Ethereum is seriously back in the operating as the rate trend has recovered extremely strongly in excess of the previous week. Based on latest inner aspects, Ethereum’s rate could have loads of area to make a greater breakthrough in the close to long term.

The rate of Ether (ETH) has been on a downward spiral considering the fact that Ethereum delayed its London challenging fork in July, moving it to August four for the principal network update. While the hurdle ETH faced was substantial on the portion of the local community, it was also a fortunate element that for most of July Bitcoin’s trend for the whole industry was not good.

If Bitcoin took a magnificent flip with ten consecutive green candles in advance of correcting, ETH is accelerating with a amount exceeding BTC of 13. ETH is at the moment trading close to the $ two,566 rate zone.

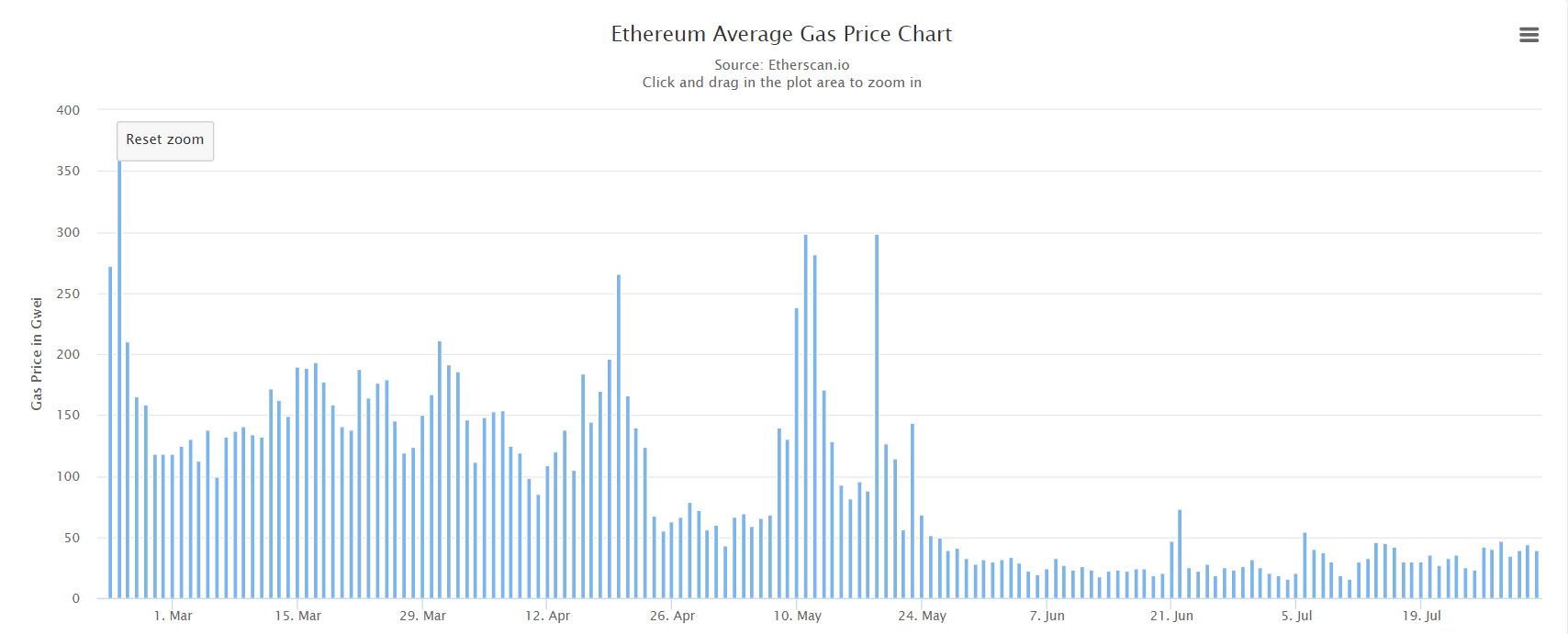

The expense of fuel is an significant challenge. The picture of the Berlin challenging fork in April is the most concrete demonstration of the bullish rate trend of the ETH. After the Berlin challenging fork, fuel tariffs on ETH have enhanced substantially, in contrast to the latest scenario, fuel in advance of the London improve exhibits a somewhat uniform index in contrast to the decline following Berlin.

So what occurs when EIP-1559 is the “trump card” made use of in this occasion? A prolonged-awaited option from the local community will develop a breakthrough in solving the “difficult” trouble of Ethereum charges. Find out much more about this spearhead of the ETH. Please read through beneath for reference:

-See much more: Is EIP-1559 the greatest option to all Ethereum challenges?

And when it is enhanced to by some means lessen the fuel tariff, quite a few dApps will have much more ground on Ethereum, a sizeable influence on ETH’s provide-demand ratio, affecting rate development.

Analysis: Ethereum rate prediction in 2021 bull run – will ETH be the latest rate x3?

Although protocols now have much more possibilities. Like Polygon blockchain, Binance Smart Chain (BSC) or Solana (SOL), but not automatically Ethereum.

We have main DeFi platforms this kind of as UniSwap (UNI), Curve Finance (CRV) and Aave (AAVE) all of which have additional help for blockchains other than Ethereum. The NFT Axie Infinity (AXS) wave has migrated to Ronin to optimize prices for consumers.

But bear in mind, the principal flags all come from Ethereum. The romantic relationship in between the contract worth and the TVL index in contrast to the ETH of the over protocols even now prospects. Regardless of the alter, Axie gamers have to invest in ETH to participate in generating income on the platform. Therefore, it can’t be denied that Ethereum has usually been the blockchain legacy of cryptocurrencies and can’t be separated.

Synthetic currency 68

Maybe you are interested: