On-chain data shows that Bitcoin is undergoing a recovery like in December 2018 and March 2020.

A new report says Bitcoin (BTC) remains below key moving averages and that “is not a bullish sign,” but signs of recovery have finally arrived.

In the latest market update released on June 11, the Decentrader trading suite highlighted three on-chain indicators calling for an impending bullish continuation for BTC/USD.

Indicators repeat events of March 2020

Bitcoin has now spent almost a month below its 200-day moving average (DMA). This is worrisome, Decentrader warns, and external factors such as geopolitical sentiment continue to weigh on sentiment.

“Bitcoin has kept the market on its toes as it continues to swing between weekly support at $32,000 and resistance near the 200DMA currently at $42,000.”

“Uncertainty following the recent crash and concerns surrounding President Biden’s statement at the G7 Summit next weekend about how the US will tackle crypto-related attacks recent ransomware, is driving prices down.”

Bitcoin continued to fluctuate over the weekend, at press time trading near $36,000 amid some signs of a break of resistance near $40,000.

Fortunately, however, several on-chain strength metrics now suggest that a recovery from a bearish phase in an overall bull market is now underway.

They are well known – dealing with positive sentiment, return-to-spend ratio (SOPR) and stock-to-flow deviation.

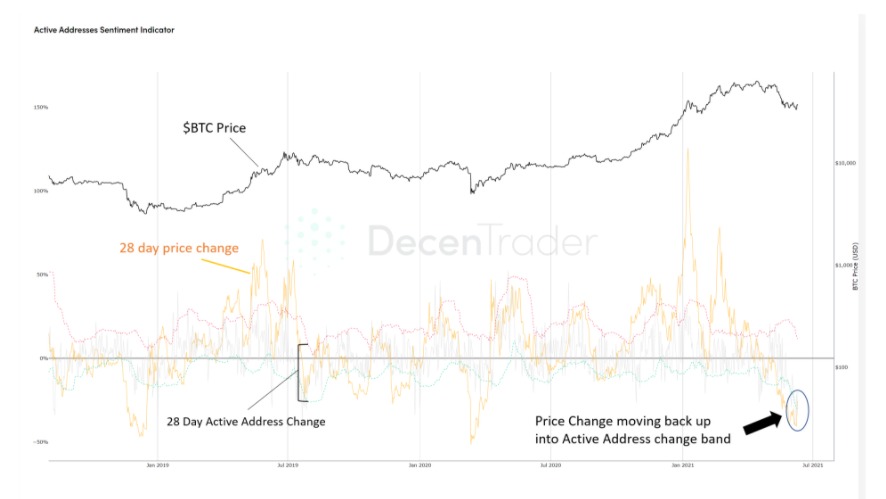

Meanwhile, active addresses measure whether Bitcoin is overbought or oversold at a given price relative to the number of active addresses on the blockchain.

Like SOPR, this indicator is currently in the same position just behind the December 2018 bear market and the March 2020 crash. As such, if history repeats itself, the only way is to go up.

“We received a similar signal yesterday, indicating that BTC price was oversold relative to on-chain active addresses and may now be poised to rebound in the coming weeks.”

$85,000 within a few months?

Additionally, on the indicators is a rally back to the trajectory, which the creator, PlanB, says will present a “surprise” if that doesn’t happen.

Amid hopes that BTC/USD will still hit $100,000 this year, Decentrader predicts that it could be just a few months before Bitcoin makes a comeback.

“While we may not be growing so fast and strong at this point, nothing has fundamentally changed with the way Bitcoin works, nothing is broken, we are just going through a lot of hard work. bad news after a strong rally at the beginning of the year.”

“So we could see a move back in the coming months. This means a new all-time high for BTC before the end of the year, as the Stock to Flow is currently stabilizing at $85,000.”

Synthetic

Maybe you are interested: