What is Project Platypus?

Platypus economic undertaking Is 1 Single-sided AMM (DEX), is integrated Avalanche blockchain and made to trade stablecoins.

The undertaking is implemented as a set of sensible contracts made to prioritize censorship resistance, safety, self-custody and maximize capital efficiency.

Platypus presents a single token giving (ought to give liquidity for one token only), eliminates the chance of short-term reduction for liquidity suppliers and minimizes slippage for traders.

The motive for the birth of the Platypus Finance undertaking

Users require far better secure exchange

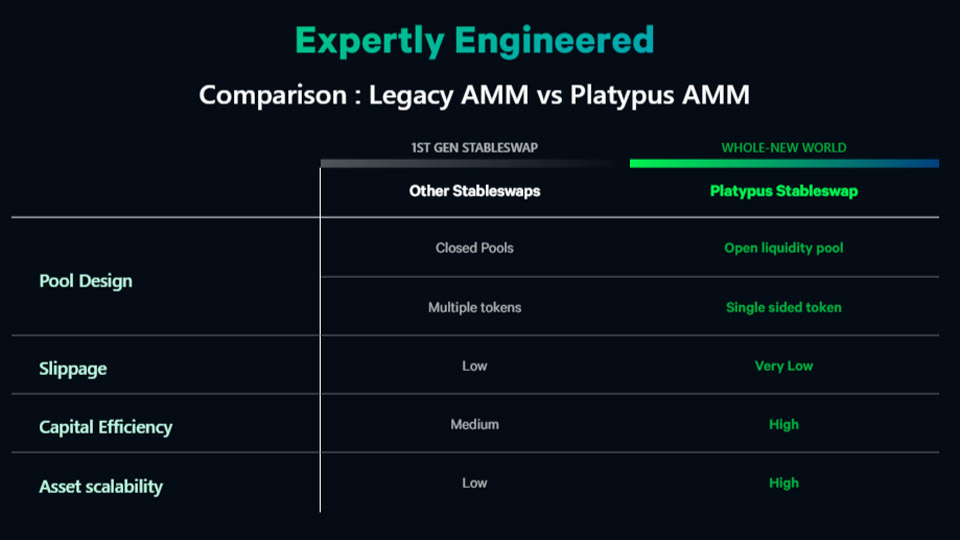

Existing StableSwap tasks lead to higher cost slippage and an underestimated consumer encounter, which then hinders the scalability and efficiency of the protocol.

Slip restrict as well higher

Most recent AMMs, like StableSwap, have a closed liquidity pool layout, which indicates liquidity amongst separate pools is not shared. Such liquidity fragmentation will inevitably lead to elevated slippage.

Enhance the consumer encounter

Current Stableswaps have an equilibrium situation established by the truth that all tokens inside of the pool ought to have the identical sum of liquidity. As a consequence, the much less well-liked token in the pool gets to be a development bottleneck and hinders the scalability of the liquidity pool to increase into a pool for a number of tokens.

For this, Stableswap now has the obligation to pair LP tokens with new tokens. Such layout is complicated, prospects to bad consumer encounter, and is not versatile to exchange current pools even as new sources emerge (eg MIM vs DAI).

High fee when utilizing a single token

Depositing and withdrawing a single token utilizing StableSwap is presently not a dilemma for little cap customers. But for customers with significant capital, it can lead to a significant penalty when that capital is significant ample in relation to the general dimension of the liquidity pool. For Platypus, there will be no penalty (or just a little commission) even if you deposit or withdraw significant quantities single-sided tokens.

All of the over shortcomings will stay unless of course basic adjustments are manufactured to the StableSwap layout. To adjust the standing quo, Platypus has experimented with to generate a new mechanism, rewrite the guidelines of DeFi and will start out with a StableSwap on Avalanche.

Particularities of the Platypus Finance undertaking

The principal idea behind the layout of Platypus economic undertaking is the management of equity liabilities asset liability management (ALM). Platypus is the initial products to use a single variant scroll perform (mono-variant slip) as a substitute of invariant curves (invariant curves).

a aspect from that Platypus economic undertaking Optimization of the effectiveness of outstanding functions in DEX

- Share prevalent liquidity: 1st generation AMMs frequently type their personal liquidity pairs like USDT-DAI, USDC-DAI … effortlessly resulting in cost slippage when there are as well lots of transactions in the pool with inadequate liquidity. Platypus shares the tokens, turns them into a pool and lowers slippage to all around .01.

- Flexible swimming pool: the undertaking introduces the idea of Coverage Ratio to assess the stability, minimizing the limitation of the sorts of assets in the pool.

- Single-sided token– Users send tokens to include liquidity and get the identical kind, irrespective of the ratio of asset lessons in the pool or their dimension.

Basic information and facts about Platypus Token – PTP Token

- Token identify: Platypus

- Ticker: PTP

- Blockchain: Avalanche blockchain

- Standard tokens: ARC-twenty

- Token kind: Utility, government.

- Total give: 300,000,000 PTP

- Circulating provide: Updating…

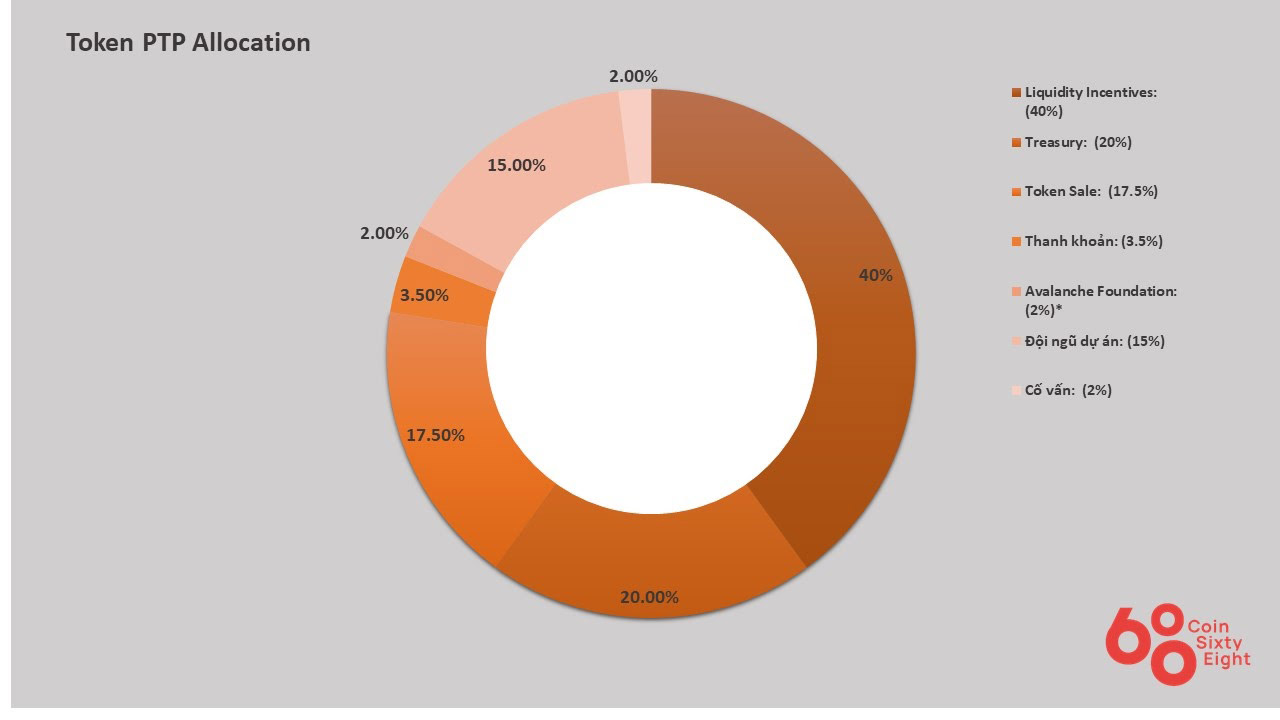

Token allocation

- Treasury: PTP 60,000,000 (twenty%) – shell out five% in advance to TGE, carry on blocking for six months and shell out steadily more than the following three many years.

- Private sale: 48,000,000 PTP (sixteen%) – shell out ten% in advance to TGE, carry on to block for three months and shell out in installments more than the following 18 months.

- Public sale: ten,500,000 PTPs (three.five%) – Deposit of ten% to the TGE, regular monthly payment of seven.five% for twelve months.

- Project crew: 45,000,000 PTPs (15%) – twelve-month freeze and amortization inside of thirty months

- Dex liquidity: ten,500,000 PTPs (three.five%) – Advance payment of 50% to TGE, block of six months and amortization in the following six months.

- Consultant: six,000,000 PTPs (two%) – twelve months deposit and thirty months installment.

- Cash extraction: 120,000,000 PTPs (forty%) – N / A.

Token use situation

- Rewards for customers who contribute money

- Stake and include accounts in the Boosting Pool to raise PTP rewards

Roadmap

Development crew

Investors

Evaluation of the Platypus Finance undertaking, is it well worth investing PTP tokens or not?

Platypus undertaking Finance is very new undertaking for StableSwap mechanism, possibly Platypus will carry innovation in secure exchange protocol to raise consumer encounter.

Through this posting, you have by some means grasped the standard information and facts about the undertaking to make your investment choices. coin 68 is not accountable for any of your investment choices. I want you accomplishment and earn a whole lot from this possible market place