Ethereum (ETH) entered a somewhat bullish phase in early October and is at the moment approaching the $ three,800 mark. Despite the current correction, ETH customers can earn $ 53 million soon after the weekly solution expires on October 15th.

Investors do not seem to be to care about Ethereum (ETH) current underperformance versus Bitcoin (BTC). So far, ETH’s acquire has stood at 265% from the bottom considering that the May 19th crash. If ETH continues to retain stability over $ three,600 on October 15, 99% of the $ 180 million alternatives on sale will come to be worthless.

Competitors to the Ethereum good contract proceed to place strain on the primary network. Polkadot (DOT) announced when parachain auctions, new token launch help and decentralized finance (DeFi) applications will start off rolling out on DOT. Binance has also created public its programs to launch a $ one billion fund to accelerate adoption of the Binance Smart Chain ecosystem, and the cost of BNB has elevated by at least thirty% considering that the announcement.

– See additional: Cardano (ADA) “cedes the throne” to BNB, the race has begun – Binace Smart Chain (BSC) explodes

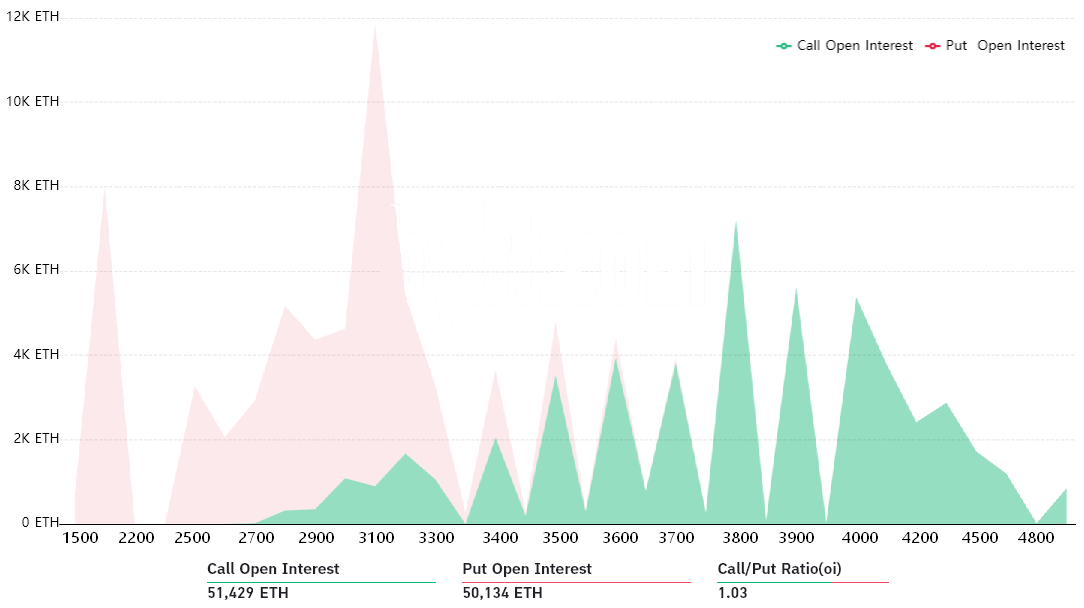

Based on the pressures over, it truly is understandable why the sellers staked 88% of their bets at $ three,300 or significantly less. The expiry date of October 15th is a fantastic stability amongst phone and place alternatives. Both sides hold about $ 180 million well worth of Ethereum alternatives, as indicated by the place-phone ratio.

Here are the 4 most very likely situations looking at ETH’s recent costs, as the imbalance tends in favor of 1 get together as the contract expires.

- USD three,300 to USD three,500: seven.450 order volume vs three.550 income volume. Net revenue brought customers $ 13 million.

- From three,500 to three,600 USD: eleven,150 order volumes versus one,900 income volumes. Net revenue brought customers $ 32 million.

- From three,600 to three,800 USD: 15,400 order volumes versus 600 income volumes. The net revenue brought customers $ 74 million.

- Over three,800 USD: 27,450 order volume vs income volume. The bulls entirely dominated when they earned $ 104 million.

However, with just more than a day just before the October 15th deadline, sellers will have a tough time holding onto Ethereum’s recent bullish cycle. Regardless of the competitors the Ethereum network faces and the large fuel charges, investor demand for decentralized finance (DeFi) and NFT seems to be ample to continue to keep ETH on an upward trend.

As of press time, ETH has not faltered in terms of cost response and is trading at $ three,806.

Synthetic currency 68

Maybe you are interested: