The distinction in pondering amongst the two top rated cryptocurrency billionaires correct now erupted on the evening of July seven.

The existing “liquidity crisis” in the cryptocurrency marketplace is resulting in several institutions to “shut down” for worry of becoming linked to Three Arrows Capital (3AC), a cryptocurrency investment fund that has gone bankrupt and need to declare bankruptcy. Meanwhile, non-interested units have also wondered no matter if they must come out to assist the marketplace or not.

The most prominent representatives of the two aforementioned colleges are Binance and FTX, two of the market’s main exchanges, led by CEO Changpeng Zhao (CZ) and CEO Sam Bankman-Fried (SBF) respectively.

According to Coinlive, the individual who in the previous “saved” the marketplace is billionaire Sam Bankman-Fried by way of the organizations he manages, like the FTX exchange and the Alameda Research fund. Specifically, FTX loaned BlockFi $ 400 million, although Alameda loaned Voyager $ 485 million. Mr. Bankman-Fried claimed he did this to stay clear of a chain collapse in the marketplace, but admitted that much more organizations would go bankrupt and he is explained to have refused to assist Celsius mainly because the lending platform is dropping $ two billion. bucks.

On the other hand, Binance CEO Changpeng Zhao explained that not all struggling cryptocurrency organizations deserve to be “saved,” even although Binance receives amongst 50 and a hundred delivers per day. CZ even posted a site publish arguing that tasks with unsustainable business enterprise versions deserve to collapse and the exchange will not come to the rescue.

The conflict amongst the two sides “exploded” on July seven by way of a series of conversations on Twitter.

The very first “blow” was Binance CEO Changpeng Zhao, who commented in a “whirlwind” on Sam Bankman-Fried’s side the filing of Voyager’s corporation regardless of becoming pumped by Alameda, and then uncovered that also Alameda was in the system and owes Voyager some dollars.

So, 3AC owes Voyager some a hundred meters, it went bankrupt. FTX / Alameda offers 3AC $ a hundred million, but has not bailed them out.

Alameda invests in Voyager, then requires a $ 377 million loan from Voyager … okay …

V has failed. Didn’t FTX “save” them or return the dollars?

Difficult to comply with?https://t.co/yx6RJjVZrB

– CZ Binance (@cz_binance) July 7, 2022

“So 3AC owed Voyager various hundred million bucks, then went bankrupt. FTX / Alameda lends dollars to 3AC, but are not able to conserve it.

Alameda then invested in Voyager, then borrowed $ 377 million from Voyager … okay …

Voyager has gone bankrupt. So FTX “saves” them or pays off the debt?

Anyone come to feel puzzled like chive soup? “

Sam Bankman-Fried’s crew quickly responded on Twitter:

normally content that folks consider an curiosity in assisting the business (much less so if it is just pretending) but I want some of them would bother to request their legal crew very first how bankruptcy functions … Or, you know, get in touch with to request for clarification. I am normally content to inform!

– SBF (@SBF_FTX) July 7, 2022

“It’s always nice to see someone willing to help the market (even if they pretend they are), but I’d like them to ask their legal team how the current bankruptcy procedure works … or at least contact to confirm clear information. I am always ready to respond ”.

This is the most current improvement of the “enmity” amongst Binance and FTX, which has been going on because 2019. In November of the similar yr, Binance sued FTX for alleged manipulation attacks, demanding $ 150 million in compensation. A month later on, the two reconciled and teamed up, whereby Binance invested in shares of FTX. CEO CZ’s platform also lists FTX’s leveraged token solution.

However, just a handful of months later on, Binance eliminated these tokens to “protect users’ interests”, only to generate their personal leveraged solution shortly thereafter. By mid-2021, FTX purchased back all of Binance’s stock on the stock exchange, officially ending the connection amongst the two sides.

Since then, CZ and SBF have not appeared with each other at any occasions nor have they even taken photographs with each other.

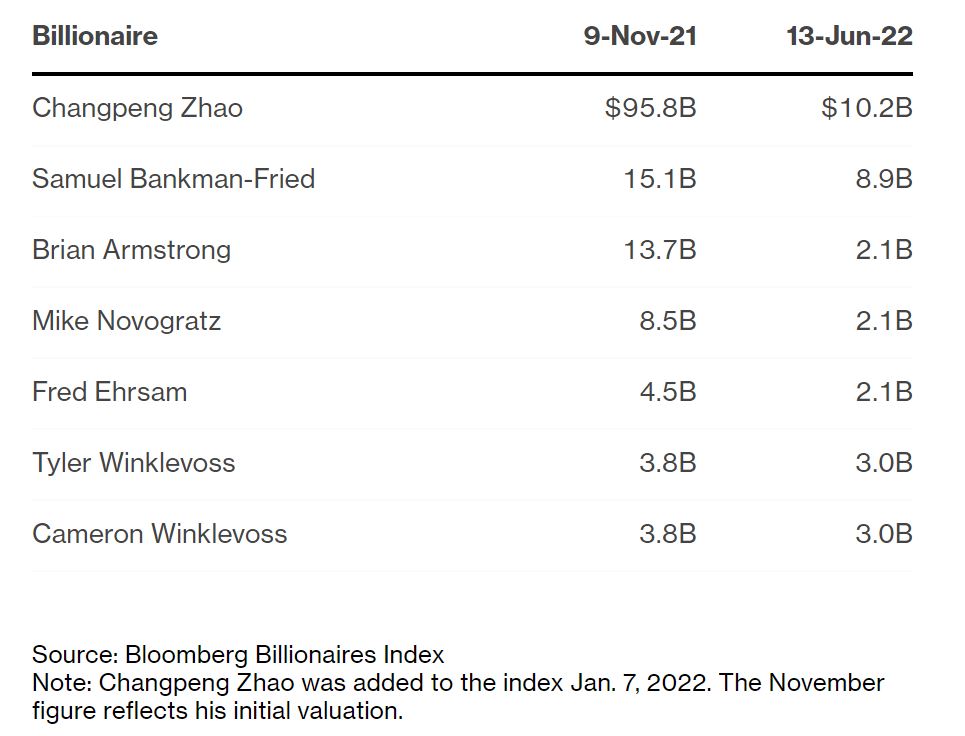

The fortunes of the two cryptocurrency billionaires also dropped substantially soon after two months of cryptocurrency marketplace crash. According to the statistics of Bloomberg As of June 13, although Sam Bankman-Fried’s assets fell 41% from $ 15.one billion in November 2021 to just $ eight.9 billion, Changpeng Zhao’s assets “evaporated” by up to 80%. from $ 95.eight billion to just $ ten.two billion.

Synthetic currency 68

Maybe you are interested: