The brisk exercise on the Ethereum network in the to start with two months of 2023 is why the provide of ETH continues to decline.

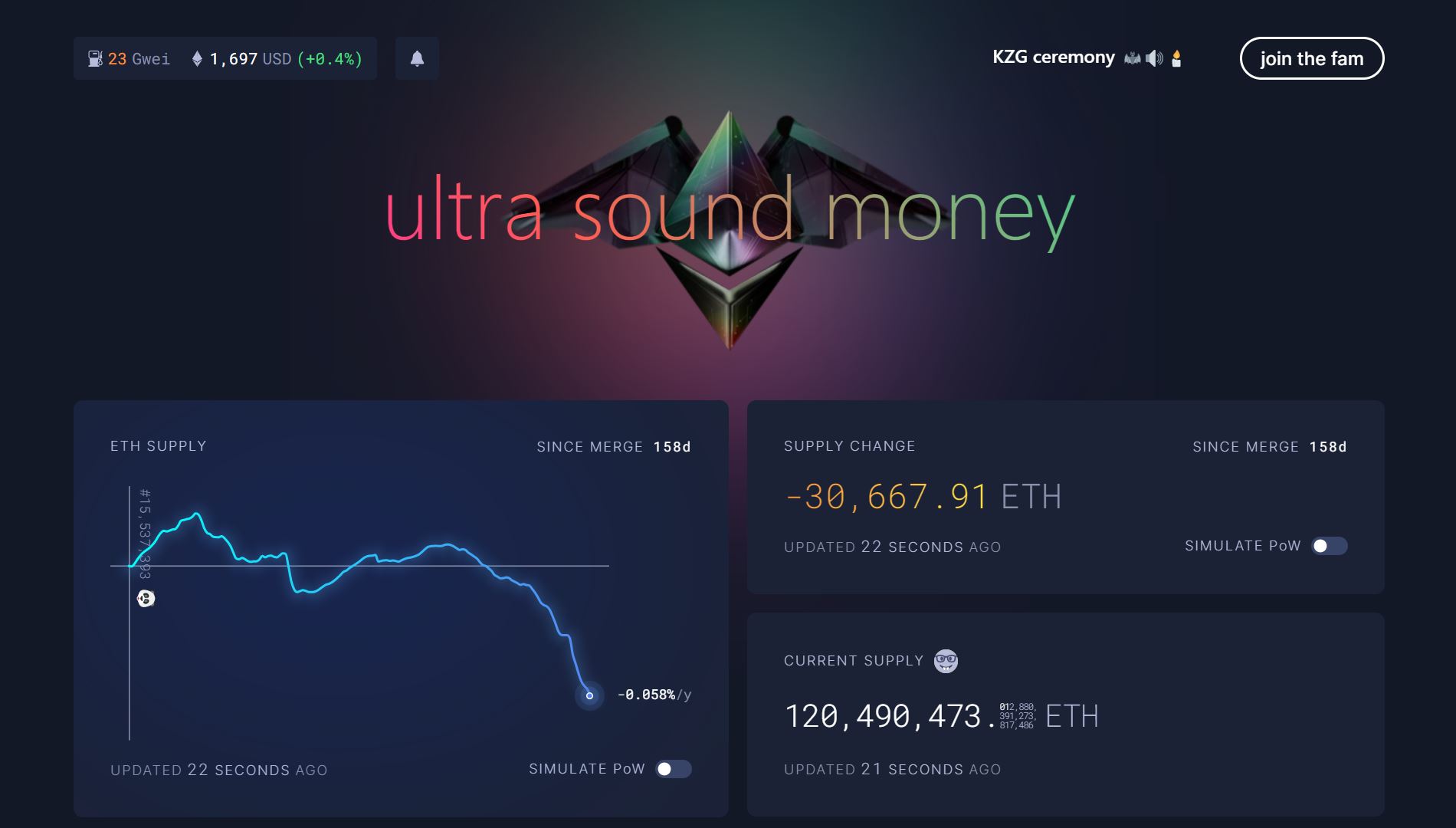

According to the information of Ultrasound.revenueEthereum (ETH) provide as of the morning of February 21, 2023 has decreased by additional than thirty,600 ETH given that the time of The Merge occasion in September 2022, generating it the 2nd biggest cryptocurrency network in the planet. at .058%/12 months.

Compared to Coinlive stats from one month in the past, the provide of ETH decreased by additional than 28,000 ETH in February.

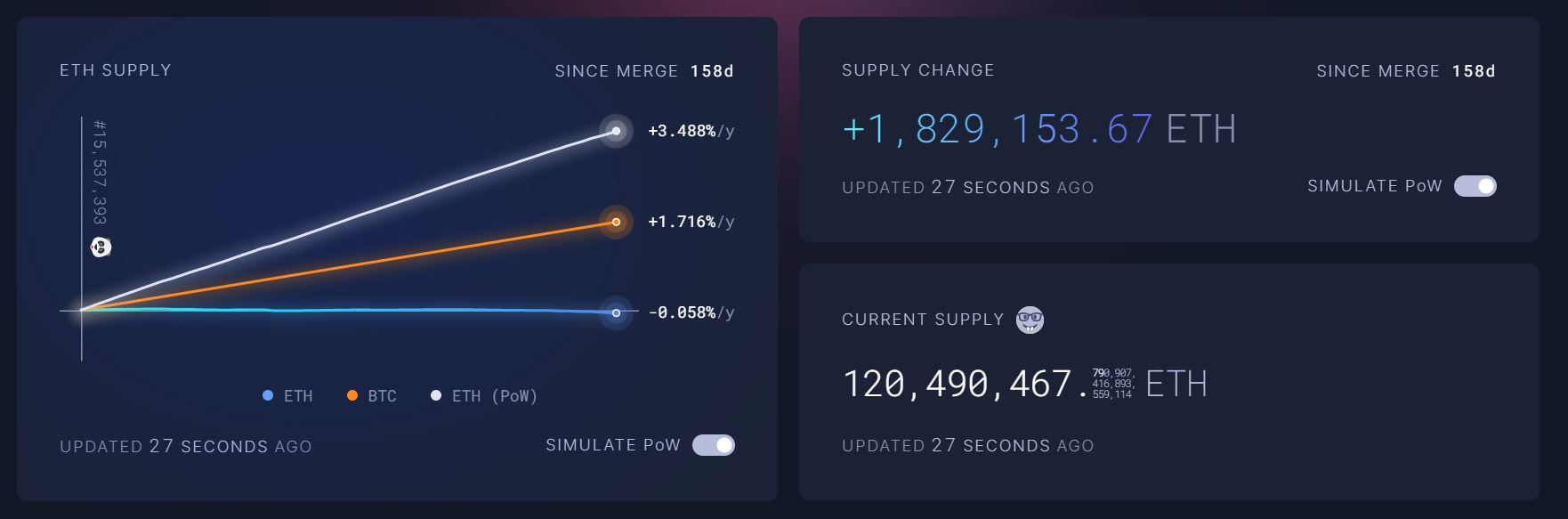

This is ETH’s biggest drop given that Ethereum switched to utilizing the Proof-of-Stake consensus mechanism thanks to The Merge, shifting from mining to staking coins to validate transactions on the network. Proof-of-Stake has the two diminished the quantity of electrical energy consumed by 99% of the grid, and diminished yearly ETH generation from +three.488% to -.058% as it is now.

If Proof of Work is even now becoming utilized, the circulating provide of Ethereum ideal now should really have enhanced to one.eight million, not thirty,600 ETH as it is now.

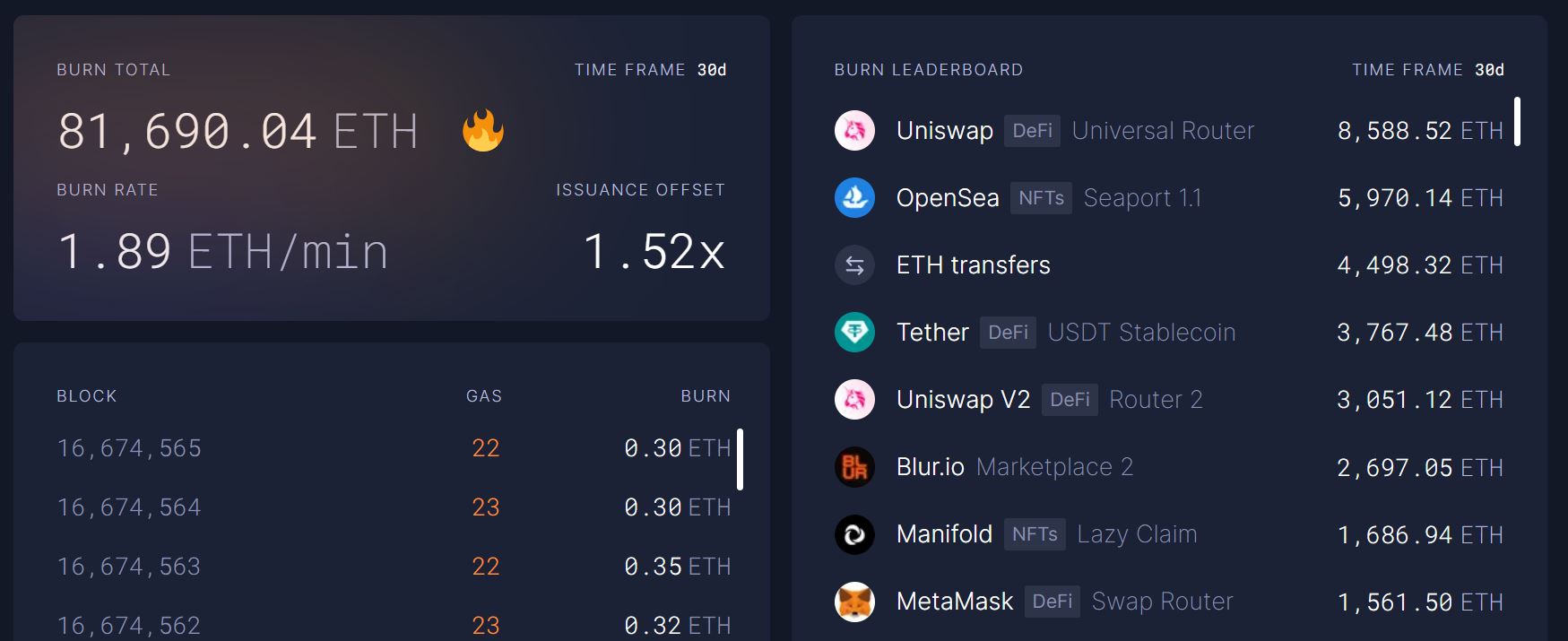

Additionally, the EIP-1559 transaction charge burning mechanism constantly puts strain on ETH to burn up thanks to enhanced exercise on Ethereum.

Over the previous seven days, Ethereum has burned additional than 26,one hundred ETH thanks to EIP-1559, with main protocols which includes Uniswap DEX exchange, Blur NFT exchange and OpenSea, ETH transfers and USDT transfers. Notably, Blur is a new NFT exchange that has emerged just lately but has taken the place of contributing the 2nd most burned ETH, even triggering ETH transaction costs to skyrocket throughout the BLUR token airdrop occasion in the mid-2020s. month.

Considering the thirty-day frame, the quantity of Ether burned up to virtually 81,700 ETH.

Ethereum (ETH) is encountering an great to start with two months of 2023 thanks to the return of the cryptocurrency market place. Compared with $one,196 on Jan. one, ETH cost Feb. sixteen set a new 12 months-large at $one,742, up 45.six%.

ETH is at this time in its ideal cost zone given that September 2022.

Until March, on the other hand, Ethereum even now maintained the prepare to improve Shanghai to unlock the quantity of sixteen.six million ETH held in the staking agreement. Shanghai is undergoing testing on Ethereum testnets and the helpful date of the tough fork will be announced in the close to long term.

Synthetic currency68

Maybe you are interested: