Europe’s biggest asset manager, Amundi, is contemplating providing NFT as an investment possibility.

According to a statement by Amundi’s Chief Investment Officer Vincent Mortier, Europe’s biggest asset manager with in excess of $ two trillion in assets below management (AUM) is contemplating getting into the NFT market place and providing consumers the chance to invest. in this spot. He mentioned that Amundi has not nonetheless finalized how the firm will enter the NFT area, but is wanting at it from various perspectives.

“Ultimately we can’t rule out the likelihood that the NFT will also grow to be an investable asset. Furthermore, Amundi is evaluating no matter if there is a answer to invest in corporations that have a robust partnership with NFT. “

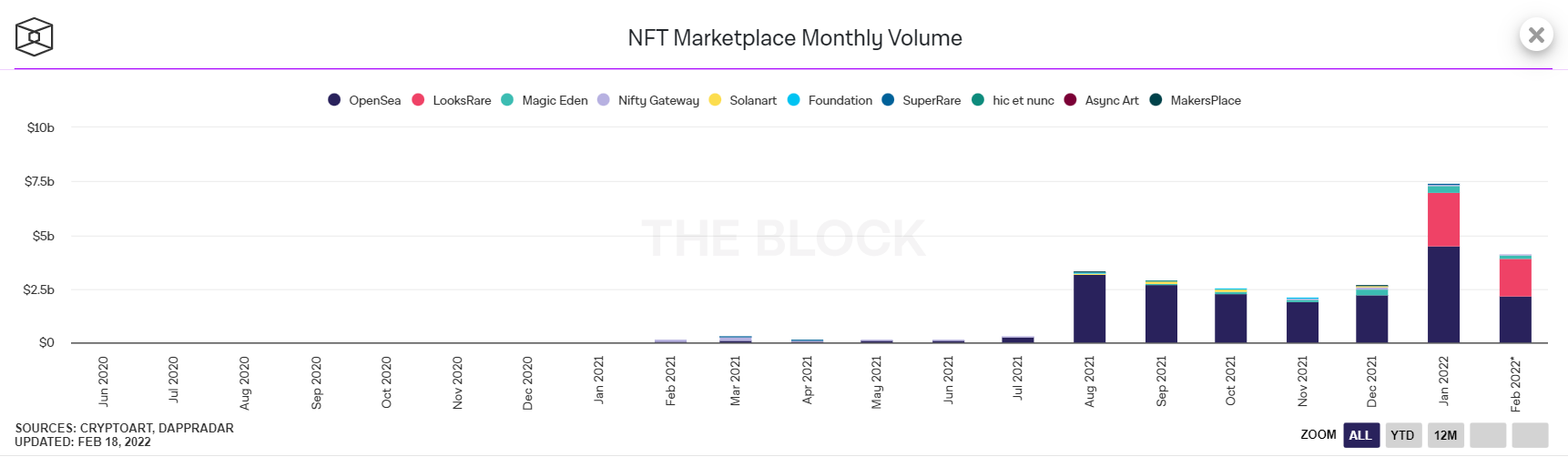

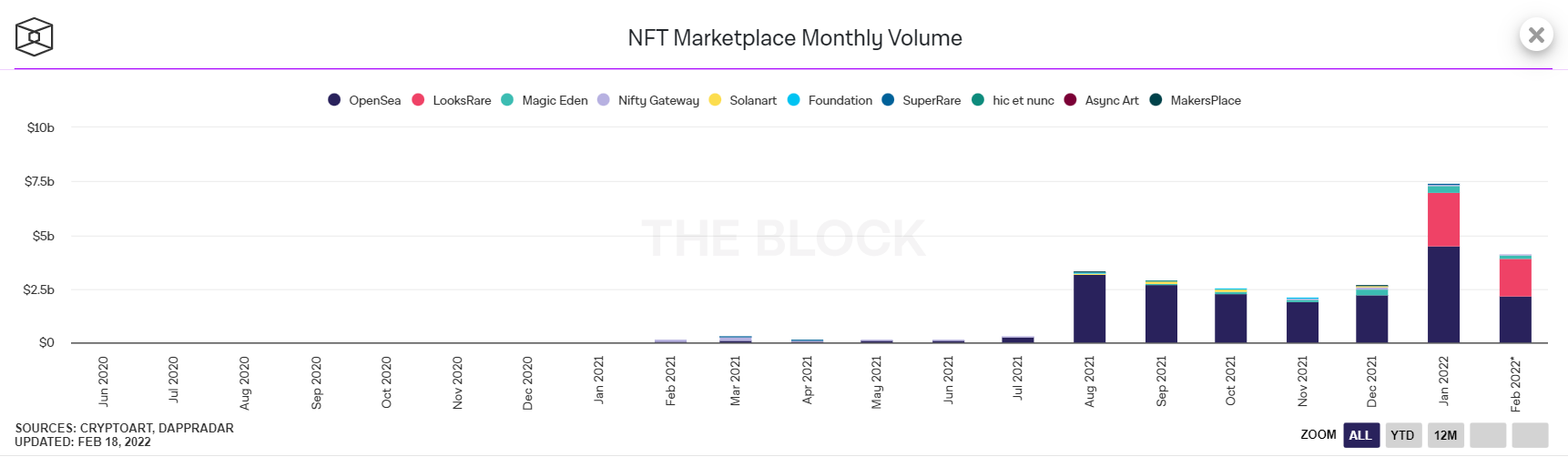

Furthermore, Mortier even further unveiled that the firm is also contemplating the possibility of developing a focused fund solely to emphasis on investing in NFTs. Based on the explosive development of the NFT market place in 2021, with a trading volume of in excess of $ 23 billion, Mortier says that NFT will be the most promising spot in the cryptocurrency market place in the close to potential.

Mortier’s argument is fully legitimate when contemplating the overview of the advancement of the cryptocurrency business starting up this 12 months, NFT is the most important obstacle to supporting the whole market place. See how OpenSea broke record NFT trading volume in January alone, entirely mind-boggling their journey so far, getting efficiently raised $ 300 million, at 1 valuation. The $ 13.three billion large or the entry of a wide variety of huge common organizations is ample to show just how robust the “heat” of NFT is.

However, Mortier mentioned Amundi’s views on cryptocurrencies continue to be unchanged regardless of openness on NFT advances. Previously, Amundi had a rather conservative see of cryptocurrencies in basic and DeFi in certain. Even the economic giant has warned its consumers not to invest in cryptocurrencies due to the fact it is an asset that has definitely no intrinsic worth.

“On cryptocurrencies, we have not transformed our company stance. Cryptocurrencies are as well speculative and there are quite a few query marks surrounding them. “

Synthetic currency 68

Maybe you are interested:

Europe’s biggest asset manager, Amundi, is contemplating providing NFT as an investment possibility.

According to a statement by Amundi’s Chief Investment Officer Vincent Mortier, Europe’s biggest asset manager with in excess of $ two trillion in assets below management (AUM) is contemplating getting into the NFT market place and providing consumers the chance to invest. in this spot. He mentioned that Amundi has not nonetheless finalized how the firm will enter the NFT area, but is wanting at it from various perspectives.

“Ultimately we can’t rule out the likelihood that the NFT will also grow to be an investable asset. Furthermore, Amundi is evaluating no matter if there is a answer to invest in corporations that have a robust partnership with NFT. “

Furthermore, Mortier even further unveiled that the firm is also contemplating the possibility of developing a focused fund solely to emphasis on investing in NFTs. Based on the explosive development of the NFT market place in 2021, with a trading volume of in excess of $ 23 billion, Mortier says that NFT will be the most promising spot in the cryptocurrency market place in the close to potential.

Mortier’s argument is fully legitimate when contemplating the overview of the advancement of the cryptocurrency business starting up this 12 months, NFT is the most important obstacle to supporting the whole market place. See how OpenSea broke record NFT trading volume in January alone, entirely mind-boggling their journey so far, getting efficiently raised $ 300 million, at 1 valuation. The $ 13.three billion large or the entry of a wide variety of huge common organizations is ample to show just how robust the “heat” of NFT is.

However, Mortier mentioned Amundi’s views on cryptocurrencies continue to be unchanged regardless of openness on NFT advances. Previously, Amundi had a rather conservative see of cryptocurrencies in basic and DeFi in certain. Even the economic giant has warned its consumers not to invest in cryptocurrencies due to the fact it is an asset that has definitely no intrinsic worth.

“On cryptocurrencies, we have not transformed our company stance. Cryptocurrencies are as well speculative and there are quite a few query marks surrounding them. “

Synthetic currency 68

Maybe you are interested: