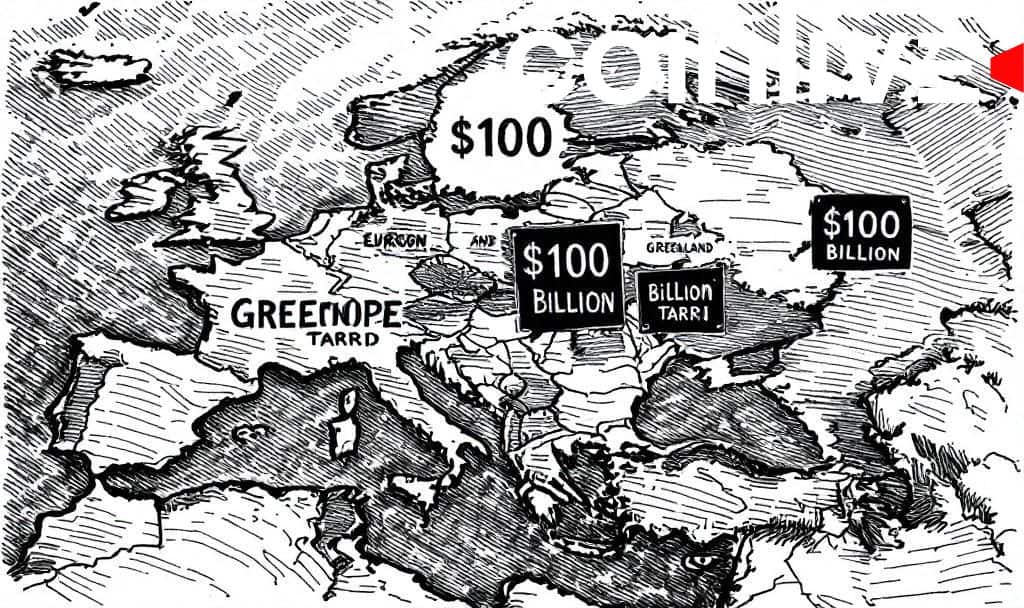

- EU plans $100 billion retaliation against US after tariff threats.

- US threats target eight European countries over Greenland.

- EU-US trade deal faces suspension amid rising tensions.

The EU is preparing up to $100 billion in tariffs and market restrictions on US companies, a potential response to US imposed tariffs on European countries starting February 2026.

This escalation could challenge transatlantic trade relations, potentially affecting sectors beyond agriculture. Economic tensions may influence market conditions, although cryptocurrency impacts remain unverified at this stage.

EU Plans Retaliatory Tariffs

The European Union is preparing up to $100 billion in tariffs and potential market restrictions on US companies. This move comes as a response to US tariff threats concerning eight European countries over Greenland disputes.

US President Donald Trump announced new tariffs on social media, impacting imports from European countries starting February 2026. The European Commission, under President Ursula von der Leyen, considers the trade deal at risk due to these developments. “The trade deal with the US is now at risk due to recent developments,” von der Leyen noted. Source

The potential EU tariffs could impose additional costs on US industries, while EU countries face increased export expenses. Agricultural exports could see billions in added costs if US tariffs are implemented.

Economically, the EU’s retaliatory measures might impact key sectors such as aircraft and autos, affecting bilateral trade. Political implications include stalled trade agreement discussions as tensions escalate between the regions.

The EU could invoke the Anti-Coercion Instrument as a countermeasure, potentially affecting market access for US goods. This mechanism, adopted in 2023 but yet unused, aims to protect EU interests through diplomatic negotiations.

Historically, similar trade disputes have led to economic shifts and policy changes. The current situation could influence future EU-US negotiations, particularly in sectors crucial to both economies, such as aviation and automotive industries. Reciprocal Trade and Tariffs Overview