According to a new review primarily based on Metcalfe’s law, the industry price tag of ETH is at present 27% reduce than its genuine worth.

Research: Ethereum is undervalued by 27% in contrast to its genuine worth

Research: Ethereum is undervalued by 27% in contrast to its genuine worth

Valuation and price tag prediction are often sizzling subjects in the cryptocurrency industry. A array of analysts, from classic to crypto, are striving to come up with valuation versions for main coins this kind of as BTC, ETH, Layer-one, Layer-two,…

Most not long ago, the exploration-targeted joint venture in between Republic Crypto and Re7 Capital, RxR, just launched an Ethereum (ETH) pricing model primarily based on Metcalfe’s Law that has attracted a great deal of local community focus.

The RxR staff just presented their hottest exploration:

✨On the valuation of Ethereum✨https://t.co/1RRhUq4W19

— Republic Crypto (@RepublicCrypto) September 13, 2023

Second Metcalfe’s law (ML – Metcalfe’s Law), the worth of the network is proportional to the square of the quantity of customers on the network. Therefore, the far more energetic and interactive genuine customers are in a network, the far more important that network is. Metcalfe’s law was initially applied in the telecommunications market and later on utilized to social media and technologies. It has now expanded into the crypto context.

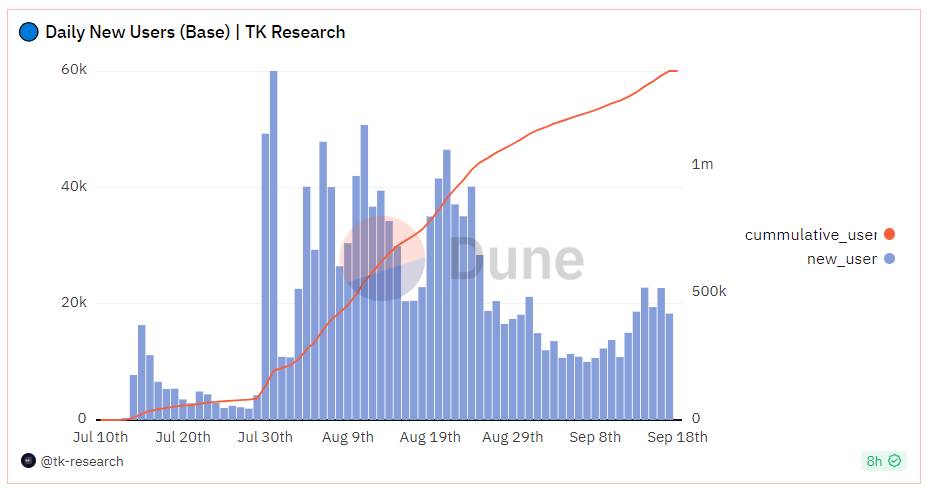

RxR’s ETH pricing model utilizes Metcalfe by combining Ethereum’s mainnet consumer base and ever-developing Layer-two consumer base. Especially with L2 developing as a Base attracting one.37 million newcomers, in accordance to the information TK Search summarized over Dune evaluation.

Source: TK exploration on Dune Analytics

Source: TK exploration on Dune Analytics

RxR analyst Lewis Harland explained:

“The new ML index predicts ETH valuation more accurately than the old index, because the new ML takes into account the user base of Ethereum Layer-2 networks.”

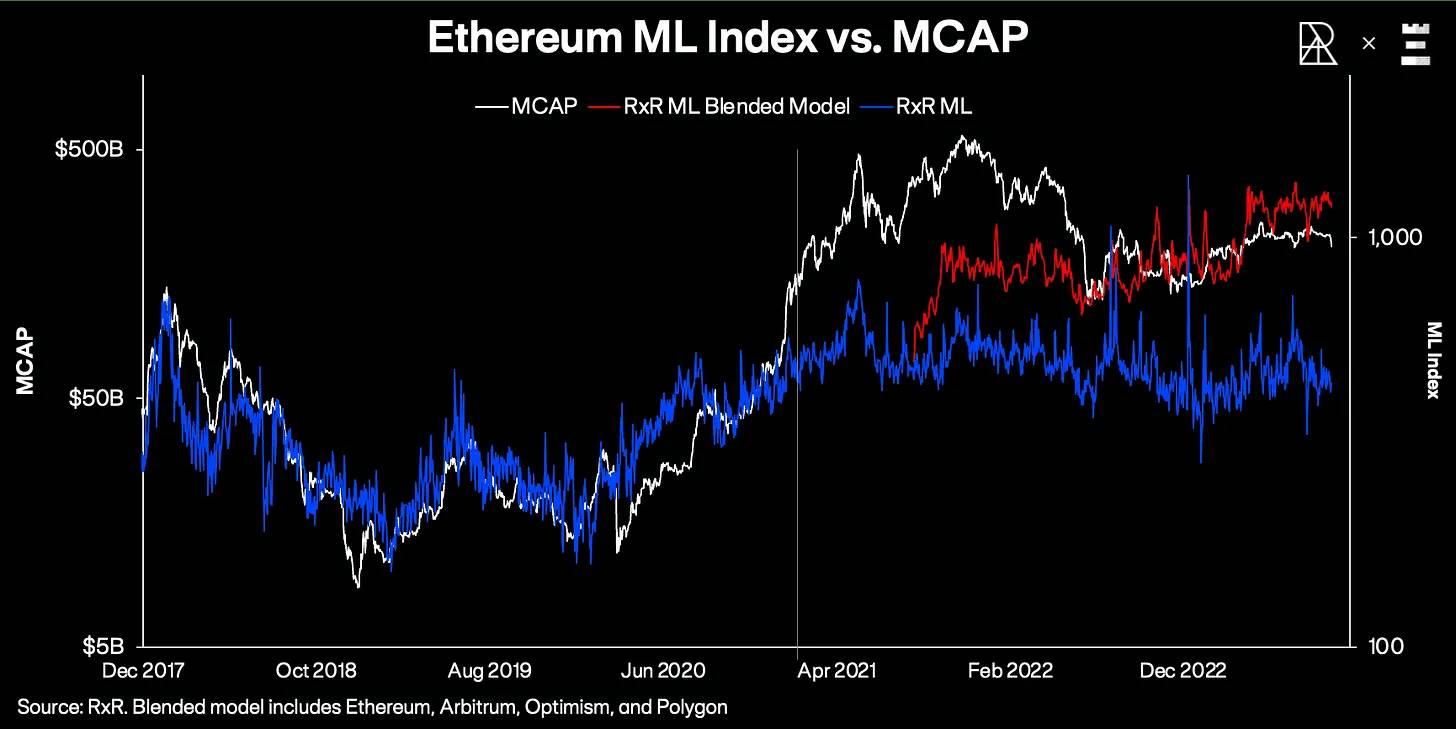

And in accordance to the new ML Index, RxR charges Ethereum at 275 billion bucks, assuming there is no even further development of the recent consumer base. This implies that at the time of creating the capitalization of ETH is significantly less than $200 billion 27% significantly less in contrast to the genuine worth.

ETH capitalization (white line) versus ETH valuation underneath New ML (red line). Source: RxR

ETH capitalization (white line) versus ETH valuation underneath New ML (red line). Source: RxR

This also implies that ETH need to trade all-around USD two,237.

1h chart of the ETH/USDT pair on Binance at three.30pm on September 18, 2023

1h chart of the ETH/USDT pair on Binance at three.30pm on September 18, 2023

Layer-2s are actually the critical stage when applying Metcalfe. Not only Base, other tasks this kind of as Arbitrum, Optimism or zkSync have also left their mark in the race to appeal to customers. They all produce the undeniable worth of the Ethereum ecosystem.

Harland commented:

“The biggest milestone was in April 2021, when extension networks started contributing to the Ethereum mainnet block space. Curve, Sushiswap, Decentraland, and Aave launched on Layer-2 Polygon around that time , bringing TVL over that period to $10 billion.”

Fast forward to the existing, Ethereum now has 250 dApps with a TVL in excess of $one million. In terms of Layer-two alone, there are far more than thirty tasks big and little, with a mixed TVL of $ten billion.”

Coinlive compiled

Maybe you are interested: