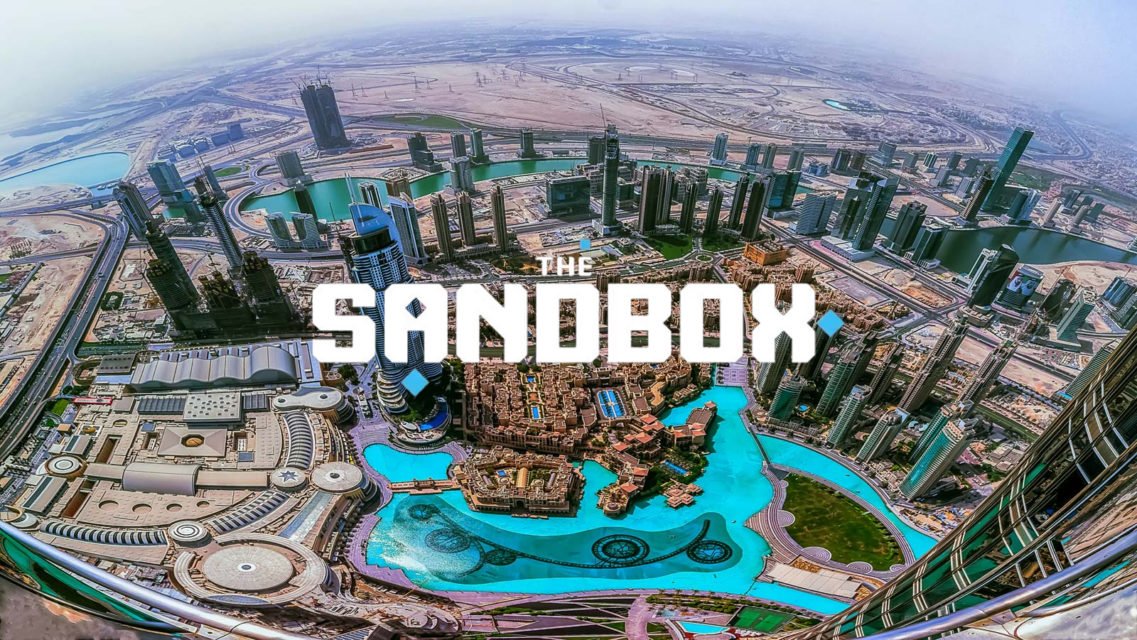

Dubai’s Virtual Asset Regulatory Authority (VARA) has announced a rather daring prepare to set up a world’s initial metaverse operations headquarters in The Sandbox (SAND).

According to an official announcement by Crown Prince and President of the Dubai Executive Council Sheikh Hamdan bin Mohammed, the Dubai Virtual Asset Authority (VARA) will enter the metaverse area by way of the establishment of a new headquarters simulator on The Sandbox. This initiative generates a new model for managing and expanding government operations in Dubai.

VARA’s presence in the Metaverse will lengthen Dubai’s providers and regulatory energy to the public in an open technological expanse, without having constraints or boundaries. The move marks a new phase in Dubai’s efforts to be a crucial player in shaping the potential of engineering and government

– Hamdan bin Mohammed (@HamdanMohammed) May 3, 2022

VARA established in March comes with a new regulatory framework to keep track of cryptocurrency trading, trades numerous other virtual assets which includes NFT, generates an superior regulatory framework and management procedure for cryptocurrencies in Dubai and the rest of the UAE. Companies wishing to operate in the UAE will have to not only have a small business presence in the nation but also get a small business license from VARA.

All in all, this is component of a important work by the UAE government in latest instances to make Dubai a hub for virtual sources and the worldwide digital economic system. However, Dubai has accomplished some good results by attracting a amount of big cryptocurrency exchanges and investment money from Singapore this kind of as Binance, Bybit, and Three Arrows Capital.

On The Sandbox’s component, getting the openness and cooperation of the Dubai government will absolutely generate the most important momentum to assist the platform carry on to increase, positioning itself as the main metaverse venture on the marketplace currently, especially with its direct competitor Decentraland. (MANA).

While Decentraland has its very own platform with numerous top quality partnerships this kind of as the greatest US financial institution JPMorgan, Samsung Group or the Australian Open, The Sandbox is no significantly less aggressive when it comes to attracting big numbers of shoppers. of the venture .

These involve the “shocking” offers of giants Big4 PwC, HSBC Bank and Standard Chartered Bank, in spite of latest statistical reviews exhibiting that curiosity in the metaverse has “declined”, has not slowed down, creating a reduce in transaction volume. in the virtual planet twelve% in contrast to the fourth quarter of 2021, reaching just above $ 430 million in the initial quarter of 2022. Since then, the typical rate of land in Decentraland and Sandbox has dropped by forty%, whilst the volume of transactions on each platforms decreased by twenty% and 60% respectively.

Recently, The Sandbox is also getting ready to carry out a new funding round of up to $ 400 million with a corporation valuation of about $ four billion exclusively for numerous huge ambitions this 12 months, this kind of as moving video games to Polygon and setting up an organization. DAO. Additionally, in accordance to information in early March, the wave rushing into The Sandbox of numerous of the major one firms in the mainstream gaming market is even now booming and exhibiting no indicators of cooling.

Summary of Coinlive

Maybe you are interested: