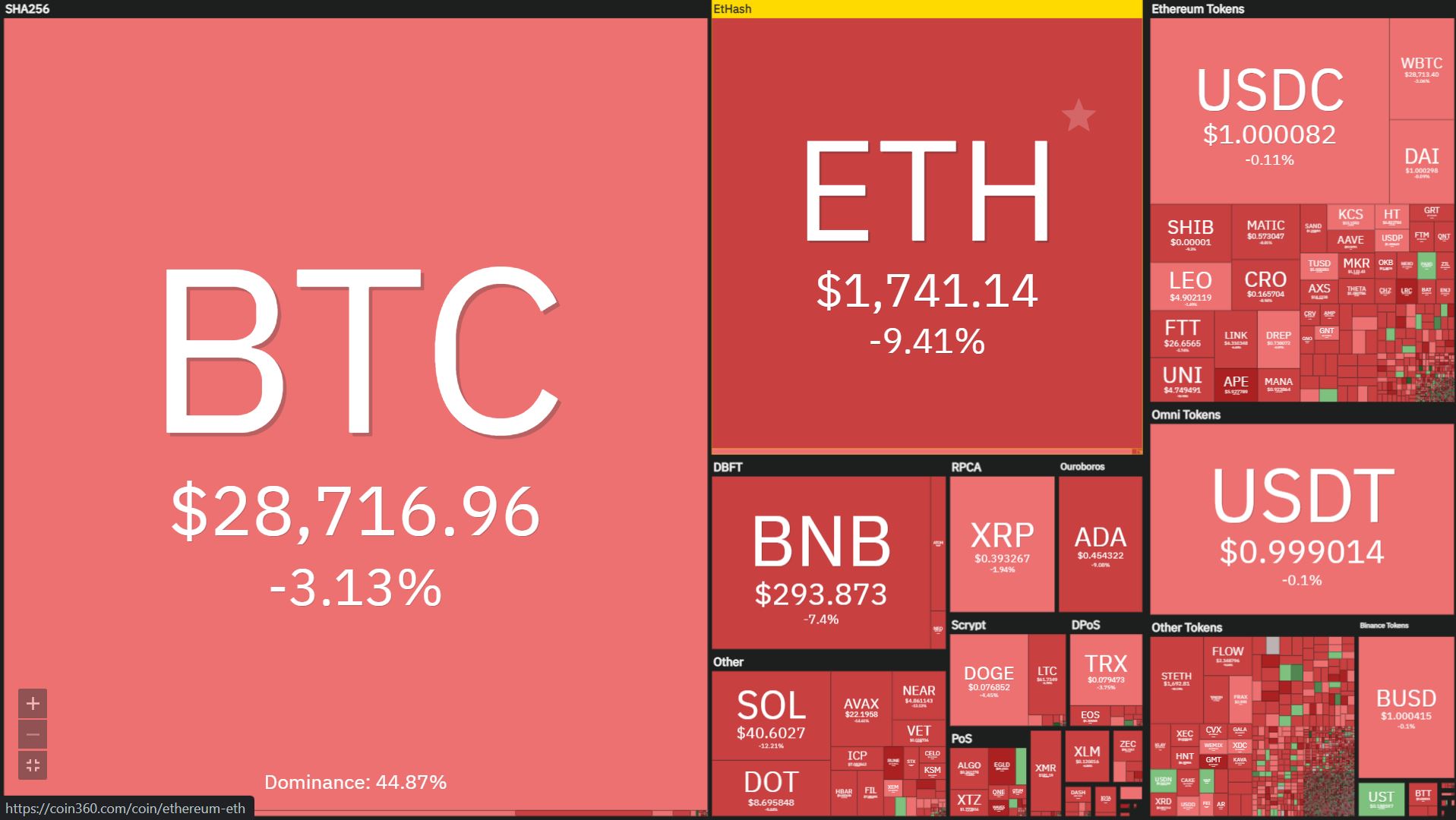

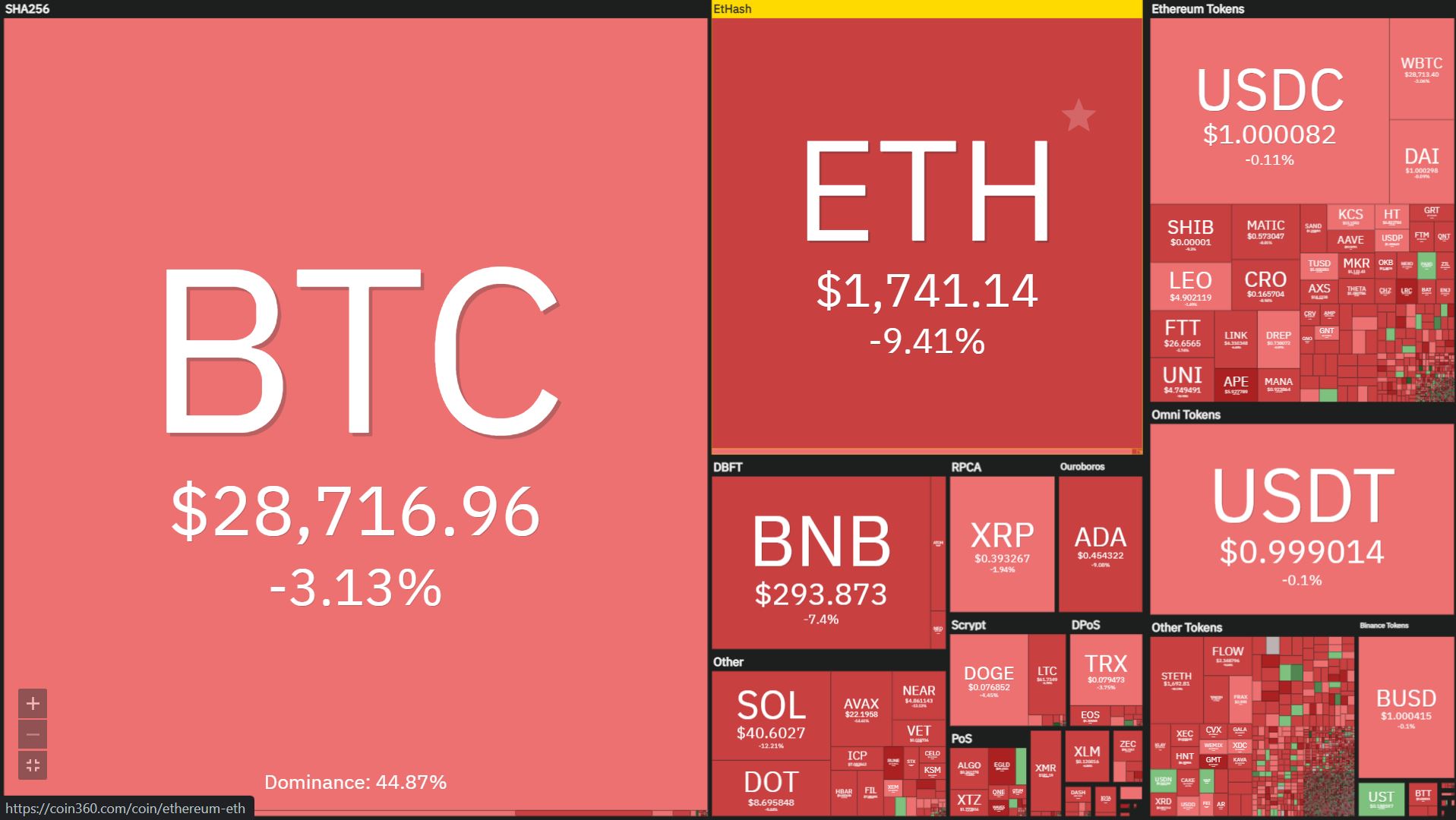

The 2nd greatest cryptocurrency in the planet, Ethereum (ETH), suffers heavily from industry volatility, in spite of getting ready to roll out The Merge update.

At noon on May 27, the cost of ETH continued to change to $ one,712, the lowest worth degree because July 2021 and is the new very low of this 2022.

In the final seven days alone, Ethereum has misplaced additional than 15% of its worth and is owning a series of eight consecutive red candles, which has under no circumstances occurred in the seven 12 months historical past of this coin.

It seems that the information about Ethereum getting ready to improve The Merge – the merger of two present Ethereum blockchains (working with Proof-of-Work) with Ethereum two. (working with Proof-of-Stake) all around August 2022 does not they can conserve the industry. Recently, the Ethereum two. Beacon Chain also encountered a severe glitch, which delayed the dread of The Merge yet again.

Likewise, Bitcoin is as well on the way to a series of 9 week red candles, for the very first time ever. BTC within On the evening of May 26th there was a moment when it was pushed to the $ 28,019 mark, just before recovering in the $ 28,700 – $ 29,000 zone. The world’s greatest cryptocurrency even now holds a harmless distance from the 2022 very low of $ 26,700 set on May twelve, at which time the industry was heavily dumped as a consequence of the LUNA-UST crash.

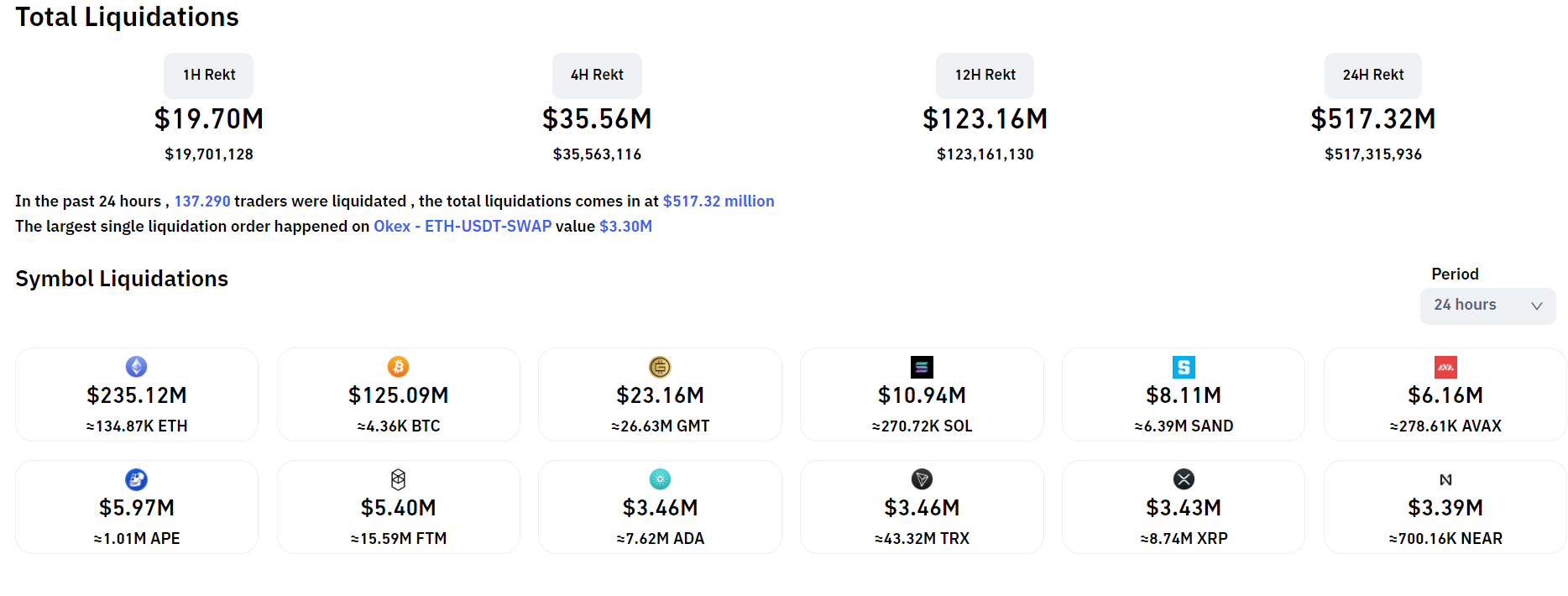

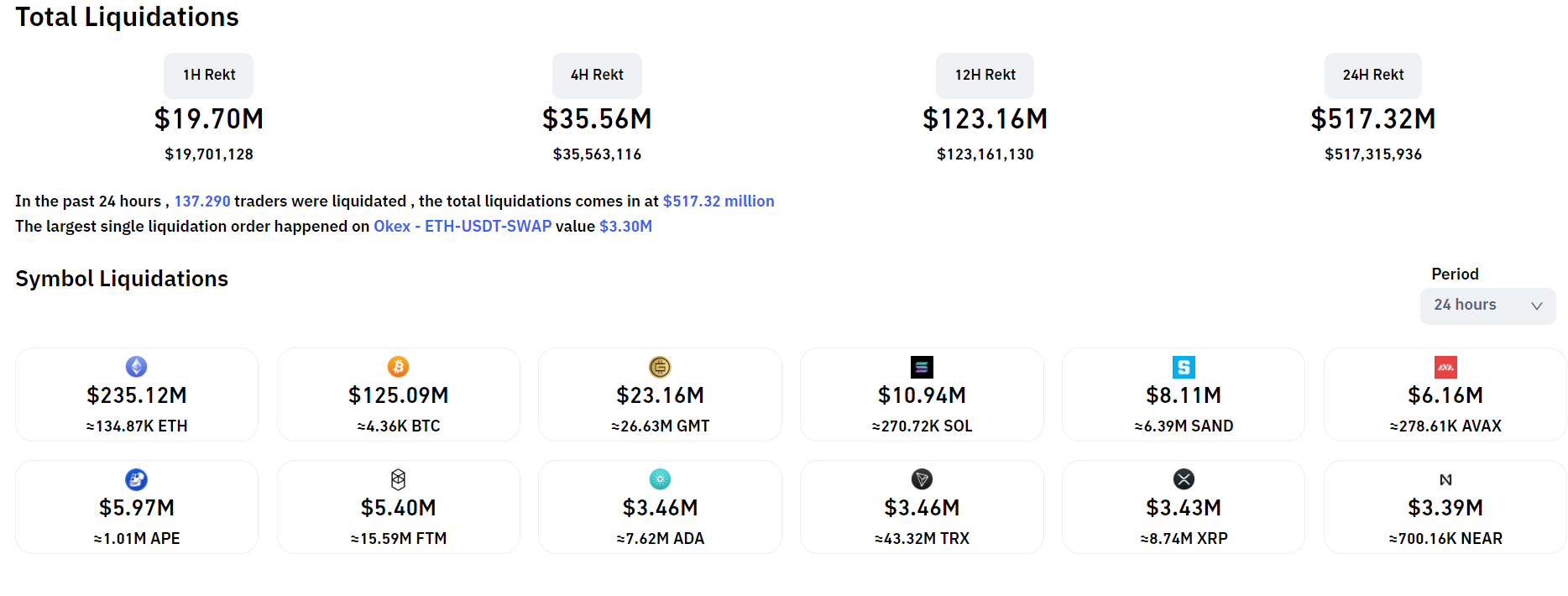

Over the previous 24 hrs, above $ 517 million well worth of crypto derivative orders have been cleared, 80% of which had been prolonged orders. An sudden stage is the worth of ETH liquidated at $ 235 million, nearly double that of Bitcoin.

