Element Finance task overview

What is the Element Finance task?

Element Finance is a protocol that will allow end users to search for High Fixed Yield in the DeFi industry.

Users can accessibility, by the ecosystem and present AMMs at a discounted price, with no time limits, permitting the exchange of discounted assets and underlying assets Every time that. Fixed price cash flow can be secured by exchanging any of the principal underlying assets.

The Element protocol does not demand intermediaries, permitting for rapidly and productive fixed or variable return transactions.

Website: https://www.element.fi/

Particularities of the Element Finance task

Element Finance will allow you to deposit money to end users who want to obtain variable curiosity prices on a distinct asset. Current simple floating price techniques are complemented by Yearn techniques.

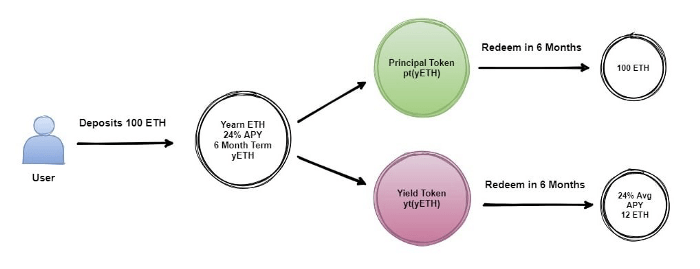

When end users make a deposit, they can opt for from a assortment of blocking terms for their assets. After the consumer selects the Duration, the principal token and revenue token will be minted working with the protocol and issued to the consumer, redeemable at the picked Duration.

The method of the factors

The protocol of the component, inside of it, functions by permitting end users by Ethereum contracts to divide the underlying assets (ETH, BTC, USDC, DAI) of the revenue-producing positions, for instance as the Yearn vault or the ETH2 validator, in two separate and replaceable tokens: Master Token (PT) and Profit Token (YT).

The split mechanism will allow end users to promote their capital at a discounted selling price, so providing end users the potential to produce a industry for fixed cash flow positions. Their capital is no longer tied up and they can use newly launched money to leverage at higher multiples, escalating profitability with no the common liquidation threat. Users can also obtain more trading charges or APYs on their worthwhile positions by working with their new tokens to deliver liquidity to AMM. Regular end users subsidize DeFi users’ energetic techniques by guaranteeing a fixed price return at a low cost on what DeFi end users earn. The participation of DeFi end users subsidizes the worth of a fixed price return.

Element’s method will take an different to on-chain goods, as an alternative permitting industry end users to set rates from a fixed price of return to a variable price of return. This aggressive exercise, coupled with the customized curve created on the Balancer V2 to assistance PTs, is what drives the higher fixed margin industry. It also promotes liquidity in the fixed cash flow industry by minimizing slippage, charges and short-term losses, in the end opening the door to a host of new DeFi primitives.

Minting and provision of liquidity

Extracting and giving liquidity to PT and YT can be a quite worthwhile endeavor for DeFi end users. Showing how minting functions and concluding with a thorough appear at simulations and evaluation of profitability and liquidity sourcing procedure, this kind of as sugar utilization, transaction curves and parameterization.

Market forces

High fixed price yields subsidized by industry forces. Regular end users subsidize energetic DeFi consumer techniques by guaranteeing a fixed price return with a low cost on the sum earned by DeFi end users. The energetic participation of DeFi end users subsidizes the worth of a fixed price return. The following sections delve into the distinct industry forces.

Based on the Element Protocol

Element Protocol opens the door to a amount of new structured and primitive money goods. This segment explores some of the long term ideas that can be created working with Element Protocol.

Element’s code and goods are open supply and make it possible for third events to integrate or develop on the platform in their very own way.

How the Element Finance task functions

Element Finance functions by enabling end users by way of intelligent contracts of Ethereum, split the core asset like ETH, BTC, USDC, DAI into 1 platform like Yearn Vault or ETH validator to produce revenue. This asset will be traded in two tokens, Principal Token (PT) and Yield Token (YT):

- Principal Token (PT): This token represents the worth of the user’s deposit in the Element protocol. These tokens are one: one exchangeable with your assets on expiration.

- Return token (YTs): This token represents the variable return that can be earned above the time period your assets are deposited.

Easier for end users, Element Finance functions like this:

- When end users deposit money into the pool, they can opt for from a assortment of maturities for every single asset class.

- After picking out a critical phrase, the principal token and effectiveness token will be created by the protocol and launched to end users. Yield tokens are exchangeable right after expiration.

- The sum of revenue that the consumer will earn is based mostly on the common APY of the picked deposit above the provided time time period.

Element Finance will be appropriate for:

- Large institutions look for steady curiosity prices, prevent the versatile lending price model (APY) is very volatile.

- Risk averse end users want stability. Example: You opt for to get a discounted asset offered by other speculative end users to earn a assured fixed return when the asset expires or deposit your assets in AMM to earn trading charges.

- Traders have the potential to optimize the industry. For instance, a trader has the potential to consider benefit of the big difference in returns in between many protocols and revenue from that big difference.

Basic data of the Element Finance token

ELFI critical metrics of the token

- Token title: Finance component

- Ticker: ELVES

- Blockchain: Ethereum (ERC20)

- To contract: 0x5c6D51ecBA4D8E4F20373e3ce96a62342B125D6d

- Token style: Utility and governance

- Total provide: a hundred,000,000 ELVES

- Circulating provide: Updating…

ELFI Token Allocation

- ten% retroactive

- 21% Team, Advisor and strategic partners

- 21% Investors

- seven% Foundation

- 41% of money

ELFI token use situation

The present ELFI token is the Element Finance governance token. You can use the ELFI token to vote for oneself and delegate selections to other individuals on proposals on Element Finance.

Where to retail outlet and get ELFI tokens

Since the ELFT token is a token of the Ethereum ecosystem and has an ERC-twenty format, the ELFT token can be stored on individual cryptocurrency wallets this kind of as Metamask, Coin98 Wallet, and so on.

Roadmap for the advancement of the Element Finance task

Updating…

The most important advancement workforce of the Element Finance task

Updating…

Investor and supporter of the Element Finance task

Element Finance task overview, really should I invest in ELFI tokens?

Element financing task is a Defi platform that follows the route of the Fixed Rate comparable to comparable platforms Fictitious Finance (NOTE), Saffron Finance (SFI.)), and with Fixed Rate, you can effortlessly handle your capital additional effortlessly. You can use Element Finance as a instrument to maximize your revenue. However, this is not investment assistance and Defi threat is a issue that constantly exists, you really should cautiously look at just before investing or working with the Element Finance task.

This write-up is not investment assistance, you really should cautiously look at just before building selections when working with your cash. Coinlive is not accountable for any of your investment selections. I want you good results and earn a whole lot from this possible industry.