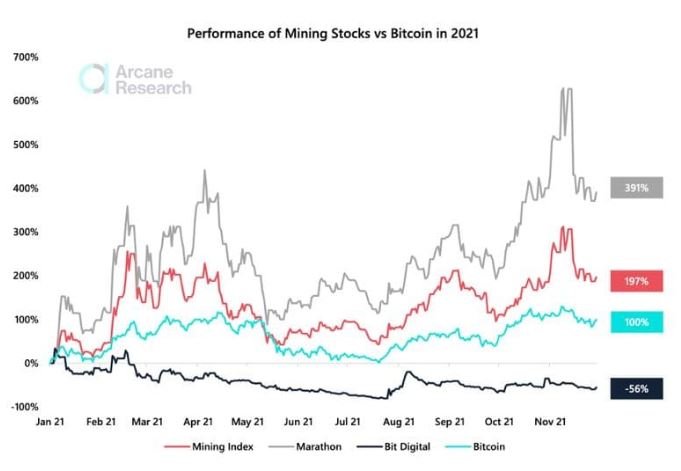

Bitcoin mining stocks outperformed BTC’s development this yr. However, it really should be mentioned that investing in miners carries a considerably larger possibility than direct publicity to Bitcoin.

The chart displays that the two the mining index and Marathon stocks are outperforming Bitcoin, gaining 390% and 197% respectively in 2021, which is far much more extraordinary than Bitcoin’s a hundred% get given that the start out of the yr 2021. .

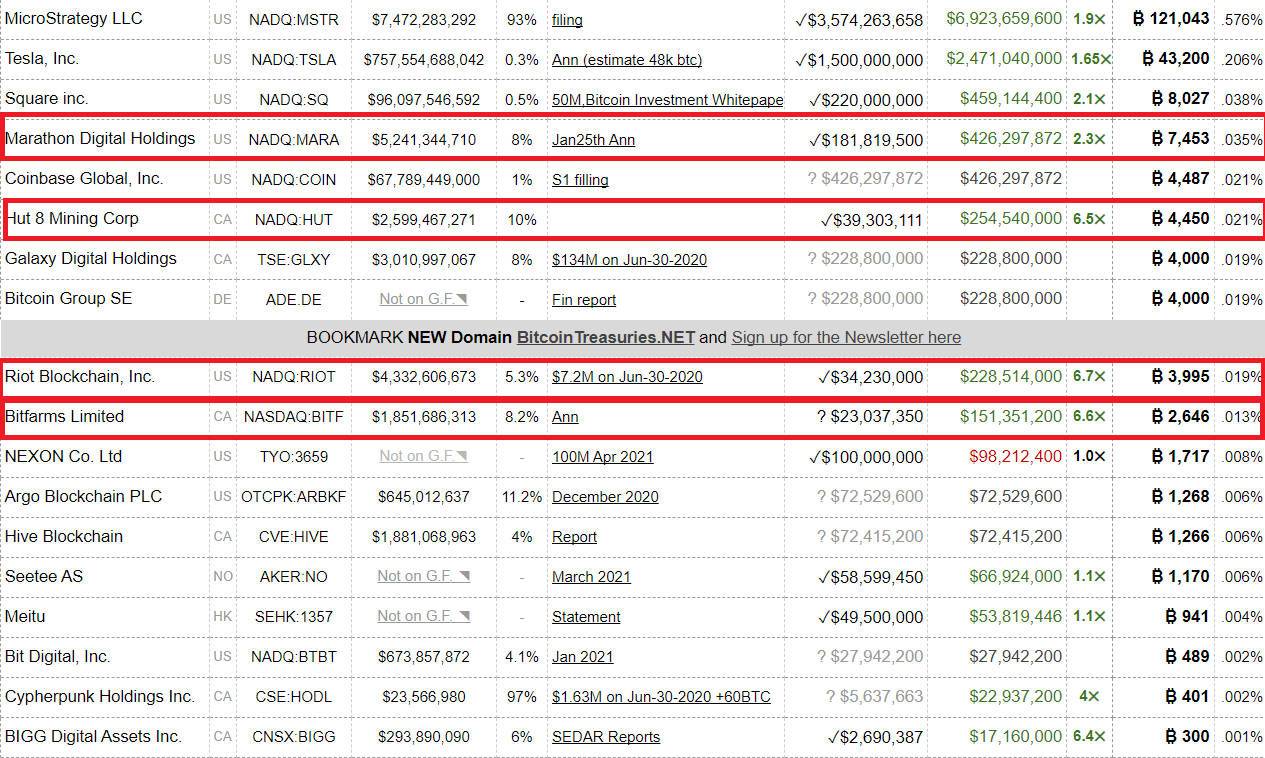

Beyond that, what tends to make us even much more surprising is the six-7x improve in the proportional revenue efficiency of Bitcoin mining businesses like Hut eight, Bitfarms, and Riot Blockchain. The amount that brings about the greats who hold a “huge” quantity of Bitcoin, MicroStrategy, Tesla or Square, to bow in awe.

– See much more: The billions of dollars’ investment in Bitcoin (BTC) by the greats was x2

So what assisted the development fee of mining stocks overshadow the presence of Bitcoin? The challenge possibly lies in the globally chip shortage that has manufactured ASIC miners much more useful and of program the flagship representative marathon cannot pass up the chance.

Marathon does not very own the information center but leases the storage, which suggests that most of its assets are machines. The worth of the machines is considerably much more volatile than the worth of the information center, with the outcome that Marathon’s share value is driven more powerful than the worth of other miners.

The organization not too long ago extra Bitcoin to its stability sheet. Additionally, Marathon’s mining pool, MaraPool, has adopted and distributed Bitcoin Core edition .21.one. to help the Taproot update launched at the finish of October.

Marathon will apply the update without having alterations. As a outcome, MaraPool will no longer filter transactions. Once the improve is finish, the pool will get started validating transactions persistently with all other miners working with the regular node. Fred Thiel, CEO of Marathon, stated:

“Marathon is committed to respecting the fundamental principles of the Bitcoin community, including decentralization, inclusion and zero censorship.”

On the other side of the line, we have the Chinese giant Bit Digital. Bit Digital has had a pretty tricky yr with its share value down 56%. The organization invested most of 2021 moving its operations out of North America ahead of the ban came from China. Poor efficiency in 2021 reminds us that migrating a mining operation is exceptionally high priced.

Growth in stocks that have a more powerful correlation than BTC’s value action may perhaps let traders to flock to these assets alternatively of just holding BTC, such as possibility limitations and regulatory uncertainty about shopping for Bitcoin immediately. This is also a signal that Bitcoin mining is progressing pretty properly regardless of all the problems coming from China.

As a outcome, Bit Digital will possible thrive in 2022, as will the Bitcoin network. The fantastic information is that it truly is only been 5 months given that China banned Bitcoin mining and the network’s hashrate has practically entirely recovered.

Synthetic Currency 68

Maybe you are interested: