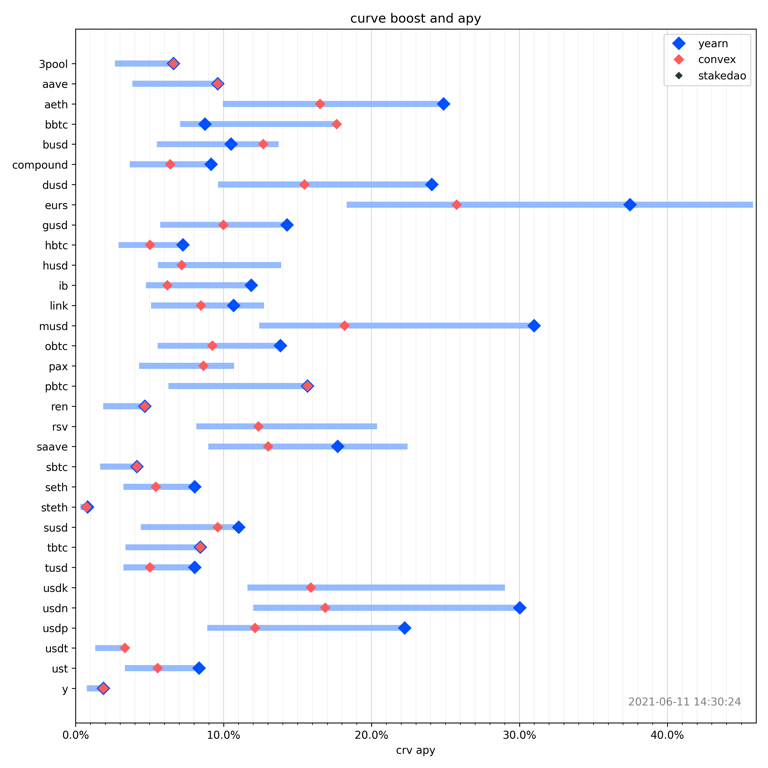

Despite getting fewer tokens and earning a reduce gross revenue, Yearn is the additional successful generator, with an annualized yield of 21% APY in contrast to Convexs which is just twelve.seven%. This could be due to the dispersion of increase amid distinct Curve groups. Note, the improve volume depends on the volume of veCRV held and the liquidity in the pool.

Based on the chart over, Yearn has an beneficial APY achieve in most of the distinct groups. This produces an very fascinating contrasting condition. Convex vault is earning increased general APY as a end result of CVX rewards, even though Yearn is supplying depositors improved return on their CRV.

As we all know, veCRV holders can define CRV inflation distribution across distinct groups. Since Convex at this time holds the biggest variety of votes (orange line), they will be ready to have a substantial say in the path of the CRV. We can see a situation in which Convex votes to allocate CRVs to groups that will maximize their achieve rather than Yearn’s (blue line).

One aspect that requirements to be regarded as is that it is not totally sure irrespective of whether the CRV inflation reallocation will have an impact on Yearn’s aggressive place as any improve in the power of the providers. Convex vault also added benefits Yearn.

That’s for the reason that a substantial portion of Convex’s TVL comes from Yearn himself, as the 33 vaults Yearn’s LP Curve is employing involve depositing money into Convex. In truth, Yearn is at this time earning additional than twenty% of all CVX rewards paid out.

The chart of CRV farming earnings proves once again, Convex is totally underdog in advance of Yearn. All these elements indicate that the two protocols are each complementary and aggressive. Yearn added benefits from Convex locking CRV for the reason that it increases Yearn’s yield as a depositor. Meanwhile, Yearn locks in CRV in favor of Convex, as a increased Yearn yield can lead to an improve in Yearn deposits and as a result an improve in TVL Convex.

In the finish, the serious winners and most significant beneficiaries of this battle may perhaps be the CRV holders themselves. While Yearn and Convex…