Ethereum (ETH), the leading cryptocurrency among altcoins, has seen a significant surge over the past week, climbing 29% and reaching a three-month high of $3,184.

This rally has fueled speculation that ETH could soon reach its year-to-date high of $4,095. As market sentiment increases and investor confidence strengthens, several factors could propel Ethereum to new highs in the coming weeks.

Ethereum Holders Not For Sale

Ethereum holding times have increased by 40% in the past seven days. This measure evaluates how long a coin stays in an address before being moved or sold.

The increase in currency holding periods indicates growing long-term confidence among investors. When holders choose not to sell, this demonstrates confidence in the future value of Ethereum and minimizes the impact of short-term price fluctuations. This often leads to price stability and can stimulate demand because there is less coin to trade.

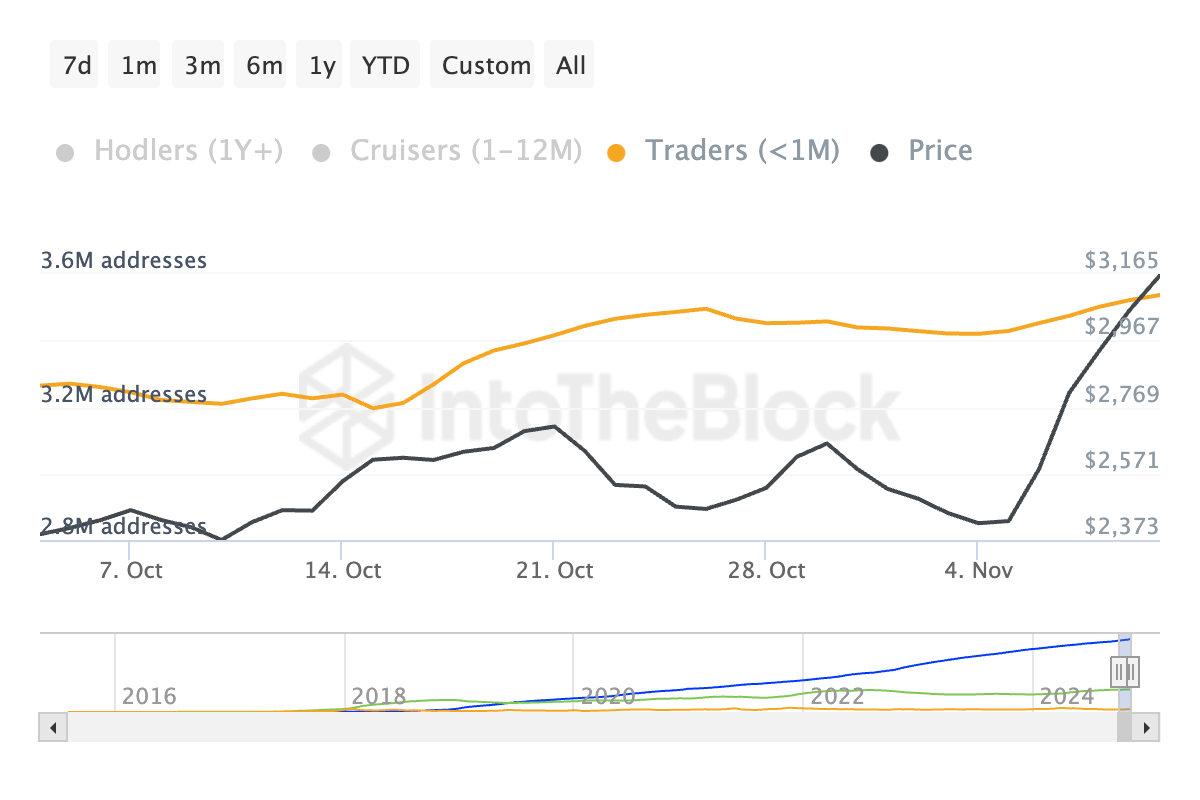

Besides long-term investors, short-term Ethereum Holders (STHs) have also shown a notable behavioral shift, choosing to hold on to their assets instead of selling. Over the past month, STHs — those who have held their coins for less than 30 days — have increased their holding period by 9%, a sign of growing confidence in the asset.

This trend is especially important, as short-term holders control a significant portion of Ethereum’s circulating supply. When they choose to hold on to their coins, it reduces the selling pressure in the market. This transition further strengthens the bullish outlook for ETH, as the number of coins available for sale is immediately reduced.

Furthermore, Ethereum-based products have attracted significant attention from market participants. In report Recently, digital asset research firm CoinShares found that Ethereum-backed crypto products saw a notable inflow of $157 million over the past week — the largest since their launch. ETFs in July this year.

“Ethereum, which has been languishing, saw an inflow of $157 million over the past week, the largest since the ETFs launched in July this year, marking a significant improvement in sentiment,” the company said. research company said.

ETH Price Forecast: 4,000 USD Within Reach

If the uptrend continues, Ethereum price is likely to establish support at $3,103. This support floor will pave the way for a rally to $3,337. A successful break through this level would clear the next hurdle at $3,671, paving the way for Ethereum’s rally towards a yearly high of $4,095.

However, if selling pressure intensifies, this bullish outlook could be nullified. In that case, the price of ETH could drop below $3,000, potentially falling to around $2,869.