The international monetary market place is distressed by the latest information that Evergrande, China’s major authentic estate group, is in danger of defaulting on its $ 300 billion debt.

Evergrande and its $ 300 billion debt

Evergrande Group is a authentic estate enterprise primarily based in Guangzhou city in Guangdong province (China). According to the details supplied on the internet site, Evergrande is handle up to one,300 authentic estate tasks in 280 cities of China. In addition, the enterprise also expands into lots of other sectors, together with the manufacturing of electrical automobiles, the provision of Internet and telecommunication companies, the investment in amusement parks, the sponsorship of football, meals and meals.…

The Chinese authentic estate “bubble”

The primary lead to of the debt crisis that Evergrande is dealing with comes from the Chinese authentic estate market place. After a prolonged time period of robust development, lots of organizations in this sector, together with Evergrande, have on a regular basis borrowed capital to build new tasks and attain market place share.

However, as the COVID-19 pandemic hit and getting electrical power cooled, debt started to come to be a dilemma for authentic estate giants. In addition, the reality that the Chinese government has begun to tighten lending laws for authentic estate organizations due to the fact 2020 has prevented organizations from acquiring new sources of liquidity.

Many Western analysts feel that China’s authentic estate market place is a tangible “bubble” and the probable collapse of Evergrande will be the set off for the country’s monetary sector to collapse.

Crisis signal

For 2020, Evergrande posted a net revenue of thirty.one billion yuan ($ four.seven billion). However, this is the decline in yearly earnings for two consecutive many years, towards all analysts’ expectations.

Evergrande’s story started in 2020 when the enterprise sent a letter of assistance to the Guangdong provincial government due to indications of insolvency. In the letter, Evergrande uncovered presently on loan to 128 banking institutions and 121 monetary institutions it truly is distinctive. The enterprise believes that if it is not supported quickly, Evergrande will have to go bankrupt and set off a “cross-insolvency” across the Chinese monetary market place.

The crisis was then resolved when a group of creditors made the decision to publish off Evergrande’s $ 13 billion debt.

The bell rings

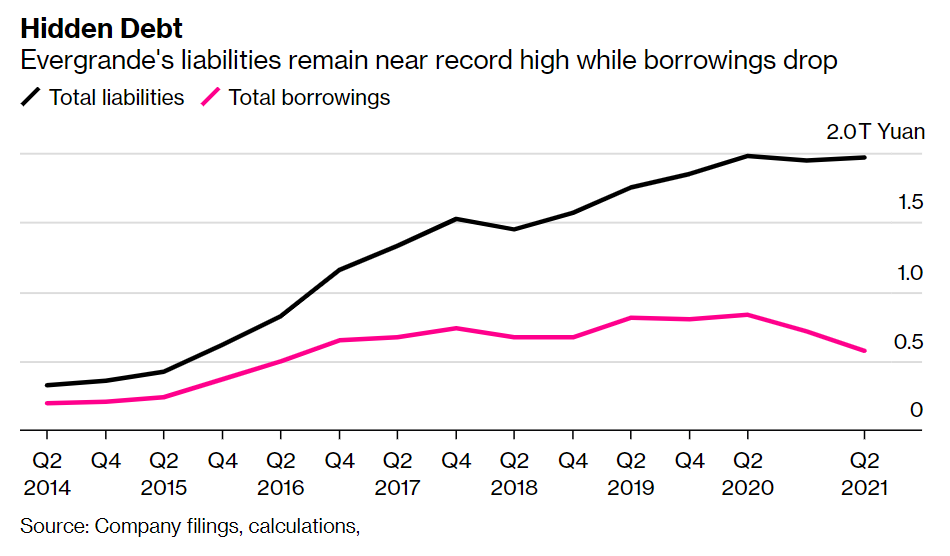

This is just the tip of the iceberg, even though. According to the estimate of Bloomberg, the debt that Evergrande is carrying on its shoulders is up to two trillion yuan (305 billion bucks), paid in installments.

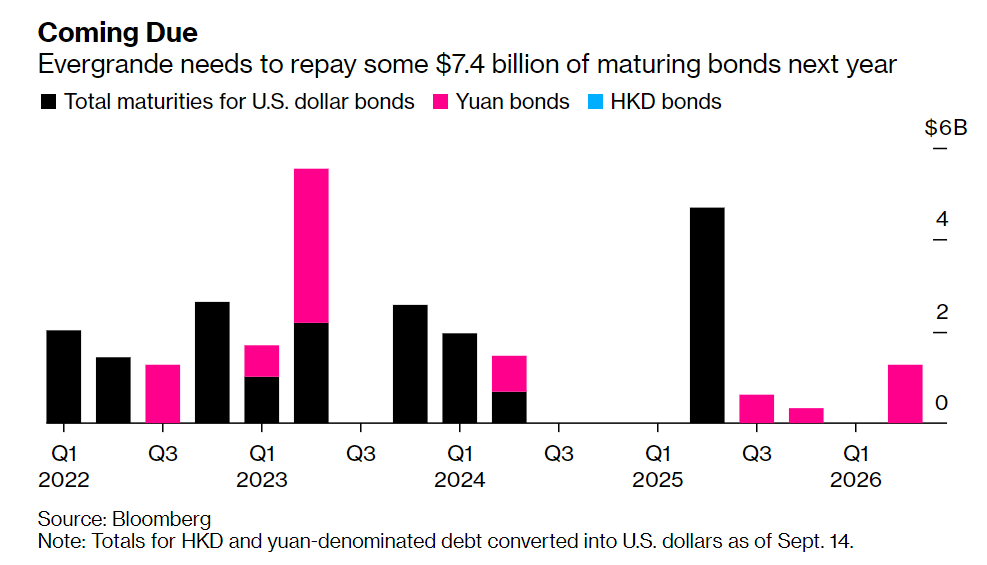

For bonds denominated in yuan and Hong Kong bucks alone, the volume Evergrande has to spend among now and 2026 is: $ seven.four billion (2022), $ 9.eight billion (2023), three.five billion ( 2024), $ five.seven billion (2025), $ one.three billion (2026) – extra than $ 27.seven billion in complete.

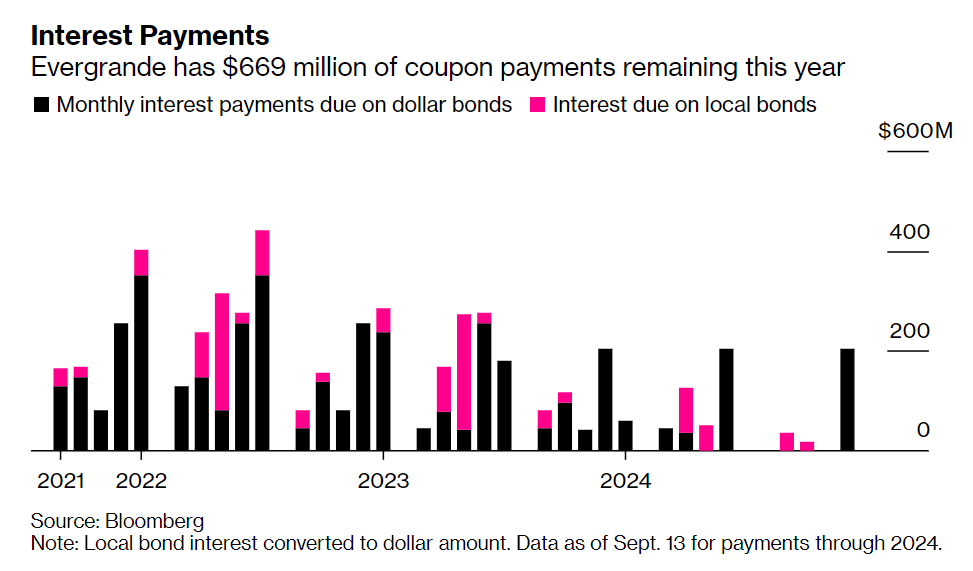

Additionally, the enterprise has a great number of other curiosity payments among now and 2024, totaling in excess of $ five.four billion.

