Ethereum is nonetheless the most talked about by the crypto local community considering the fact that the launch of The Merge since the most essential update in Ether background has “accidentally” made an fascinating divided chain war.

What is a miner’s genuine need?

Even although the coins mining the similar algorithm with Ethereum has improved substantially immediately after the official activation of The Merge, but miners nonetheless have a really hard time picking a seriously superior ETH revenue undertaking to transfer the excavation do the job to conserve the value of its mining rig.

However, the possibility for miners appears to glow with hope that the Ethereum Proof-of-Work fork chain efficiently took area on the evening of September 15, kicking off the race for marketplace share amongst these blockchains for a broad assortment of end users and miners.

Before we get to the latest state of Ethereum forks, it is important to clarify why miners seem to be to want Ether in excess of other PoW tasks.

In addition to the revenue story just talked about, Ethereum has been a wonderful brand for in excess of seven many years for miners and the coverage that contributes to the power of the ETH network is really massive. Therefore, they want to have a viable substitute on the Ethereum chain irrespective of the switch from ETH to PoS.

Hashrate and marketplace share of Ethereum forks

First, the greatest and most effective recognized local community fork closely linked to Ethereum is Ethereum Classic (And so on), which at present has a hashrate of 263.67 TH / s, the highest in ETC’s improvement background.

At the similar hashrate as over, And so on is trading at a cost of $ 33.97 at press time with $ four.six billion in marketplace cap.

Next up is EthereumPoW (ETHW) – the fork implemented by the undertaking of the similar title to proceed “maintaining” ETH’s standard PoW consensus mechanism. Although it has only been operating for much less than 24 hrs, the ETHW hashrate is reaching a quite higher degree: 73.72 TH / s.

With a hashrate of 73.72 TH / s, the trading cost of ETHW is moving all-around 13 USD.

Finally, there is EthereumHonest (ETF), one more forked edition of Ethereum’s PoW supported and renamed by the Poloniex exchange.

Poloniex has renamed #ETHW how @EthereumFair #ETF and resume trading on the ETF markets (USDT, USDD, ETH) on September 15th at one:15 pm (UTC).

The trading background of the ETHW markets is inherited from the corresponding ETF markets.

Details: https://t.co/CobIKrUnfK pic.twitter.com/aTAGWpSqus

– Exchange Poloniex (@Poloniex) September 15, 2022

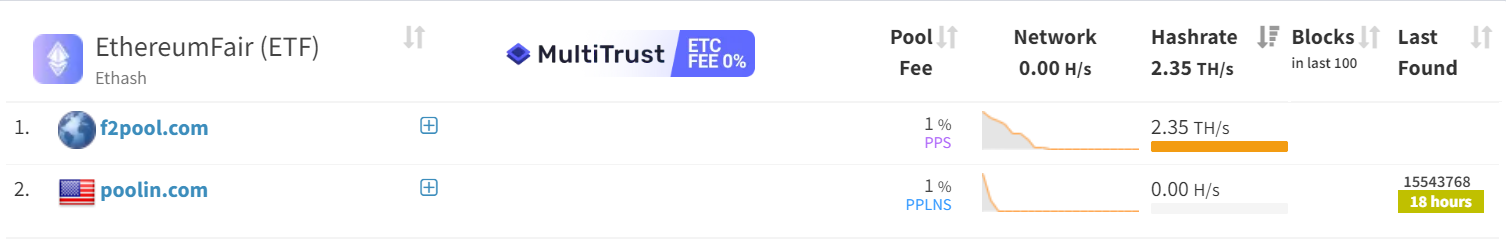

Currently, only two significant pools such as f2pool and Poolin participate in the mining of EthereumHonest, the hashrate is three.35 TH / s. However, till noon on September sixteen, Poolin withdrew from this mining pool, as a result dragging the ETF’s hashrate to just two.35k / sec.

Despite the drop in the hashrate, the ETF cost has unexpectedly improved somewhat from a reduced of USD 17 to USD 18.53 in the previous 24 hrs.

What will the long term fork of Ether seem like?

Before Ethereum efficiently implemented The Merge and fully eradicated guide mining, the ETH hashrate held at 740.88 TH / s.

This implies that if you include up the hashrates of the forks just talked about, they all signify about 45.eight% of Ethereum’s hashrate. In terms of capitalization, it is nonetheless rather reduced, falling inside of just five% of ETH’s latest marketplace capitalization of $ 180.seven billion.

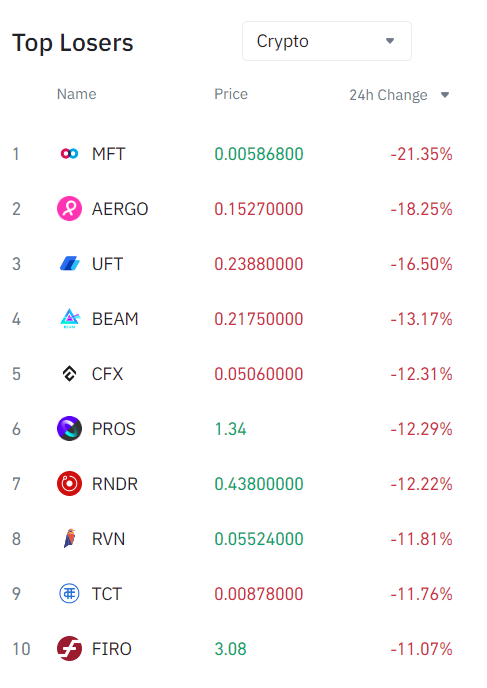

In basic, in terms of hashrate, ETH forks have an benefit in excess of coins that share the similar algorithm with ETH or comply with other PoW consensus mechanisms. Typically Ravencoin (RVN), Firo (FIRO) or Conflux (CFX).

This is also the cause why immediately after the surge just occurred The Merge, these tasks right away fell additional in the rankings on the Binance exchange to make way for EthereumPoW (ETHW) and EthereumHonest (ETF).

However, in terms of lengthy-phrase pricing, it is nonetheless unattainable to conclude whether or not EthereumPoW and EthereumHonest will be sustainable with the marketplace since a related situation of Bitcoin’s “crypto king” has occurred in the previous. Many distinctive forks, most notably Bitcoin Cash (BCH), triggered a storm at 1st, but swiftly died down later on.

To place it bluntly, on the other hand, the latest forks of Ethereum can be viewed as a way in which significant institutions, exchanges and specific segments of miners are taking benefit of the “opportunity” of Ethereum’s The Merge to build a new game to their benefit, when the stage of maturity will be progressively degraded.

Ethereum Classic (And so on) – Ethereum’s most prosperous “sister” undertaking, has also been questioned by numerous authorities about its lengthy-phrase stability due to the lack of numerous utilities to be employed on the blockchain, which has develop into a “fad”. or temporarily termed “shelter” for miners to recover the value of capital and unloading of tools.

Synthetic currency 68

Maybe you are interested: