Larix venture overview

What is Larix?

Larix is a lending protocol on Solana’s blockchain platform. Larix applies a dynamic curiosity model and generates helpful chance management pools, this kind of as a broad choice of collateral, cryptocurrencies, stablecoins, synthetic assets, NFTs and other other assets (lively accounts, payments, mortgages, and so forth.) to be taken into loan and lend securely.

Additionally, the token economic climate-primarily based reward process is meticulously calculated to constantly distribute and inspire to drive demand for token ownership. All precious properties can be accepted by Larix.

Special characteristics of Larix

Larix is the very first lending protocol on Solana with a direct mining characteristic, verified on Solana, and also the very first open supply lending protocol to assist place assets with loan worth (this kind of as NFTs or worldwide assets).

Larix leverages pool-primarily based collateral and a dynamic fee optimization engine to allow quick loan execution.

Some of the characteristics of Larix:

- Supply: By giving tokens, stablecoins and synthetic assets that consumers can earn APY curiosity. The provide can be flexibly custom-made, the transaction charges on Solana are minimal, and the buy processing velocity is fairly speedy, about .001 seconds.

- Loan: After earning APY on Larix, consumer can borrow with that asset, for illustration APY on BTC / ETH and use it as collateral to borrow USDC / USDT.

- Liquidation and distribution: when you borrow and lend on the protocol you will acquire LARIX reward tokens.

- In addition, Larix also debuted Loan Launchpad specializes in delivering separate asset pools for native SLP, enabling and supporting a assortment of loan tokens.

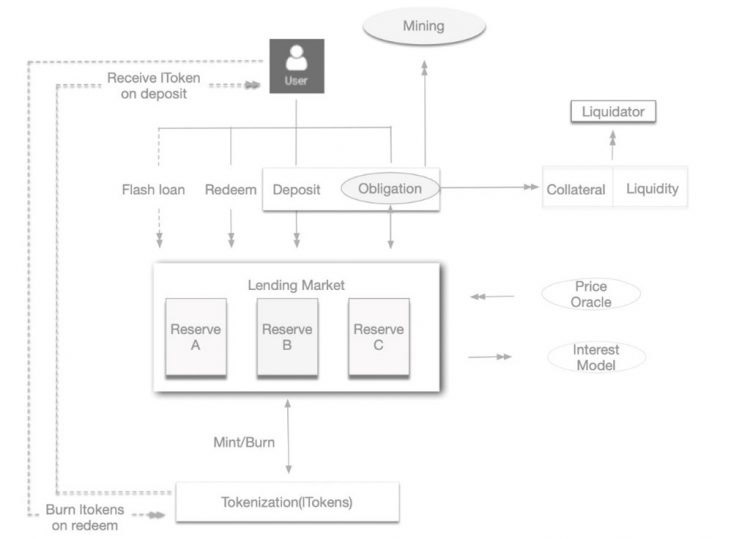

The working model of Larix

In response to various attacks on flash loans and market place manipulation for malicious functions, collateral will be cautiously picked and positioned in a series of separate clustered pools primarily based on asset chance profiles. primary.

This is a extra optimum way to manage and decrease hazards to the platform and defend the two borrowers and lenders. We all know that greater liquidity will restrict slippage. Collateral will be valued and grouped by market place capitalization, chance concentration, volatility, and so forth. Therefore, actions with distinct chance measures can be managed individually to boost chance management and probable reduction reduction at the protocol degree.

Larix applies a dynamic curiosity fee model to control liquidity and stay clear of “bank runs” when depositors have to withdraw cash from the pool. The liquidity pool involving diverse tokens is an necessary component of the Larix venture model. The cautiously created curiosity fee model manages to incentivize the two borrowers and lenders by rewarding them with Larix tokens.

A DAO will be made use of to govern Larix working with voting and governance tokens. Important challenges, this kind of as modifying side variables, including / getting rid of side tokens, and unique acceleration in some mining pools, can be made the decision by voting on the DAO proposal.

Basic information and facts about the LARIX token

LARIX Token Token Specifications

- Token title: Larix token

- Ticker: LARIX

- Blockchain: Solana

- Standard Token: SPL

- To contract: Lrxqnh6ZHKbGy3dcrCED43nsoLkM1LTzU2jRfWe8qUC

- Token style: Utility, Governance

- Total provide: ten.00,000,000 VND

- Circulating provide: Updating

LARIX Token Allocation.

- Mining pool: fifty five%

- Funds for treasury and ecosystem improvement: 15%

- Investors: 15%

- Development group: 10%

- Marketing: five%

Uses of the LARIX token

When holding the LARIX token, consumers will appreciate the following gains:

- Use in the Larix ecosystem.

- Aim LARIX tokens to get extra rewards than LARIX tokens.

- Furthermore, consumers have the suitable to vote in the mechanisms of innovation of policies and in the route of improvement of the Larix protocol.

How to obtain, promote and hold LARIX tokens

You can trade Solana Dex LARIX tokens this kind of as Raydium, Serum and Orca.

Also, you can obtain LARIX on CEX bags this kind of as: MEXC and Gate.io.

To keep LARIX tokens, it is needed to use wallets belonging to the Solana blockchain ecosystem this kind of as: Phantom, Sollet, Slope to keep LARIX tokens.

Project improvement roadmap

Phase one: June – September 2021

- Use tokens, stablecoins and synthetic assets as collateral.

- Apply a dynamic curiosity fee model to stay clear of a financial institution run.

Phase two: from the finish of 2021 to 2022

- Collaboration with the PYTH network.

Phase three: In 2022

- Expanding guarantee (like NFT).

- ABS is encrypted and NFT wrapped format.

- Connect serious-planet sources.

The major improvement group of the venture

Updating …

Investors and improvement partners

The Larix venture has the help of numerous investment money and also the presence of the Solana group to help and broaden. Additionally, Larix has a rather well known Oracle companion, Pyth Network.

Thinking about the Larix venture in the potential, must I invest in LARIX tokens?

Overall, the Larix venture has some highlights more than classic lending tasks when it comes to becoming in a position to integrate with NFTs and serious assets, but this difficulty is nevertheless also early for the crypto and NFT markets. But with the improvement of the direct mining characteristic and Lending Launchpad it is also remarkable adequate to appeal to consumers. Although Larix has created fairly superior characteristics and consumer practical experience, in the recent gloomy market place, Lending Dapps are of small curiosity when consumers opt for to hold their positions rather than use leverage to maximize ownership preferences. Therefore, investing in LARIX tokens is quite risky. Through this report, you have by some means grasped the primary information and facts about the venture to make your investment selections. Coinlive is not accountable for any of your investment selections. I want you accomplishment and earn a whole lot from this probable market place.