Evergrande’s net really worth was valued at $ 80 billion. The enterprise expects to lower its debt by $ a hundred billion by mid-2023, by means of measures this kind of as liquidation of assets and the sale of shares. In August 2021, Evergrande raised just $ eight billion from these corporations, setting alarm bells off once again. The monetary rating company Fitch Ratings on September eight commented Evergrande’s default is “possible”. Moody’s has downgraded Evergrande’s rating 3 instances in the previous couple of months.

The overpowering unfavorable details has sent Evergrande’s share selling price plummeting, presently just one/ten from early 2021.

Any way out for Evergrande?

Evergrande is dealing with 3 instructions forward:

– One is debt restructuring. The enterprise will have to negotiate with creditors to delay the payment date, or agree to spend only component of the debt. This is the most probable situation, but it will severely have an effect on each Evergrande and creditors.

– Secondly, the Beijing government will have to phase in and “save” Evergrande. This is the ideal situation, but the least probable. The explanation is since China has a policy of containing monetary dangers, as demonstrated by the crackdown on cryptocurrencies due to the fact May. Saving a troubled authentic estate enterprise will go towards the government’s determination, as very well as not educate other authentic estate “giants” a lesson if they observe Evergrande’s “fall path”. .

Third, Evergrande will have to declare insolvency, probably leading to this enterprise to go bankrupt and reduce creditors’ cash. This is the worst situation situation, as it is anticipated to set off a “cross default” in China’s monetary markets, probably triggering a monetary crisis in the nation.

Impact on the cryptocurrency market place

Inhabit

Evergrande’s credit score danger will have a direct influence on the cryptocurrency organizations that have relationships with it. The only identify identified as so far is To tie – the most well known stablecoin issuer on the market place is USDT. As reported by Coinlive, most of the assets that Tether utilizes to assistance the USDT stablecoin are held in the type of industrial paper, i.e. quick-phrase bonds issued to borrow sizzling capital.

Answer the interview CoinDeskTether’s rep confirmed that this unit does not hold Evergrande’s bonds.

“Tether does not currently hold and has never held any commercial paper or other securities issued by Evergrande.”

Another stablecoin issuer, Circle, with USDC is also suspected, but the probability of this taking place is not large.

Analysts say that in the worst-situation situation of Evergrande defaulting on its debt, the direct influence on the cryptocurrency market place, if any, will be smaller since the connection is not robust ample to have a unfavorable influence.

Adam Cochran, a Cinneamhain Ventures skilled, explained:

“Currently each Tether and Circle hold industrial paper, and even though I never feel they each hold a substantial volume of Evergrande bonds, the market place can react negatively if factors go incorrect.

But if Tether or Circle collapse with the international market place, I feel this will advantage cryptocurrencies, as traders will be inclined to move stablecoins to BTC / ETH at all prices to steer clear of the storm.

indirect

In the previous, the cryptocurrency market place has been repeatedly dragged into the downward spiral of the international monetary market place. The most important will have to be the time period of February and March of 2020, when the COVID-19 pandemic severely impacted the Chinese economic system, hence spreading to the international monetary sector. Surely every person remembers the “Friday the 13th” occasion (March 13, 2020), when BTC dropped from $ eight,000 to just $ three,400 in a single morning.

The recent Evergrande crisis carries lots of comparable indications of concern. It originated in China and poses a risk to the country’s monetary market. At worst, it can spread to other sectors and generate a community monetary crisis. However, it is hard to predict the influence of this crisis and no matter whether it will spread globally like the COVID-19 pandemic.

If the consequences are constrained to China, the cryptocurrency market place could advantage from the movement of cash out of the nation or into safer investments like gold or cryptocurrencies. As if a chain response took spot and dragged the complete international monetary market place into it, then there is a large probability that we will see the story of March 2020 repeat itself, when gold, stocks and cryptocurrencies are all at the identical time. declining.

Bitcoin’s decline nowadays (Sept. twenty) has also been attributed by some to the Chinese “bubble” of Evergrande, even though the connection is unclear. Over the previous 24 hrs, BTC has misplaced up to $ eight,000 in worth, with an intraday very low of $ 42,500, even reduced than the very low of $ ten,000 on September 7th.

Synthetic currency 68

Maybe you are interested: