In this text, we’ll take a look at the variations in value motion between Bitcoin (BTC) and Ethereum (ETH), to find out which coin will carry out higher in July.

The short-term ETH motion seems to be extra optimistic than the BTC motion. Furthermore, the ETH / BTC pair is exhibiting indicators of a bullish reversal, which makes it extra possible that ETH will overtake BTC in July.

Ethereum

ETH has been declining because it hit an all-time excessive on May 12. During the decline, ETH adopted a descending resistance line.

So far, it hit a low of $ 1,730 on May 23. On June 22, ETH created a double backside sample near the identical degree. This is taken into account a bullish sample. Furthermore, it’s related to the bullish divergence within the MACD.

Subsequently, ETH broke the aforementioned descending resistance line. The value of Ethereum is at present being confirmed in assist.

The closest resistance is at $ 2.724, 0.382 Fib retracement resistance.

Technical indicators are nonetheless lower than par. The RSI has not but damaged above the 50 degree, the Stochastic Oscillator has not but produced a bullish crossover, and the MACD histogram shouldn’t be optimistic. These should occur for the development to be thought of bullish.

Measuring from the low of twenty-two June, the present excessive of ETH has elevated to 34.62%. Although it has decreased since then, there isn’t any overlap (purple line) with the earlier excessive, permitting for the chance that the uptrend could proceed.

Bitcoin

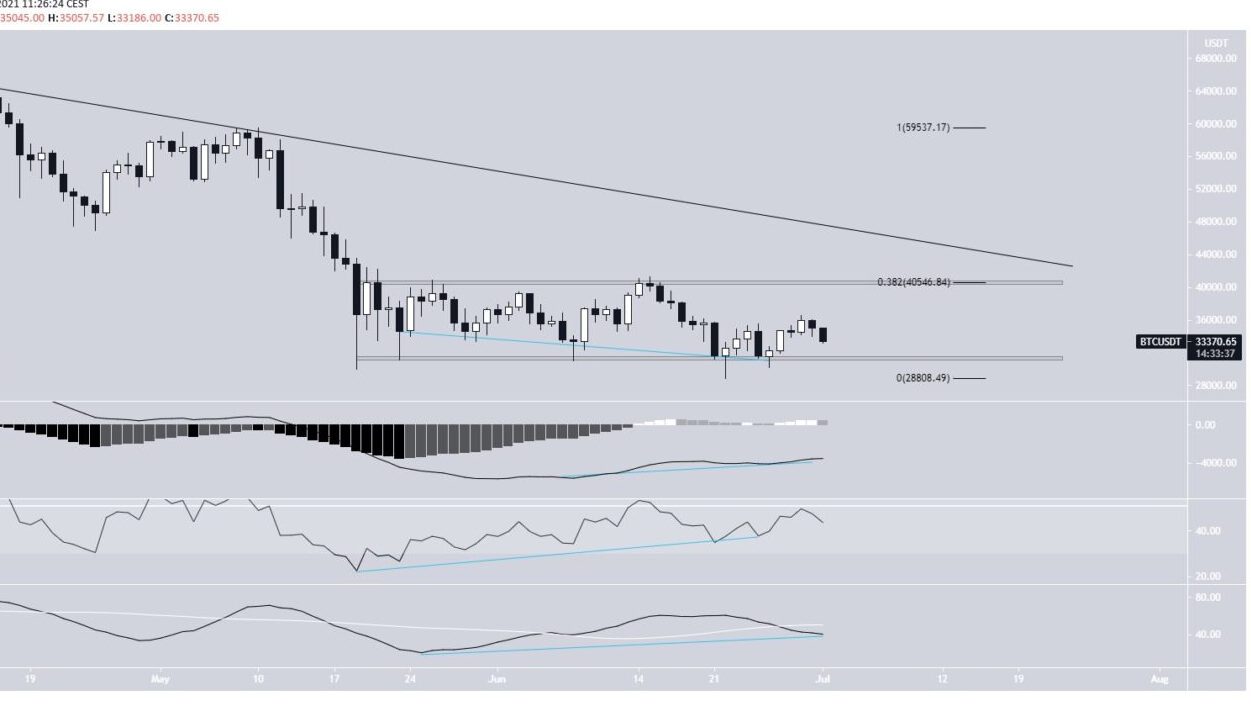

BTC has additionally been down because it hit an all-time excessive on April 14.

Since May 19, Bitcoin has been trading in a spread of $ 40,500 to $ 31,400. On June 22, Bitcoin hit a low of $ 28,805 earlier than rebounding sharply.

The upward transfer was initiated by a really important bullish divergence within the MACD, RSI and Stochastic. However, the RSI has not but damaged above the 50 degree and the Stochastic Oscillator has made a bearish crossover.

Therefore, judging from the day by day time-frame, the worth motion is extra bullish for ETH, however the technical readings are extra bullish for BTC.

Measuring from the June 22 low, BTC’s present excessive has risen by 27%. Bitcoin has declined since then and has important overlap with the earlier excessive, suggesting the transfer is correcting.

Alternatively, the worth could also be trading inside an ascending wedge, which is taken into account a bearish sample.

Compared to ETH, the short-term motion seems to be way more bearish for BTC.

ETH / BTC

ETH / BTC has been on the rise because it hit a low of 0.055 on June 27. The minimal was created exactly on the assist of the 0.5 Fib retracement.

So far, the pair has reached a excessive of 0.065.

Technical indicators are on the rise. The MACD confirmed a bullish reversal sign and nearly moved above the zero line.

The RSI has moved above the 50 degree and the Stochastic Oscillator could be very shut to creating a bullish crossover.

The short-term 2-hour chart reveals what seems to be like the beginning of a bullish momentum. After the rejection, ETH is seeking to discover assist between the 0.5.-0.618 Fib retracement assist ranges at ₿0.058 – ₿0.06.

Making the next low at this degree will verify the uptrend.

Synthetic Currency 68

Maybe you have an interest:

.