Being publicly traded for the 1st time is an critical milestone in the lifestyle cycle of any task. Learning from numerous tasks, Elrond Network (EGLD), a top well-known blockchain platform on the marketplace nowadays, has officially announced a new pricing mechanism.

The mechanism was made to assistance align tokens at the correct worth and give absolutely everyone a honest probability to participate in the early phases of a new economic climate.

This mechanism is an critical component of the 3-stage program:

- Explore the charges

- More liquidity

- Start trading

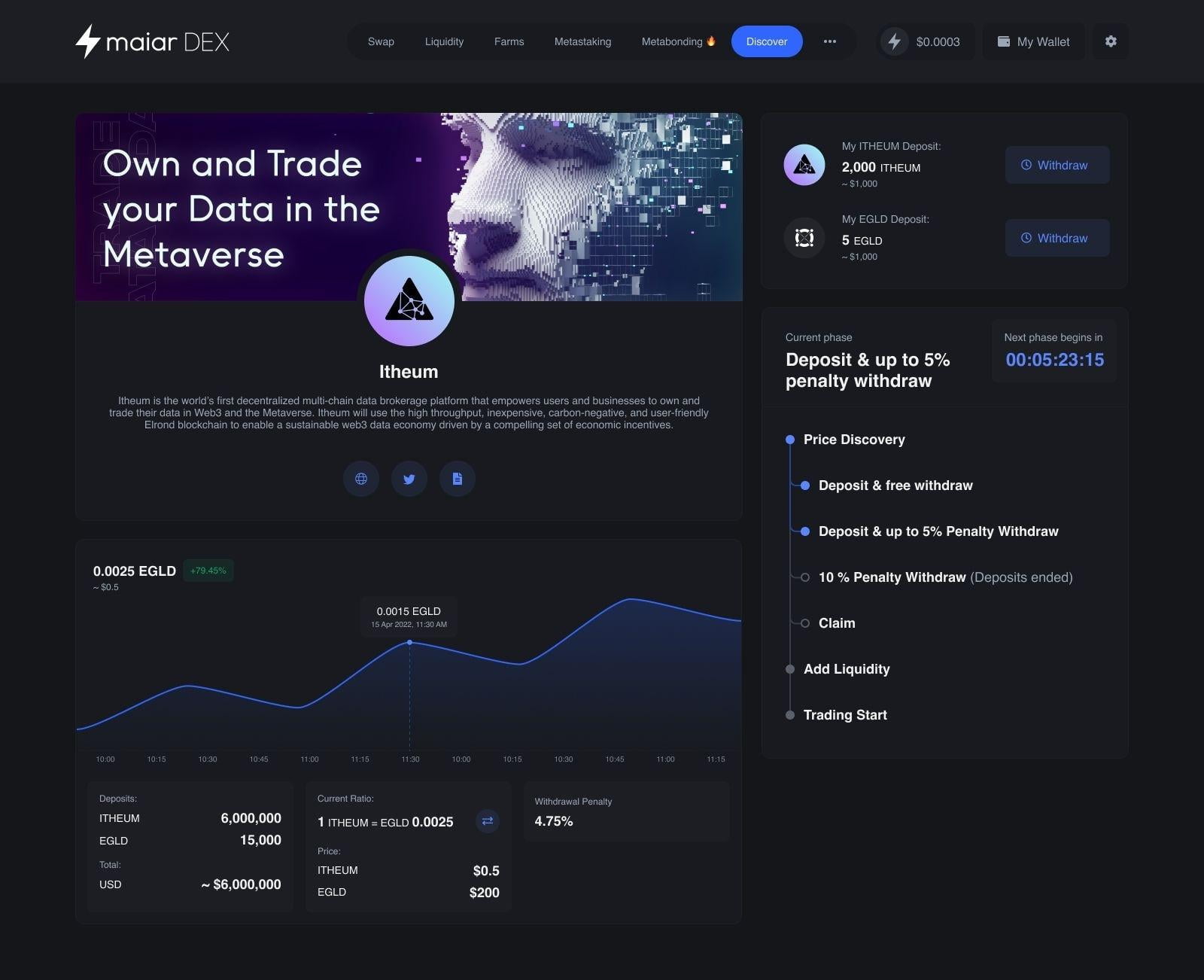

Explore the charges

During this phase, participants will deposit tokens in a wise contract: EGLD (to acquire ITEO) or ITHEUM (for the sale of EGLD). Based on the EGLD and ITHEUM numbers filed at the finish of this time period, the technique will set an EGLD / ITHEUM fat.

So these who sent EGLD will be blocked ITHEUM and vice versa these who sent ITHEUM will be blocked EGLD.

The blocking mechanism is utilized to tokens for two days just after listing, to handle speculative movements and generate greater priorities for these who want to go along with the task.

The discovery of the selling price itself is divided into 4 sub-phases:

- State one: Itheum purchasers deposit EGLD and Itheum sellers deposit ITHEUM in wise contracts to jointly create EGLD / ITHEUM weights. Users are cost-free to withdraw their tokens deposited for the duration of this time period.

- Phase two: Similar to phase one, but token withdrawals will be penalized, raising in excess of time from % to five%. This is to protect against attempts at selling price manipulation by “sharks” with huge quantities of tokens.

- Phase three: It is no longer feasible to deposit EGLD or ITHEUM deposits and withdrawals from the pool will now incur a fixed ten% penalty. The penalties accumulated in phases two and three continue to be in the wise contract and contribute to the determination of the last fat.

- Phase four: finish of the selling price recording and formally create the EGLD / ITHEUM weights. The pool can no longer be withdrawn. Participants in the discovery of the selling price have been in a position to receive their respective tokens in a locked kind and could not trade them for three days.

More liquidity

In the following phase, the holders of blocked ITHEUM and EGLD, as effectively as the holders of standard ITHEUM and EGLD, can deposit liquidity in accordance to the EGLD / ITHEUM weights established in the prior time period.

Providing liquidity just after selling price discovery will considerably cut down losses for preliminary liquidity companies and supply a sound starting up level just before tokens are traded.

To incentivize the provision of liquidity for the duration of this time period, liquidity companies will straight away get one thousand% APR in the 1st week just after the start off of trading.

Start trading

Once the selling price discovery has been produced and liquidity has been supplied, trading can start off. To much better illustrate the selling price discovery mechanism, contemplate the following hypothetical situation:

- Starting EGLD Price: $ 200 (guess)

- Initial EGLD / ITHEUM Weight one: 5000

- Total quantity of EGLD deposited: 50,000

- Total ITHEUM deposited: 50,000,000 VND

- Final EGLD / ITHEUM Weight one: one thousand

- ITHEUM Price: .two USD

- If A has sent one EGLD, he will get one thousand blocked ITHEUMs.

- If A has sent five,000 ITHEUMs, he will get five blocked EGLDs.

Elrond will quickly release public exams for the duration of a unique Battle of Yields occasion, the place the local community will hear the facts of the pricing discovery approach and can participate in a reside simulation of Itheum’s pricing discovery.

Through this check, Elrond will validate his assumptions and refine parameters this kind of as penalty percentage, token block time, and so forth.

Maybe you are interested:

Note: This is sponsored material, Coinlive does not immediately endorse any info from the over write-up and does not ensure the veracity of the write-up. Readers really should perform their personal analysis just before creating selections that have an impact on themselves or their enterprises and be ready to consider duty for their personal selections. The over write-up is not to be viewed as investment guidance.

Being publicly traded for the 1st time is an critical milestone in the lifestyle cycle of any task. Learning from numerous tasks, Elrond Network (EGLD), a top well-known blockchain platform on the marketplace nowadays, has officially announced a new pricing mechanism.

The mechanism was made to assistance align tokens at the correct worth and give absolutely everyone a honest probability to participate in the early phases of a new economic climate.

This mechanism is an critical component of the 3-stage program:

- Explore the charges

- More liquidity

- Start trading

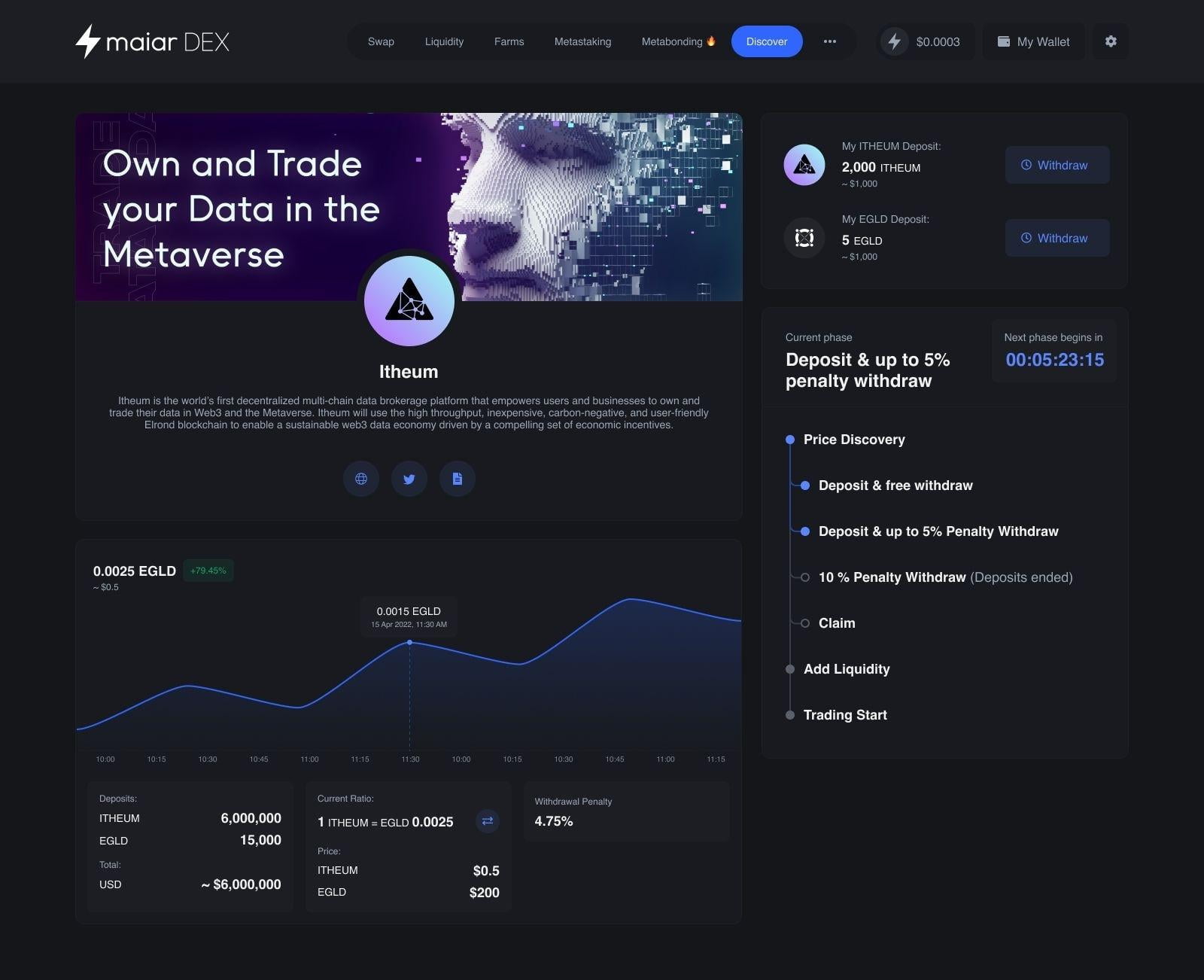

Explore the charges

During this phase, participants will deposit tokens in a wise contract: EGLD (to acquire ITEO) or ITHEUM (for the sale of EGLD). Based on the EGLD and ITHEUM numbers filed at the finish of this time period, the technique will set an EGLD / ITHEUM fat.

So these who sent EGLD will be blocked ITHEUM and vice versa these who sent ITHEUM will be blocked EGLD.

The blocking mechanism is utilized to tokens for two days just after listing, to handle speculative movements and generate greater priorities for these who want to go along with the task.

The discovery of the selling price itself is divided into 4 sub-phases:

- State one: Itheum purchasers deposit EGLD and Itheum sellers deposit ITHEUM in wise contracts to jointly create EGLD / ITHEUM weights. Users are cost-free to withdraw their tokens deposited for the duration of this time period.

- Phase two: Similar to phase one, but token withdrawals will be penalized, raising in excess of time from % to five%. This is to protect against attempts at selling price manipulation by “sharks” with huge quantities of tokens.

- Phase three: It is no longer feasible to deposit EGLD or ITHEUM deposits and withdrawals from the pool will now incur a fixed ten% penalty. The penalties accumulated in phases two and three continue to be in the wise contract and contribute to the determination of the last fat.

- Phase four: finish of the selling price recording and formally create the EGLD / ITHEUM weights. The pool can no longer be withdrawn. Participants in the discovery of the selling price have been in a position to receive their respective tokens in a locked kind and could not trade them for three days.

More liquidity

In the following phase, the holders of blocked ITHEUM and EGLD, as effectively as the holders of standard ITHEUM and EGLD, can deposit liquidity in accordance to the EGLD / ITHEUM weights established in the prior time period.

Providing liquidity just after selling price discovery will considerably cut down losses for preliminary liquidity companies and supply a sound starting up level just before tokens are traded.

To incentivize the provision of liquidity for the duration of this time period, liquidity companies will straight away get one thousand% APR in the 1st week just after the start off of trading.

Start trading

Once the selling price discovery has been produced and liquidity has been supplied, trading can start off. To much better illustrate the selling price discovery mechanism, contemplate the following hypothetical situation:

- Starting EGLD Price: $ 200 (guess)

- Initial EGLD / ITHEUM Weight one: 5000

- Total quantity of EGLD deposited: 50,000

- Total ITHEUM deposited: 50,000,000 VND

- Final EGLD / ITHEUM Weight one: one thousand

- ITHEUM Price: .two USD

- If A has sent one EGLD, he will get one thousand blocked ITHEUMs.

- If A has sent five,000 ITHEUMs, he will get five blocked EGLDs.

Elrond will quickly release public exams for the duration of a unique Battle of Yields occasion, the place the local community will hear the facts of the pricing discovery approach and can participate in a reside simulation of Itheum’s pricing discovery.

Through this check, Elrond will validate his assumptions and refine parameters this kind of as penalty percentage, token block time, and so forth.

Maybe you are interested:

Note: This is sponsored material, Coinlive does not immediately endorse any info from the over write-up and does not ensure the veracity of the write-up. Readers really should perform their personal analysis just before creating selections that have an impact on themselves or their enterprises and be ready to consider duty for their personal selections. The over write-up is not to be viewed as investment guidance.