The proposal to cut down trading premiums on the early derivatives trading platform dYdX has officially come to an finish.

Propose writes, dYdX would like to adjust the trading reward from two.88 million DYDX to one.59 million tokens (a 45% reduction). The objective of this initiative is to maximize the reward treasury of the protocol and curb the yearly inflation of the tokens.

The writer states:

“As aspect of V4 Vanguard Post, we are proposing to cut down business rewards by about 45%. In the midst of the existing industry downturn, we feel trading premia are nevertheless excessively large and a important contributor to token inflation given that the starting of the yr.”

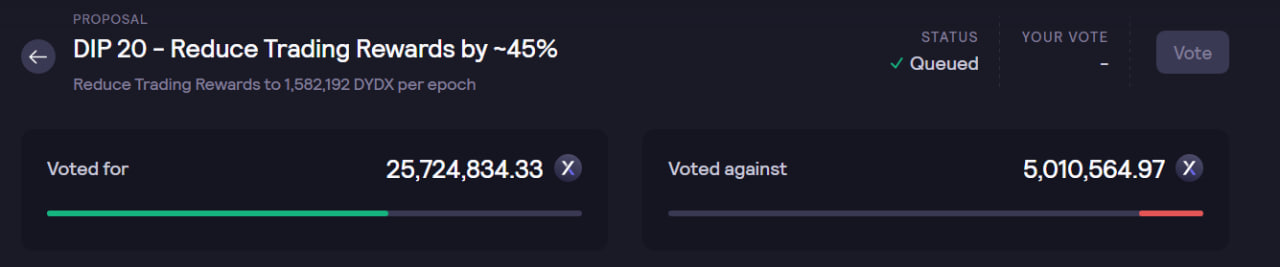

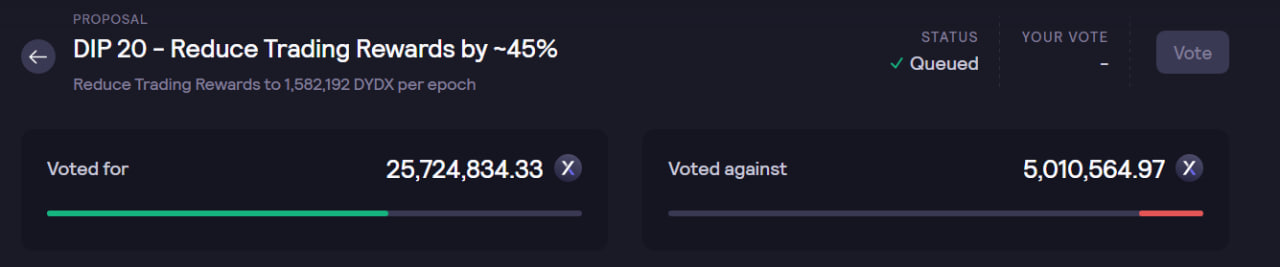

According to the published benefits, there have been additional than 25 million votes in favor of the proposal, additional than five million votes towards. The organization will proceed to vote later on on what to do with the tokens.

“More importantly, the maintained DYDX will have a significant impact on DAO’s sustained and controlled funding of V4 initiatives.”

DYDX, the token of the decentralized exchange of the identical title, acquired virtually thirty% following the approval of the governance vote. From the starting of the yr right up until nowadays, specially following The venture has determined to postpone the maturation token release routine to December, DYDX had an amazing 121% development. At the time of creating, this token is trading all over the $two.38 mark, up all over six% from the past 24-hour cost variety.

Synthetic currency68

Maybe you are interested:

The proposal to cut down trading premiums on the early derivatives trading platform dYdX has officially come to an finish.

Propose writes, dYdX would like to adjust the trading reward from two.88 million DYDX to one.59 million tokens (a 45% reduction). The objective of this initiative is to maximize the reward treasury of the protocol and curb the yearly inflation of the tokens.

The writer states:

“As aspect of V4 Vanguard Post, we are proposing to cut down business rewards by about 45%. In the midst of the existing industry downturn, we feel trading premia are nevertheless excessively large and a important contributor to token inflation given that the starting of the yr.”

According to the published benefits, there have been additional than 25 million votes in favor of the proposal, additional than five million votes towards. The organization will proceed to vote later on on what to do with the tokens.

“More importantly, the maintained DYDX will have a significant impact on DAO’s sustained and controlled funding of V4 initiatives.”

DYDX, the token of the decentralized exchange of the identical title, acquired virtually thirty% following the approval of the governance vote. From the starting of the yr right up until nowadays, specially following The venture has determined to postpone the maturation token release routine to December, DYDX had an amazing 121% development. At the time of creating, this token is trading all over the $two.38 mark, up all over six% from the past 24-hour cost variety.

Synthetic currency68

Maybe you are interested: