The Ooki Protocol undertaking was designed from the previous bZr Protocol undertaking and has fully revamped the performance and consumer interface and grew to become a fully new undertaking. Let’s find the particularities of this undertaking with Coinlive!

Ooki Protocol Project Overview

What is the Ooki protocol?

Ooki protocol is a lending and margin trading platform for cryptocurrencies. The undertaking is a new, productive and totally free money platform for quick marketing, leveraged trading, lending and lending, even though improving the decentralized blockchain.

The Ooki protocol permits the neighborhood to jointly make and produce applications that allow lenders, borrowers and merchants to interact with the most versatile decentralized finance protocol on Ethereum. Ooki Protocol is a neighborhood run undertaking by voting on all choices on the course of undertaking growth.

Special characteristics of the Ooki protocol

Compared to comparable tasks, Ooki Protocol has excellent characteristics that present aggressive strengths and appeal to consumers with the following traits:

No KYC

Ooki is a decentralized margin trading platform. There is no want for any verification, KYC or AML.

No depositary

Whether it really is lending or trading, keep in management of your keys and assets with the automated undertaking option.

Minimum penalty for liquidated assets

Positions that grow to be decentralized are liquidated only ample to sustain a margin of 15% to 25%.

Position by perpetual contract

Enjoy a easy trading practical experience with automobile-renewing positions and no conversion charges.

Main characteristics of the Ooki protocol

Trading – Trade on the Ooki protocol

The Ooki Protocol improves decentralized escrow transactions to help new entrants and DeFi. Users can enter lengthy or quick margin positions with up to 15x leverage.

Trading positions are managed by means of the Ooki trading interface. Unlike centralized exchanges, for totally decentralized exchanges like Ooki, consumers retain custody of their money.

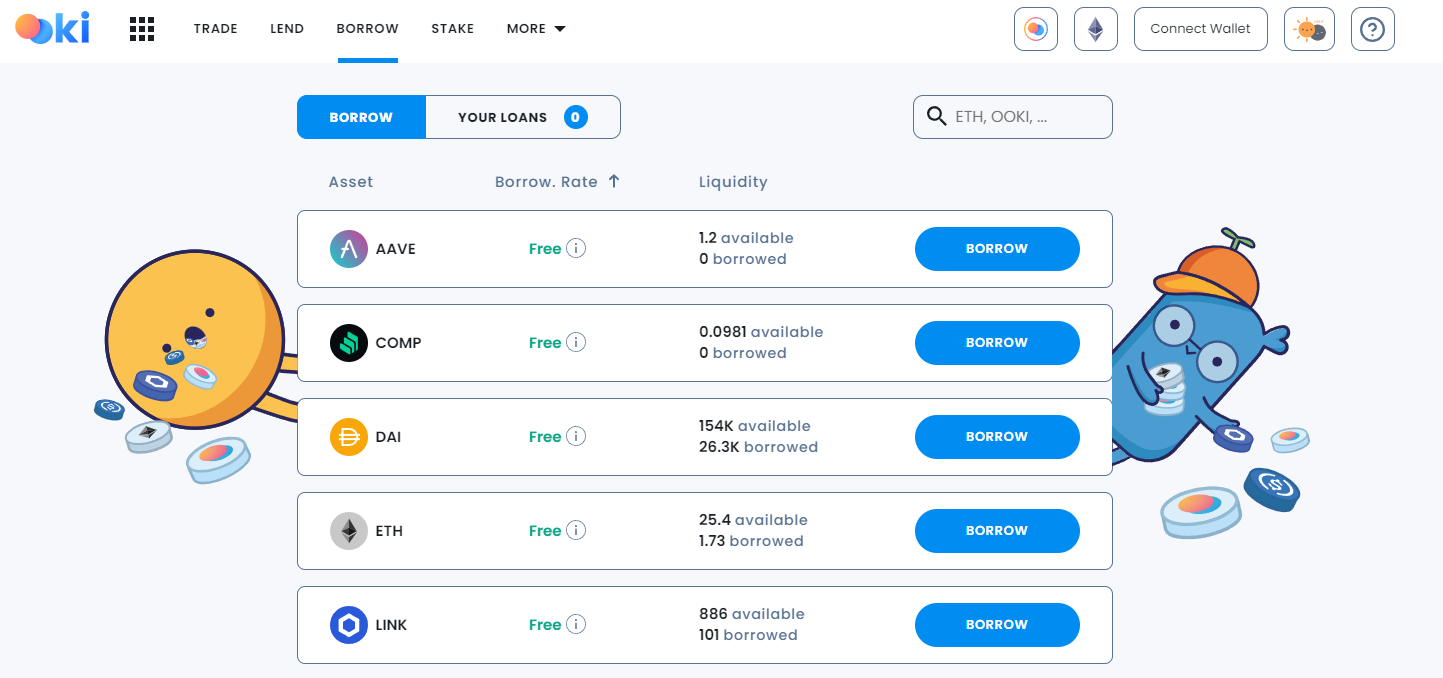

Loan – Loan on the Ooki protocol

Users can borrow money primarily based on the collateral deposited. Once you have picked the house to borrow, click the borrow and send collateral button and pick the quantity you want to borrow.

Loan – Loan on Ooki protocol

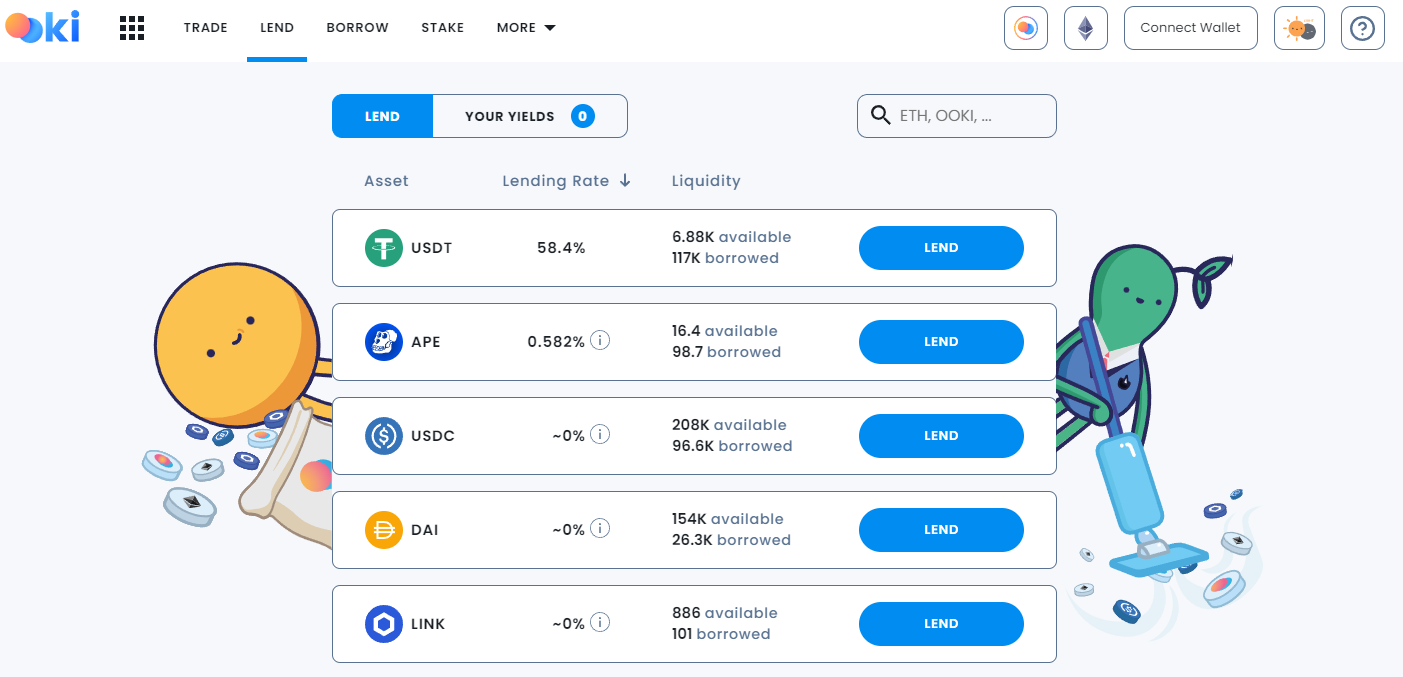

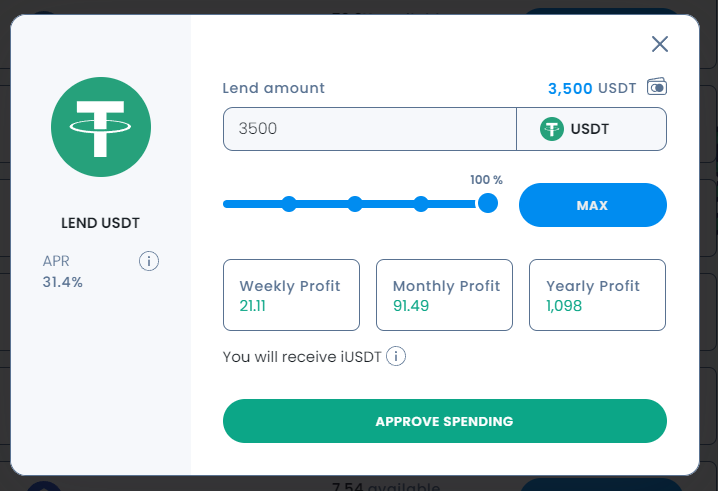

The Ooki Protocol is a totally decentralized, non-custodial lending protocol that enables lenders to effortlessly lend and revenue from their crypto assets.

When the consumer selects the house they want to lend, a modal popup prompts the consumer to enter the complete quantity they want to lend and the APR price will be calculated on a weekly / regular monthly / yearly basis primarily based on the recent loan APR.

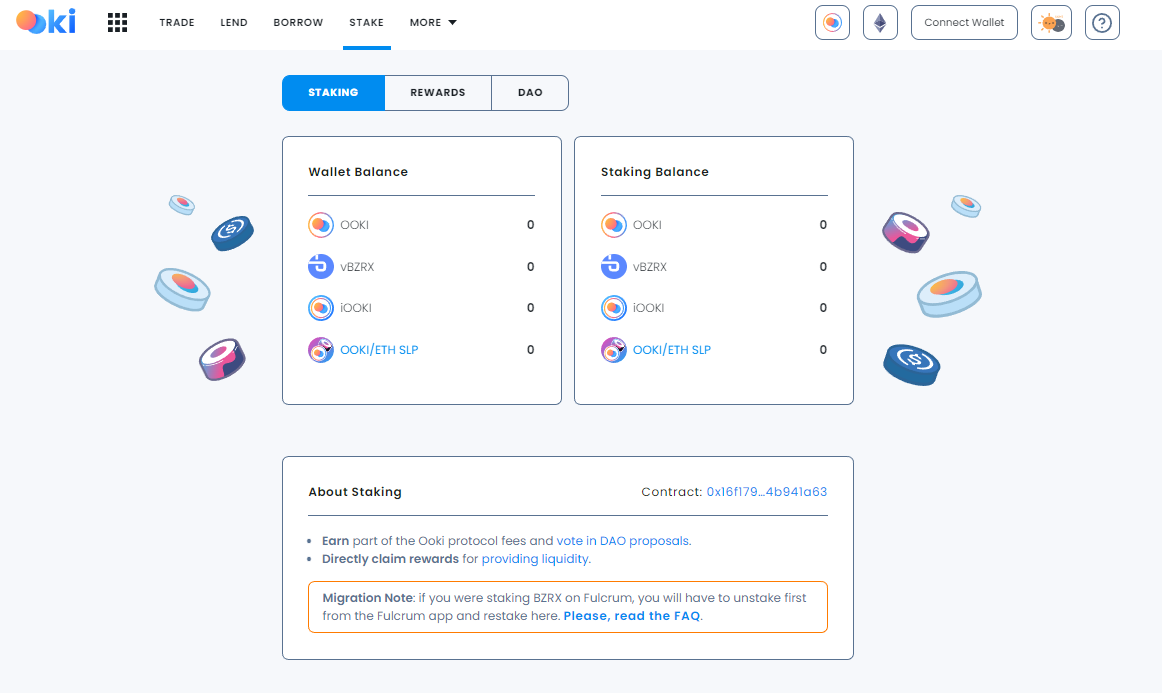

Staking on the Ooki protocol

OOKI token holders can wager the tokens to earn a portion of the commissions from the Ooki protocol. But staking can only do the job on Ethereum. Furthermore, the commissions produced on all blockchains that put into action the Ooki protocol will be distributed to the stakers. OOKI on Ethereum.

The Ooki stakers The protocol will obtain transaction charges primarily based on the distribution ratio established by the platform. The distribution will be divided as follows:

- 50% will be distributed to the Treasury Fund

- 50% will be distributed equally amongst the stakers:

- Staking rewards will be distributed to all consumers in proportion to the quantity they have wagered with respect to the complete provide of the wagered quantity.

- The complete sum will be transferred to the liquidity suppliers of the OOKI / ETH LP pair on SushiSwap.

- Other money go to iOOKI, vBZRX and OOKI.

- For illustration, if ten% of the complete OOKI provide is staking, SushiSwap ETH / OOKI LP receives 90% of the commission.

- For illustration, if 90% of the complete provide of OOKI is staking, SushiSwap ETH / OOKI LP will obtain ten% of the commission.

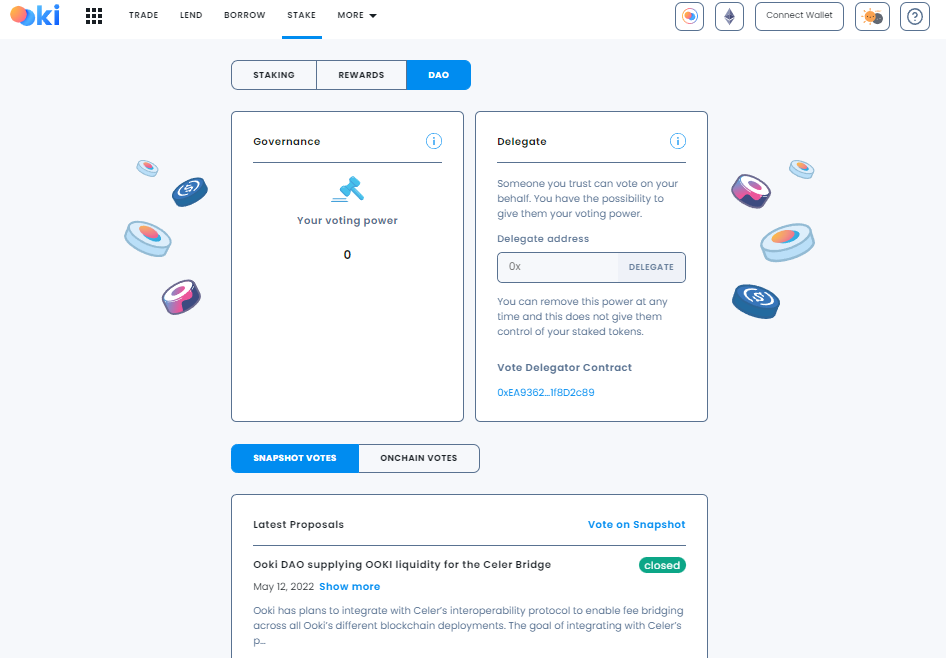

Also, when participating in OOKI staking, consumers have the ideal to participate in the voting to determine the growth course of the Ooki Protocol.

Basic info about the .OKI token

The Ooki protocol has three varieties of tokens:

- OKI: OOKI is the primary token on the OOKI protocol platform.

- iToken: iToken, for illustration iDAI or iUSDCthey are tokens that accumulate curiosity that continually raise in worth as you hold them.

- vBZRX: This token is a vesting token. It will gradually release tokens which can be exchanged for OOKI tokens.

OKI Token Specifications

- Token identify: Ooki protocol

- Ticker: OKI

- Blockchain: Ethereum, BNB Chain, Polygon, Arbitrum

- Standard: ERC20, BEP-twenty

- To contract:

- ETH: 0x0De05F6447ab4D22c8827449EE4bA2D5C288379B

- Polygon: 0xcd150b1f528f326f5194c012f32eb30135c7c2c9

- BNB: 0xa5a6817ac4c164F27df3254B71fE83904B1C3c3e

- Referee: 0x400F3ff129Bc9C9d239a567EaF5158f1850c65a4

- Token form: Government

- Total provide: four,141,055,731 OKI

- Circulating provide: three.812.962.152 OOKI

- Maximum provide: ten,300,000,000

Distribution of OOKI tokens

The OOKI token is the token transferred from the BZRX token previous with a price of one BZRX = ten OOKI, so the general token allocation price to traders seems to be like this:

Uses of Ooki protocol tokens

OKI token

The fundamental use of the OOKI token is utilised to:

- Administration

- Liquid assets

- Stakeout

- Transaction

Token vBZRX

VBZRX Token utilised to obtain OOKI tokens throughout vesting.

iToken

iToken, this kind of as iDAI or iUSDC, are tokens that accumulate curiosity that continually raise in worth as you hold them. They make up a portion of the loan pool as it increases in dimension as borrowers spend curiosity to them.

iToken they can be exchanged, utilised as collateral, turned into structured solutions by developers, or sent to treasury for safekeeping.

Where to purchase, promote and keep OOKI tokens

You can presently trade and purchase OOKI tokens on the following exchanges:

- DEX: SushiSwap, UniSwap

- CEX: Binance, MEXC, Gate.io or KuCoin.

To keep OOKI tokens on personal and participating wallets and DeFI, consumers want to use wallets like Metamask, Coin98 Wallet for storage as these wallets are extremely compatible with ERC-twenty form tokens like OOKI.

Project growth roadmap

The undertaking growth roadmap does not have a distinct timeline, but the growth staff has listed the targets determined by the DAO to be finished as follows:

- Plan to produce the neighborhood

- Building characteristics this kind of as:

- Fees are primarily based on the volume of transactions.

- Margin trading pair stETH/ ET.

- Possibility to configure the curiosity price curves in accordance to the form of itoken promise.

- List of trusted tokens.

- Distribute Ooki on the EVMOS chain.

- Limit the growth of the purchase.

- Use the iToken as a promise.

The primary growth staff of the undertaking

Updating …

Investors and growth partners

Recently, the undertaking is pleased to announce a partnership with Crypto.com that enables consumers to keep up to date on Ooki Protocol solutions and companies via the integration of integrated reside RSS information feeds.

Assess the development likely of the Ooki Protocol undertaking in the potential

In standard, just after the conversion from bZx Protocol to Ooki Protocol, the undertaking has manufactured several new measures forward this kind of as: creating a consumer-pleasant interface that is uncomplicated to use for newbies, acquiring a Multi-chain ideal for just about every possibility appetite. investor. consumers and have a DAO to empower consumers and raise decentralization.

However, this undertaking has quite tiny info on the growth staff and investment partners to confirm the credibility of the undertaking and The Ooki protocol is designed from the bZx protocol, an previous undertaking has been hacked several instances so there are a good deal of difficulties to take into consideration but I cannot inform Ooki maybe he discovered from his previous problems to produce additional.

Through this post, you have by some means grasped the fundamental info about the undertaking to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you results and earn a good deal from this likely marketplace.