On June 28, MakerDao launched a proposal to cut back its stability fee to an all-time low. So, how this transfer impacts the present stablecoin market state of affairs, let’s discover out via the article under.

MakerDao reduces the steadiness charge to document highs

First of all, we have to perceive what a stability fee is. This is the upkeep charge when customers wish to mortgage property to mint DAI stablecoins. For instance, in case you mint 100 DAI, with a 4% stability charge, then one yr, whenever you repay 100 DAI as collateral, it’s important to pay a further 4 DAI upkeep charge.

A governance survey has been added to the voting portal:

Parameter modification proposal –

⬇️ Lower stability charges for a number of vault varietiesMKR holders can report their help to https://t.co/zUCKxMPGVR

Read extra:https://t.co/pG2hBYU20p

– Creator (@MakerDAO) June 28, 2021

Recently, DAI introduced a proposal that might scale back the upkeep charge to historic lows because the implementation of the MCD mechanism (about 1 ~ 2% relying on the chance of every sort of vault).

First, this transfer helps DAI to take care of a secure provide, particularly in the course of the present sharp downturn available in the market.

To perceive how this transfer by DAI impacts DAI’s providing, let’s check out the collection of banteg tweets, to see what the issue is with the DeFi stablecoins.

In reality, solely 12 out of 150 collateral are web worthwhile after deducting unit mortgage charges. Here are the one ones which can be worthwhile in case you develop crvUSDP through Yearn. pic.twitter.com/rmpO3MdmVA

– bang (@bantg) June 28, 2021

Of the 150 sorts of property that may be assured for stablecoin minting, solely 15 are worthwhile when repaying loans within the type of USDP.

This is as a result of the upkeep charge is simply too giant, making after coining stablecoins, manipulating the DeFi market, returning USDP to regain sources, the person is nearly at a loss. This is as a result of Unit Protocol USDP has a really excessive fee of round 10%.

USDP provide shrank 41.7% from its current excessive, whereas DAI provide noticed virtually no decline. pic.twitter.com/Dhz1aE4qbh

– banteg (@bantg) June 28, 2021

Due to this weak spot, the USDP noticed a major drop in demand, the whole provide of this stablecoin dropped by greater than 40%, in comparison with DAI’s 3% in the course of the current market crash.

What does the whole provide of DAI say?

Simply put, the transfer to regulate the steadiness charge is much like the way in which the Fed makes use of rates of interest to manage the whole greenback provide. If the fare is low, folks will have a tendency print extra DAI, thus selling the method of utilizing, shopping for and promoting tokens within the DeFi house.

Therefore, it may be inferred that that is excellent news, because it helps to take care of the whole provide of this stablecoin, thus selling circulation within the DeFi house.

Looking at tether, taking a look at usdc, what future for the market within the close to future?

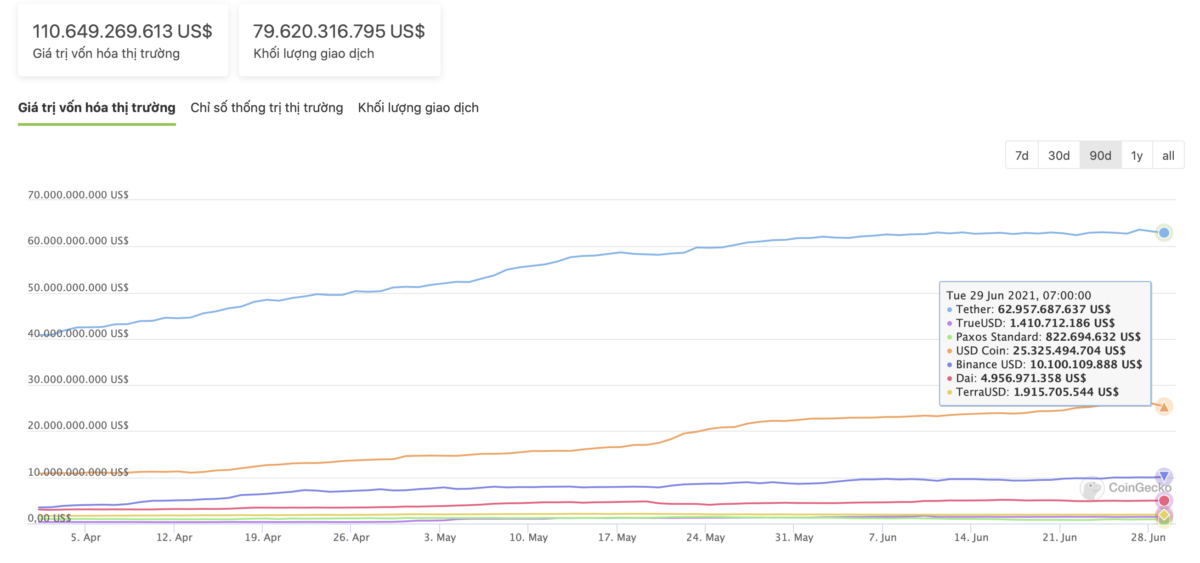

DAI’s $ 4 billion market capitalization when positioned alongside Tether (greater than 60 billion) or different stablecoins continues to be too small. Therefore, it’s troublesome to conclude that this transfer to ease the provision from MakerDao will set the market off within the close to future.

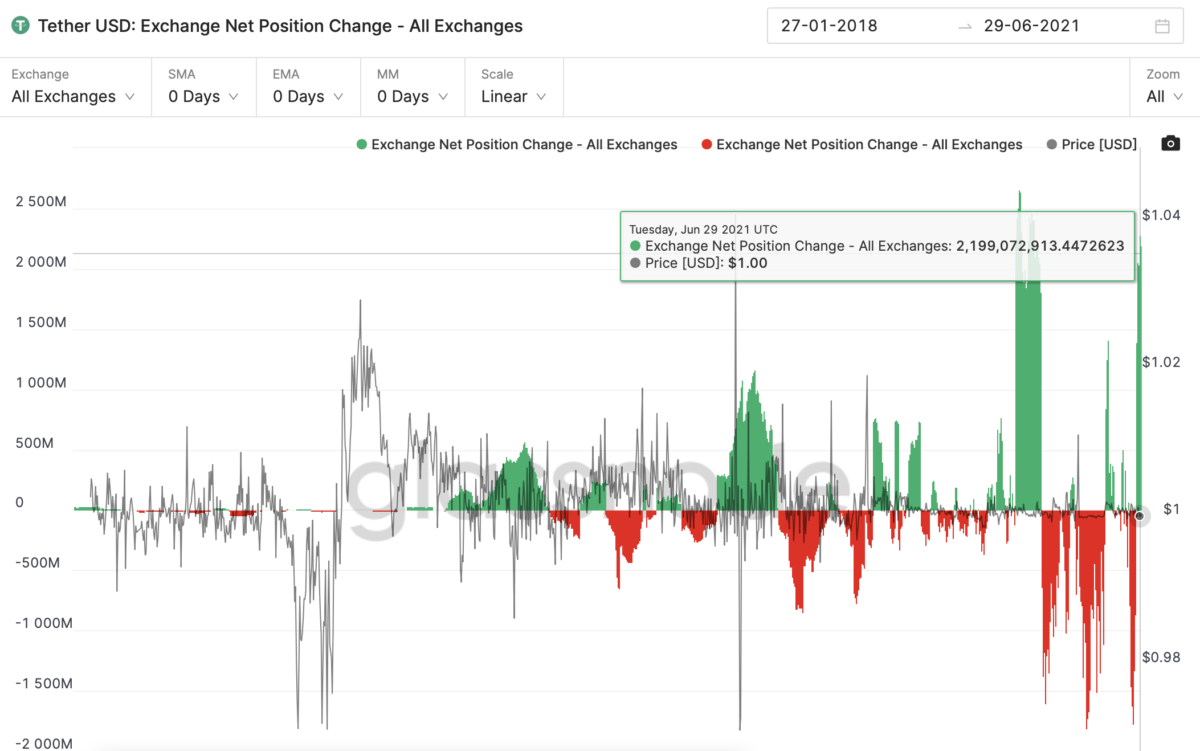

However, if we have a look at the general stablecoin market, we are able to see numerous optimistic information for the market generally. Just not too long ago, Glassnode recorded an enormous quantity of tether flowing into the exchanges. The distinction between money inflows and outflows even hit the $ 2 billion mark on June 29.

Furthermore, USDC can be a stablecoin with fairly optimistic on-chain indicators for merchants when the deposit degree additionally tends to rise.

These indicators, accompanied by a transfer to stimulate the market by the MakerDao workforce, stablecoins are seen as an vital core for the market’s efforts within the close to future.

From there, we are able to draw some tentative conclusions:

- With new cash from stablecoins, within the brief time period, the market might recuperate quickly.

- However, a brand new push continues to be wanted, particularly from the large cap market, to drag up the complete market in the long run.

Synthetic forex 68

Maybe you have an interest:

.