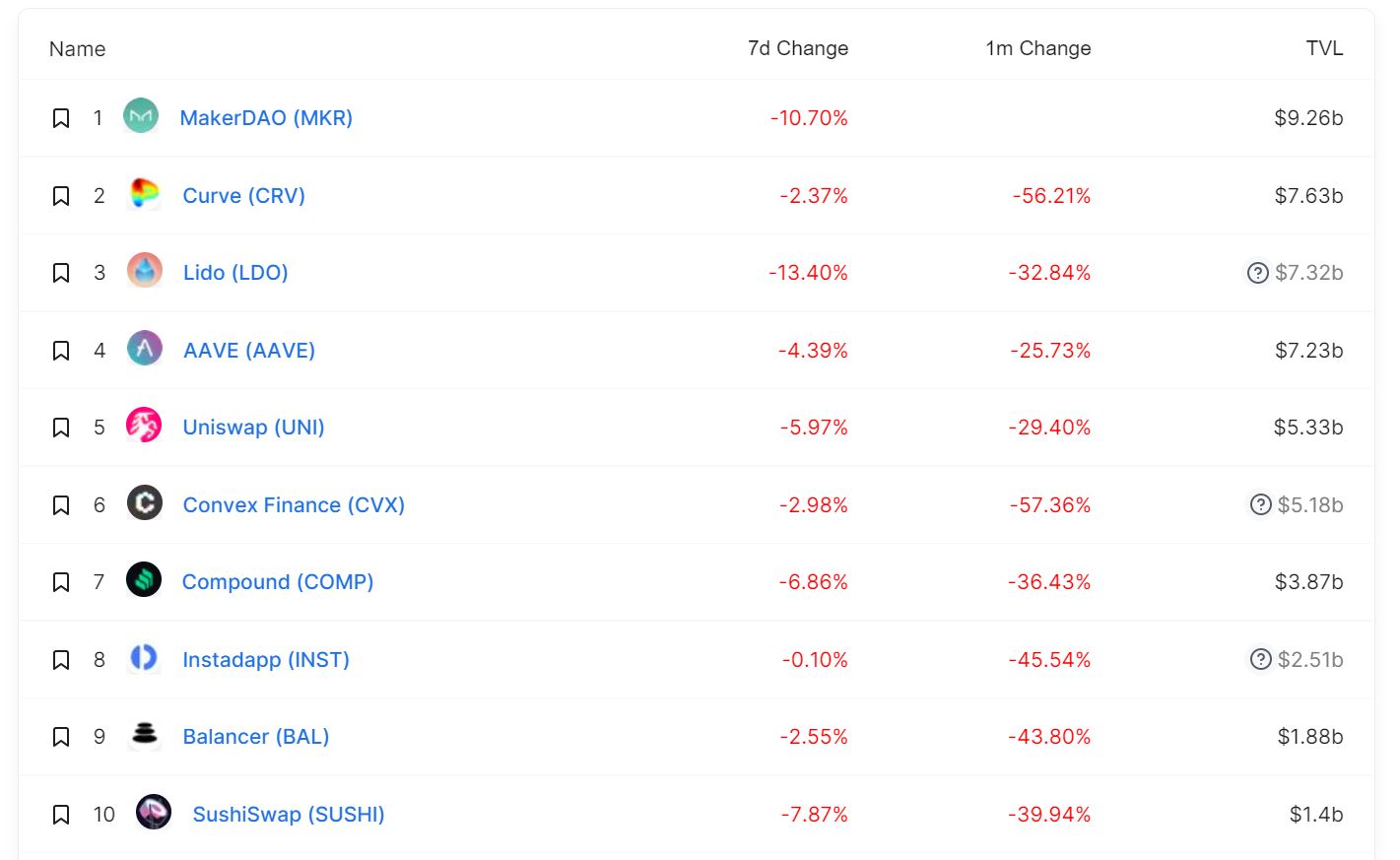

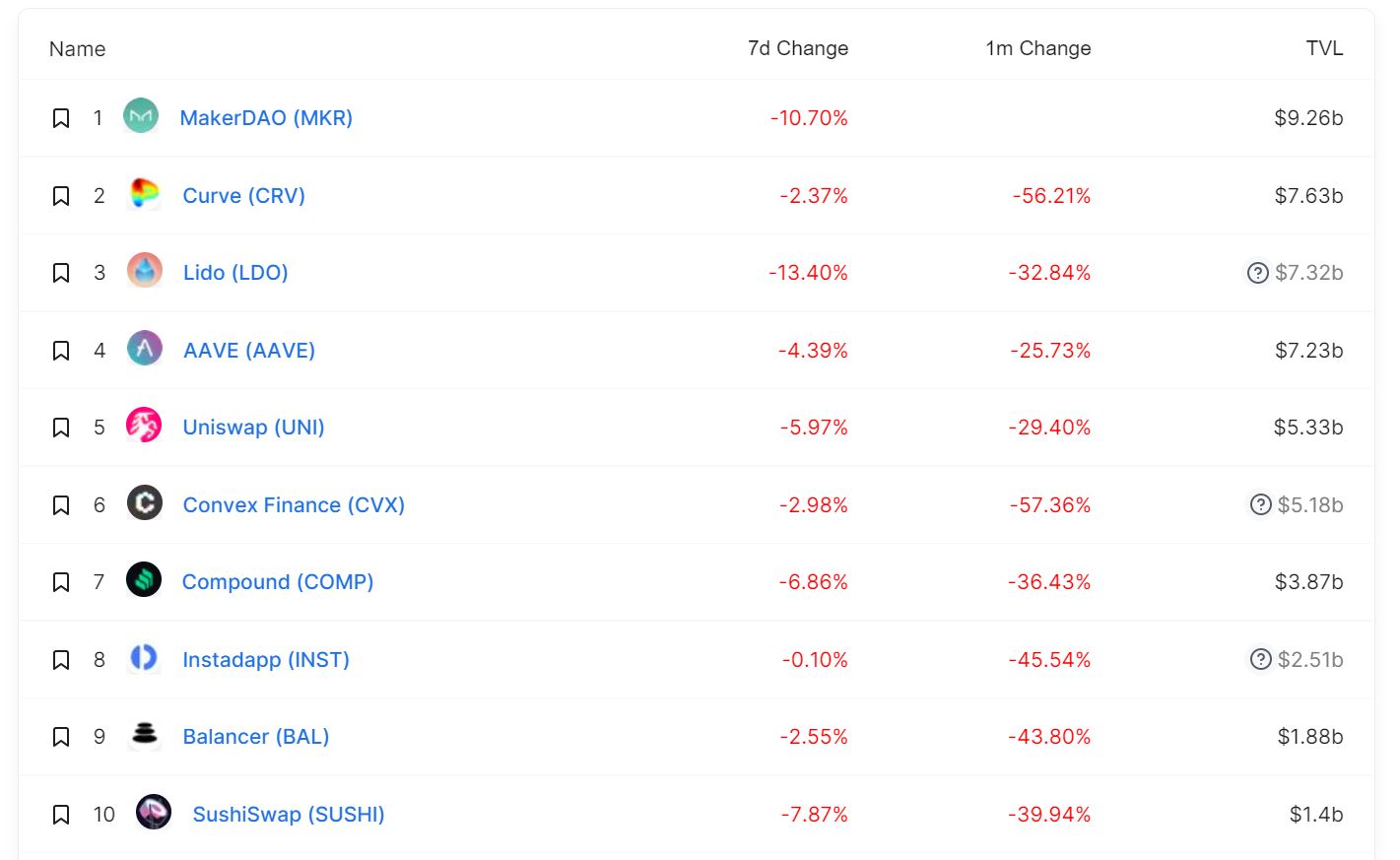

The sharp drop in the cost of ETHs also critically influences the DeFi section. According to statistics from DeFi Llama, the block worth (TVL) on Ethereum is only $ 48.three billion, down 38.37% from one month in the past. Many of the big DeFi protocols on the ETH network also encounter drops of thirty-60%.

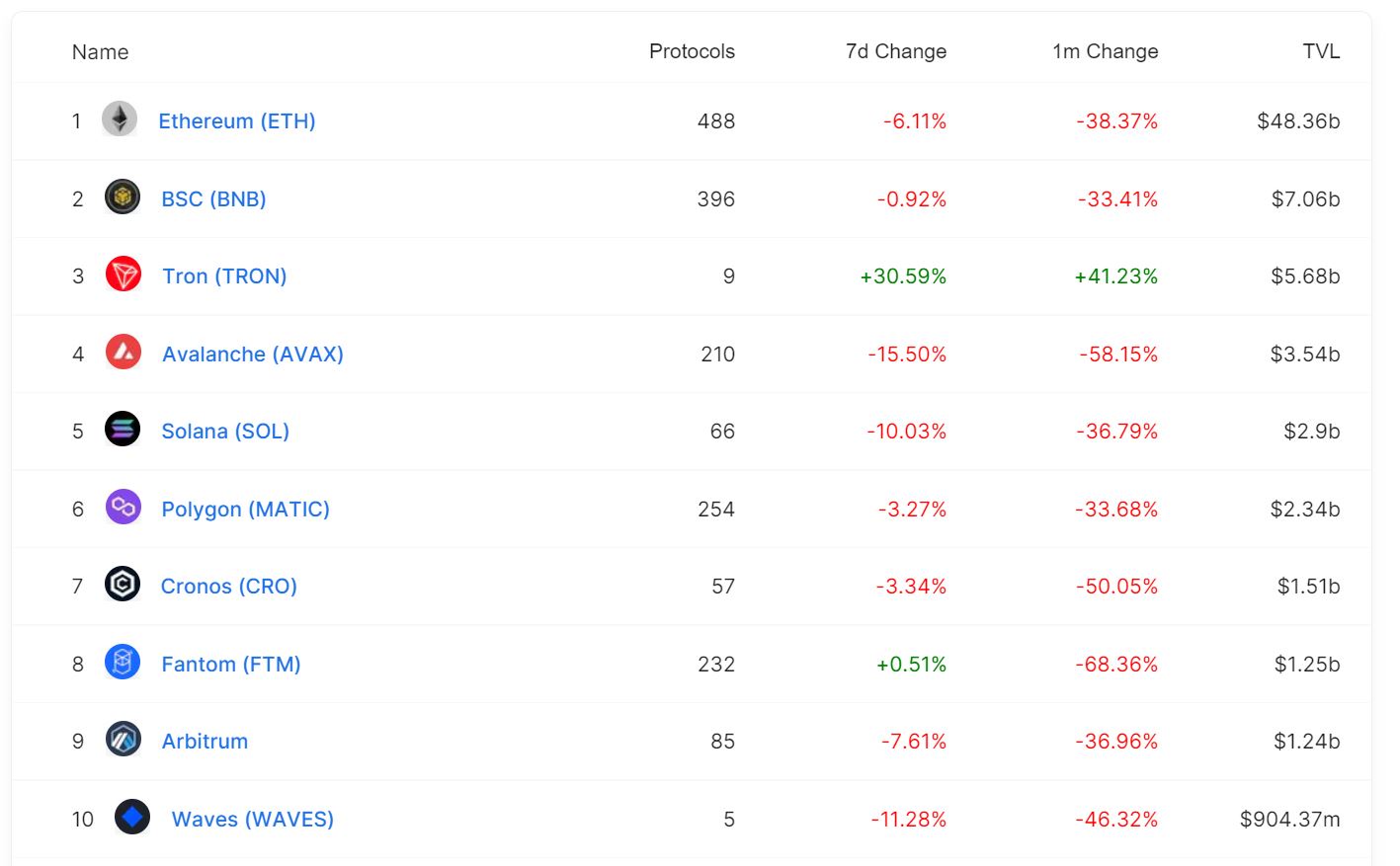

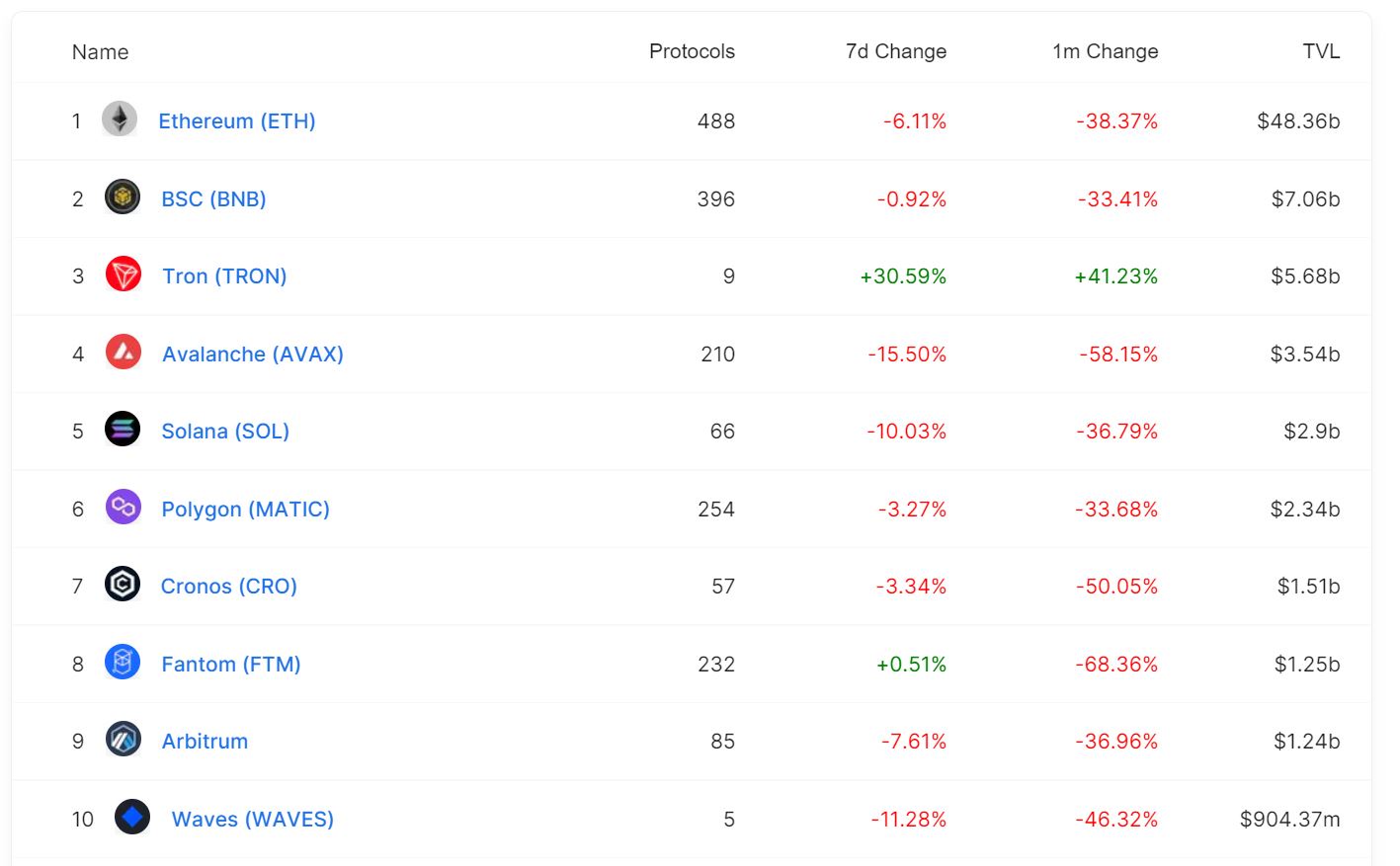

Not only Ethereum, also other big blockchain platforms this kind of as BNB Chain, Avalanche, Solana, Polygon, and so on. they recorded drops in TVL of forty-60% in worth. As for Terra, the platform that “triggered” the May industry dump, noticed TVL “fly” from $ 29 billion to $ 83 million, moving from the 2nd greatest TVL blockchain in the industry to 2nd area.

The only blockhain that has elevated TVL at the second is TRON thanks to the new USDD stablecoin launched not as well prolonged in the past.

Synthetic currency 68

Maybe you are interested:

The 2nd greatest cryptocurrency in the planet, Ethereum (ETH), suffers heavily from industry volatility, in spite of getting ready to roll out The Merge update.

At noon on May 27, the cost of ETH continued to change to $ one,712, the lowest worth degree because July 2021 and is the new very low of this 2022.

In the final seven days alone, Ethereum has misplaced additional than 15% of its worth and is owning a series of eight consecutive red candles, which has under no circumstances occurred in the seven 12 months historical past of this coin.

It seems that the information about Ethereum getting ready to improve The Merge – the merger of two present Ethereum blockchains (working with Proof-of-Work) with Ethereum two. (working with Proof-of-Stake) all around August 2022 does not they can conserve the industry. Recently, the Ethereum two. Beacon Chain also encountered a severe glitch, which delayed the dread of The Merge yet again.

Likewise, Bitcoin is as well on the way to a series of 9 week red candles, for the very first time ever. BTC within On the evening of May 26th there was a moment when it was pushed to the $ 28,019 mark, just before recovering in the $ 28,700 – $ 29,000 zone. The world’s greatest cryptocurrency even now holds a harmless distance from the 2022 very low of $ 26,700 set on May twelve, at which time the industry was heavily dumped as a consequence of the LUNA-UST crash.

Over the previous 24 hrs, above $ 517 million well worth of crypto derivative orders have been cleared, 80% of which had been prolonged orders. An sudden stage is the worth of ETH liquidated at $ 235 million, nearly double that of Bitcoin.

The sharp drop in the cost of ETHs also critically influences the DeFi section. According to statistics from DeFi Llama, the block worth (TVL) on Ethereum is only $ 48.three billion, down 38.37% from one month in the past. Many of the big DeFi protocols on the ETH network also encounter drops of thirty-60%.

Not only Ethereum, also other big blockchain platforms this kind of as BNB Chain, Avalanche, Solana, Polygon, and so on. they recorded drops in TVL of forty-60% in worth. As for Terra, the platform that “triggered” the May industry dump, noticed TVL “fly” from $ 29 billion to $ 83 million, moving from the 2nd greatest TVL blockchain in the industry to 2nd area.

The only blockhain that has elevated TVL at the second is TRON thanks to the new USDD stablecoin launched not as well prolonged in the past.

Synthetic currency 68

Maybe you are interested: