Nearly $ one.61 billion really worth of Ethereum (ETH) has left cryptocurrency exchanges because the start off of the yr, ahead of the likely total consolidation of the platform in the direction of the arrival of Proof-of-Stake (PoS).

In specific, ETH reserves on exchanges have fallen to their lowest degree because September 2018, signaling a robust signal that traders are ready to hold on to Ether in hopes that the cost will rise in 2022.

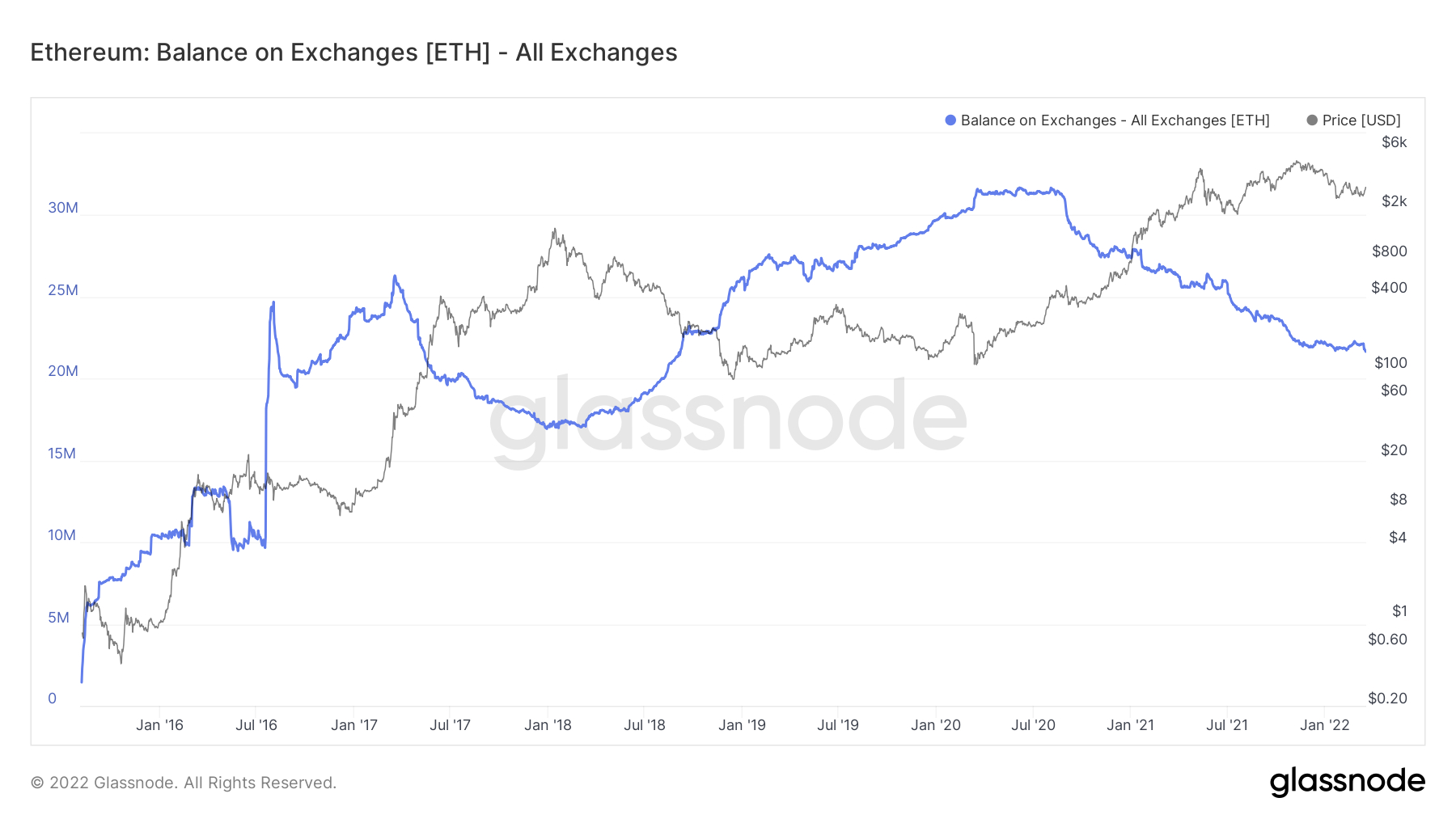

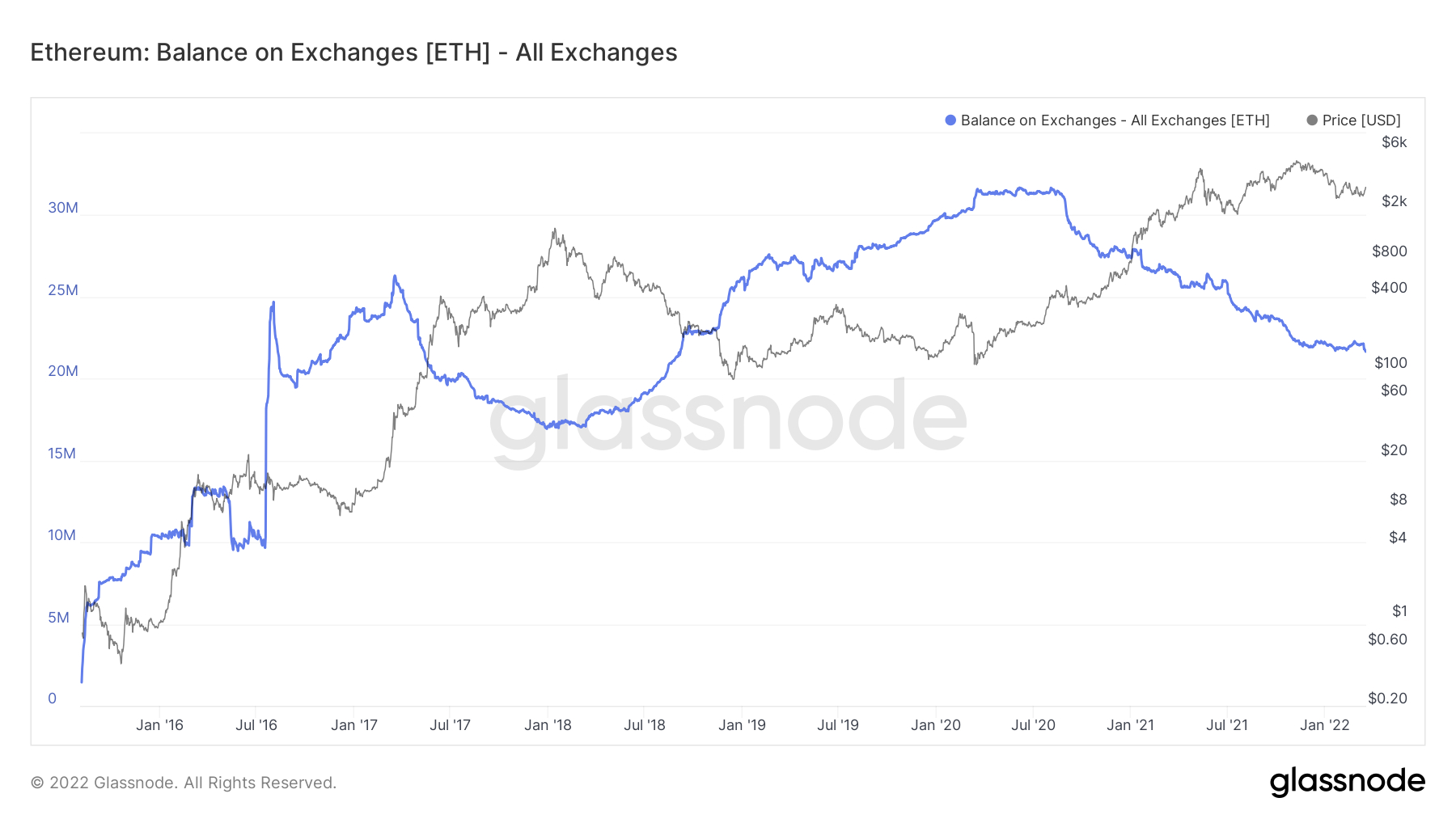

According to information launched by Glassnode, regardless of only staying just about three months in 2022, just about 550,000 ETH, really worth about one.61 billion bucks, are leaving the centralized trading platforms extremely swiftly. This large retracement decreased Ethereum’s net stability on the exchange to 21.72 million ETH, from a record 31.68 million ETH in June 2020.

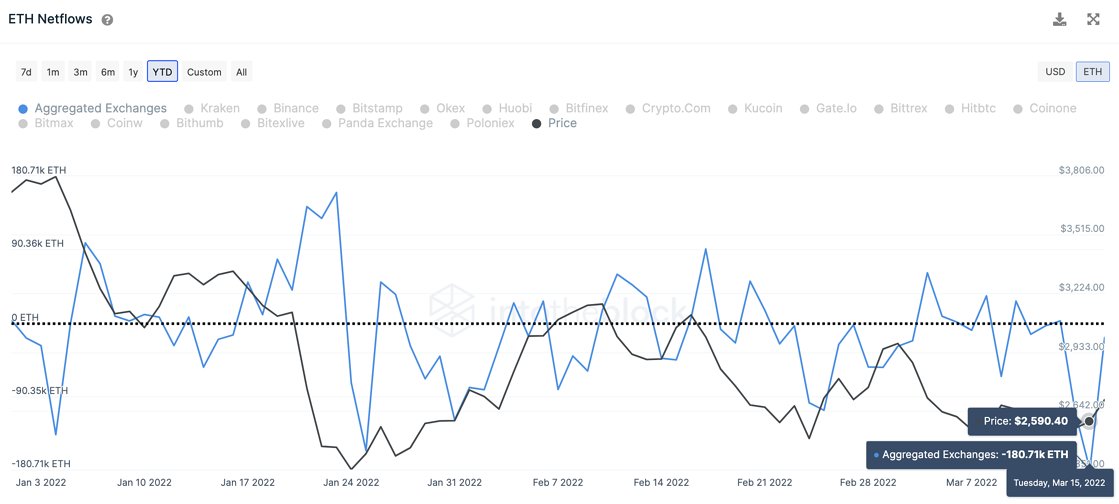

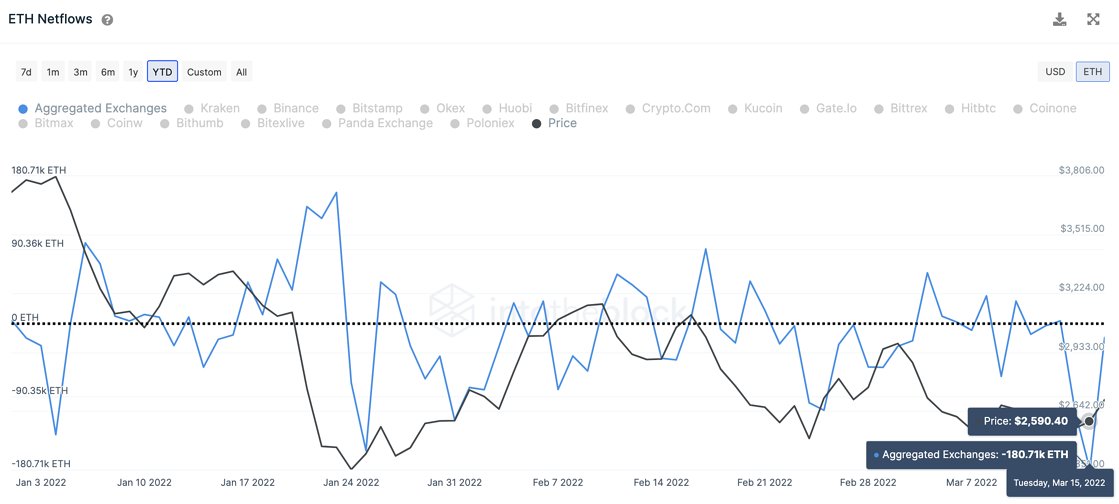

Interestingly, in excess of thirty% of all ETH withdrawals from trades recorded in 2022 occurred earlier this week. Notably, extra than 180,000 ETH was additional to investor portfolios on March 15, bringing the weekly net movement worth to in excess of $ 500 million because March 18, in accordance to statistics from IntoTheBlock. On the other hand, IntoTheBlock also mentioned that the improve in Ether withdrawals coincided with the transfer of about 190,000 ETH to the staking pools for the Eth2 contract (now modified in consensus degree) as portion of the Lido Finance (LIDO ).

In essence, Lido is an on-demand staking platform that will allow customers to conquer the issues related with ETH keying, which includes a minimal staking necessity of 32 ETH. Furthermore, Lido proposes to remedy the trouble of capital efficiency by issuing stETH, a cryptographic edition of ETH in staking. In early March, Lido acquired $ 70 million from the giant a16z.

– See extra: Using DeFi: Experience Lido Finance (LDO) – The greatest Ethereum two. staking option

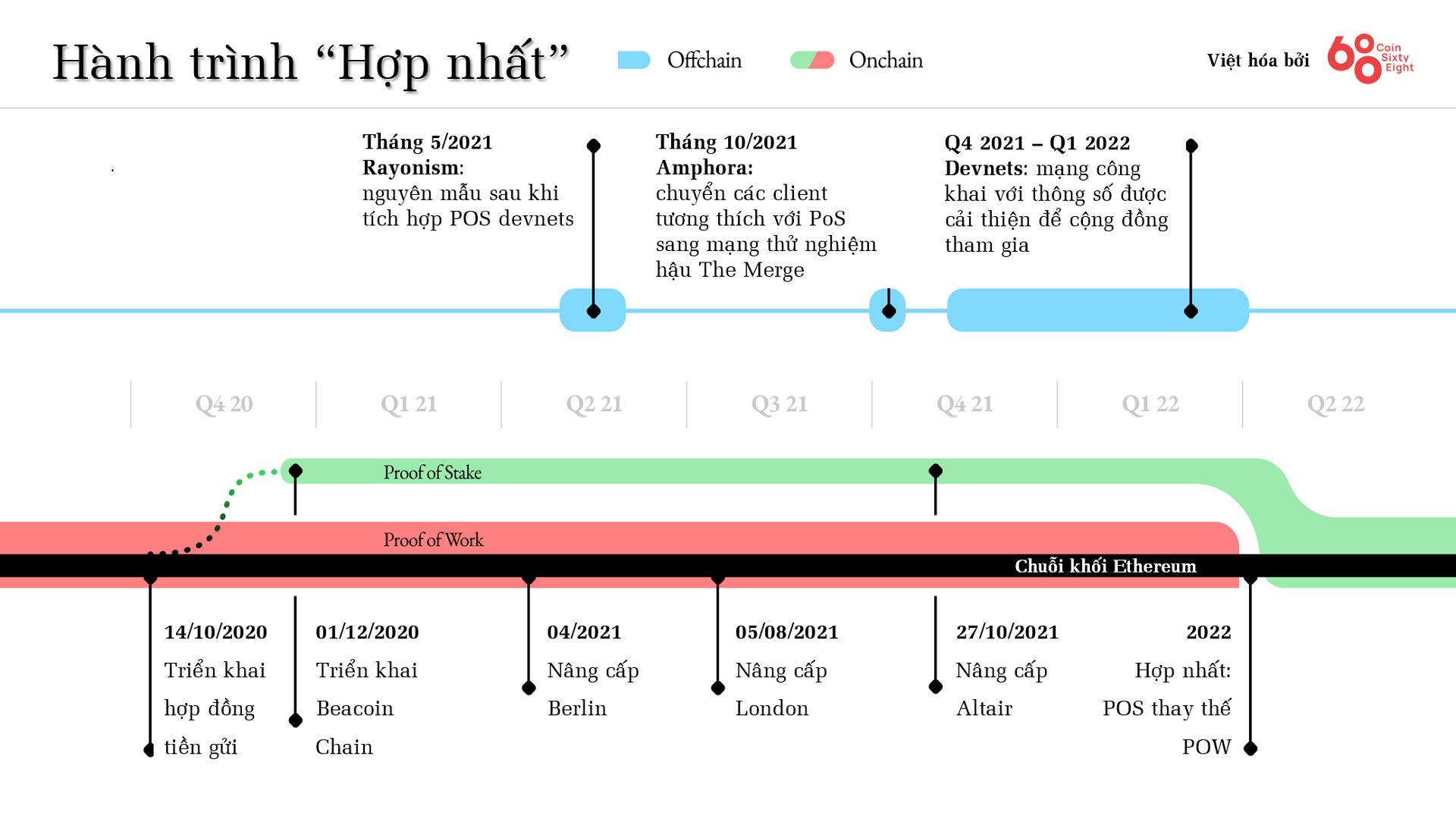

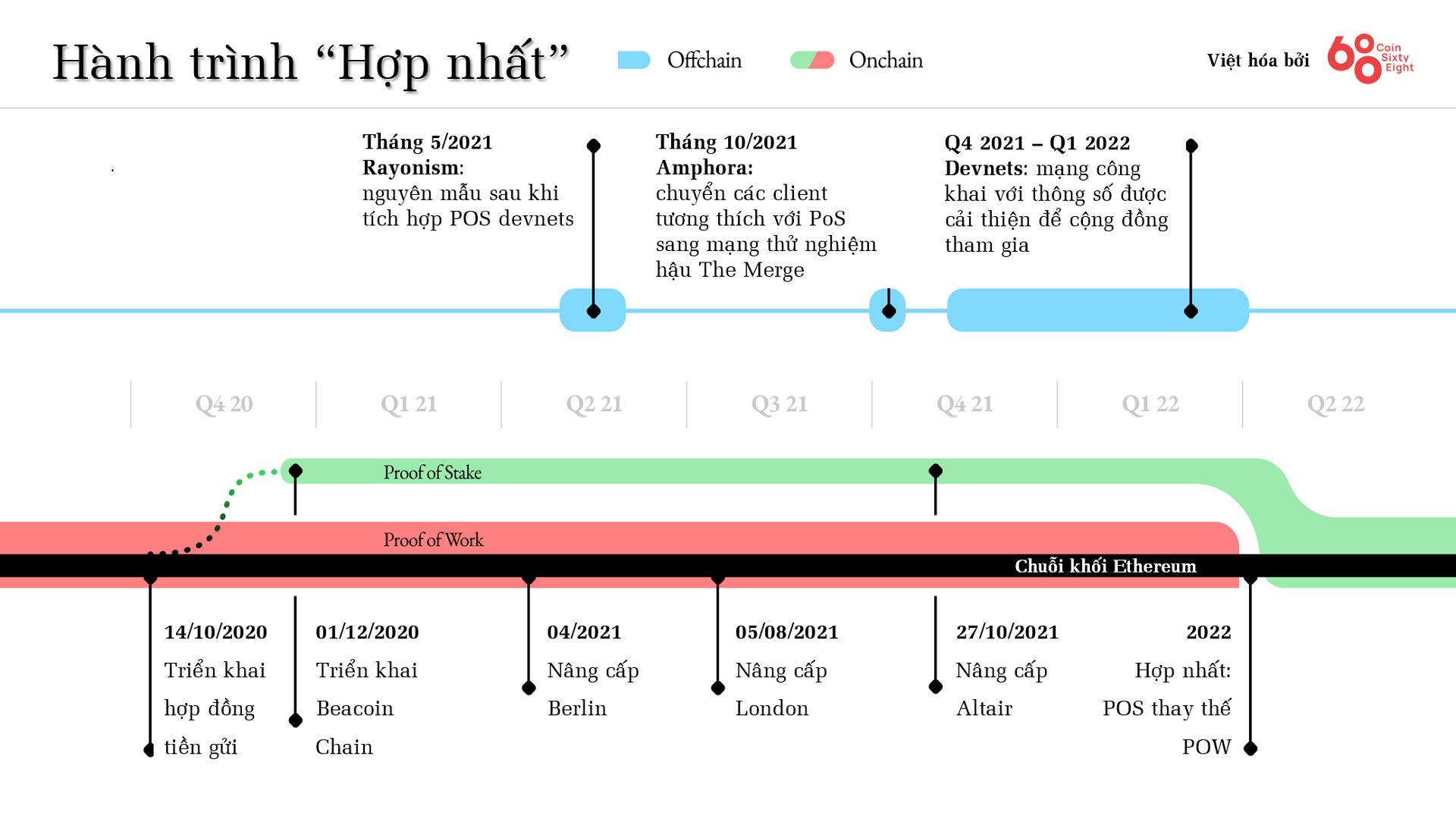

Another cause to describe the latest wave of investor “lust” is the good results of the Kiln testnet, the most up-to-date testnet launched by the ETH staff final week to generate a reliable premise, most very likely for the official launch of the merger occasion. ” The Merge “.

As evidenced by the reality that in excess of the previous thirty days, traders have additional extra than one million ETH to the consensus degree, regardless of the industry even now staying rather perturbed by Bitcoin’s unpredictable movements, resulting in a significant affect on the cost of ETH. . Additionally, Ethereum’s gasoline costs also dropped to a six-month lower, due to the short-term discouragement and lack of attractiveness coming from the two the NFT and DeFi area.

Especially immediately after the sudden departure of DeFi “godfather” Andre Cronje and a series of flash loan DeFi attacks that are exhibiting indicators of returning, threatening users’ assets, have brought on very significant barriers to the psychology of the latest trader, resulting in them to turn into much less interested in this discipline. Overall, regardless of the over issues, the on-chain index at press time confirmed that numerous Ether out of energetic provide improved considerably.

Synthetic currency 68

Maybe you are interested:

Nearly $ one.61 billion really worth of Ethereum (ETH) has left cryptocurrency exchanges because the start off of the yr, ahead of the likely total consolidation of the platform in the direction of the arrival of Proof-of-Stake (PoS).

In specific, ETH reserves on exchanges have fallen to their lowest degree because September 2018, signaling a robust signal that traders are ready to hold on to Ether in hopes that the cost will rise in 2022.

According to information launched by Glassnode, regardless of only staying just about three months in 2022, just about 550,000 ETH, really worth about one.61 billion bucks, are leaving the centralized trading platforms extremely swiftly. This large retracement decreased Ethereum’s net stability on the exchange to 21.72 million ETH, from a record 31.68 million ETH in June 2020.

Interestingly, in excess of thirty% of all ETH withdrawals from trades recorded in 2022 occurred earlier this week. Notably, extra than 180,000 ETH was additional to investor portfolios on March 15, bringing the weekly net movement worth to in excess of $ 500 million because March 18, in accordance to statistics from IntoTheBlock. On the other hand, IntoTheBlock also mentioned that the improve in Ether withdrawals coincided with the transfer of about 190,000 ETH to the staking pools for the Eth2 contract (now modified in consensus degree) as portion of the Lido Finance (LIDO ).

In essence, Lido is an on-demand staking platform that will allow customers to conquer the issues related with ETH keying, which includes a minimal staking necessity of 32 ETH. Furthermore, Lido proposes to remedy the trouble of capital efficiency by issuing stETH, a cryptographic edition of ETH in staking. In early March, Lido acquired $ 70 million from the giant a16z.

– See extra: Using DeFi: Experience Lido Finance (LDO) – The greatest Ethereum two. staking option

Another cause to describe the latest wave of investor “lust” is the good results of the Kiln testnet, the most up-to-date testnet launched by the ETH staff final week to generate a reliable premise, most very likely for the official launch of the merger occasion. ” The Merge “.

As evidenced by the reality that in excess of the previous thirty days, traders have additional extra than one million ETH to the consensus degree, regardless of the industry even now staying rather perturbed by Bitcoin’s unpredictable movements, resulting in a significant affect on the cost of ETH. . Additionally, Ethereum’s gasoline costs also dropped to a six-month lower, due to the short-term discouragement and lack of attractiveness coming from the two the NFT and DeFi area.

Especially immediately after the sudden departure of DeFi “godfather” Andre Cronje and a series of flash loan DeFi attacks that are exhibiting indicators of returning, threatening users’ assets, have brought on very significant barriers to the psychology of the latest trader, resulting in them to turn into much less interested in this discipline. Overall, regardless of the over issues, the on-chain index at press time confirmed that numerous Ether out of energetic provide improved considerably.

Synthetic currency 68

Maybe you are interested: