Decentralized finance or DeFi is a particularly massive, colourful land with a wide range of purposes. It is tough to encapsulate your complete DeFi ecosystem in a brief article. However, there are very primary purposes in DeFi that any consumer ought to find out about. So at the moment DeFi 101 will introduce you to all-in-one DeFi.

I. The Similarities That Every DeFi App Has

The phrase DeFi – Decentralized Finance itself accommodates essentially the most attribute function of DeFi. That is decentralized, or no central occasion controls consumer property on the network. With DeFi, the position of the financial institution is eliminated, changed by strains code in good contract (good contract) – administration and circulation of consumer property.

DeFi purposes are extraordinarily numerous, together with foremost areas reminiscent of:

- Decentralized Exchange (DEX)

- Lending platform

- Stablecoins

- General property

- Insurrance

- …

Despite their range, DeFi purposes at all times have some key issues in frequent, which assist us distinguish DeFi from CeFi (conventional finance) or from different fields.

Key options of DeFi embody:

- Blockchain construction as the principle accounting ledger

- Open supply and clear

- Interoperability and mixture

- For everybody

1. Blockchain construction as the principle accounting ledger

Blockchain – DeFi’s core expertise performs a vital position. In CeFi, conventional monetary purposes use the core banking system because the underlying ledger – to report transactions, calculate property, show consumer balances.

With DeFi, the principle position of the ledger is blockchain expertise. Some of essentially the most outstanding blockchains used to construct DeFi purposes reminiscent of Ethereum, Binance Smart Chain, Solana, and so on. These primary blockchains retailer the ledger state of what’s despatched into the DeFi software, what’s saved within the DeFi software. saved in good contracts, all consumer transactions and withdrawals.

In different phrases, the entire core accounting capabilities that make sure that enter and output information match – are dealt with by the blockchain. As such, the DeFi software doesn’t have to create an exterior system to regulate the stability, as all transactions are queryable by means of browsers. blockchain explorer.

2. Open supply and clear

CeFi purposes are all closed supply and constructed on separate, proprietary techniques. In distinction, DeFi purposes are sometimes open supply (open supply) and construct on public blockchains.

This property results in 3 benefits of DeFi, together with:

Flexible interplay

The DeFi app itself will be fork, recombined, and reused in a wide range of purposes. For instance, SushiSwap was initially a fork of Uniswap however added many enhancements and new options.

This flexibility stands in stark distinction to conventional finance. For instance, banking system A can solely be used internally by A, it’s tough for A’s system to work together with banking system B.

clear

Because the code is open supply, the group can utterly verify to know precisely what the good contract is doing by way of capabilities, rights and consumer information.

Auditing capability

Since the blockchain itself is open supply, your complete money movement is totally auditable. Including collateral within the system, transaction quantity, default worth, particular consumer’s account, … – all will be checked and retrieved.

3. Interoperability and mixture

As defined above, DeFi purposes are absolutely interoperable and might work along with some other DeFi software within the ecosystem.

All these DeFi apps are like particular person lego items that may be put collectively to work with different lego items – for the aim of constructing newer apps, options.

Therefore, in DeFi we regularly hear information like Konomi integrating with Chainlink to enhance DeFi options or Uniswap making ready to combine Arbitrum’s layer 2 scaling resolution or Maker and Dai integrating scaling options. layer 2 of Optimism.

In distinction, conventional finance reveals many weaknesses reminiscent of:

- Fragmentation: Traditional monetary purposes will not be constructed on a typical infrastructure

- Monopoly: Traditional monetary purposes are sometimes proprietary to at least one group or establishment – can’t be mixed with different purposes

- Not programmer-friendly: It is tough for builders and programmers to construct purposes on the normal monetary system. Unlike with blockchain, like Ethereum, sequence of DApps construct and function

4. For everybody

With conventional finance, new customers usually have to undergo an revenue verification, credit score verify, and even meet a monetary officer in particular person – simply to have the ability to use a sure monetary product. .

This course of is vulnerable to biases reminiscent of discrimination when reviewing mortgage purposes, denial of banking providers to an unsatisfactory consumer, many hidden prices, further charges, and so on.

With DeFi apps, all you want is a pockets deal with. The DeFi app requires no revenue verification, no credit score historical past checks or sophisticated KYC necessities.

Simply put, so long as you’ve gotten cash in your pockets, you may make transactions. There isn’t any group or middleman to stop or deny service to you.

No matter what your background or what nation you come from, DeFi does not discriminate.

II. The Structure of a DeFi Ecosystem

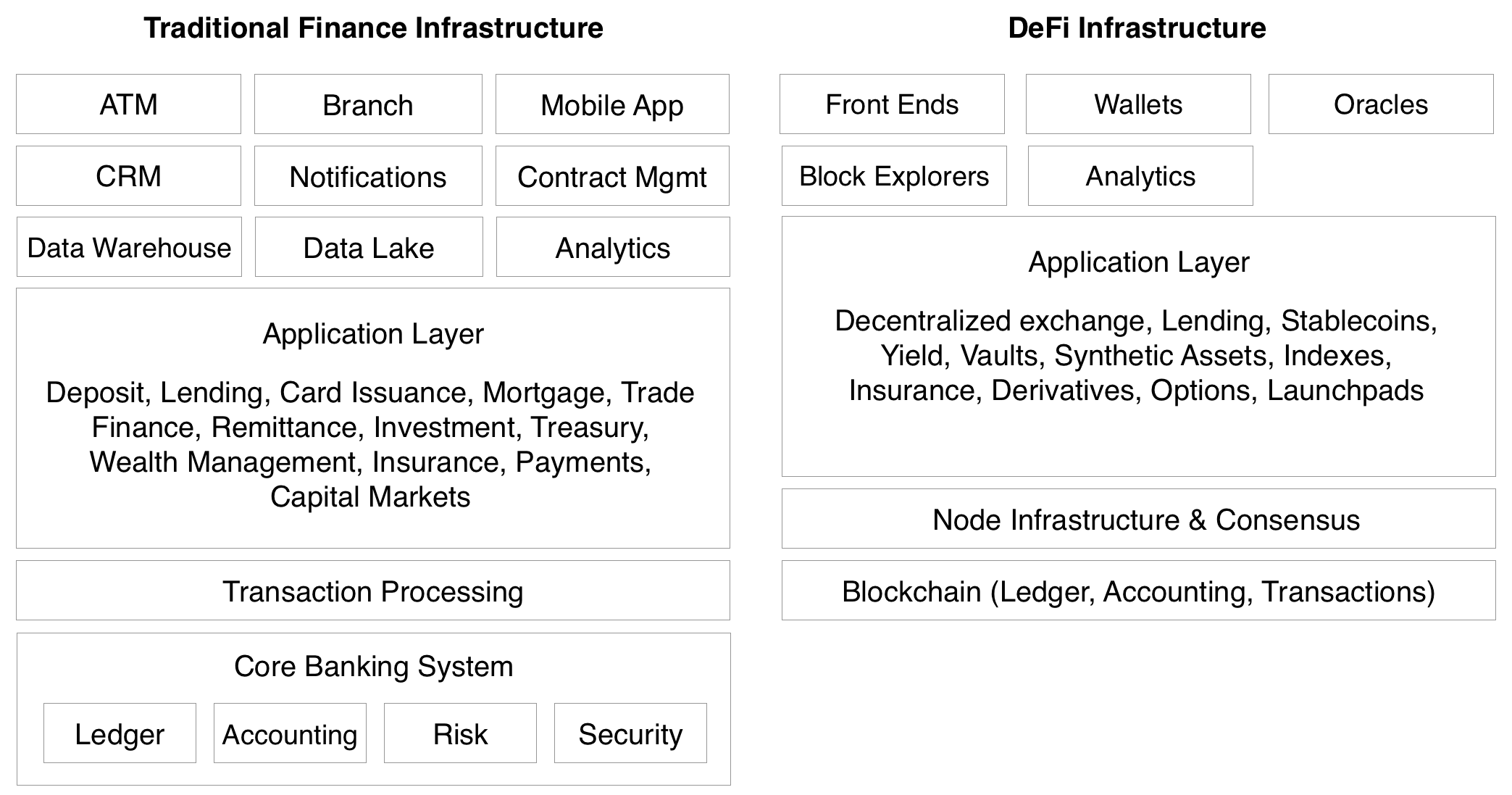

Below is an structure diagram depicting the important thing variations between a standard FinTech software and a DeFi software.

To dive into the DeFi construction, the writer takes for instance the market map of two DeFi ecosystems constructed on Solana and on Ethereum.

The purpose for selecting these two ecosystems is as a result of Ethereum is the beginning blockchain of all DeFi purposes. And Solana is rising, the ecosystem construction is kind of completely different from Ethereum.

In basic, the DeFi infrastructure consists of the next parts:

1. 1st layer (Layer 1) – Base layer

This is the blockchain layer the place the principle accounting ledger works. Although Ethereum is the dominant blockchain on this space, it has turn out to be the inspiration for a lot of initiatives to construct. But there are lots of newer blockchains popping out to compete with Ethereum, like Binance Smart Chain or Solana.

2. Node system (for Ethereum)

The downside of Ethereum proper now’s: Network enlargement is simply too sluggish + Gas charges are too excessive. Because of the low processing capability, whereas there are lots of lively DApps, Ethereum has to course of an enormous quantity of information. To meet this want, a sequence of node-based initiatives have sprung as much as assist purposes question the underlying ledger (retrieve blocks, discover transactions, synchronize information, report transactions, and so on.) ). Some outstanding initiatives reminiscent of Infura, Alchemy,…

Even, Infura has turn out to be the “centralization” bottleneck of the world’s largest “decentralized” network, Ethereum.

Meanwhile, Solana at the moment doesn’t have the identical congestion downside as Ethereum. So (briefly) there is no such thing as a construction for this node system.

3. 2nd Layer (Layer 2) – Extended Solution (for Ethereum)

On Ethereum, there are numerous layer two options which are primarily used for scaling as Etheruem itself can’t deal with all transactions by itself. Two of the promising scaling options embody Matic, Optimistic, amongst others.

Layer 2 on Ethereum is the place scaling options bloom. About this Layer 2, Coinlive has many detailed explanations, you possibly can learn it at:

The most outstanding consultant of Layer 2 on Ethereum is Polygon (MATIC).

In distinction to Ethereum, Solana at the moment (but) doesn’t want a scaling resolution, so it additionally doesn’t have a Layer 2 construction.

4. Order Book (for Solana)

This is a construction particular to Solana. Serum supplies a CLOB (Central Limit Order Book) to be used by all different DeFi initiatives within the Solana ecosystem.

Simply put, when new DeFi initiatives are constructed on Solana (like DEX, AMM, choices market, betting, …), the challenge will pull orders from Serum and push orders to Serum – lowering the demand load. pressing liquidity for brand new initiatives.

Serum is sort of a “liquidity connection” or an “order management” system for development initiatives within the Solana ecosystem.

5. Toolkit

Every DeFi ecosystem wants a set of instruments that embody the fundamental purposes wanted to perform.

A primary DeFi toolkit consists of:

Wallet

The foremost interface that customers use to retailer property and work together with DeFi purposes.

In the Ethereum ecosystem, outstanding wallets reminiscent of Trust Wallet, Metamask, and so on. or Sollet pockets for Solana.

Oracle

The information supply utilized by DeFi purposes for worth reference and transaction execution.

Chainlink and Band Protocol are the 2 most outstanding oracle initiatives on Ethereum at the moment. However, oracle is a particularly potential land with many blooming initiatives.

To be taught extra about oracle, you possibly can see extra at Kyros Kompass #2: Oracle – “Eyes and Eyes” of the Blockchain world.

Blockchain evaluation and discovery device

Tools like Block Explorer have been created to assist folks question the blockchain ledger instantly.

You will need to have used Etherscan no less than as soon as to question transactions. But there are lots of helpful instruments on Etherscan you have not used but! Find out within the Etherscan Quiz – “Know” to now not “fear”.

Stablecoins

The two foremost property used within the DeFi ecosystem embody the platform’s token (ETH or SOL) and ideally…