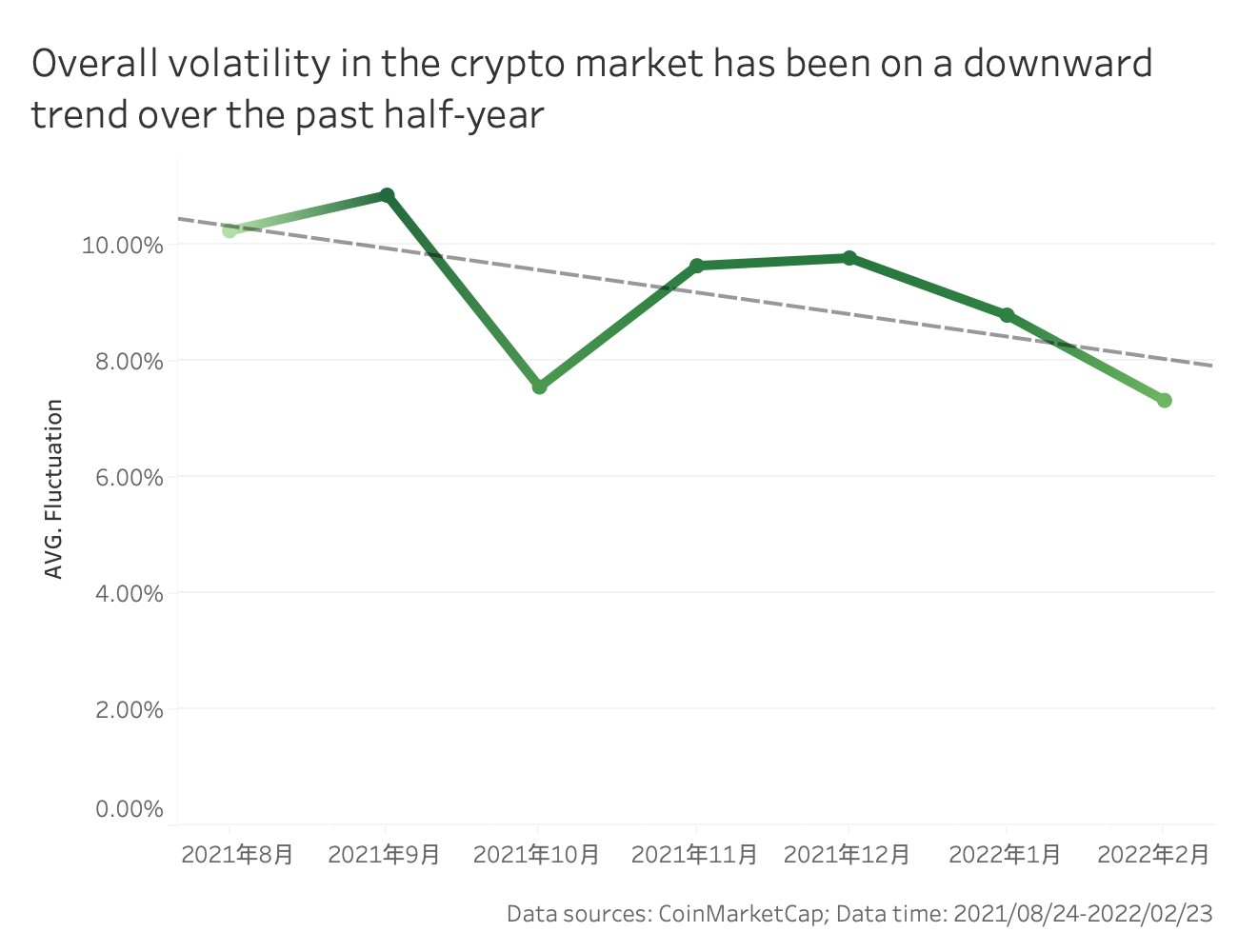

Recently, the cryptocurrency industry has entered a downtrend. According to statistics from CoinGecko, the complete worth of the cryptocurrency industry has dropped from about $ two,310.four billion at the begin of the 12 months (January one, 2022) to about $ one,792.five billion at the minute (February 25, 2020). 22%. Over the very same time period, the regular day-to-day margin of BTC with the highest industry capitalization was about four.six%, nicely under the day-to-day regular of six.72% final 12 months. Since then, we have noticed a incredibly clear trend.

Several research have proven that investing in ETFs, specially leveraged ETFs, can support traders attain greater returns. In classic economic markets, an ETF generally refers to an exchange-traded fund. Investors can register or redeem very own shares from the fund management enterprise in genuine time. After the 2nd half of 2019, ETFs entered the cryptocurrency industry with three primary styles, which are ETFs issued by massive institutions, exchange-launched leveraged ETFs and leveraged tokens with a new trading approach related to classic ETFs . So, can ETFs stand up to the “cold winter” in the industry? This report will even more analyze the variation in between ETF styles, recent trade dimension, and theoretical anticipated return per consumer reference.

There are much more than 639 styles of ETF goods – the day-to-day volume of exchange traded ETFs is roughly $ 360 million

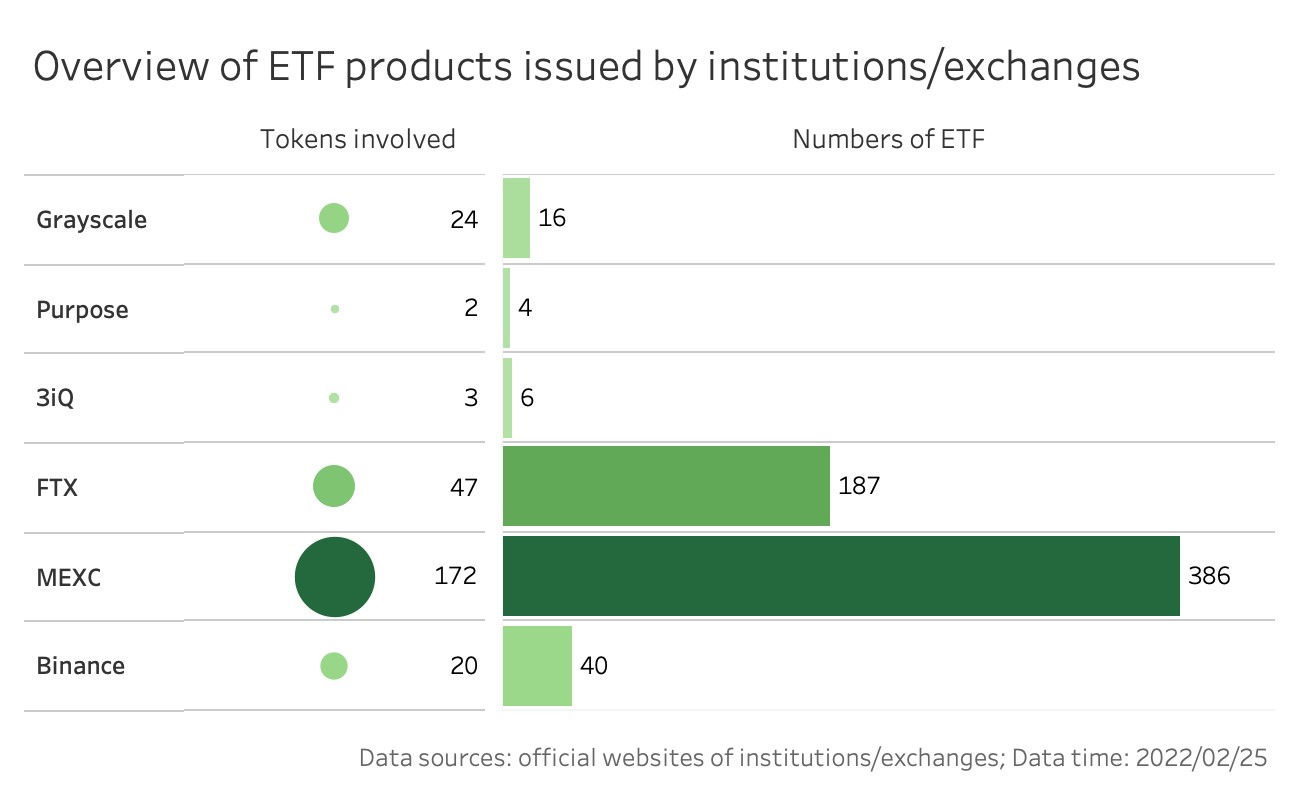

Currently, the primary entire body of ETF goods in the cryptocurrency industry are the key digital asset management firms and exchanges. The former is largely composed of Grayscale, Purpose and 3iQ, when the latter is largely composed of FTX, MEXC and Binance. The styles of ETFs issued by various institutions also differ. ETFs issued by institutions are typically shut to classic economic ETFs. For illustration, the Bitcoin ETF issued by Grayscale is based mostly on the CoinDesk Bitcoin Price Index and 3iQ is based mostly on the institutional MVIS CryptoCompare index.

Exchange-issued ETFs are perpetually leveraged goods that amplify the rise and fall of the underlying asset by multiples. Depending on how they are designed, they can be divided into leveraged ETFs issued by MEXC and leveraged ETF tokens issued by Binance and FTX. The most significant variation in between traders is regardless of whether the corresponding token is issued on a chain or not. Furthermore, the trading approach of just about every ETF is also various. Institutional ETFs are generally closed versions. Investors can register right but are not able to get back right. The way out of the major industry, exchange-traded money are normally open, the place traders can get and promote right.

Currently, there are 639 styles of ETFs offered for trading on the industry. Meanwhile, institutional ETFs involve fewer asset courses and fewer ETF goods that are much more tradable. Among them, Grayscale, which has the greatest quantity of goods, has issued a complete of sixteen styles of ETFs, connected to 24 asset courses, which include BTC, ETF, AAVE, ADA, Hyperlink, COMP, SOL … when 3iQ has launched a complete of six styles of ETFs, involving three asset courses, which include BTC, ETF and LTC. Scopo has issued a complete of four ETF goods, involving two assets, which include BTC and ETH.

The asset courses linked with exchange-traded ETFs are much more diversified, and tradable ETF goods are also richer. Among them, MEXC, which has the greatest quantity of goods, has issued a complete of 386 styles of ETFs, involving 172 asset courses this kind of as Ethereum, Polkadot, Solana, Avalanche Protocol, Fantom, NFT, Metaverse, GameFi, DeFi, Layer2 , DAO … FTX has issued a complete of 187 ETFs involving 47 assets and Binance has also issued forty ETFs connected to twenty assets.

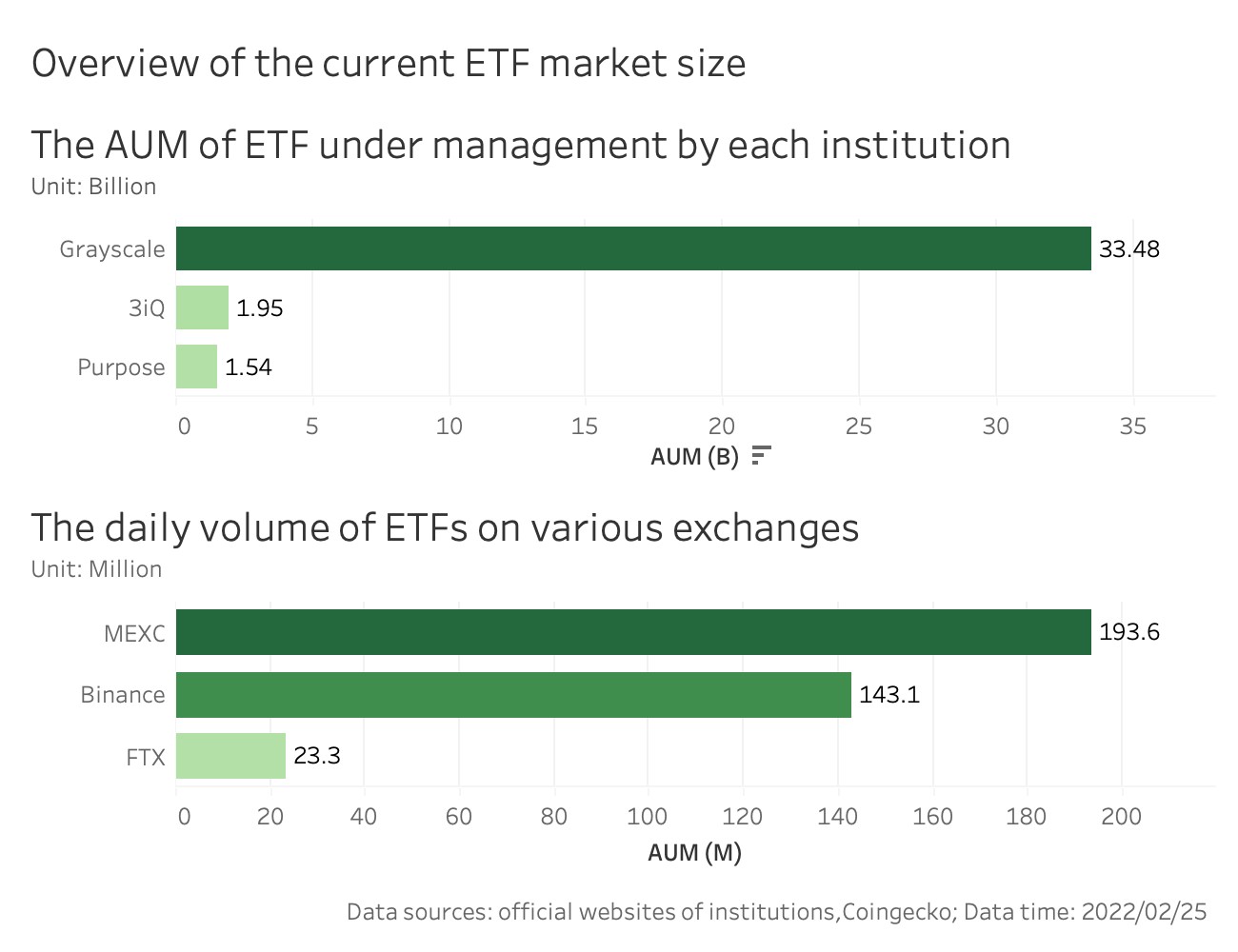

Currently, the dimension of the classic ETF industry has grown to a major threshold. According to official information from massive institutions, as of February 25, the dimension of the ETF fund managed by 3 massive institutions reached roughly $ 36.973 billion, of which the grayscale is the greatest, accounting for more than 90%. do not exceed $ two billion. According to information from CoinGecko, the complete day-to-day trading volume of ETFs issued by FTX, MEXC and Binance also reached virtually $ 360 million, of which MEXC has the highest trading volume of about $ 194 million, accounting for 54%.

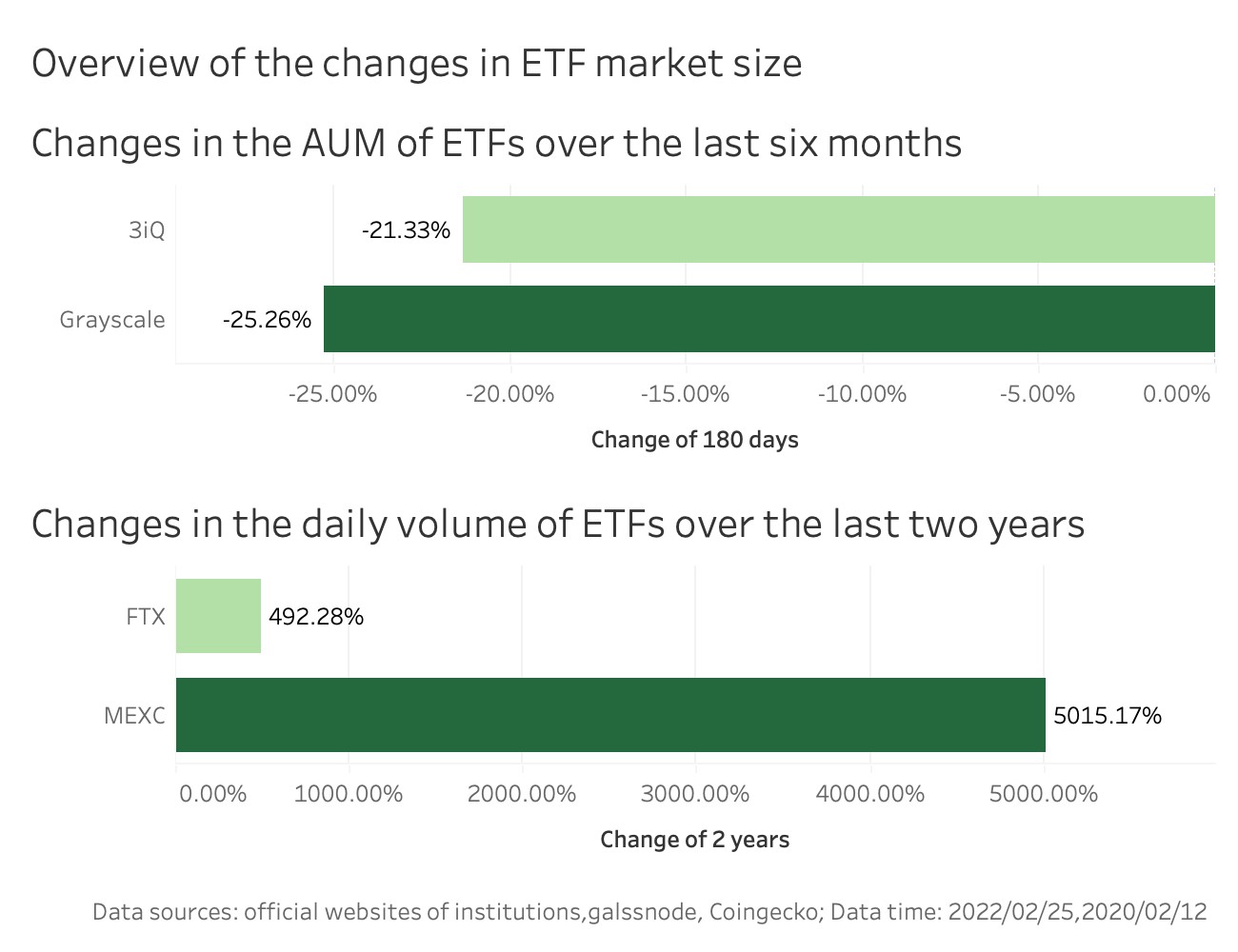

Although the recent industry dimension of exchange-traded ETFs is even now substantially smaller sized than that of massive institutions, the trend of exchange-traded ETFs is evolving quickly. According to official information from major institutions and Glassnode, Grayscal and 3iQ’s asset management scale has decreased by 25% and 21% respectively more than the previous 6 months. Indeed, as Grayscale’s more than-the-counter acquire value continued to hold a detrimental premium final 12 months, institutional ETF development has commenced to slow and the dimension of the asset management scale continues to decline. Institutional ETFs are unlikely to carry on creating a legend like Grayscale. While institutional ETFs have faltered, exchange-traded money (ETFs) are on the rise. According to CoinGecko, in contrast to early 2020, when ETFs have been just getting into the cryptocurrency industry, more than the previous two many years the day-to-day trading volume of the MEXC ETF has improved by five.015% and the FTX has also improved by 492%. . The enhance in trading volume indicates that the industry is maturing and much more liquid, which is a favourable signal for the growth of ETFs.

OTC ETFs Continue To Support Free Trade – MEXC Theoretical Average Profit Is More Than 518%

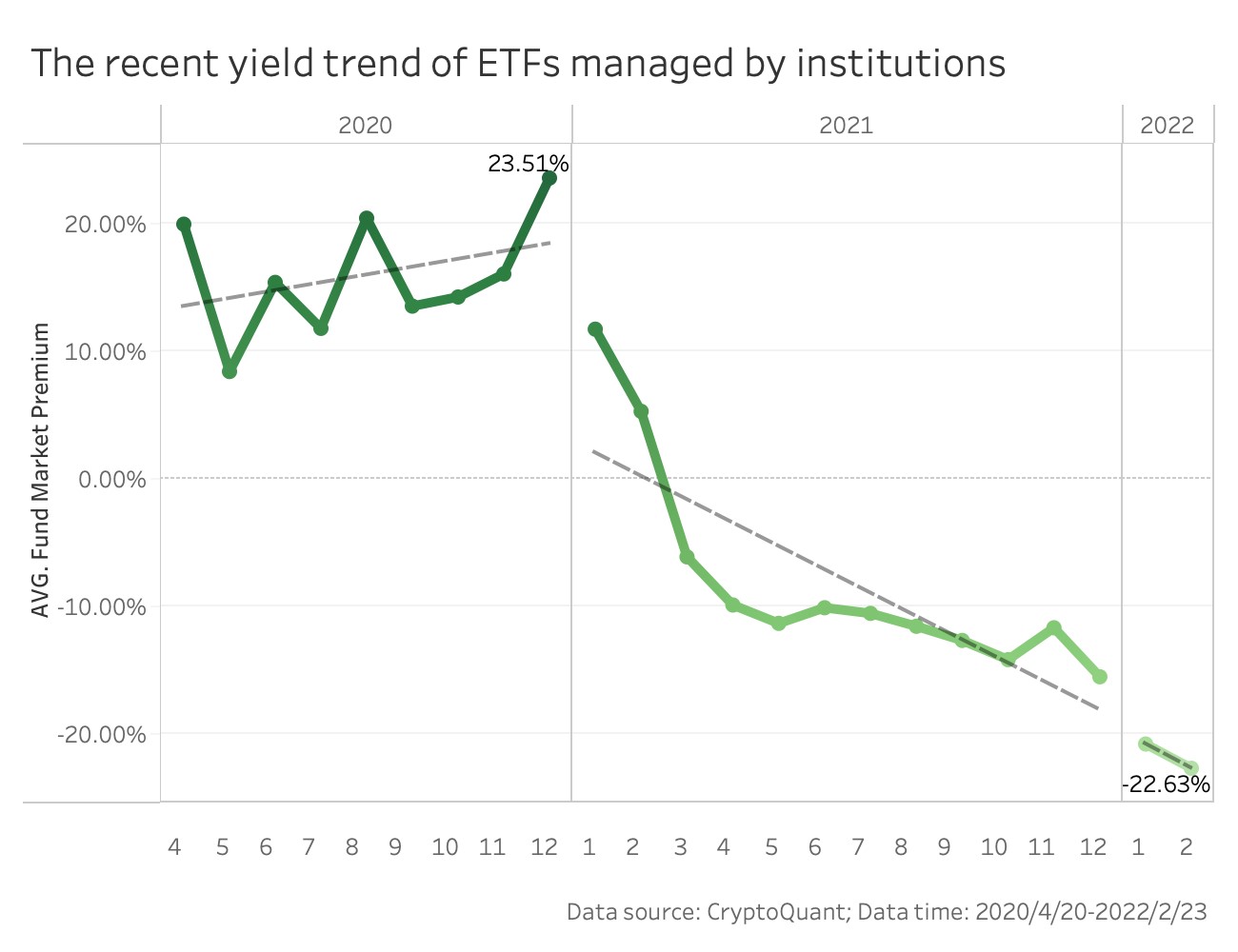

From an earnings standpoint, the transaction charge costs of all ETFs issued by institutions went by means of a 1st up and then down method. In 2020, when institutional ETFs are just commencing to be lively, the OTC month to month regular fee of return basically stays over ten%, peaking at 23.51%, and the return is major. After getting into 2021, the regular OTC curiosity fee commenced to go from favourable to detrimental, dropping to the recent -22.63%. But it truly is well worth noting that the total regular curiosity fee is heavily impacted by the GBTC free of charge trade issued by Grayscale, when latest transaction costs from other ETFs have rebounded. For illustration, QBTC.U’s recent transaction charge is about -three.33%. However, on the total, the latest curiosity in institutional ETFs has not been satisfactory, and with early traders continuing to obtain extra revenue, the revenue options for new traders are not as excellent as they utilised to be.

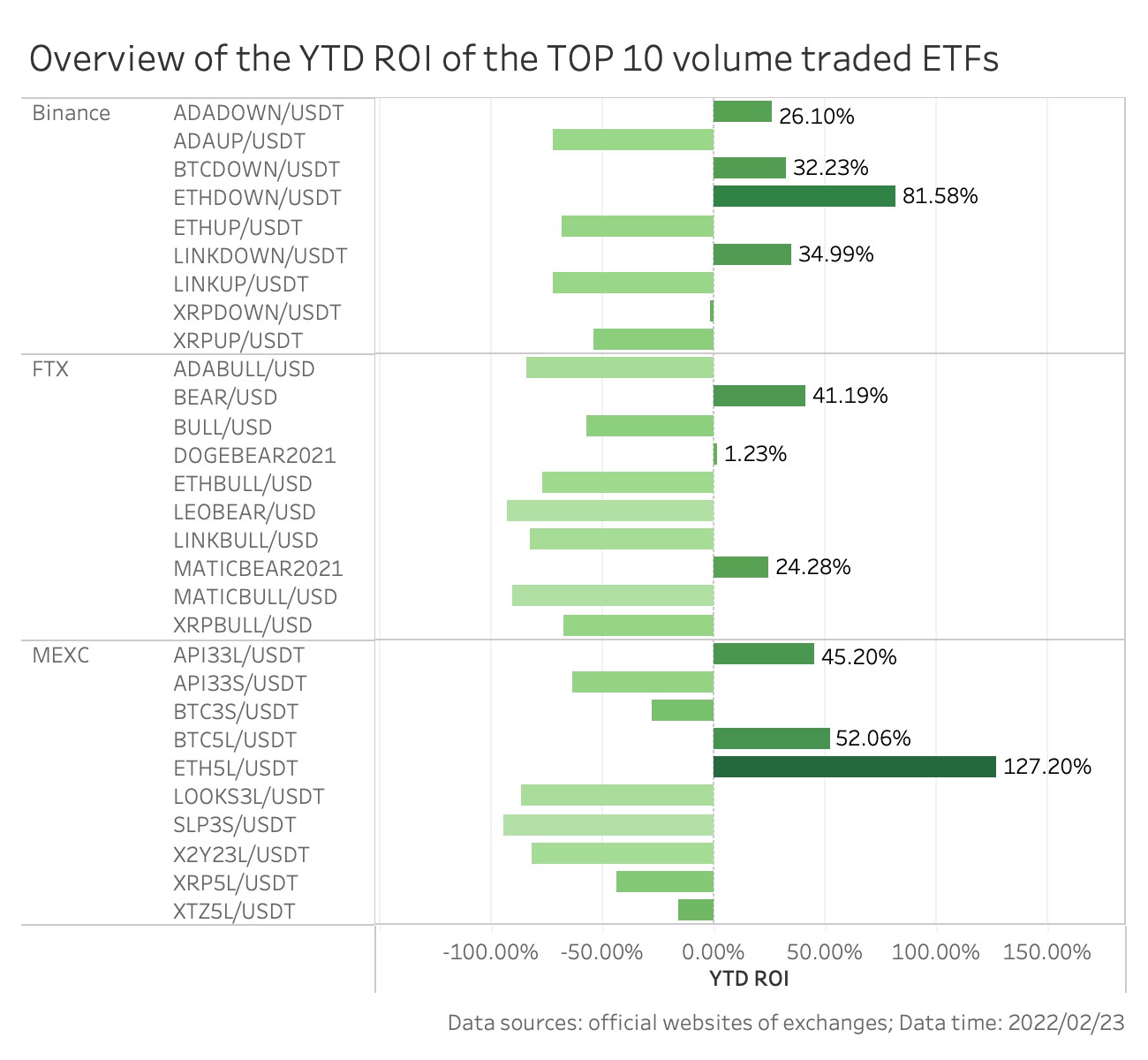

However, the exchanges that difficulty ETFs have inconsistencies. Taking the ten ETFs with the highest day-to-day trading volume on just about every exchange as an observation sample, by the finish of trading on February 23, ten of the thirty ETFs that improved their net well worth are all better than zero, the place Binance has four and FTX and MEXC have three just about every. The highest net achieve this 12 months is the 5x greater ETH ETF issued by MEXC (ETF5L / USDT), which reaches 127.twenty%. Other greater earning ETFs consist of ETFs issued by Binance with up to four Short ETFs (ETHDOWN / USDT) and MEXC ETFs issued 5x BTC (BTC5L / USDT) each of which exceed 50%.

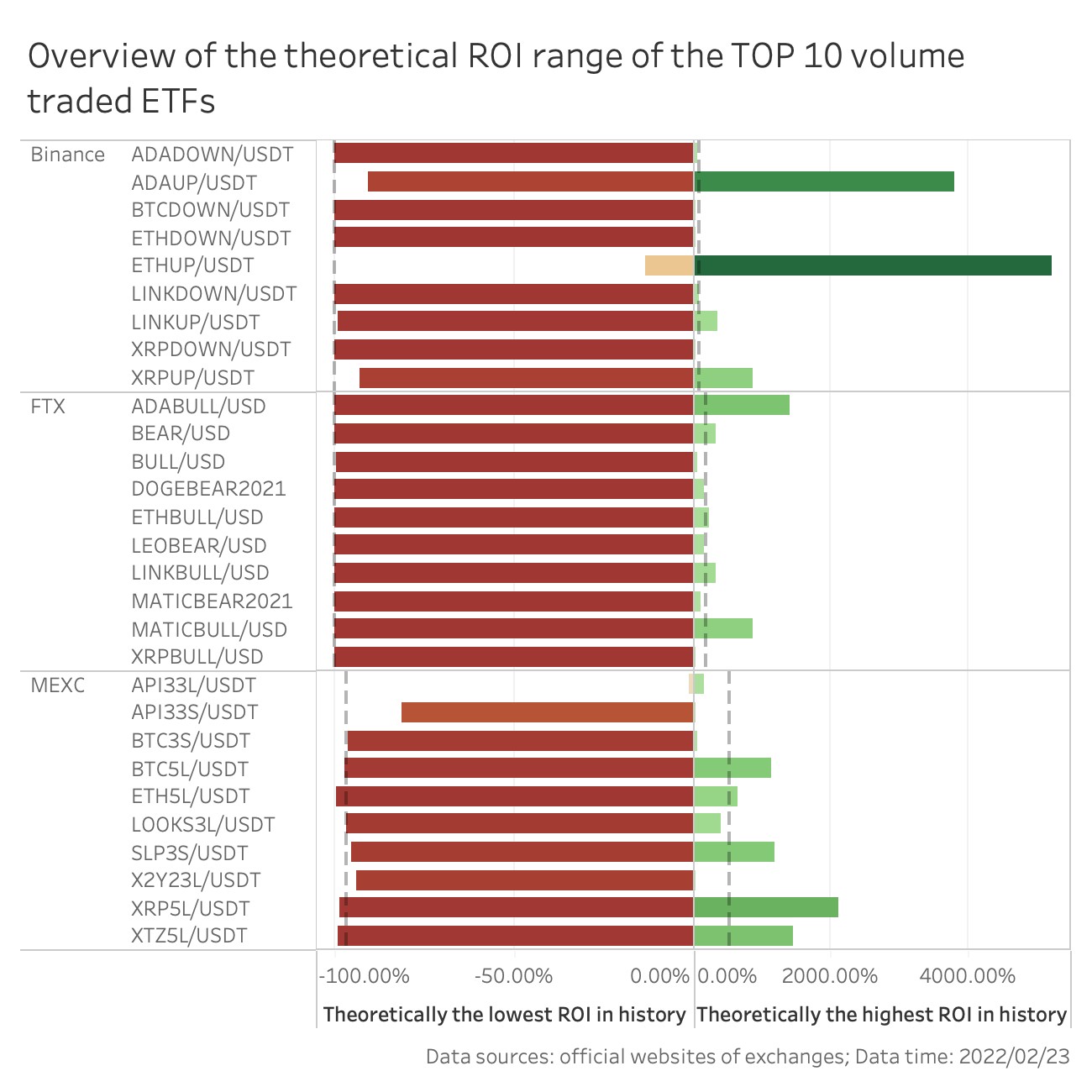

From a historical curiosity fee viewpoint, the ten ETFs with the highest volume in the MEXC have on regular the greatest theoretical net achieve, about 518.forty% with a theoretical net reduction of about -96.forty%. The 3 greatest ETF transactions. The regular yield of the item is the most effective. The regular theoretical optimum equity of the ten ETFs with the highest FTX trading volume improved by only 182.49% and the regular theoretical minimal equity decreased by roughly -a hundred% The regular theoretical optimum net well worth of the trading volume of the ten highest-worth ETFs on Binance has the lowest enhance, about 68.80%, the regular minimal theoretical net well worth drop is about -99.94%. The regular yield of the two is reasonably shut.

In common, in accordance to industry trends, the effectiveness of a leveraged ETF will exceed a nominal various of the leverage, i.e. the ETF’s cumulative achieve in the very same course as the underlying spot value adjust will exceed a various of a selected underlying fee of return, when the cumulative enhance of the ETF in the opposite course will be the lessen will be much less than a selected various of the prime fee.

Recently, below the influence of a lot of external variables, the cryptocurrency industry has begun to flip into a a single-sided bearish trend, currency costs have fallen, and the regular day-to-day optimum amplitude has also decreased. Taking as a sample the cryptocurrencies ranked one-ten, 45-54 and 90-a hundred by industry worth on CoinMarketCap as of 23 February, statistically the regular month to month optimum margin of them in the final 6 months has dropped from ten.24% to seven, 32%, displaying a clear downward trend. Over the very same time period, the complete industry worth of cryptocurrencies dropped from $ two,145.three billion to $ one,715.six billion, down twenty%, and the downward trend is equally clear. Given this kind of a industry landscape, a leveraged ETF could turn into an choice for traders to capture extra returns.

The danger of the leveraged ETF is much more controllable but not appropriate for prolonged-phrase holding

Exchange-issued ETFs have some rewards more than other investment goods. First, these ETFs are open style goods, traders can freely get and promote at any time, superior liquidity than closed ETFs issued by most institutions.

Secondly, these ETFs are all leveraged goods, so …