After just about two months in an inflationary state, the quantity of ETH burned by transaction charges has after yet again outpaced the provide from staking.

According to information from Ultrasound.income, the Ethereum (ETH) network has returned to deflation for the initial time given that early December 2022.

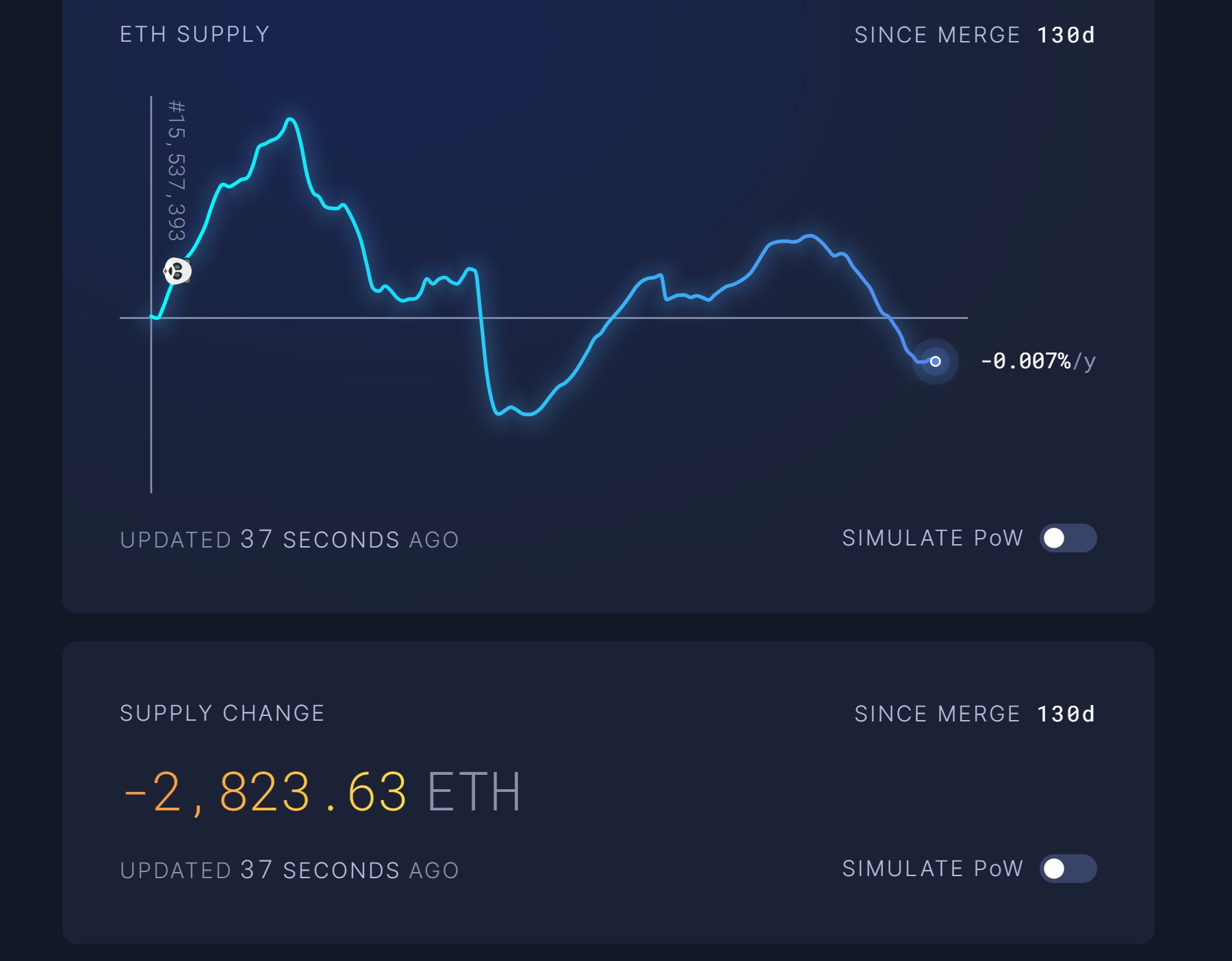

Notably, as of 07:00 on January 24, 2023, Ethereum is encountering an yearly deflation charge of .002%, with the provide of ETH diminished to more than VND two,800 given that the time of The Merge update in the middle. September 2022. Even so, this deflation is nonetheless under the .0051% of the mid-November time period, when the cryptocurrency market place seasoned extreme volatility following the collapse of the FTX exchange.

As explained by Coinlive, Ethereum just after The Merge has switched to making use of the Proof-of-Stake and staking consensus mechanism, cutting up to 90% of new coins produced in contrast to the outdated Proof-of-Work mechanism of coin mining actions. When mixed with the EIP-1559 update to burn up off some of ETH’s transaction charges, this could generate deflationary strain on the world’s 2nd biggest cryptocurrency.

Over the previous thirty days, the quantity of ETH burned has reached a lot more than 59,000 coins, most of which came from NFT protocols this kind of as OpenSea and Blur. This is a distinction from the early December time period when the options to burn up most coins have been DEX trading and on-chain ETH circulation when trading demand was at a substantial degree. At current, it can be viewed that the new NFT shopping for and offering demand is the principal purpose pushing the ETH degree to burn up yet again and generate a relief impact for the Ethereum network.

The chart of the everyday quantity of ETH burned has also viewed a slight recovery in the final month, averaging all around one,900 – two,000 ETH per day.

The cost of ETH given that the starting of the new 12 months 2023 has obviously recovered in the bullish course of Bitcoin (BTC). From $one,196 on Jan. one, ETH jumped to $one,679 at a single stage, up forty%. However, contrary to BTC, Ethereum nonetheless failed to break by way of the cost degree prior to the FTX crash in early November.

Looking back on historical information, January and February are typically fantastic occasions for ETH with lots of months of solid gains.

In Q1 2023, Ethereum will very likely make an improve in Shanghai to unlock $25 billion of ETH employed for staking. Shanghai had a check tricky fork on the testnet final evening, and if there are no sudden challenges, it will be carried out in March.

The reality that a huge quantity of ETH is about to be unlocked is forming a trend to invest in Liquid Staking tasks with the expectation that when traders get ETH back, they will place income into versatile staking options like Lido or Rocket Pool alternatively of remaining offered on the market place.

Synthetic currency68

Maybe you are interested: